They can be "durable" — they go into effect immediately and continue in effect if the principal becomes incapacitated. Or they may be "springing." They do not go into effect unless and until the principal becomes incapacitated.

Full Answer

When does a power of attorney go into effect?

Jul 08, 2018 · A power of attorney authorizes one person to act on behalf of another person in the event that they become incapacitated. A power of attorney generally goes into effect when the person is incapacitated, but they can also go into effect in other situations, such as: According to a set date stated in the power of attorney documents; If the person is out of country or cannot …

What is a power of attorney and how does it work?

Apr 10, 2014 · It is possible to create a power of attorney that goes into effect if and when a certain event takes place. This type of power of attorney is called a springing power of attorney. You could create a springing durable power of attorney that would only go into effect if you were to become incapacitated. A springing durable power of attorney can sound like the ideal …

What happens to power of attorney if grantor becomes incapacitated?

Mar 20, 2014 · A springing durable power of attorney would not become effective right away. Instead, it would “spring” into effect and become activated if and when you become incapacitated. Avoiding a Guardianship Proceeding. Every comprehensive estate plan should include an incapacity component. If you do not execute a durable power of attorney, the state could be …

Do I need a power of attorney for my retirement plan?

May 11, 2021 · When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated.

Can you have a POA on an IRA account?

The IRA Creator (or his attorney) may prepare a power of attorney for the IRA and give it to his or her agent. The Creator may instruct the agent not to present it to the IRA Custodian until the Creator has become incapacitated.Aug 24, 2010

What is an IRA POA?

A POA lets you name or appoint someone to handle important legal and financial issues for you, either now or in the future if you are unable to make decisions for yourself. A POA can also be used to manage or make decisions related to your IRAs.Mar 26, 2013

What happens to an IRA upon death?

If you inherit a Roth IRA, you're free of taxes. But with a traditional IRA, any amount you withdraw is subject to ordinary income taxes. For estates subject to the estate tax, inheritors of an IRA will get an income-tax deduction for the estate taxes paid on the account.Mar 30, 2022

How does an IRA passed to a beneficiary?

A beneficiary may open an inherited IRA using the proceeds from any type of IRA, including traditional, Roth, rollover, SEP, and SIMPLE IRAs. Generally, assets held in the deceased individual's IRA must be transferred into a new inherited IRA in the beneficiary's name.

Can power of attorney inherit?

A power of attorney cannot be used for inheritance tax planning without the court's permission. A recent judgement in the Court of Protection has highlighted that attorneys have limited authority to make gifts under a power of attorney.

Can power of attorney withdraw money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

What is 5-year inherited IRA rule?

The 5-year rule requires the IRA beneficiaries who are not taking life expectancy payments to withdraw the entire balance of the IRA by December 31 of the year containing the fifth anniversary of the owner's death.

What is the 10 year distribution rule for inherited IRA?

For an inherited IRA received from a decedent who passed away after December 31, 2019: Generally, a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the IRA owner (this is known as the 10-year rule).

What is the 10 year rule on inherited IRA?

Under the new regulations, if you inherited a traditional IRA from someone who had already passed their required beginning date and had been taking out payments (required minimum distributions/RMDs), you can't wait until year 10 to take out the money out.Mar 4, 2022

What happens to an inherited IRA when the beneficiary dies?

Inherited IRAs: Old Rules If an original beneficiary died prior to depleting the full inherited IRA, the successor beneficiary was able to "step into the shoes" of the original beneficiary. They could continue to take the RMD each year based on the original beneficiary's remaining life expectancy.

What is the difference between an inherited IRA and a beneficiary IRA?

An inherited IRA is one that is handed over to someone upon your death. The beneficiary must then take over the account. Generally, the beneficiary of an IRA is the deceased person's spouse, but this isn't always the case.Nov 20, 2018

What happens when estate is beneficiary of IRA?

With your estate as the beneficiary of your IRA or plan, the money in the account is first distributed to your estate, and then passes to your heirs according to the terms of your will. Having your estate as beneficiary is usually the worst possible beneficiary choice in terms of tax implications.Feb 1, 2019

What is a durable power of attorney?

With a power of attorney, you name someone else to act on your behalf in a legally binding manner. Durable powers of attorney remain effective even if the grantor of the device becomes incapacitated. It can be tricky to create a durable power of attorney to account for the possibility of incapacity, because you do not know if you will ever become ...

Can you name an attorney in fact that you trust implicitly?

When you name an attorney-in-fact that you trust implicitly, you should not run into any problems, even though the agent would be empowered to act on your behalf right away. It is possible to create a power of attorney that goes into effect if and when a certain event takes place.

Can you stipulate a date for a power of attorney?

It is possible to stipulate a date upon which a power of attorney would become effective. However, this is not going to do you much good when you are creating a durable power of attorney to account for the possibility of incapacity because you have no way of knowing if or when you will become incapacitated. Because of the above, you may want your ...

Can you have a durable power of attorney if you are incapacitated?

You could create a springing durable power of attorney that would only go into effect if you were to become incapacitated. A springing durable power of attorney can sound like the ideal incapacity planning solution because you are not bestowing the power until and unless you become incapacitated.

What happens if you don't have a durable power of attorney?

If you do not execute a durable power of attorney, the state could be petitioned to appoint a guardian to act on your behalf.

Why do people use powers of attorney?

From an estate planning standpoint, powers of attorney are often used to account for the possibility of incapacity later in life.

Why are seniors unable to handle their own affairs?

There are numerous causes of incapacity, but the biggest culprit is Alzheimer’s disease.

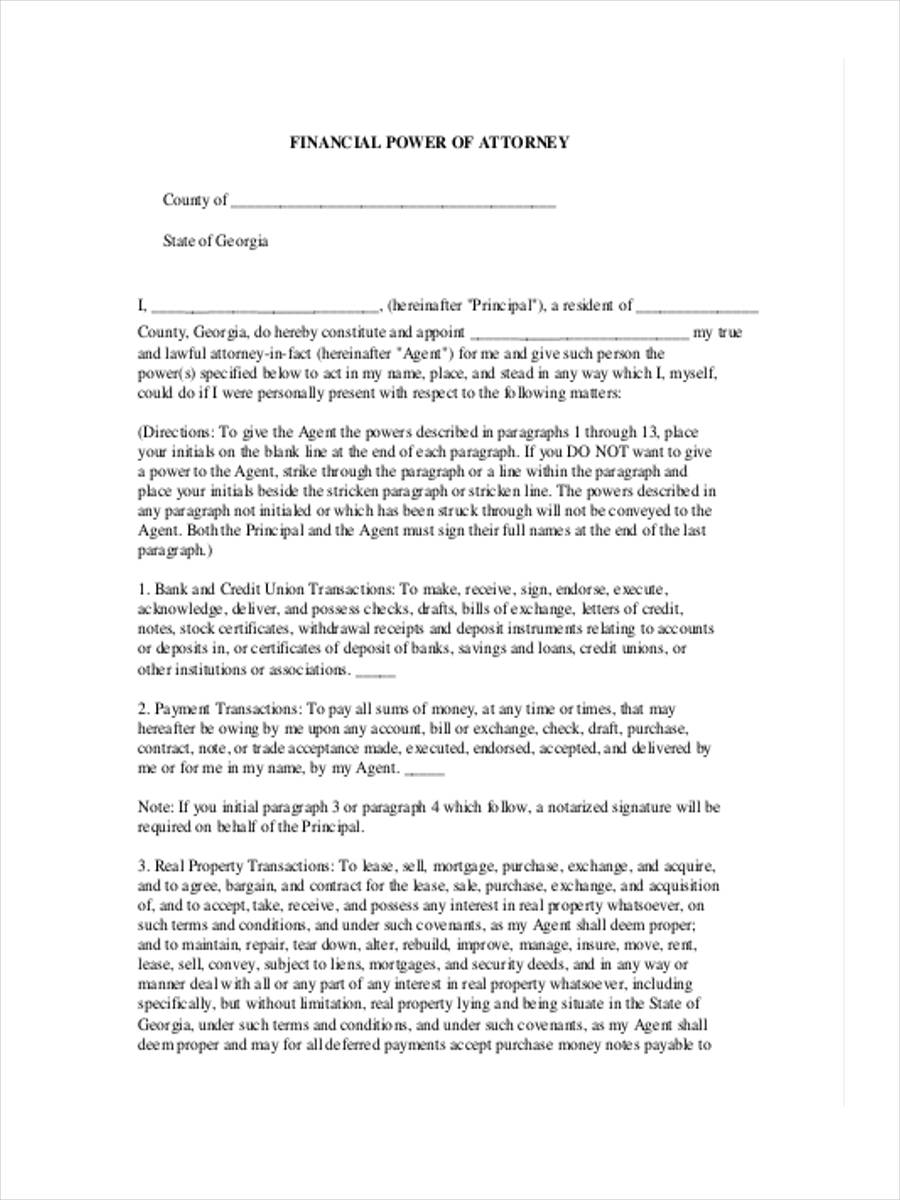

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What happens to your agent if you revoke your authority?

The authority also ends if you revoke it, a court invalidates it, your agent is no longer able to serve and you have not appointed an alternative or successor agent, or (in some states), if your agent is your spouse and you get divorced.

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

Can a third party accept a POA?

The big question about any POA is will a third party accept it? Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form. One thing you can do to help assure its acceptance is contact anyone you think your agent may need to deal with and be sure they find your POA acceptable.

What is durable power of attorney?

In the field of estate planning, durable powers of attorney are utilized to account for the possibility of incapacity. A significant percentage of people become incapacitated and unable to make their own decisions at some point in time.

Is Alzheimer's disease a cause of incapacity?

You should definitely take the possibility of future incapacity quite seriously and make the appropriate advance preparations. There are other causes of incapacity, but Alzheimer’s disease alone is enough to get your attention.

What is Durable Power of Attorney?

There’s no doubt that a Durable Power of Attorney (DPOA) is an important part of your estate plan. Ideally, if it’s well crafted and updated, a DPOA will protect both you and your assets by enabling someone you have deep trust in, to take care of both your healthcare decisions and decisions concerning your estate.

What is incompetence in power of attorney?

For the purposes of a Durable Power of Attorney, the idea of incompetence can also be looked at as a determination of whether or not a person is competent. If they are not competent, then they can be said to be incompetent.

What is the third point of a DPOA?

And in some cases there is a third point where you should understand what a determination of competence requires.

What is a DPOA?

A DPOA is one aspect of lifetime planning that you should consider at any age . However, it is a very serious item that you will want to spend time thinking about, understanding, and once established you’ll want to update it to reflect your changing life needs as well as your changing relationships.

Can a DPOA go into effect?

Whatever criteria you and your estate planning attorney discuss and agree upon for your DPOA, once you’ve established the D POA it can and will go into effect if the criteria are met. And it’s possible that if executed, by meeting the criteria you set forth, that you may not feel at the time that you’re incompetent.

Can you be incapacitated with a revocable trust?

If you have formed and funded a revocable living trust, you may mistakenly believe that all your assets are covered if you should become mentally incapacitated. One of the advantages of a revocable living trust is that the individual you name as successor trustee can take over for you as trustee and continue to manage your financial affairs for you if you become incapacitated.

Can a person with a power of attorney access 401(k)?

But the reality is that if you become mentally incapacitated and lose the ability to manage your finances, your loved ones won't be able to access these assets unless one or more of them have power of attorney.

What is a power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

What happens to a power of attorney when you die?

Power of attorney dies with you. Once you pass away, the document is no longer valid and your will then controls what happens to your assets. Fund your revocable trust. If you fund your revocable trust during your lifetime, you may not need to use your power of attorney although you should still have one just in case.

What to do if your named agent dies before you?

Name an alternate. If your named agent dies before you or is incapacitated, you want to have a back-up who can act. Also, consider nominating a guardian and conservator in your power of attorney in case one is needed down the road. Read the document. This seems obvious, but clients often do not read their documents.

When is a durable power of attorney effective?

A durable power of attorney is effective when you sign it and survives your incapacity. A springing power of attorney springs into effect when you are incapacitated. A springing power of attorney seems more attractive to most people, but it is actually harder to use.

Is a power of attorney important?

People tend to focus their energies on their wills and trusts, naming someone to serve as their power of attorney at the last minute. This is an important decision and not one that should be taken lightly.

Can a financial agent access your funds?

The unfortunate answer is “yes. ”. Since he will have access to your financial accounts, he can access your funds and use them for his own benefit. The agent does have a fiduciary duty to use the assets only for your benefit or as you direct in the document.

Can a power of attorney change bank account?

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations. This is a common scenario in second marriages.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Is a power of attorney valid if you are incapacitated?

There are powers of attorney that are limited in time. There are also powers of attorney that are no longer valid if you become incapacitated.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

Can you get yourself in trouble with a power of attorney?

At times, it is very easy to unintentionally get yourself in trouble through the use of a power of attorney. The guiding north star for any agent should always be to act solely in the best interests of the person who granted the power of attorney. You cannot use the power of attorney to provide any benefit to yourself.

Can a power of attorney be used without oversight?

They are typically able to engage in such actions, without your direct oversight, because the document allows for that. There are many different types. People often think that one power of attorney document is like all others. This is simply not the case. There are powers of attorney that are limited to healthcare.

Popular Posts:

- 1. what type of attorney would sue the ny state foster care system

- 2. what are the qualifications to be attorney general

- 3. what does a financial power of attorney form look like?

- 4. how to formally address a state attorney

- 5. show sampkes of what a power of attorney records look like

- 6. when signing as power of attorney

- 7. who was the attorney in the miranda vs. arizona case

- 8. how to back out of attorney contingency

- 9. what kindof attorney do i need to sue someone for more than 10k

- 10. how to incorporate an attorney and advisors into your organizational chart