When you need durable power of attorney For purposes of Medicare, you need legal authorization anytime you’re acting on behalf of a beneficiary. For example, you can’t enroll another person in Medicare, even your spouse, unless you have power of attorney, health-care proxy or other authorization to make such decisions for the beneficiary.

How do you obtain medical durable power of attorney?

Sep 22, 2021 · Medicare recognizes power of attorney as legal authorization when someone else is acting on behalf of the beneficiary. Make sure to fill out the Authorization to Disclose Personal Health Information form and send that to Medicare with a copy of the POA.

How to complete the power of attorney form?

Aug 25, 2016 · To help a Medicare beneficiary, the power of attorney or other advance directive needs to grant the agent the ability to make health-care decisions for the principal. If the person being cared for becomes incapacitated, a durable medical power of attorney or other advance directive will generally allow the agent to make decisions on his or her behalf, including actions …

Does Social Security recognize power of attorney?

Apr 04, 2022 · Using a Power of Attorney to Enroll a Beneficiary in a Medicare Drug Plan. A question posed by an attorney on ElderLawAnswers' members-only Listserv has raised questions about the Center for Medicare and Medicaid Service's (CMS) policy on agents making Medicare Part D decisions for an incapacitated individual. The member wondered if CMS had ...

What are the guidelines for Medicare?

Medicare Beneficiary Services:1-800-MEDICARE (1-800-633-4227) ... Power of Attorney). 7. Send your completed, signed authorization to Medicare at the address shown here on your ... According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of

What is Medicare POA?

To group diagnoses into the proper MS-DRG, CMS needs to identify a Present on Admission (POA) Indicator for all diagnoses reported on claims involving inpatient admissions to general acute care hospitals.

Who are the primary beneficiaries of Medicare?

Medicare is available to most individuals 65 years of age and older. Medicare has also been extended to persons under age 65 who are receiving disability benefits from Social Security or the Railroad Retirement Board, and those having End Stage Renal Disease (ESRD).Dec 1, 2021

Does Medicare cover beneficiaries?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.Dec 1, 2021

Can I call Medicare on behalf of someone else?

You can either give verbal permission over the phone for the customer service representative to speak with someone else on your behalf, or fill out an authorization form in advance.

Who is the administrator of Medicare?

Chiquita Brooks-LaSureChiquita Brooks-LaSure is the Administrator for the Centers for Medicare and Medicaid Services (CMS), where she will oversee programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the HealthCare.gov health insurance marketplace.

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

What was the purpose of offering Medicare Advantage to Medicare beneficiaries?

Medicare claims that this rule will improve the relevance and depth of Medicare's value and quality-based payments, which will better reward clinicians for providing high quality, efficient care. By contrast, in Medicare Advantage Plans, Medicare pays private companies a predetermined monthly rate for each beneficiary.

What other types of coverage can a beneficiary have in addition to Medicare?

Other optionsIn addition to Original Medicare or an MA Plan, you may be able to join other types of Medicare health plans.You may be able to save money or have other coverage choices if you have limited income and resources. ... You may also have other coverage, like employer or union, military, or veterans' benefits.

Which Medicare Parts require additional premiums from beneficiaries?

Medicare Advantage plan enrollees generally pay the monthly Part B premium and many also pay an additional premium directly to their plan. Medicare Advantage plans are required to place a limit on beneficiaries' out-of-pocket expenses for Medicare Part A and Part B covered services ($6,700 in 2015).Mar 20, 2015

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. when you applied for benefits.

How to check if I have Medicare?

To learn about Medicare plans you may be eligible for, you can: 1 Contact the Medicare plan directly. 2 Call 1-800-MEDICARE (1-800-633-4227), TTY users 1-877-486-2048; 24 hours a day, 7 days a week. 3 Contact a licensed insurance agency such as Medicare Consumer Guide’s parent company, eHealth.#N#Call eHealth's licensed insurance agents at 888-391-2659, TTY users 711. We are available Mon - Fri, 8am - 8pm ET. You may receive a messaging service on weekends and holidays from February 15 through September 30. Please leave a message and your call will be returned the next business day.#N#Or enter your zip code where requested on this page to see quote.

What is springing power of attorney?

Springing power of attorney: legal authority only begins in certain circumstances or when a specific event occurs, such as mental incapacitation. Durable power of attorney: legal authority is granted once the document is signed and stays in effect throughout the principal’s life. For a caregiver of a Medicare beneficiary, ...

What can a power of attorney do?

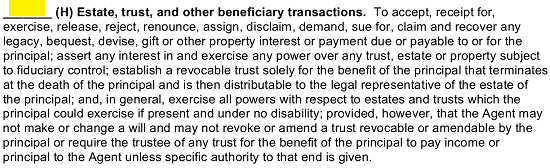

Depending on the state, a power of attorney may grant broad authority to handle finances, sell real estate, and make charitable donations–or it can be limited to medical decisions. To help a Medicare beneficiary, the power of attorney or other advance directive needs to grant the agent the ability to make health-care decisions for the principal.

What is a durable medical power of attorney?

If the person being cared for becomes incapacitated, a durable medical power of attorney or other advance directive will generally allow the agent to make decisions on his or her behalf, including actions related to Medicare.

What is an authorization form for Medicare?

Every plan has an authorization form and it goes by many different names, such as authorization to share personal information or authorization to share protected health information. This form would provide authority to speak to plan representatives about claims or coverage, update contact information, and more, depending on the individual plan.

Why is it important to have a POA?

Establishing powers of attorney (POA) must be done while a person is of sound mind and able to make financial and medical decisions. Because of COVID-19, this issue is very important. There’s no getting around the fact that the risk for severe illness from this disease increases with age.

What is a POA?

A power of attorney (POA) is a powerful thing. A financial power of attorney document allows an appointed person to make financial, legal and property decisions on another individual’s behalf. A person holding another’s POA can sell the individual’s car to pay medical bills, for example.

What is a POA in healthcare?

A medical POA is a durable power of attorney for healthcare . This allows an agent (a trusted friend or family member) to make important and necessary healthcare decisions if the individual becomes incapacitated or unable to communicate or participate in care. For example, with this authority, the POA can make healthcare decisions ...

Why is it important to name beneficiaries?

Naming beneficiaries is an integral part of estate planning for same-sex couples. It is important to dictate who should receive what benefits, and when. Beneficiaries do not have any legal authority, though, which means that preparing a power of attorney (POA) document is also crucial – especially for partners who choose not to marry.

What is a beneficiary in a will?

A beneficiary is basically a recipient of something. It can be a person, multiple people, a charity, a trustee, or even your estate. Beneficiaries are typically designated on life insurance policies, annuities, and certain retirement plans – like 401 (k)s and IRAs. They are also named in wills and trusts.

Do beneficiaries get taxed?

reaching a certain age or getting married). The funds or property that a beneficiary receives may also be subject to taxes, depending on the nature of the disbursement.

What is a POA?

What is a Power of Attorney? A Power of Attorney (POA) is a document that grants a person or organization certain powers over your affairs if you become incapacitated for some reason. This person or organization to whom you bestow power is called an attorney-in-fact or agent.

What is a representative payee?

A representative payee is a person or an organization. We appoint a payee to receive the Social Security or SSI benefits for anyone who can’t manage or direct the management of his or her benefits. . A payee’s main duties are to use the benefits to pay for the current and future needs of the beneficiary, and properly save any benefits not needed ...

Is a power of attorney the same as a payee?

Being an authorized representative, having power of attorney, or a joint bank account with the beneficiary is not the same as being a payee. These arrangements do not give legal authority to negotiate and manage a beneficiary's Social Security and/or SSI benefits. In order to be a payee, you must apply for and be appointed by Social Security.

What is a beneficiary in Social Security?

A beneficiary is a person who receives Social Security and/or Supplemental Security Income (SSI) payments. Social Security and SSI are two different programs. we administer both. Who Needs a Representative Payee? The law requires most minor children and all legally incompetent adults to have payees.

Does the Treasury recognize power of attorney?

The Treasury Department does not recognize power of attorney for negotiating federal payments, including Social Security or SSI checks. This means, if you have power of attorney for someone who is incapable of managing his or her own benefits, you must still apply to serve as his or her payee.

Can a payee sign a document other than Social Security?

A payee cannot : Sign legal documents, other than Social Security documents, for a beneficiary. Have legal authority over earned income, pensions, or any income from sources other than Social Security or SSI.

What is a power of attorney?

Power of attorney is a legal process where one individual grants a third party the authority to transact certain business for that individual. It does not lessen the rights of the individual and does not usually grant the third party the right to manage the individual's assets.

Beneficiary Signature

A request for payment signed by the beneficiary must be filed on or with each claim for charge basis reimbursement except as provided below. All rules apply to both assigned and unassigned claims unless otherwise indicated.

One-Time Authorization (CMS-1500, Items 12 & 13)

CMS Internet Only Manual (IOM), Medicare Claims Processing Manual, Publication 100-04, Chapter 1, Section 50.1.2

Popular Posts:

- 1. what can i file a complaint about attorney ga

- 2. what can someone do with a power of attorney

- 3. attorney with first name of tomas who graduated from ucsb and harvard law

- 4. attorney review nj when does it begin

- 5. how successfull is an attorney in supressing statements

- 6. how to invoke a signed power-of-attorney with a physicians review

- 7. how to find real esate attorney

- 8. how to decide on a divorce attorney

- 9. how long does one remain an entry level attorney

- 10. when an attorney handles title work