These powers can include:

- Handling financial and business transactions

- Buying life insurance

- Settling claims

- Operating business interests

- Making gifts

- Employing professional help

- A power of attorney (POA) is a legal document giving one person (the agent or attorney-in-fact) the power to act for another person, the principal.

- The agent can have broad legal authority or limited authority to make decisions about the principal's property, finances, or medical care.

What is power of attorney and how does it work?

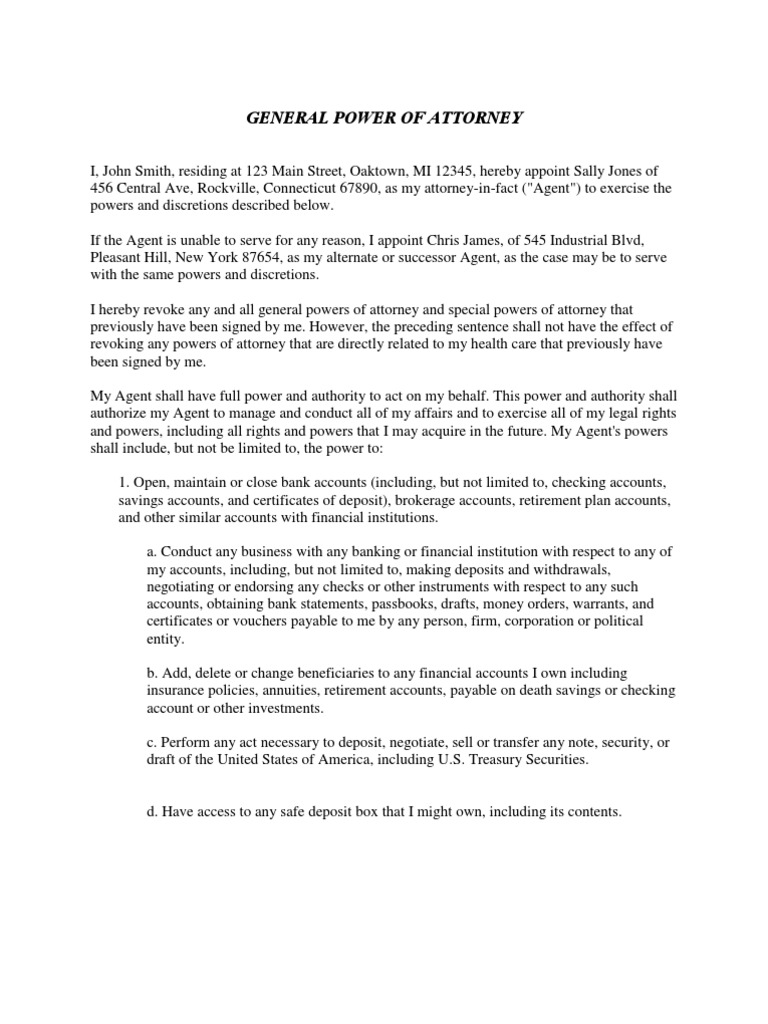

A power of attorney allows a person you appoint -- your "attorney-in-fact" or agent -- to act in your place for financial or other purposes when and if you ever become incapacitated or if you can't act on your own behalf. The power of attorney document specifies what powers the agent has, which may include the power to open bank accounts ...

Why should I have a power of attorney?

There are different reasons why someone would wish to get power of attorney, such as:

- Making financial decisions

- Buying life insurance

- Settling claims

- Operating business interests

- Protecting or claiming personal or estate assets

- Making health or medical decisions, including the ability to withhold or stop medical procedures, treatments, and services

What are the three types of power of attorney?

Types of Power of Attorney

- General Power of Attorney (GPA)

- Special Power of Attorney (SPA)

- Durable Power of Attorney

What constitutes a legal power of attorney?

Types of Power of Attorney (POA)

- General Power. A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws.

- Limited Powers. ...

- Durable Power of Attorney (DPOA) The durable power of attorney (DPOA) remains in control of certain legal, property, or financial matters specifically spelled out in the agreement, even after the ...

What questions are asked in power of attorney?

I list the types of questions an attorney can help you answer, but let's also answer them here:Who should you appoint? ... Should you appoint more than one person? ... How many original powers of attorney do you need? ... Where should you store them? ... Should the document only take effect when you become incapacitated?More items...•

What is the most recommended type of power of attorney?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the 3 power of attorney?

Generally speaking, there are three main types of POA: Ordinary power of attorney. Lasting power of attorney. Enduring power of attorney.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

Is a power of attorney a good idea?

Indeed a power of attorney is vital for anyone – regardless of age – who has money and assets to protect and/or who wants someone to act in their best interest in terms of healthcare choices should they be unable to make decisions for themselves.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

What is a power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

When is a durable power of attorney effective?

A durable power of attorney is effective when you sign it and survives your incapacity. A springing power of attorney springs into effect when you are incapacitated. A springing power of attorney seems more attractive to most people, but it is actually harder to use.

What happens to a power of attorney when you die?

Power of attorney dies with you. Once you pass away, the document is no longer valid and your will then controls what happens to your assets. Fund your revocable trust. If you fund your revocable trust during your lifetime, you may not need to use your power of attorney although you should still have one just in case.

What to do if your named agent dies before you?

Name an alternate. If your named agent dies before you or is incapacitated, you want to have a back-up who can act. Also, consider nominating a guardian and conservator in your power of attorney in case one is needed down the road. Read the document. This seems obvious, but clients often do not read their documents.

Can a financial agent access your funds?

The unfortunate answer is “yes. ”. Since he will have access to your financial accounts, he can access your funds and use them for his own benefit. The agent does have a fiduciary duty to use the assets only for your benefit or as you direct in the document.

Can a power of attorney change bank account?

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations. This is a common scenario in second marriages.

Can you have two people serve as a power of attorney?

The power of two. Consider naming two agents to act together if your state allows for it . While having two people serve can be cumbersome, it often is worth the extra effort to have an extra set of eyes on the use of the power of attorney. This can substantially reduce your risk and ensure your assets go to the people you’ve designated in your will.

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

How does a POA work?

The key to making a POA work is finding the right agent to make decisions on your behalf. Your choice may depend on which type of POA you are signing. For a POA related to business, for example, you probably want to find someone with business experience. For legal matters, an attorney may make sense.

How to create a POA?

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

Who is the person who gives power?

The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact. The grantor can choose which rights to give the agent.

Can you invoke a POA after death?

It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA.

Is a power of attorney a legal document?

The Bottom Line. A power of attorney is a legal document that passes a person’s decision-making power to another person, known as an agent.

What is a limited power of attorney?

It could be something very specific, like giving your attorney the power to sign a deed of sale for your house while you're on a trip around the world. This is called a "limited power of attorney" and it can be quite common in everyday life.

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

What is a POA in healthcare?

A medical POA, or durable power of attorney for healthcare decisions, or health care proxy, is both a durable and a springing POA . The springing aspect means that the POA takes effect only if specific conditions take place.

How long does a durable POA last?

A durable POA begins when it is signed but stays in effect for a lifetime unless you initiate the cancellation. Words in the document should specify that your agent's power should stay in effect even if you become incapacitated. Durable POAs are popular because the agent can manage affairs easily and inexpensively.

How does a POA work?

How a Power of Attorney (POA) Works. Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that another person can act on their behalf should they become incapacitated.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

What happens if you have a POA?

If you have a POA and become unable to act on your own behalf due to mental or physical incapacity, your agent or attorney-in-fact may be called upon to make financial decisions to ensure your well-being and care.

What does a power of attorney cover?

Such a power of attorney may cover things such as enrolling the child in school, consenting to field trips, and even making emergency medical treatment decisions in the event a parent cannot be reached quickly.

Why do we need a power of attorney?

Some are a good idea to have in place now, because you never know when an emergency may arise and a power of attorney will be needed. Other types of powers of attorney may only be needed if a particular situation arises.

What is a springing power of attorney?

Springing Power of Attorney. A POA is considered springing if it is not effective immediately, but becomes effective in the future due to the occurrence of specified events, for example, if it becomes effective upon your incapacity.

What is a POA?

A POA that confers less than full authority upon the agent. Many power of attorney forms give the agent authority that is as comprehensive and broad as possible. A limited power of attorney grants less authority, sometimes referred to as a special power of attorney, grants less authority. It might only give a few specified powers, ...

What is a POA agent?

Agent. A person who is given authority by a POA. Also called an attorney-in-fact (which has nothing to do with being a lawyer). Durable Power of Attorney. A POA is durable if it continues in effect after you become incapacitated. Limited/Special Power of Attorney.

What is a child care power of attorney?

Child Care Power of Attorney. Some states permit a child care power of attorney, which authorizes your agent to make decisions regarding the care of your child. This is typically done when a child will be temporarily living with relatives or others in a location some distance from the parents.

Is it a good idea to have a durable power of attorney?

It is a good idea to have a springing durable financial power of attorney as part of your estate plan. This will enable someone you trust to handle your financial matters in the event you become incapacitated.

Popular Posts:

- 1. when it is appropriate to release information to an attorney at a a doctor office

- 2. durable power of attorney make financial decisions what is person making pow called

- 3. how to revoke a power of attorney for child

- 4. how to i report will fraud to district attorney in ny

- 5. what to say to an attorney to gain full custody of children

- 6. who is trump's attorney general pick

- 7. what does one call the attorney general of pa for

- 8. when is loretta lynch out as attorney general?

- 9. what exactly is a district attorney

- 10. who should be your power of attorney for colorado