If you have been served with a foreclosure lawsuit or are a party to a foreclosure proceeding, you should contact a real estate foreclosure defense attorney right away. A real estate foreclosure defense attorney is an expert in foreclosure law. The attorney is the only person who can legally represent you. The attorney is a skilled negotiator.

Full Answer

How to find a good foreclosure attorney?

You Have a Defense and Want to Keep Your Home. If you think you have a defense to the foreclosure, and you want to keep your home, you'll likely need a skilled attorney to help. Some defenses that probably require the aid of an attorney include the following: The servicer didn't follow proper foreclosure procedures.

How expensive is a foreclosure attorney?

Jun 02, 2010 · In evaluating each case, an attorney looks at all the issues that the borrower knows of, and then looks at all the other issues known to be defenses to foreclosure. Your attorney should decide on a tailored strategy, depending on the details and on the borrowers' situation and goals. A good attorney will listen to all of the relevant information, tell you upfront what is and …

What to ask a foreclosure lawyer?

You should speak with an attorney regarding your foreclosure situation in order to determine your possible courses of action. A real estate lawyer can provide valuable legal information as well as representation in a court of law should a lawsuit become necessary. Contact a lawyer to learn more about your state’s foreclosure laws.

Do you need a lawyer for a foreclosure?

Whether or not you should hire, or at least consult with, an attorney depends on the level of comfort and understanding that you have about the deed in lieu of foreclosure process, as well as the documents you'll have to sign to complete the transaction. Understanding Deeds in …

What are the consequences of a foreclosure?

A foreclosure won't ruin your credit forever, but it will have a considerable impact on your score, as well as your ability to obtain another mortgage for a while. Also, a foreclosure could impact your ability to get other forms of credit, like a car loan, and affect the interest rate you receive as well.

What triggers foreclosure?

Major reasons for foreclosures are: Job loss or reduction in income. Debt, particularly credit card debt. Medical emergency or illness resulting in a lot of medical debt. Divorce, or death of a spouse or partner who contributed income.Oct 7, 2021

Do lenders want to foreclose?

It is true that in most cases, lenders do not want to foreclose on a home. The process for them is lengthy, and they typically do not receive the full value of the loan. Unfortunately, sometimes lenders really do want to foreclose on a home.Mar 6, 2020

Do you lose all equity in foreclosure?

Simply put, the equity remains yours, but it will likely shrink during the foreclosure process. If you've defaulted on your loan, and your home is in foreclosure, there are a few things that could happen. If you are unable to get new financing or sell your home, the lender could attempt to sell your home in auction.Aug 8, 2021

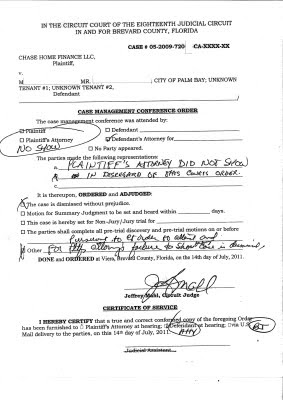

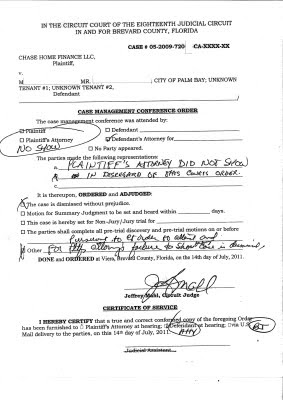

Why it's a bad idea to represent yourself

The law allows people to represent themselves, so people are free to do this, but it is almost universally true that they will wind up hurting themselves, not helping. This is comparable to doing delicate surgery yourself on a loved one if you are not a surgeon.

What a good foreclosure lawyer will do

In evaluating each case, an attorney looks at all the issues that the borrower knows of, and then looks at all the other issues known to be defenses to foreclosure. Your attorney should decide on a tailored strategy, depending on the details and on the borrowers' situation and goals.

Avoiding cookie-cutter lawyers

There are many attorneys these days who offer to assist borrowers with foreclosure defense. If you go out to find a foreclosure defense attorney, be very careful and make sure to find someone with whom you feel comfortable, and make sure that that person understands your objectives and can explain to you how those can be achieved.

What is foreclosure in real estate?

A foreclosure is forced sale of home or property by a financial institution such as a bank or mortgage company. Unless you paid for your property in full (cash) at the time of purchase, most property owners use a 3rd party to provide the additional funds to complete the sale. As a result, the owner is obligated to repay ...

What is foreclosure process?

The foreclosure process is a lawsuit brought by the bank or lender to force the sale of property to satisfy the outstanding debt. In most instances, the court will order a sale of the property after deciding the actual balance due on the mortgage (this includes accrued interest). The proceeds of the sale of your property will then apply to ...

What is acceleration clause?

The acceleration clause permits the bank or mortgage holder to declare the whole loan due if the property owner misses a specified number of mortgage payments. Usually, the property owner must be provided with sufficient notice before the lending institution can invoke the acceleration clause. The foreclosure process is a lawsuit brought by ...

How long does a pre foreclosure take?

The homeowner has 30 days to make the payments on the debt owed or the foreclosure process will be initiated.

What happens when a property owner fails to pay the mortgage?

When a property owner fails to make payments as part of the loan agreement for their mortgage, the bank or other lien holder may begin foreclosure proceedings to take possession of the property to satisfy the debt owed to them.

Can a lender purchase a property and sell it independently?

The lender issuing the default can also purchase the property and sell it independently in a private sale. At this time, the homeowner must vacate the property or an unlawful detainer will be filed to evict the homeowner if he or she is still living on the property after the sale.

Can you still owe the bank for a foreclosure?

If the value of your property is less than the outstanding debt, you may still owe the lending institution for the remainder, depending on the terms of the original loan. As the owner, you have the right to pay the bank off before the foreclosure sale in order to keep your property. If you think you may default on your mortgage and fear ...

What to do if you don't understand the deed in lieu?

If you receive the deed in lieu documents from the bank, but can't figure out what your rights are under the agreement or don't fully understand what the documents that you're signing actually mean, you should consider hiring an attorney to go over the paperwork and explain all of the terms and conditions to you.

How to avoid a deficiency judgment after deed in lieu?

To avoid a deficiency judgment after the deed in lieu is completed, the paperwork that the bank sends you to sign must expressly state that: the transaction is in full satisfaction of the debt, and/or. the bank agrees not to seek a personal judgment against you.

What is a deed in lieu?

A deed in lieu of foreclosure (deed in lieu) is one way that borrowers who are behind in their mortgage payments can avoid a foreclosure. Specifically, with a deed in lieu, the borrowers agree to sign title to the home over to the bank. In exchange, the bank agrees that the borrowers won't be liable for all, or some, of the money due under the defaulted promissory note and to release the mortgage lien. (Learn about the difference between a mortgage and a promissory note .)

What is an estoppel affidavit?

Among other things, the estoppel affidavit generally includes the terms of the agreement, such as whether or not the bank has the right to seek a deficiency judgment, which is explained in further detail below, as well as a provision that you are acting voluntarily, not under duress or undue influence.

Do you need an attorney to sign a deed in lieu?

On the other hand, if you have a good understanding of the deed in lieu process, application, and the documents you're required to sign, there's no requirement that you must have an attorney to help you with the transaction. For example, you might not need an attorney if all of the following are true.

Can you get extra time in a foreclosure?

You need help getting extra time in the home. If you want to get some additional time to stay in the home (beyond what you'd get if you let the property go through foreclosure), an attorney can help you with the negotiations. You don't understand the deed in lieu documents.

Can a 1099C be used as income?

If the bank forgives all or part of the deficiency and issues you an IRS Form 1099-C ("Cancellation of Debt" form),the forgiven amount could be considered income for tax purposes. However, an exception or exclusion might save you from having to report thecanceled debtas part of your income.

Popular Posts:

- 1. what does a county attorney in florida responsible for

- 2. who choese the attorney general

- 3. who will trump appoint northern district of illinois us attorney

- 4. how to decline a durable power of attorney

- 5. what is the job of the vermont state attorney general

- 6. who is the warrenton va district attorney

- 7. why would an attorney be so jittery

- 8. when would the attorney general recommend the death penalty

- 9. what information do i need for a power of attorney

- 10. how to fire a bankruptcy attorney