Your Attorney-in-Fact under your DPOA could do that for you. Your trustee can’t because your IRA is usually not owned by your trust. Although the state laws surrounding the use of Durable Powers of Attorney have been recently modified and in many cases strengthened, it remains difficult to use a DPOA in certain instances.

Full Answer

Can a durable power of attorney be used as a trustee?

Apr 29, 2020 · 4.1/5 (569 Views . 44 Votes) A trustee only has power over an asset that is owned by the trust. A trustee may delegate their power to a third party by use of a power of attorney. A document which merely gives the attorney-in-fact power over the principal's personal affairs is not sufficient to permit them to exercise authority over the trust.

Do you need a power of attorney for a living trust?

Aug 06, 2021 · How Does a Durable Power of Attorney Differ from a Trustee? There can be confusion about who has the authority to act in financial matters when a client becomes incapacitated. Two documents give direction on this. One that the client probably has is the Durable Power of Attorney (“DPOA”), which names a person (the “Power Holder”) to act ...

Can a trustee resign under the pppra?

A trustee can appoint an agent under a power of attorney, with the trustee in the role of principal. The agent can then be empowered under the POA to sign for the trustee in whatever circumstances the trustee needs. The division of responsibilities in such a case could be: The trustee looks after any assets that have been placed in the trust ...

What happens to a dpoa when the trustee dies?

Jun 26, 2019 · Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or …

Can a trustee sign a power of attorney?

A trustee can appoint an agent under a power of attorney, with the trustee in the role of principal. The agent can then be empowered under the POA to sign for the trustee in whatever circumstances the trustee needs.

Can a trust have a power of attorney?

Generally, a power of attorney (POA) is not designated for a trust. However, there could be instances when you might want to name the same person as your trustee and as your attorney-in-fact. ... A trust, on the other hand, is managed by a trustee.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can an attorney act on behalf of a trustee?

What if the settlor or trustee has made a power of attorney? ... The short answer is that, although an attorney has wide powers to deal with both the donor's personal financial affairs and their investments, an attorney cannot act on behalf of the donor when the donor is acting as trustee.Mar 16, 2018

What is the difference between a trustee and a durable power of attorney?

The Trustee only manages the assets that are owned by the trust, not assets outside the trust. ... The Power of Attorney controls assets that are not inside your trust such as retirement accounts, life insurance, sometimes annuities, or even bank accounts that are not in trust title.

Who holds the real power in a trust the trustee or the beneficiary?

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend ...Jun 22, 2021

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Can you challenge a power of attorney?

You may wish to dispute a Power of Attorney if you consider the power has been granted to the wrong person or the individual did not have the necessary capacity to make the power of attorney. You may also have concerns that an attorney's actions are not in the best interests of the individual.Sep 13, 2017

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

What happens if trustee loses capacity?

This loss of capacity means that they are unable to continue in their role as trustee, and the surviving capable spouse has to apply for them to be removed and appoint a third party in their place in order to sell the property. ... An attorney could then appoint another trustee.Feb 27, 2018

Can an attorney appoint a second trustee?

Appointing additional trustees The attorney can work around this problem by appointing another trustee of the property (in addition to the other joint proprietor) solely for the purpose of dealing with the property transfer. There is provision under s.Feb 12, 2018

What happens when a trustee loses mental capacity?

When a trustee has lost capacity, action needs to be taken to remove and replace them with someone who does have capacity to carry out the trustee functions. As a starting point, consideration should be given to the issue of capacity.Aug 16, 2016

Can a Convicted Felon Have Power of Attorney?

Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they...

Can a Company Be a Power of Attorney?

Yes. In Texas, you can grant your power of attorney to an entity of your choosing. In certain circumstances, you may choose to give your power of a...

Can a Doctor Override Power of Attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision o...

Can a Durable Power of Attorney Be Changed?

Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of...

Can a Girlfriend Be a Power of Attorney?

Yes. Any trusted person can serve as a power of attorney. They do not have to be a legal relative.

Can a Power of Attorney Also Be a Beneficiary?

Yes. In many cases, the person with power of attorney is also a beneficiary. As an example, you may give your power of attorney to your spouse.

Can a Power of Attorney Be Challenged?

Yes. If you believe that a power of attorney was not properly granted or the person with power of attorney is not acting in the best interests of t...

Can a Power of Attorney be Irrevocable?

Yes — though it is unusual. You can bestow an agent with irrevocable power of attorney in Texas. However, generally, estate planning lawyers will r...

Can a Power of Attorney Create an Irrevocable Trust?

Yes — but only with the express authorization of the principal. To be able to create an irrevocable trust, the power of attorney documents must sta...

Can a Power of Attorney Holder Open an Account?

Yes — but certain requirements must be met. Banks and financial institutions will require the agent to present specific documents.

What is a power of attorney?

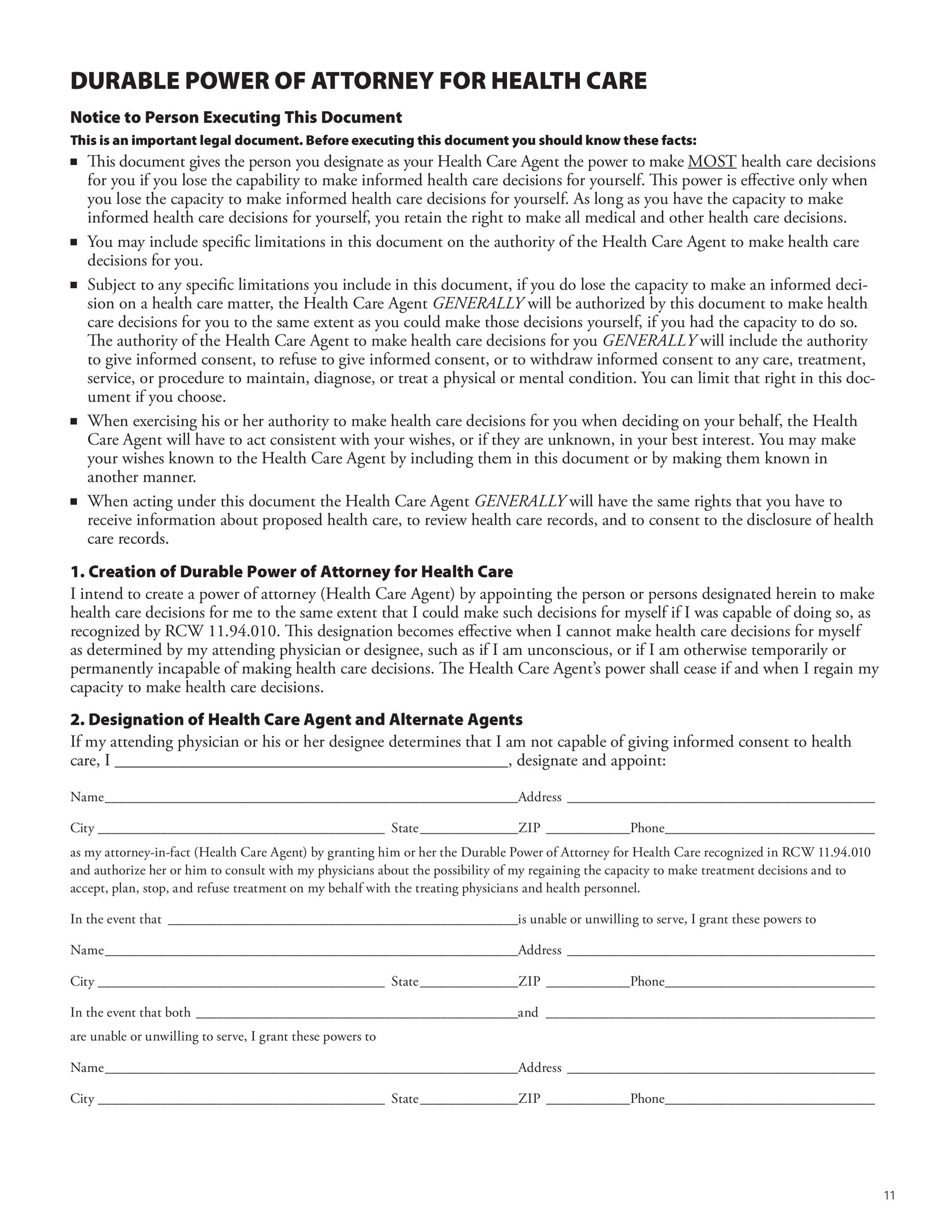

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

What is a POA?

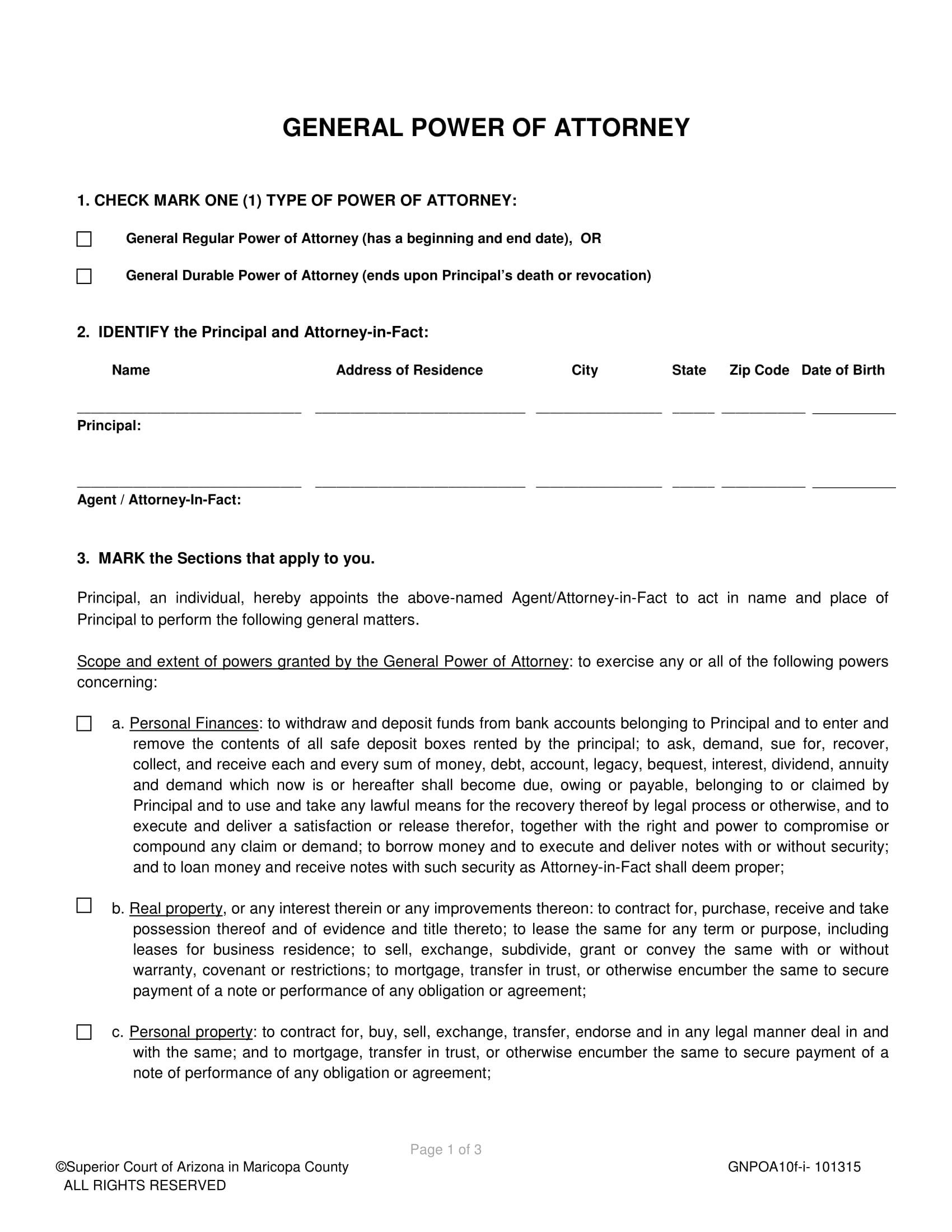

What is a Power of Attorney? Power of Attorney (POA) is an appointment you can establish that gives a person or entity (known as your Agent) the legal authority to act on your behalf and manage your affairs.

Who owns the assets in a trust?

Who owns the assets? Technically, assets inside a Trust are owned by the Trust itself. They are managed and controlled by the named Trustee, who owns the legal title to said assets. The Trustee will also act on behalf, and in the best interest of, the Trust’s beneficiaries.

What is the purpose of a trustee?

A Trustee, on the other hand, only has the authority to manage assets inside a Trust. This means their overall power can be much more limited in scope. There is a specific document, known as a Trust Agreement or a Deed of Trust, that explicitly lays out and defines the powers a Trustee holds. 3. Duration of power.

What is a trustee?

A Trustee, by contrast, could also be a person in your life, but it could just as easily be an institution or entity like a Professional Trustee, a law firm, a bank or even an investment advisory company. 2. Scope of authority. Of course it makes sense that different roles will have different scopes of authority.

Who created a trust?

Who created the Trust? The creator of a Trust is called the Grantor. There are other names you may hear, including Settlor, Trust-Maker or Trustor, just to name a few. The Grantor can also be the beneficiary of the Trust, and he or she can name themselves as the Trustee as well.

What is probate in trust?

Probate is the costly and timely process that validates a Will before assets can be distributed to inheritors. Trustees can bypass this whole process, managing Trust assets seamlessly even after the passing of the estate owner.

What is a power of attorney?

The Power of Attorney controls assets that are not inside your trust such as retirement accounts, life insurance, sometimes annuities, or even bank accounts that are not in trust title. A Power of Attorney agent (if granted authority) can also have power over your tax return filings.

Who is the trustee of a trust?

First, a Trustee is the person or entity that protects and manages the assets in a trust. For a revocable living trust, that Trustee is usually the person that created the trust. The trust document will have a successor trustee or set of successor trustees. The successor trustee usually takes power when the person that created ...

What does a successor trustee do?

The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust. Common assets that are owned by a trust include things like real estate, bank accounts, non-retirement brokerage accounts, ...

What happens if a trust is not owned by a trust?

It’s important to highlight that if a particular asset is not owned by your trust, then access to that asset will most likely lay with your Power of Attorney agent (not your Trustee) if they have been given authority over that type of asset in your POA document.

What is a power of attorney?

A power of attorney is a legal document that gives one person (the attorney) the right to act on behalf of another (the principal) in certain situations. A trust is a legal arrangement wherein some person (the trustee) is designated to manage the property of another (the grantor or settlor) for the benefit of a third party (the beneficiary).

What is a springing power of attorney?

A springing power of attorney is one that takes effect only once the principal is declared mentally incapacitated. If the power of attorney is in effect prior, and explicitly says it is to remain in effect should the principal become incapacitated through illness or injury, it is called a durable power of attorney.

Where is Joseph Nicholson?

He received a Bachelor of Arts in English from the University of Florida and is currently attending law school in San Francisco.

Is a power of attorney a separate document?

The parties to the document should clearly be identified and the powers or limitations of the attorney in fact enumerated. Though a trust document can have parts that resemble a power of attorney, listing the powers of the trustee, a power of attorney should remain a separate document. It can be incorporated into the trust document by reference. ...

Is a power of attorney necessary for a trust?

In this type of trust, it is highly advisable to have a separate person other than the grantor serve as the trustee. A power of attorney is not strictly necessary, since the property given to the trust is titled either in the name of the trust or of the trustee. Resources.

Can a living trust be used as a power of attorney?

Even if the grantor acts as trustee during their lifetime, a durable power of attorney can be used to give a third party the power to act in their role as trustee if the grantor/trustee is incapacitated.

What is an EPA power?

An EPA empowers the donee to act in relation to the donor’s property. Even if the power to resign is not a trust power per se, if it is a power relating to property at all, then it is a power relating to trust property. [20] For all these reasons, the PPPRA must be read as not extending to an attorney the power to act for a trustee in relation ...

Do incapacitated trustees retire?

The issue of incapacitated trustees is not a new one. Trustees continue to age and many do not retire when they can still elect to do so. This leaves the issue of removing incapacitated trustees and transferring property held by them to continuing and new trustees.

Popular Posts:

- 1. what if i dont want power of attorney

- 2. how much does a da attorney make

- 3. why want investigators return my attorney call

- 4. durable power of attorney how do i sigb his checks

- 5. how to rescind medical power of attorney in california

- 6. when was mueller deputy attorney general

- 7. who is attorney danielle mccarthy in colorado?

- 8. what is the difference between legal services/ attorney?

- 9. how much is the attorney fee to defende battery charges

- 10. how many hours can attorney charge in indignet cases in maine