Can I get a loan to pay for a lawyer?

Dec 10, 2020 · Referral fee. Typical cost: 10% to 50% of total legal fees. A fee you pay to a lawyer for referring you to other legal representation, usually in the form of a percentage of the total fees your new lawyer earns. Referral fees are restricted to specific situations in some states.

Can a personal loan be used to cover legal fees?

Apr 01, 2022 · The entire application process is completed online and can be finished in minutes. One benefit of Figure is that you can get prequalified for a loan without any impact on your credit score. Credit score category: Good or excellent. Soft credit check: Yes. Deposit time: As fast as two days. Origination fee: 0% – 3%.

What are the different types of law firm loans?

Jul 20, 2014 · If you are the person who is owed the money, any lawyer who handles civil litigation and/or collection law may be interested in the case, but it really depends on the amount owed and whether the debtor has any means to pay a judgment (e.g., is there a bank account or employment wages to garnish).

How do law firm loans work?

Sep 26, 2017 · What Are Covered Loans? Covered loans are loans in which the lender’s money is "covered” by collateral from the borrower. The borrower pledges an asset with the lender and obtains the loan. All legal documents pertaining to asset remains in the possession of the lender. In the event of a default on repayment, the lender gains claim on the ...

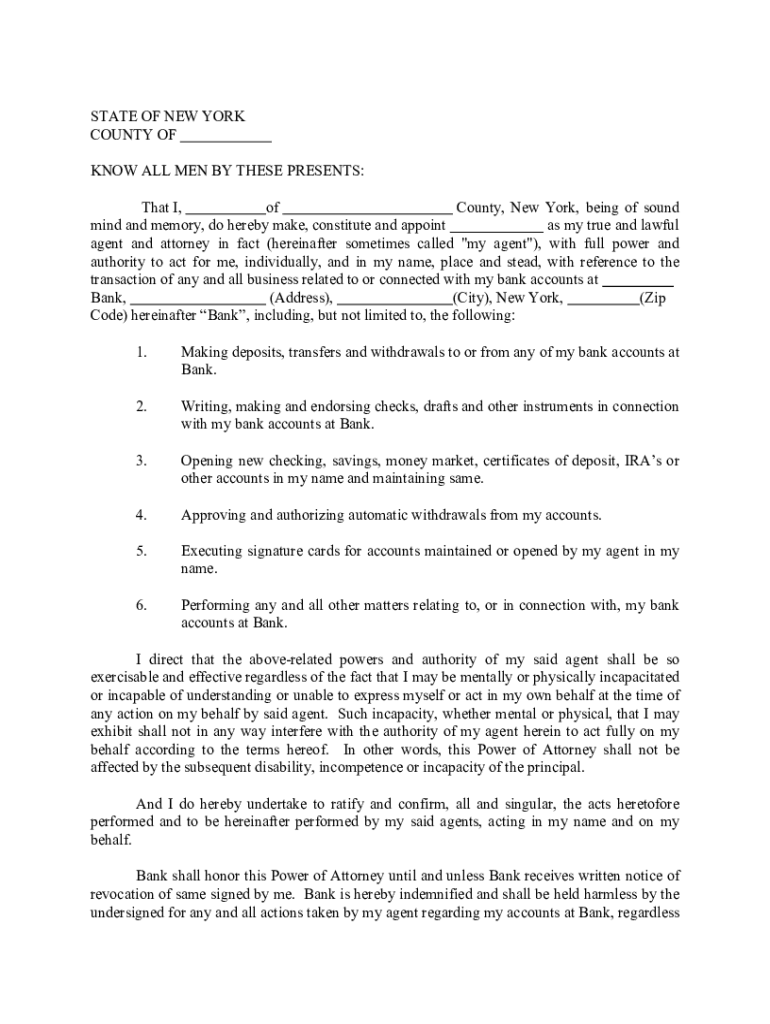

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

What is a POA on a loan?

Power of Attorney (POA) is a legal document that enables a person or entity to make decisions for you. This agreement establishes a principal and an agent.Aug 25, 2020

What is a durable power of attorney?

A durable power of attorney refers to a power of attorney which typically remains in effect until the death of the principal or until the document is revoked.

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How do I get a personal loan to pay for legal fees?

Follow these steps if you’re considering taking out a loan to pay for a lawyer and other expenses:Get an estimate. Talk to your lawyer or a legal e...

Am I eligible for a personal loan?

If you’ve run into some trouble with paying off debt in the past, you could have trouble qualifying for credit from a lender. Generally, you’ll nee...

How much do legal fees cost?

Litigation costs — the total amount of money spent on a lawsuit — vary wildly depending on your specific situation. Seven of the most common fees y...

What are attorney loans?

There are a variety of law firm loan options, including lawsuit financing, lines of credit, lawyer loans and case funding. Though the term “loans” is often used, lawyer funding is more like a cash advance that allows you to receive capital today to fund tomorrow’s success.

Why should I apply for a law firm loan?

Law firm loans provide capital to fund the costs of litigation. Attorney loans can help you fund studies or finance the appearance of expert witnesses who are integral to your case. Lawyer funding is meant to help you present the best possible case to a jury, and win the biggest settlement.

Loans for lawyers

LawStreet Capital offers a simple application process, 24-hour hour approval, and the lowest legal loan interest rates available in the country. Once we approve your request for attorney funding, you will receive those funds as soon as overnight.

What is an upstart loan?

Upstart is an online lending platform that partners with banks to provide personal loans that can be used for almost anything. Upstart’s lending model considers education, employment, and many other variables when determining eligibility. 3 This model leads to 27% more approvals and 16% lower rates than traditional models. 4

What credit score do I need to get a mortgage?

However, most lenders require borrowers to have a good credit score (670 or higher), a reliable source of income, and an active bank account.

How is APR determined?

Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved. 2 Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application.

What is retainer in legal?

Retainer: A retainer can be considered as somewhat of a down payment and is typically required up front before the lawyer works on the case. In most cases, the retainer is then used to cover a portion of the fees that are incurred throughout the process.

How old do you have to be to get a personal loan?

Additionally, borrowers in the United States are typically required to be citizens or permanent residents who are at least 18 years old. However, there are non-U.S. citizen personal loan options.

What is litigation cost?

Litigation costs: “Litigation costs” is somewhat of a catch-all phrase that includes attorney fees, court fees, and copy fees, as well as fees related to obtaining or hiring witnesses, accessing records, recreating an accident scene, etc.

Can I get a lawyer's fee without a credit check?

There are a variety of online lenders that provide loans for lawyer fees. Many of those lenders allow potential borrowers to see the loan information (rates, terms, and limits) without a hard credit check, meaning you can shop around without damaging your credit score.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

How many types of power of attorney should I include in my estate plan?

Therefore, you may want to include two or three types of power of attorney in your estate plan.

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

When does a power of attorney expire?

For example, during an extended period of travel outside of the country. A general power of attorney expires upon your incapacitation (unless it’s durable) or death. The powers granted under a general power of attorney may be restricted by state statutes.

Can you rescind a durable power of attorney?

A durable power of attorney ends automatically when you die. You can rescind a durable POA using a revocation of power of attorney form as long as you’re competent .

When does a medical power of attorney become effective?

A medical power of attorney becomes effective immediately after you’ve signed it, but can only be used if you’ve been declared mentally incompetent by physician (s). Once you’ve selected an agent, make sure they know how to sign as power of attorney on your behalf. 3. General Power of Attorney.

Can a limited power of attorney cash checks?

For example, a limited power of attorney can allow someone to cash checks for you. However, this person won’t be able to access or manage your finances fully. This type of power of attorney expires once the specific task has been completed or at the time stated in the form.

Mark W. Oakley

Are you the debtor or the creditor? If you are the person who is owed the money, any lawyer who handles civil litigation and/or collection law may be interested in the case, but it really depends on the amount owed and whether the debtor has any means to pay a judgment (e.g., is there a bank account or employment wages to garnish).

Bennett James Wills

Consumer defense. Often time you can negotiate a pre-lawsuit settlement, or you may have several other options as well. One would need much more information.

What happens if a borrower defaults on a loan?

If the borrower defaults on discharging either the interest payments or the ultimate repayments, the lender can legally claim the title on the asset pledged . So, she doesn't have much to lose. Also, the lender often ends up earning far more money on the loan than what she actually lent. The extra income is called “add-on-sum." This sum is spread over the tenure of the loan and lender earns at the end of specified periods of time.

What is covered loan?

Covered loans are loans in which the lender’s money is "covered” by collateral from the borrower. The borrower pledges an asset with the lender and obtains the loan. All legal documents pertaining to asset remains in the possession of the lender. In the event of a default on repayment, the lender gains claim on the asset.

What is a short term covered loan?

With short-term covered loans, the borrower usually purchases jewelry and home utility items. Long-term loans are used by the borrower to buy homes and vehicles.

What is the extra income called?

Also, the lender often ends up earning far more money on the loan than what she actually lent. The extra income is called “add-on-sum.". This sum is spread over the tenure of the loan and lender earns at the end of specified periods of time. 00:00.

Is the rate of interest at which an individual is able to obtain a covered loan linked to his past credit

Also, the rate of interest at which an individual is able to obtain a covered loan is linked to his past credit history. The better the credit rating, the lesser is the rate at which he obtains the loan. A borrower with good credit history is also able to get the loan very easily.

What is a reverse mortgage?

These loans include: Residential mortgages (financing to buy or build a home that is secured by the home), mortgage refinances, home equity loans or lines of credit, or reverse mortgages; A loan to buy personal property when the credit is secured by the property you’re buying, like a vehicle or home appliance.

Is a payday loan covered by the Military Lending Act?

Payday loans, overdraft lines of credit, and most installment loans are covered by the Military Lending Act. As of October 3, 2016, most types of consumer loans offered to active-duty servicemembers and their dependents have to comply with the Military Lending Act (MLA).

When did credit card companies comply with the MLA?

NOTE: Credit card companies didn’t have to comply with the MLA until October 3, 2017. If you’re a servicemember on active duty and decide to take out one of these loans, you have rights under the MLA, including a limit on the interest rate the creditor can charge.

What is a payday alternative loan?

A payday alternative loan is a short-term loan offered by some federal credit unions. A PAL is designed to be more affordable than a payday loan. Payday alternative loan amounts range from $200 to $1,000, and they have longer repayment terms than payday loans — one to six months instead of the typical few weeks you get with a payday loan.

How much can you borrow on a home equity loan?

The amount you can borrow is based on the equity you have in your home, or the difference between your home’s market value and how much you owe on your home. You typically can’t borrow more than 85% of the equity you have in your home.

What is payday loan?

Payday loans. Payday loans are short-term, high-cost loans that are typically due by your next payday. States regulate payday lenders differently, which means your available loan amount, loan fees and the time you have to repay may vary based on where you live. And some states ban payday lending altogether.

What is a cash advance credit card?

Credit card cash advances. 1. Unsecured personal loans. Personal loans are used for a variety of reasons, from paying for wedding expenses to consolidating debt. Personal loans can be unsecured loans, which means you’re not putting collateral like a home or car on the line in case you default on your loan.

How much is a payday loan?

Payday loans are usually $500 or less. Getting a payday loan may be helpful if you’re in a pinch and don’t have savings or access to cheaper forms of credit.

How long do I have to be a credit union member to get a payday alternative loan?

To qualify for a payday alternative loan, you’ll need to be a member of a federal credit union for at least a month. If you’re struggling to pay for something right away and aren’t a credit union member, you may want to look for another option. 7. Home equity loans.

Why is credit important in comparing loans?

As you begin comparing loans, you’ll find that your credit is often an important factor. It helps determine your approval and loan terms, including interest rate. To help you get started, we’ll review eight types of loans and their advantages.

Popular Posts:

- 1. attorney who speaks spanish los angeles

- 2. when is ace attorney 6 coming out in america

- 3. what is the standard contingency fee for an attorney in georgia

- 4. who is smollett attorney

- 5. how to be an attorney in 5 seconds

- 6. how to get a file for a divorce without an attorney

- 7. how do you address a letter to a states attorney

- 8. how to remove someone from power of attorney

- 9. does law school matter when hiring an attorney

- 10. how long does a u.s. district attorney serve quizlet