When should you appoint a power of attorney?

You should appoint at least two people to do this ... and these should not be beneficiaries. Power of attorney is a legal document where one person (known as the donor) gives another person (the attorney) the right to make decisions on their behalf.

What is the procedure for establishing power of attorney?

Part 2 Part 2 of 3: Obtaining Power of Attorney

- Check your state's requirements. Requirements for power of attorney are similar in most states, but some have special forms.

- Download or write a power of attorney form. In most states, power of attorney forms don't have to be government-written legal documents.

- Check your document for clarity. ...

- Gather witnesses. ...

What is power of attorney and when do you need one?

Power of Attorney: When You Need One. A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf to make decisions in specified matters or in all matters.

When should you give someone power of attorney?

When Should You Give Someone Power of Attorney

- Types of Power of Attorney. There are many types of power of attorney that can be utilized in different situations. ...

- Travel and Military Service Abroad. It may be in your best interest to give someone power of attorney if you travel abroad extensively or anticipate military service that will involve ...

- Elderly Physical and Mental Health Issues. ...

Is power of attorney a good idea?

Indeed a power of attorney is vital for anyone – regardless of age – who has money and assets to protect and/or who wants someone to act in their best interest in terms of healthcare choices should they be unable to make decisions for themselves.

What happens if there is no power of attorney UK?

The consequences of not having a lasting power of attorney A deputy's application could be refused, so the council may be appointed instead. Your family will have to pay extra to apply for and maintain a deputyship. You may not be able to sell jointly held assets until the court appoints a deputy.

What happens if you do not have power of attorney?

If you lose the capacity to make your own decisions and don't have a valid Power of Attorney, the application goes to the Court of Protection. The court can: Decide whether you have the mental capacity to make a decision.

Does power of attorney override next of kin?

While next of kin is a relationship designation, power of attorney is a legal designation. You can choose almost any adult you want as your power of attorney. It's a good idea to make sure they're on board with this responsibility, though.

Why do we need a power of attorney?

Some are a good idea to have in place now, because you never know when an emergency may arise and a power of attorney will be needed. Other types of powers of attorney may only be needed if a particular situation arises.

What does a power of attorney cover?

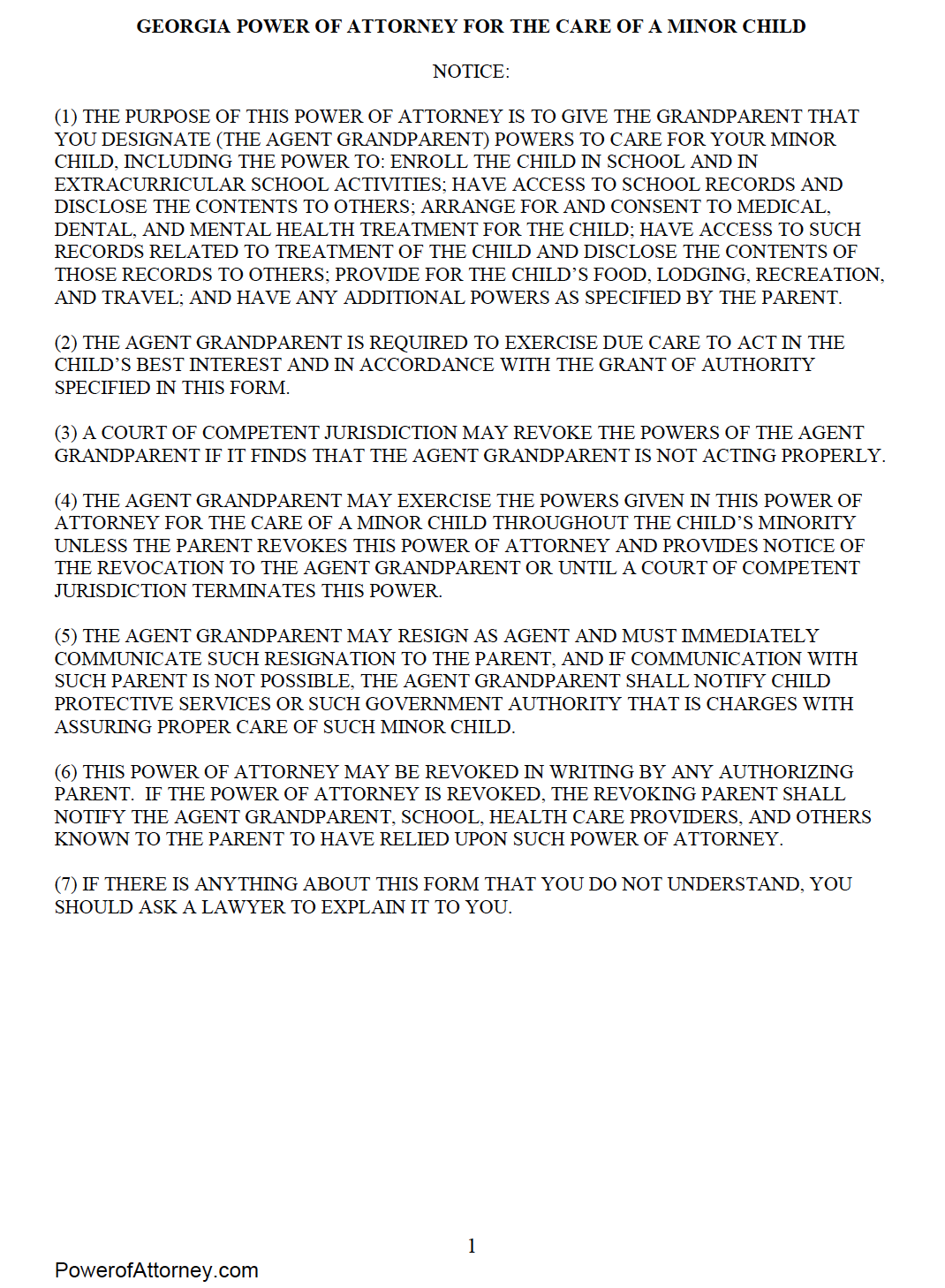

Such a power of attorney may cover things such as enrolling the child in school, consenting to field trips, and even making emergency medical treatment decisions in the event a parent cannot be reached quickly.

What is a POA?

A POA that confers less than full authority upon the agent. Many power of attorney forms give the agent authority that is as comprehensive and broad as possible. A limited power of attorney grants less authority, sometimes referred to as a special power of attorney, grants less authority. It might only give a few specified powers, ...

What is a principal in power of attorney?

Principal. A person who executes a power of attorney to give another person authority to act on his or her behalf.

What is an agent in law?

Agent. A person who is given authority by a POA. Also called an attorney-in-fact (which has nothing to do with being a lawyer).

Can a power of attorney be present at a closing?

For example, you could execute a power of attorney that allows your spouse, a business associate, your lawyer, or a friend to attend a real estate closing and sign documents on your behalf.

Can an agent's authority be regained?

Your agent’s authority only exists while you are incapacitated. In the event you regain the ability to make and communicate an informed decision, you also regain the ability to make the decision.

What is a power of attorney?

A “power of attorney” is a grant of legal rights and powers by one person to another. The person granting the powers is know as the “principal,” and the person receiving the power is known as the “agent” or “attorney-in-fact.”.

Why is it important to choose a power of attorney?

It is important to choose this person carefully because he or she can control your assets. A power of attorney can be very handy in the event that one is unable to take care of his/her own financial affairs, for reasons such as extended travel or illness.

What is a durable power of attorney in Massachusetts?

Massachusetts Uniform Durable Power of Attorney Act was enacted to allow a standard power of attorney document to stay in effect in the event the principal became mentally incapacitated; hence the term “durable power of attorney.”. When one does not grant a “durable” power of attorney, family members of a person stricken with a mentally ...

When preparing a document, should the principal consider particular types of transactions or accounts?

When preparing the document the principal should consider particular types of transactions or accounts, which financial institutions are likely to be relying on the document, and the nature of the accounts owned by the principal , to aid document acceptance.

Can a power of attorney be revoked?

It is important to note that a power of attorney does NOT take away the rights of the principal. It is similar to handing the keys to ones car to someone else. Just as the keys can be taken back, so can a power of attorney be revoked. Both a standard and a durable power of attorney will terminate upon the principal’s death.

Does a power of attorney give the agent full authority?

Although, the typical power of attorney may grant the agent very broad powers, it does not give the agent full authority to take ...

Who can be considered a third party in a power of attorney?

This third party could be a real estate purchaser or seller, a retirement plan administrator, or the principal’s business associates.

What happens if you have a power of attorney?

If you have a Power of Attorney, your wishes will be clear. There will be no dubiety and your family and friends will be able to do as you would wish. This means that there is no room for argument or disagreement amongst family members or friends as to who should act on your behalf. In addition to this, if spouses do not have joint bank accounts and one spouse loses capacity, having a Power of Attorney in place will allow the other spouse to access their finances to continue to pay bills and other living costs.

Why is a power of attorney important?

A Power of Attorney grants someone else permission to make decisions about your finances and property, as well as your health and personal welfare. It is vitally important that you have a Power of Attorney in place. Here are six reasons why you should have one…

Is a will a power of attorney?

A WILL is NOT a Power of Attorney. A common misconception is that having a Will means that you do not need a Power of Attorney. The reality is that having a Will only dictates how your estate will be dealt with upon your death. It has no bearing on critical welfare and financial decisions that would require to be made during your life ...

Is a power of attorney necessary?

It is often thought that having a Power of Attorney is only necessary if you are retired, elderly or have a long-term illness. This is not the case. The reality is that you cannot predict what may happen in the future, so it is very much a case of the earlier, the better. Even if you are in the prime of your youth or have never experienced any ...

Can a spouse give you a power of attorney?

This is not the case. If you do not grant a Power of Attorney while you still have the capacity to do so, a court order is required to give someone ...

What is a power of attorney?

A power of attorney is a legal document granting powers to someone you trust to act in your place when you are not available or no longer capable of doing so. This person is called an agent or attorney in fact. Broadly speaking, there are two types of power of attorney: financial powers of attorney and medical powers of attorney. An agent appointed under a financial power attorney acts on your behalf with respect to financial matters. A medical power of attorney allows you to select the person who will make medical and care decisions for you when you lack the ability to give informed consent.

Why are powers of attorney important?

However, they are among the most important to ensure that your needs are properly met if you become incapacitated.

Do you need a power of attorney if you are married?

Many people mistakenly believe that there is no need to create powers of attorney if they are married. They may believe that they are protected if they and their spouse are joint owners of property, or that their spouse will automatically be able to make medical and financial decisions for them when they cannot. However, this is not always the case.

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

How to get guardianship if you have no power of attorney?

Pursue legal guardianship if you cannot obtain power of attorney. If the person is already mentally incapacitated and did not grant power of attorney in a living will, it may be necessary to get conservatorship or adult guardianship. In most regards, the authority held by a guardian is similar to (but more limited than) those held by someone with power of attorney. A guardian is still accountable to the court, and must provide regular reports of transactions. To become a guardian of someone, a court must deem the principal to be “legally incompetent." In other words, they are judged to be unable to meet their own basic needs. If you believe someone you known meets the criteria for incompetence, you may petition the court to be named guardian.

What is an ordinary power of attorney?

An ordinary or general power of attorney is comprehensive. It gives the agent all the powers, rights, and responsibilities that the person granting POA has. A person can use an ordinary power of attorney if s/he is not incapacitated but needs help in some areas. An ordinary power of attorney usually ends with the death or incapacitation of the person granting POA.

Why is notarizing a power of attorney important?

Notarizing the power of attorney document reduces the chance that it will be contested by an outside party.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

When does a springing power of attorney go into effect?

A springing power of attorney does not go into effect until a specified qualification is met. Typically, power of attorney is granted following the incapacitation of the principal.

How to get a power of attorney for a parent?

Broadly speaking, you get power of attorney for a parent by having him or her name you as the agent in a POA document that he or she has signed while sound of mind. However, the process is rarely as simple as it seems, especially when it comes to ensuring that your power of attorney will be recognized by third parties. Things can also become more complicated if you're trying to get power of attorney for a sick parent who is already suffering from dementia or another terminal illness or incurable condition that affects his or her ability to communicate or make reasoned decisions.

What is the duty of a power of attorney agent?

The duty of a power of attorney agent is to always act in the best interests of the principal.

What is POA agreement?

Depending on the particular agreement, a power of attorney covers a broad or narrow set of responsibilities, usually related to financial and/or medical and caregiving matters.

What is Durable Power of Attorney?

So, what is a durable power of attorney? It's an agreement that goes into effect right away and gives an agent the authority to carry out his or her specified responsibilities even after the principal becomes incapacitated. Essentially, the difference between a "general power of attorney" and a "durable power of attorney" is that a general POA terminates when the principal is deemed to lack capacity, whereas a durable POA stays valid beyond that point. In most cases, a durable power of attorney covers financial responsibilities, but some people also use it to cover certain duties related to caregiving or healthcare.

What is POA in law?

A POA document is generally a written agreement between two people: (1) the principal (sometimes called the grantor) and (2) the agent (sometimes called the attorney-in-fact). The agent is the person appointed to act on behalf of the principal. So your parent (the principal) can grant you (the agent) certain powers of attorney.

How to sign as a POA agent?

For example, you sign as a power of attorney agent by using a formula like "Your Parent's Name, by Your Name under POA." (If your name was John Doe and your parent's name was Jane Doe, your signature would be "Jane Doe, by John Doe under POA.")

When does a springing POA take effect?

Unlike most other types of POA documents, a springing POA agreement doesn't take effect until a specified date or a particular event takes place. For example, your parent may not want you to have any authority until he or she becomes incapacitated or turns a certain age.

What is a power of attorney?

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

How to get a power of attorney for an elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your state and the scope of available powers. Talk to your parent so they understand why you want to take this step and the benefits and drawbacks of the action. Consult a lawyer who can help you draw up a document that details your parent’s rights and the agent’s responsibilities, whether that’s you or another person. Finally, execute the document by getting all parties to sign it and have it witnessed as required by state law.

How does a durable power of attorney work?

A durable power of attorney lasts after the principal’s incapacitation. What you can do with a durable POA is based on both the document and state laws. In some cases, you may only be able to manage the principal’s finances and will need a separate medical power of attorney to make health care decisions. These POAs are used when a person can no longer handle their affairs, and it can end in several ways. They can be revoked upon the principal’s death or when a guardian is appointed. The principal can revoke the POA if they’re no longer incapacitated. For example, if a person wakes from a coma, they can take back control of their finances. There may also be conditions in the document that, if fulfilled, end the POA. A durable power of attorney comes into effect on the day it’s signed unless otherwise specified.

Why do you need a power of attorney for your parent?

Arranging a power of attorney for your parent is a good way to open up a discussion with them about their wishes and needs for the future. Jeter continues, “Having those respective POAs in place means that an elderly parent has had time to think about what they really want for their medical care and their finances when they aren’t coherent to make such decisions.”

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a medical POA?

A medical POA is different from a living will , which states what medical procedures a principal does and does not want done. In the case of a medical POA, the agent can make all health care decisions for the principal. Because of this, your parent needs to make their wishes known to the agent before they’re incapacitated. The American Bar Association has detailed information available about medical powers of attorney and the process of giving someone that power.

What is a power of attorney?

A power of attorney is a legal document that one person (known as the principal) can use to appoint another individual (known as the agent) to handle his or her personal, financial, and other affairs. This document allows the principal to transfer certain powers to their trusted agent in case they become incapacitated or unable to make decisions on their own.

Does DoNotPay generate POA?

And there you go! DoNotPay will generate your POA document instantly, and all that’s left is for both parties to read the notices and sign the document.

Popular Posts:

- 1. who will be trump's next attorney general

- 2. why didn't trump pick trey gowdy for attorney general

- 3. in ga what determines if a person can get a court appointed attorney

- 4. how old does the attorney general make

- 5. who are the candidates running forcommonwealth attorney in virginia

- 6. how to fire an attorney and hire another

- 7. do i need to use an attorney for a real estate closing where i am the sellerin illinois

- 8. how can an attorney help special needs estate planning

- 9. what form do i need for power of attorney

- 10. what to do if i cannot afford an attorney in my custody battle