When you have a trust, your power of attorney can act as a catch-all, making sure there’s someone in charge of bank accounts and assets that are not included in your trust. It is, however, important that you know which of your property is controlled by your trust, and which falls under your power of attorney.

What can you do with a power of attorney?

Generally, a power of attorney (POA) is not designated for a trust. However, there could be instances when you might want to name the same person as your trustee and as your attorney-in-fact. A POA is a legal document that gives someone else the power to act on your behalf. A trust, on the other hand, is managed by a trustee.

What is the purpose of a power of attorney?

Jun 27, 2011 · Not at all – a power of attorney is an essential document whether you have a will or a trust. When you have a trust, your power of attorney can act as a catch-all, making sure there’s someone in charge of bank accounts and assets that are not included in your trust. It is, however, important that you know which of your property is controlled by your trust, and which …

What are the rules for power of attorney?

A power of attorney is a legal contract in which someone, called the principal, grants another person, referred to as the agent, the power to make decisions for the principal about financial and asset matters. A trust, however, is a legal entity that holds title to assets that someone, called a settlor, transfers to the trust.

Is a trustee the same as a power of attorney?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

What is a power of attorney?

A power of attorney is an essential estate planning document. It lets you appoint an agent to make a range of decisions for you in the event you become disabled (or in case you’re otherwise not available to be there, in person, for a legal or financial transaction).This helps to keep you out of living probate if you ever suffer a disabling injury ...

What is the purpose of a trustee in a trust?

When you establish a trust, you designate a trustee to manage all of the property you fund into the trust. Once property is transferred to your trust, it’s within the control of your trustee, and it is not governed by the terms of your power of attorney.

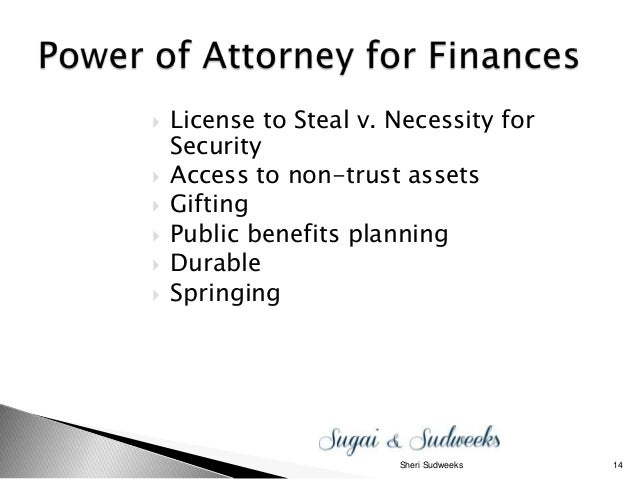

What is a financial power of attorney?

A Financial Power of Attorney designates an agent the authority to make financial decisions and act on your behalf should you not be able to. This type of POA can be broad or very specific. It’s another title for General POA, and could typically grant all the same actions listed above.

What is a fiduciary POA?

The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a wide range of authority. At the most basic level, your POA will act on your behalf if you become unable to do so ...

What is a POA?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

When does a POA end?

A General POA: General POAs end as soon as you are incapacitated. While this tool is great for many things in life, it is not a solid option for end-of-life decisions. A Durable POA: A durable POA stays in effect until you pass away or revoke its power.

Can you have more than one power of attorney?

Yes, you can appoint more than one Power of Attorney. If you designate more than one person, be sure to clearly note how you want them to act. You can specify if they must act jointly or if they can act independently. If you only choose one POA, you should consider having a backup designation.

What is a health POA?

Health POAs allow you to appoint an agent to act on your behalf regarding health-related matters. A Financial POA does this for all other financial-related issues in your life. Decisions could be in relation to business or personal financial issues, or a combination of the two.

Is a Power of Attorney the same as a Living Will?

Keep in mind that a Healthcare Power of Attorney is not necessarily the same thing as a Living Will. Some states allow certain preferences to be included in a Living Will, such as whether or not you’d want to be on life support.

Who can act as successor trustee?

The grantor of the trust can designate an individual, bank, or trust company to act as successor trustee or co-trustee. Upon the grantor's incapacity or death, property titled in the trust's name will be controlled by the successor trustee or co-trustees in accordance with any direction you have provided in your trust.

What can an attorney in fact do?

The attorney-in-fact can manage assets that fall outside a trust, such as real estate, tangible property, investments, bank accounts, business interests, and IRA assets . The attorney-in-fact can file taxes, make legal claims, gift property on behalf of the incapacitated individual, and even create additional trusts for estate planning purposes.

Can an attorney in fact make gifts?

The attorney-in-fact can exercise only those powers specifically granted in the document, such as the power to make gifts. Unless a particular power is clearly stipulated, the attorney-in-fact won't be able to carry it out.

Is a will a good start?

Having a will is a good start, but sound advance planning should go further. Granting a power of attorney and creating a trust are two additional planning vehicles to consider. There are pros and cons to each, and often, using a combination of the two brings added benefits.

What is a power of attorney?

A power of attorney is a legal document that gives one person (the attorney) the right to act on behalf of another (the principal) in certain situations. A trust is a legal arrangement wherein some person (the trustee) is designated to manage the property of another (the grantor or settlor) for the benefit of a third party (the beneficiary).

What is a springing power of attorney?

A springing power of attorney is one that takes effect only once the principal is declared mentally incapacitated. If the power of attorney is in effect prior, and explicitly says it is to remain in effect should the principal become incapacitated through illness or injury, it is called a durable power of attorney.

Can a living trust be used as a power of attorney?

Even if the grantor acts as trustee during their lifetime, a durable power of attorney can be used to give a third party the power to act in their role as trustee if the grantor/trustee is incapacitated.

Is a power of attorney a separate document?

The parties to the document should clearly be identified and the powers or limitations of the attorney in fact enumerated. Though a trust document can have parts that resemble a power of attorney, listing the powers of the trustee, a power of attorney should remain a separate document. It can be incorporated into the trust document by reference. ...

Is a power of attorney necessary for a trust?

In this type of trust, it is highly advisable to have a separate person other than the grantor serve as the trustee. A power of attorney is not strictly necessary, since the property given to the trust is titled either in the name of the trust or of the trustee. Resources.

Where is Joseph Nicholson?

He received a Bachelor of Arts in English from the University of Florida and is currently attending law school in San Francisco.

What is a power of attorney?

A power of attorney is a customizable estate planning tool that allows you to choose someone to manage all or part of your personal affairs, including making health care and financial decisions while you are alive. As the person who signs and executes the power of attorney, you are referred to as the “principal.”.

What is the purpose of a living trust?

An important component of an estate plan that includes a living trust is that you will be required to transfer your assets to the trust. This must be done in order for your trust to be effective . The trustee has the authority to manage only the trust assets and no other property in your estate.

Why do you need a living trust?

Another important benefit of creating a living trust is that your family may be able to avoid the expensive and time-consuming probate process . With a last will and testament, your estate is required to go through probate so that your assets can be distributed according to the terms of your will. On the other hand, having a living trust means your estate does not go through probate, at least as to the assets that are title in the trust name. That also means your heirs can receive their inheritance much sooner.

What are some examples of estate planning?

There are many different estate planning options, all of which can help you achieve your goals in preparing for the future. A living trust and a durable power of attorney are two common examples. Clients are often confused as to the difference between the two estate planning tools.

Can you name yourself as trustee of a trust?

With living trusts, most people name themselves as trustee. That allows you to maintain control over your property while you are still alive. Then upon your death, your chosen successor trustee will take over management of the trust on behalf of your beneficiaries.

Popular Posts:

- 1. what would district attorney send a letter

- 2. in canada how long can an attorney take to settle a will

- 3. what would be considered attorney work product

- 4. how long does it take to get power of attorney through ssi

- 5. what would yu do if your attorney lie to you

- 6. texas attorney and daughter who died in 2016

- 7. how much is attorney malpractice insurance for a solo practitioner

- 8. what info do i need for my attorney to dile chapter 7

- 9. why does a prosecuting attorney

- 10. why do you need a birth injury attorney