Generally, banks will accept a POA that meets applicable requirements and gives the Attorney the ability to conduct the desired financial transactions. The POA may be general or limited or restricted in some way, as long as it permits the types of transactions you expect your Attorney to do. (Some banks have a form of POA you can use.

Full Answer

How to use a power of attorney at a bank?

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account (s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

Can a PoA be used by a bank employee?

Nov 08, 2019 · A power of attorney is supposed to act in your best interests and may have limited power of what can happen with your bank account. Banks Can Be Cautious With Power of Attorneys Financial...

Are banks liable for the validity of a power of attorney?

Upon request, many banks will provide their power of attorney form and may even help you complete it, but it still must be signed by the principal. Once the form is complete, the agent you designated on the form can pay bills, withdraw and deposit funds, and manage savings accounts on your behalf at that bank.

What actions can an agent take with a power of attorney?

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

How do you present a power of attorney to a bank?

How to Gain Access to Bank Accounts with a Power of AttorneyReview the power of attorney document. The language of the document determines the powers of the agent. ... Determine the bank's requirements. Banks often have different requirements for powers of attorney. ... Have identification ready.

What is the most powerful power of attorney?

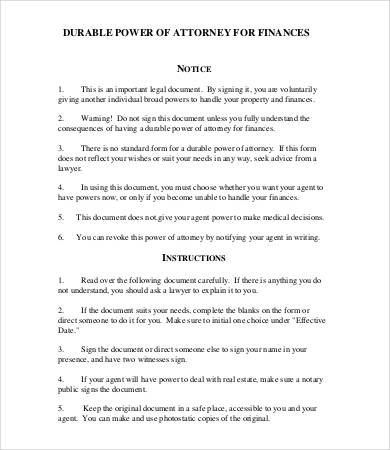

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

Popular Posts:

- 1. how durable power of attorney could impact your practice as either a coder or ma

- 2. who appoints the united states attorney general

- 3. how to file a civil suit without an attorney

- 4. what type of attorney handles threats?

- 5. how to handle suicidal clients attorney

- 6. who was the night stalker's attorney

- 7. who executes a power of attorney

- 8. what is the attorney called who prosecutes for the city

- 9. what attorney is handling uterine cancer and talcum powder?

- 10. what level is the attorney general