In New Jersey, there are 4 types of power of attorney documents that are commonly used: General Power of Attorney With a general power of attorney, you will authorize your agent to act on your behalf in a wide variety of situations, including financial matters.

What are the different types of power of attorney in New Jersey?

What Types of Power of Attorneys Are Available in New Jersey? You can make several different types of POAs in New Jersey. In particular, many estate plans include two POAs: a financial POA, which allows someone to handle your financial or business matters, and a medical POA, which allows someone to make medical decisions on your behalf.

Will lasting powers of attorney be introduced in Jersey?

Oct 15, 2019 · In New Jersey, there are four categories of power of attorney. Durable Power of Attorney A Durable POA grants the attorney-in-fact the power to make healthcare decisions. These are often used in cases of Alzheimer’s, Parkinson’s dementia, and other degenerative diseases that can subsequently render the principal incapacitated.

What is a general power of attorney?

In New Jersey, there are 4 types of power of attorney documents that are commonly used: General Power of Attorney With a general power of attorney, you will authorize your agent to act on your behalf in a wide variety of situations, including financial matters. This kind of POA should be used sparingly due to the wide array of powers it grants.

Does a power of attorney need to be notarized in NJ?

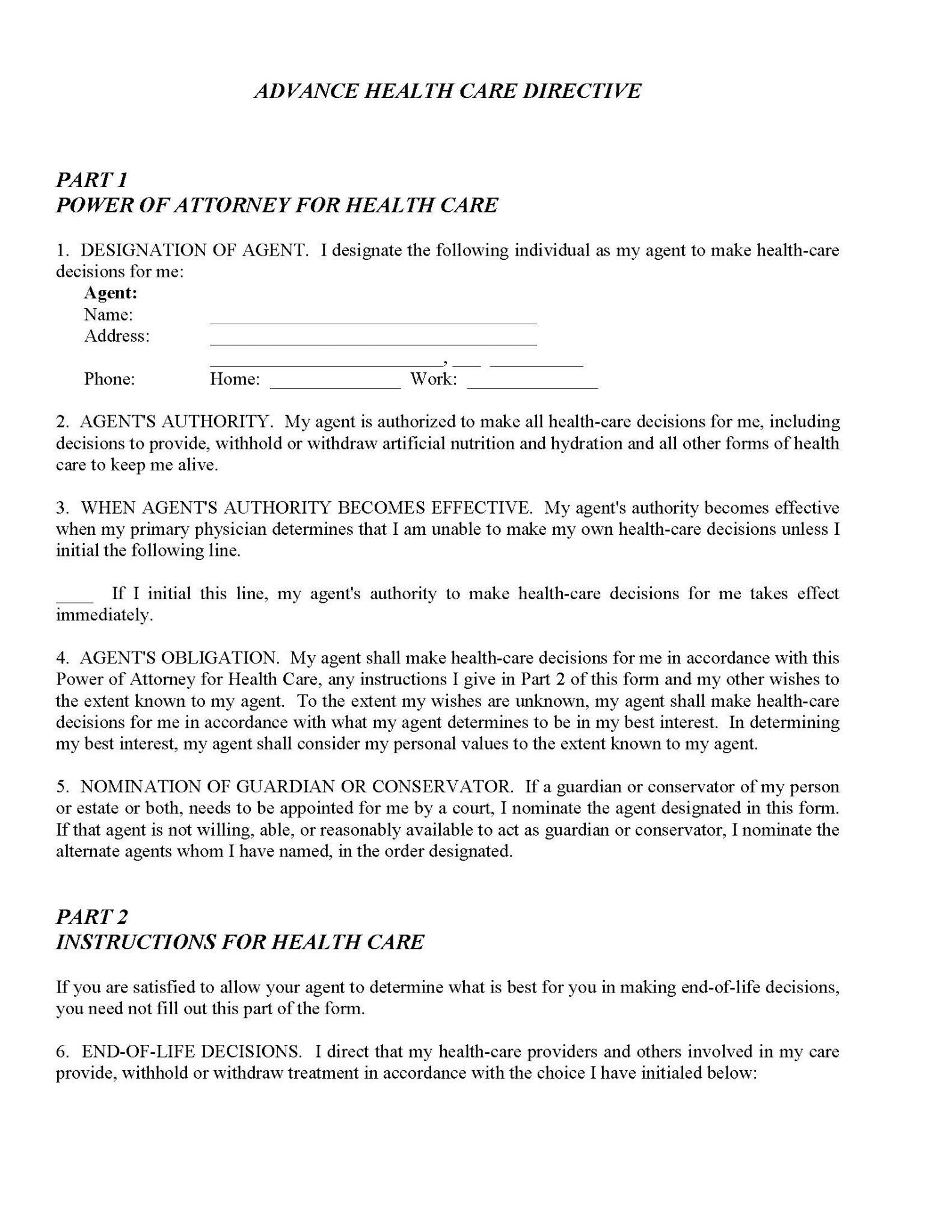

Mar 08, 2021 · New Jersey Durable Power of Attorney Laws. A durable power of attorney grants a named individual the power to make important health care and end-of-life decisions on behalf of another, usually in conjunction with a living will. State laws regulate the procedures and requirements for this legal process. In New Jersey, durable power of attorney laws require that …

Does a power of attorney have to be notarized in New Jersey?

To make a power of attorney in New Jersey, you must sign your POA in the presence of a notary public.

What is a power of attorney in NJ?

Power of attorney has long existed as part of New Jersey law, and it is used to elect an agent who will act, during incapacity, on the behalf of an individual (the principal). It is a written document where one person appoints another as their agent, and that agent has the authority to act on their behalf.

What is general durable power of attorney NJ?

A New Jersey durable power of attorney is a document used to allow someone else (“agent”) to handle the financial affairs of another person (“principal”). The powers granted will be the same as if the principal was acting themselves with the powers being restricted or unlimited.

What is the most common power of attorney?

We break down some of the most common varieties for you below.Durable power of attorney. ... Springing power of attorney. ... General power of attorney. ... Financial power of attorney. ... Medical power of attorney.Jun 11, 2021

Is there a difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

Can NJ attorneys notarize documents?

In New Jersey, attorneys can notarize documents and the law applies equally to attorneys[1] and notaries. This new law is the first significant permanent revision in a long time; however, important temporary measures were put in place for notaries as a result of the coronavirus Covid 19 pandemic in P.L. 2020, Ch.Aug 30, 2021

Does New Jersey have a statutory power of attorney?

In New Jersey, durable power of attorney laws require that the process be signed and dated, with two witnesses declaring that the signee is "of sound mind and free of duress and undue influence." Learn more about New Jersey durable power of attorney laws below.Mar 8, 2021

Who makes medical decisions if there is no power of attorney in New Jersey?

Generally, decisions about a person's financial and medical management are made according to the laws of the state they live in. In the event of medical incapacitation, usually a family member will be called upon to make any important decisions in the absence of a power of attorney.

Who can witness a durable power of attorney in NJ?

In order to ensure the validity of the Power of Attorney, it should be witnessed by two people. These people do not have to have any immigration status, but they should be over 18 years old.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

What are the disadvantages of power of attorney?

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.Oct 7, 2019

General Power of Attorney

With a general power of attorney, you will authorize your agent to act on your behalf in a wide variety of situations, including financial matters....

Durable Power of Attorney

A Durable POA goes into effect immediately and is commonly used to appoint an attorney-in-fact to make decisions for you regarding healthcare. This...

Limited Power of Attorney

This kind of POA grants an individual only particular rights to act in a particular area and can have a time limit which expires. For instance the...

Springing Power of Attorney

As the name suggests, this POA springs into effect when and only when the principal becomes incapacitated. While that sounds perfect for many situa...

What is Power of Attorney?

Power of attorney is a legal concept with which most of us are familiar, but may never fully understand until it is needed.

Creating a Power of Attorney Agreement

New Jersey POA agreements require that both the principal and the attorney-in-fact are determined to be competent when the POA agreement is created. A witnesses and a licensed Notary of the State of New Jersey must be present at the signing.

Experienced Elder Law Attorney to Create Your Power of Attorney Documents

Creating a POA agreement to make healthcare choices or to manage your finances should you become unable is a crucial decision. An experienced Estate or Elder Law attorney can advise you of all contingencies and create the documents necessary to protect you.

What does a power of attorney do?

With a general power of attorney, you will authorize your agent to act on your behalf in a wide variety of situations, including financial matters. This kind of POA should be used sparingly due to the wide array of powers it grants. It goes into effect immediately and ends upon the incapacitation or death of the principal.

What is a POA?

A “power of attorney” or POA, is a written document in which a person, called the principal, authorizes another person, known as the attorney-in-fact, to perform certain duties as the principal’s agent.

Is a power of attorney valid?

It is only valid while the principle is competent enough to agree to have control relinquished on their behalf. This is the primary difference between an general Power of Attorney and a “Durable” Power of attorney.

What is a power of attorney?

A Power of Attorney is the instrument by which an agent is appointed and given the authority to act on the principal’s behalf in specified circumstances. A Power of Attorney may be given for example to the principal’s professional adviser in a transaction authorising him to sign documents on behalf of the principal.

Can a power of attorney be revoked?

The Power of Attorney has not been revoked. Under the Law a Power of Attorney is automatically revoked upon written revocation of the power by the principal, the death of the principal or by the incapacity of the principal (e.g. if a principal develops senile dementia or another illness which causes them to be incapable ...

Do you need to update your legal documents?

People move to or from another state during their lifetimes. You need to update legal documents such as driver’s licenses, insurance, social security, etc. It’s a hassle, but it needs to be done. A thing you wouldn’t think of right away is a Power of Attorney, a Will, a Trust or any other estate planning documents.

Is a power of attorney valid in New York?

Officially, a power of attorney that is appropriately signed in one state is valid in New York. For example, if someone correctly signed a power of attorney under Florida law, the agent would be able to use that form to conduct business within the state of New York. The person signing the power of attorney would not have to sign a separate New York ...

Popular Posts:

- 1. how does an attorney distort the views of an expert witness

- 2. late night district attorney who covered the jon benet ramsey trial

- 3. how is it working at fort worth attorney general office

- 4. how to get an attorney to pay their invoices

- 5. what does tn power of attorney for a minor child

- 6. how to be represented by a probate volunteer panel attorney los angeles

- 7. how to file power of attorney in maryland

- 8. how to override a power of attorney

- 9. where is the attorney general in the system of the us government

- 10. who is the best civil rights attorney