Can I ignore collection agency?

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

How do I deal with debt collectors if I can't pay?

5 ways to deal with debt collectorsDon't ignore them. Debt collectors will continue to contact you until a debt is paid. ... Get information on the debt. ... Get it in writing. ... Don't give personal details over the phone. ... Try settling or negotiating.

How do I respond to a collection letter from a lawyer?

Four Steps to Take if You Received a Debt Collection Letter From a LawyerCarefully Review the Letter to Determine the Claim. ... Consider Sending a Debt Validation Request. ... Gather and Organize All Relevant Financial Documents and Records. ... Be Proactive: Debt Does Not Go Away on its Own.

What will most debt collectors settle for?

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

What is the new debt collection rule?

The Fair Debt Collection Practices Act makes it illegal for debt collectors to harass or threaten you when trying to collect on a debt. In addition, on November 30, 2021, the CFPB's new Debt Collection Rule became effective.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

How can a debt lawsuit be dismissed?

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

How do you respond to being sued for debt?

The 3 Steps to respond to a debt lawsuitRespond to every paragraph in the Complaint. The Complaint includes several numbered paragraphs that lay out the lawsuit against you. ... Assert your Affirmative Defenses. ... File the Answer with the court and the plaintiff.

Does a debt collector have to accept my payment?

It's important to know that collection agencies aren't legally obligated to accept or agree to payment plans. Debt collectors don't have to work with you or agree to any payment schedules based on what you're reasonably able to afford. Their goal is to collect as much of the debt as they can as quickly as they can.

What is the lowest a debt collector will settle for?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How much do creditors usually settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Can you make monthly payments to debt collectors?

Do Collection Agencies Do Payment Plans? Some collection agencies do consider payment plans. However, they are not legally obligated to agree to a payment plan. And in some cases, even if they agree to a payment plan, they may change the agreement later or file a lawsuit for the remaining amount owed.

Can debt collectors take money from your checking account?

A bank account levy allows a creditor to legally take funds from your bank account. When a bank gets notification of this legal action, it will freeze your account and send the appropriate funds to your creditor. In turn, your creditor uses the funds to pay down the debt you owe.

What happens when your account is handed over?

My debts have been “handed over”. What does it mean? When a company that initially offered you credit approaches another company to take over the administration of your repayments, you've been “handed over”. Companies do this with accounts that are in arrears after a number of attempts to collect the money.

How do I make a payment to collections?

Once you and the debt collector have reached a written agreement for paying off the debt, you'll make your payment. The most secure way to make a payment to a debt collection agency is by sending a check through the mail with a return receipt. This will prove that the check was accepted by the collection agency.

How to fight a debt collection case?

A lawyer with experience in debt collection can help fight for your rights as a consumer, defending you against a debt collector or creditor. Conversely, if you have successfully sued someone but still haven't been paid, a debt collection lawyer can help you recover money you are owed. Many laws detail consumer protection laws as well as debt collection regulations, requirements, and procedures, and a debt collection attorney can help determine which legal strategies will be most effective in your case. In some cases, debt collection attorneys work for a percentage of the amount owed and only receive payment when you collect your money.

What to do if you are sued and still awaiting payment?

If you have sued someone successfully and still are awaiting payment, you may require the services of a debt collection attorney. There are different debt collection regulations and procedures that a debt collection lawyer can use to most effectively get your money.

What does a debt collection attorney do?

A debt collection attorney can represent you if you’re a creditor or a debtor. A lawyer can help come up with strategies either to get back money that you’ve loaned out or to protect yourself from overeager creditors. Your attorney can handle paperwork for you or represent you in court.

How Much Does a Debt Collection Attorney Cost?

Attorneys use different methods of billing, so there’s no straight answer to this. Many debt collection attorneys charge an hourly rate. Other charge based on a contingency, meaning you will not have to pay anything up front but your lawyer will take a percentage if you win your case. If you don’t win, your lawyer won’t receive any payment. If your lawyer decides to charge in this way, you’re likely on the creditor side because you have more to gain than if you were on the debtor side. Discuss how your lawyer bills up front, so that you can both agree on a fee you’re comfortable with.

What Should I Expect When Working with a Debt Collection Attorney?

If you are a creditor, an attorney can help you put a plan in place to gain back the money you loaned out. Should you go to court, the timeframe and the amount you get will depend on the judge’s ruling. If you’re able to settle outside of court, you and the debtor will be able to negotiate terms.

What to do if you are not paying your debt?

If you need repayment for a debt and the debtor isn’t paying up, a debt collection attorney can help figure out your best course of action to get your money back. You may also want to consider a creditors rights attorney, who works solely for creditors to help them regain their money.

Why do lawyers charge on the creditor side?

If your lawyer decides to charge in this way, you’re likely on the creditor side because you have more to gain than if you were on the debtor side. Discuss how your lawyer bills up front, so that you can both agree on a fee you’re comfortable with.

What is debt settlement?

An inability to pay back loans at the present time. Threat of lawsuit from a creditor. Being treated unfairly by collectors. You may also want to consider a debt settlement attorney who can help reduce or eliminate loans in order to avoid debt collectors.

Do creditors hate hearing from collectors?

What you'll learn: Debtors dread hearing from collectors looking for money, and creditors hate when those in debt dodge their phone calls. If you’re in either situation, you may help from a legal professional.

How to find out if your state has any restrictions on debt collection practices during this national emergency?

To find out if your state has any restrictions on debt collection practices during this national emergency, check your state’s official website and look for orders related to the pandemic. The National Consumer Law Center (NCLC) website is also a good source of information on consumer matters, including debt collection limitations during the coronavirus outbreak.

What happens if a debt collector doesn't respond to a phone call?

If a debt collector fails to reach you by phone or receive a response by mail, the next step is often to file a lawsuit. It has to serve you with notice that it's doing so, usually by sending you a copy of the filed complaint (lawsuit). If you don't go to court and try to defend yourself, like by saying that the amount the complaint says you owe is incorrect or the statute of limitations has passed, the collector will win the lawsuit by default. The court will then issue a judgment against you for the money owed.

What to do if you are facing foreclosure?

If you're facing a foreclosure, talk to a foreclosure attorney. If you have other kinds of debts, talk to a consumer protection attorney.

What are the two types of debt?

There are two types of debt—secured and unsecured— and many debt collection practices. Debt collectors must follow certain rules, though.

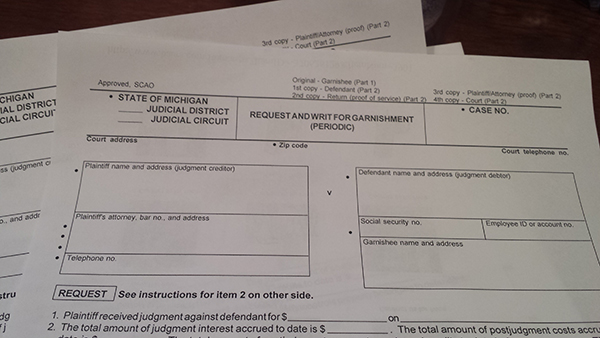

Can a debt collector garnish your wages?

The lender can take other actions to get you to pay. It can hire a debt collector to persuade you to pay the debt. It can sue you and ask the court to garnish your wages, take an asset, or put a lien on another of your assets until you've paid your debt. Unsecured debts include credit card debt, student loans, and medical bills.

Can a sheriff collect on your home?

The collector may also use a judgment to have a sheriff come to your home and collect your personal property for sale to satisfy your debt (subject to exemptions), or place a lien (ownership right) against your home or bank account.

Can a lender take back collateral?

Lenders Can Reclaim Collateral. If a loan is secured, like a car loan, the creditor can take back the collateral if you default on the payments. Secured lenders typically don't have to go through the court to get permission to do a repossession. Foreclosures on real estate are a bit different.

What is a demand letter from attorney for collection of debt?

The typical Demand Letter from Attorney for Collection of Debt has two functions: it alerts a debtor to a defaulted payment and demands that they cure the problem. This can be achieved through one of two forms, which are:

What is a demand letter from an attorney?

A demand letter from an attorney for collection of debt is a formal notice sent to a debtor by a lawyer on behalf of their client to request the payment of an outstanding bill. It provides details of the debt in default, including the date it was accrued and the total amount. Depending on the timeline, the letter could also threaten legal action or inform the reader that such actions are already in place.

How many reminder letters can an attorney send?

Depending on the organization, an attorney can send 2 to 3 general reminder letters.

Can an attorney dent a letter?

Collecting a dent is one of the toughest things to do, especially if you don’t enjoy having conversations about money. Fortunately, you don’t have to, as your attorney can do it for you more formally and effectively. Read on to find out what you need to know to draft this letter.

Popular Posts:

- 1. fee application how to court appointed attorney nc

- 2. what powers does a power of attorney give

- 3. what title u.s. attorney

- 4. where to file an irs power of attorney

- 5. what happens if you lose a case in ace attorney

- 6. what is covered by buyer's attorney closing fees

- 7. how to probate a will in texas without an attorney

- 8. is it illegal to contact someone who has an attorney in california

- 9. what do you do if client wont contact attorney

- 10. how long as assistant us attorney