What is a power of attorney?

Can a power of attorney change a will?

Can a power of attorney affect an estate?

Do you need to be notarized to make a will?

Is power of attorney specific to each state?

Is it easier to write a will?

See 3 more

About this website

Can a Person With Power of Attorney Change a Will?

A power of attorney does not award the agent, or the person receiving it, the right to change the last will and testament of the person who gave it to him. However, it does give the agent broad powers that may potentially be abused.

Can Power of Attorney Change a Will? - CHILTERN WILLS

All references to Chiltern Wills mean Chiltern Wills LLP (Partnership No. OC436116) incorporated as a limited liability partnership in England & Wales under the Limited Liability Partnerships Act 2000.

Changing Beneficiary Designation Using Power of Attorney

Question: My mother recently passed away. She had two children, myself and my sister. Prior to her death, she had named my sister as agent under her power of attorney. My mother’s will treats both of us equally.

Can a Power of Attorney Change a Will? - Yahoo!

Power of attorney is one of the most important legal forms for estate and elder care planning. Along with wills and trust documents, it is a critical document for arranging one’s affairs. A ...

Can a power of attorney (POA) be changed or revoked?

Let’s say your friend has named you her agent through a power of attorney, which means she’s given you the authority over her finances. She can take away your authority to act as her agent at any time if she wants to and is still able to make decisions.

What happens if you give someone a power of attorney?

If you have issued a broad power of attorney to someone, he can theoretically do a great deal of damage to your estate. He can usually sign checks on your behalf and can potentially empty bank and savings accounts earmarked for burial costs, probate expenses or bequests. Some states will allow him to create a trust and move your assets into it so they are immune from probate and unreachable by your beneficiaries. He might be able to change beneficiaries on your insurance policies. He may give assets away, such as vehicles or jewelry. The worst case scenario is that there would be nothing left for your will to transfer to beneficiaries upon your death.

What is a power of attorney?

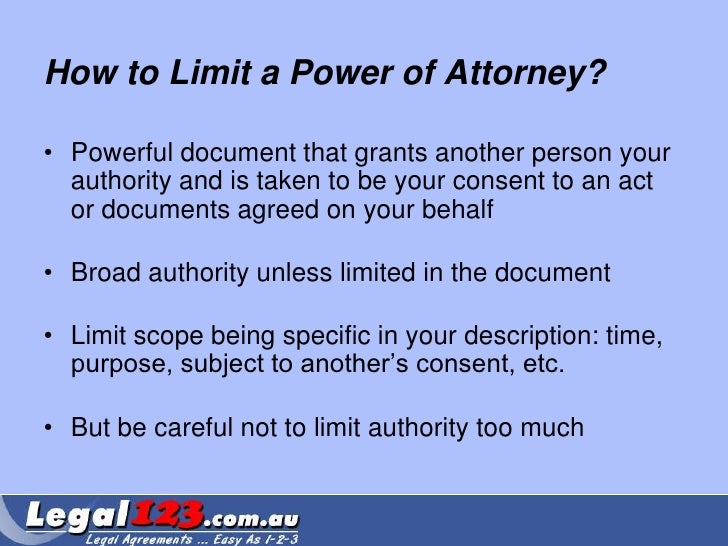

A power of attorney allows your agent to act on your behalf to any extent that you specify. You can make a power of attorney permanent or temporary, to be used by your agent only for a limited period of time. You can allow your agent to make any financial move on your behalf or only one transaction. If you are considering giving someone a power of attorney, speak to an attorney in your state first because some powers vary with different state laws.

How to protect yourself from power of attorney abuse?

You can name as many co-agents as you like and specify in the document that they cannot act unless they either do so unanimously or by majority. You should also be very specific in the document as to what you are permitting your agent or agents to do. In most states, if your loved ones suspect abuse, they can file a complaint against the agent with the court, asking to have her activities reviewed. (Reference 2)

Can an agent give a gift to herself?

For instance, it is usually illegal for an agent to make a gift from your estate to herself. You can also revoke your power of attorney at any time. Do it in writing and distribute copies ...

Can a power of attorney change a will?

A power of attorney does not award the agent, or the person receiving it, the right to change the last will and testament of the person who gave it to him. However, it does give the agent broad powers that may potentially be abused. While changes directly to a will cannot be made, a power of attorney may give your agent ...

Can a power of attorney make a financial move?

You can allow your agent to make any financial move on your behalf or only one transaction. If you are considering giving someone a power of attorney, speak to an attorney in your state first because some powers vary with different state laws.

What if the question “Can power of attorney change a Will” has been met with a firm “no”?

This would not be done by the attorneys, as a power of attorney ceases to have effect on death, but by the executors and/or beneficiaries themselves.

Why do we need a statutory will?

A statutory Will might be made for tax planning reasons, or because the client’s circumstances have changed since their existing Will was written, or perhaps because they never got around to making a Will in the first place, and the intestacy provisions are not suitable for their family.

How long does a deed of variation last?

A deed of variation must be made within 2 years of the date of death.

What is the court's decision after a hearing?

The court’s eventual decision following a hearing will be based entirely on what it believes would be in the person’s best interests, taking into account any written statements of their past wishes and feelings, and their beliefs and values.

Can you change your will?

Under normal circumstances, in order to change your Will, you must have ‘testamentary capacity’. The test for this is set out in the classic case of Banks v. Goodfellow (1870), and it has been confirmed by recent caselaw. In short, the test is that the testator must (i) know what a Will is, (ii) know who would reasonably have a claim on their estate and (iii) know what their estate includes. If the person isn’t able to recall these key facts then they do not have testamentary capacity, and they cannot change their Will themselves.

Can a deceased person challenge a will?

Make an Inheritance Act Claim. Alternatively, the Inheritance (Provisions for Family and Dependants) Act 1975 allows a spouse or former spouse, civil partner, cohabitee, child or other financial dependant of the deceased to challenge a Will. In order for a claim to succeed, the person would need to argue that reasonable financial provision had not ...

Can a power of attorney change a will?

Clients ask me from time to time “Can Power of Attorney change a Will?” It’s an interesting question, and you would think the answer should be “Definitely not.” In fact, believe it or not, there are circumstances in which an attorney can apply to court to change a person’s Will. The person in question must be over age 18, have lost mental capacity to make a Will themselves, and be domiciled in England & Wales (i.e. they have their permanent home here.)

What is a power of attorney?

Power of attorney is when you assign someone the authority to make legally binding decisions on your behalf. This can mean managing financial assets, making choices regarding medical care, signing contracts and other commitments. A power of attorney can access confidential materials and their decisions are as binding as if you had made them yourself.

Is it easier to write a will?

Writing a valid will is easier than most people believe. The only legal requirement is that you be of sound mind when you make your dispositions, meaning that you are legally competent to make decisions, and that the will must be written down.

Can a power of attorney blow up your estate?

Someone with your power of attorney may restructure your assets out of a sincere belief in your best interests, not realizing that they may blow up your estate planning in the process. As a result, if you include a general power of attorney as part of your elder care plan it is essential to discuss your estate wishes with them in advance.

Do you need to be notarized to make a will?

In most, if not all, states a will doesn’t need to be written by an attorney, notarized or witnessed. There are no specific forms that a will has to take. While all of these things can help make it more likely that your wishes will be enforced and enforceable, they aren’t necessary.

Is power of attorney specific to each state?

Readers should note that issues such as power of attorney and estate law are highly specific to each state. While this article can give you an overview of the subject, it should not be taken as individual legal or financial advice. Everything below applies to most jurisdictions, but readers should understand that any or all of these concepts can change from state to state. Seek an attorney before making any decisions regarding your own affairs.

Can a power of attorney change a will?

Along with wills and trust documents, it is a critical document for arranging one’s affairs. A power of attorney cannot change a properly written will. However, such a person can make many changes to the assets surrounding that estate. Here is how it works. Estate planning can get complicated, quickly; working with a financial advisor goes a long way to simplifying the challenge. Estate planning can get complicated, but working with a financial advisor is one of the best ways to clarify and even simplify the challenge.

What is a power of attorney?

Power of attorney is when you assign someone the authority to make legally binding decisions on your behalf. This can mean managing financial assets, making choices regarding medical care, signing contracts and other commitments. A power of attorneycan access confidential materials and their decisions are as binding as if you had made them yourself.

Can a power of attorney change a will?

Along with wills and trust documents, it is a critical document for arranging one’s affairs. A power of attorney cannot change a properly written will. However, such a person can make many changes to the assets surrounding that estate. Here is how it works. Estate planning can get complicated, quickly; working with a financial advisor goes a long way to simplifying the challenge. Estate planning can get complicated, but working with a financial advisoris one of the best ways to clarify and even simplify the challenge.

Can a power of attorney affect an estate?

But Power of Attorney Can Still Affect an Estate

Do you need to be notarized to make a will?

In most, if not all, states a will doesn’t need to be written by an attorney, notarized or witnessed. There are no specific forms that a will has to take. While all of these things can help make it more likely that your wishes will be enforced and enforceable, they aren’t necessary.

Is power of attorney specific to each state?

Readers should note that issues such as power of attorney and estate law are highly specific to each state. While this article can give you an overview of the subject, it should not be taken as individual legal or financial advice. Everything below applies to most jurisdictions, but readers should understand that any or all of these concepts can change from state to state. Seek an attorney before making any decisions regarding your own affairs.

Is it easier to write a will?

Writing a valid will is easier than most people believe. The only legal requirement is that you be of sound mind when you make your dispositions, meaning that you are legally competent to make decisions, and that the will must be written down.

Popular Posts:

- 1. how much does it cost for an attorney to request textmessage recovery?

- 2. who was the attorney general of new york when this report was made

- 3. how many years an attorney has to keep a file

- 4. attorney who checks guardian

- 5. how to fight back when credit card debt attorney instructed levy on home

- 6. movie with john turturro where he plays an attorney

- 7. how to file a complaint with the missouri attorney general

- 8. as a defense attorney, what would you do under the following circumstances? quizlet

- 9. where to get special power of attorney near me

- 10. ace attorney apollo spirit what happened to godot