A general power of attorney grants your agent a broader range of authorities such as making real estate decisions, resolving financial matters, and taking legal steps on your behalf – this includes:

- Purchasing and selling properties

- Entering contracts

- Looking after banking transactions

- Paying utility and other bills

What are the responsibilities of a power of attorney?

Some of the responsibilities and transactions you may execute on as power of attorney include:

- Property (real or personal)

- Investments and banking transactions

- Operations and dealings of an unincorporated business

- LLC ownership or voting business stock

- Interests and transactions for beneficiaries related to trusts and estates

- Decisions related to retirement plans, annuities, and insurance on coverages, investment choices, and products

Why should I have a power of attorney?

The Three Main Roles of a Power of Attorney

- Making medical decisions on behalf of the principal

- Handling financial and legal matters on behalf of the principal

- Making decisions on the behalf of someone who has lost their mental capacity

How do you gain power of attorney?

How to make a lasting power of attorney

- Choose your attorney (you can have more than one).

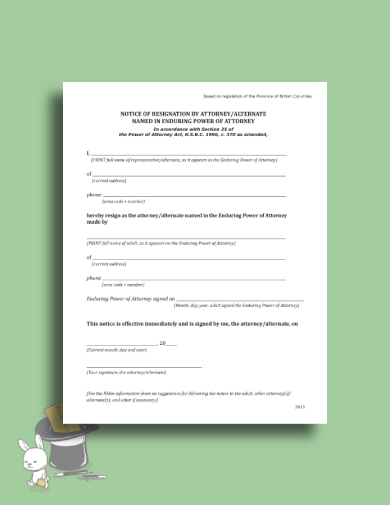

- Fill in the forms to appoint them as an attorney.

- Register your LPA with the Office of the Public Guardian (this can take up to 10 weeks).

What do you need to know about being power of attorney?

9 Things You Need To Know About Power Of Attorney Understand the power. In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. Consider your options. There are two types of powers of attorney. ... Choose wisely. ... Abuses are common. ... The power of two. ...

Is there a downside to being a power of attorney?

If you execute a general POA, one of the biggest potential disadvantages is that your Agent has the ability to devastate you financially. With a general POA your Agent can withdraw funds from all your financial and investment accounts, sell your property, and even enter contracts in your name.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Can a family member override a power of attorney?

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

What are the 3 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.

What is the difference between lasting power of attorney and enduring power of attorney?

The holder of an LPA can make life changing decisions on behalf of the mentally incapable person, for example regarding their lifestyle arrangements, medical care and 'life sustaining treatment'. In contrast, for example under an EPA, the attorney cannot decide where the donor should live.

What is the difference between power of attorney and enduring power of attorney?

The key distinction between the two is that: your general Power of Attorney becomes invalid upon your death or when you lose the mental capacity to make your own decisions; whereas,• an Enduring Power of Attorney will continue to have effect during your lifetime even if you lose capacity to self-manage.

What is the difference between a power of attorney and a lasting power of attorney?

A Lasting Power of Attorney will only come into effect if you are deemed to have lost the mental capacity to make decisions for yourself, so it offers protection against future accident or ill health. Please note: both types of Power of Attorney can only be entered into when you have full mental capacity.

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

How does a POA work?

The key to making a POA work is finding the right agent to make decisions on your behalf. Your choice may depend on which type of POA you are signing. For a POA related to business, for example, you probably want to find someone with business experience. For legal matters, an attorney may make sense.

How to create a POA?

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

What is a POA?

The power of attorney (POA) authorizes another person to sign legal documents and otherwise act on your behalf in the eyes of the law. This power, however, does not apply to making changes to a will. It ends when you die — or earlier. It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA. If you need more help sussing out the nuances of power of attorney and how it can apply to financial documents and decisions in your life, consider enlisting the help of a financial advisor.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

Who is the person who gives power?

The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact. The grantor can choose which rights to give the agent.

Can you invoke a POA after death?

It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA.

What is a power of attorney?

A power of attorney is someone involved in your estate administration and planning process. While planning for your estate, you can name a power of attorney. This individual has as much authority as you wish to give them. They do not have unlimited power over your life.

What is springing power of attorney?

In comparison, a springing power of attorney has the ability to make decisions when a triggering event occurs. If an accident occurs where you are unable to make clear decisions, they can gain control over the situation at this time.

Is a limited power of attorney the same as a general power of attorney?

However, a limited power of attorney does not have as much power as a general power of attorney. A limited power of attorney is limited in ways that you decide. You can pick what field they have the authority to control. This can include certain financial aspects.

Can you limit someone's power?

Instead, you can limit their power as much as you would like. With these roles, a person can be highly involved in making important decisions regarding your life. Due to this, you should make sure to appoint someone you trust.

Can a power of attorney have unlimited power?

This individual can have the power to make important decisions that they should not mess up making. Although a power of attorney does not have unlimited power, they can if you wish to give it to them. A general power of attorney can have the authority to make decisions for you fiscally.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

Who Should Be Your Agent?

You may wish to choose a family member to act on your behalf. Many people name their spouses or one or more children. In naming more than one person to act as agent at the same time, be alert to the possibility that all may not be available to act when needed, or they may not agree. The designation of co-agents should indicate whether you wish to have the majority act in the absence of full availability and agreement. Regardless of whether you name co-agents, you should always name one or more successor agents to address the possibility that the person you name as agent may be unavailable or unable to act when the time comes.

How The Agent Should Sign?

Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions. This is especially important if you take actions that directly or indirectly benefit you personally.

What Kinds of Powers Should I Give My Agent?

In addition to managing your day-to-day financial affairs, your attorney-in-fact can take steps to implement your estate plan. Although an agent cannot revise your will on your behalf, some jurisdictions permit an attorney-in-fact to create or amend trusts for you during your lifetime, or to transfer your assets to trusts you created. Even without amending your will or creating trusts, an agent can affect the outcome of how your assets are distributed by changing the ownership (title) to assets. It is prudent to include in the power of attorney a clear statement of whether you wish your agent to have these powers.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

Why do you need a power of attorney?

Choosing someone to hold your power of attorney and specifying that it will operate even if you lose capacity ensures that you have a plan in place for administering your financial and personal affairs if you are ever unable to do so.

Why do you need an attorney to draw up a POA?

Using an attorney to draw up the POA will help ensure that it conforms with state requirements. Since a POA may be questioned if an agent needs to invoke it with a bank or financial services company, you should ask an attorney about prior experience in drafting such powers. You want to select someone not only familiar with state requirements, but also with the issues that can arise when a power is invoked. This way, the attorney can use language that will make clear the full extent of the responsibilities that you wish to convey.

Who Should Be Your Attorney-in-Fact?

The person you choose as your agent must be someone you trust without hesitation. Depending on how you've worded your POA, the person you select will have access to and be able to make decisions about your health, home, business affairs, personal property, and financial accounts.

How long does a durable POA last?

A durable POA begins when it is signed but stays in effect for a lifetime unless you initiate the cancellation. Words in the document should specify that your agent's power should stay in effect even if you become incapacitated. Durable POAs are popular because the agent can manage affairs easily and inexpensively.

How does a POA work?

How a Power of Attorney (POA) Works. Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that another person can act on their behalf should they become incapacitated.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

What is a power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

How effective is a durable power of attorney?

Consider your options. There are two types of powers of attorney. A durable power of attorney is effective when you sign it and survives your incapacity. A springing power of attorney springs into effect when you are incapacitated. A springing power of attorney seems more attractive to most people, but it is actually harder to use. Your agent will need to convince the bank that you are incapacitated and, even though the document spells out how to do that, your local bank branch often does not want to make that determination. Translation: your lawyer often needs to get involved. For that reason, most attorneys advise you to execute a durable power of attorney. The attorney will often hold the original power of attorney until it is needed as an extra protection.

What happens to a power of attorney when you die?

Power of attorney dies with you. Once you pass away, the document is no longer valid and your will then controls what happens to your assets. Fund your revocable trust. If you fund your revocable trust during your lifetime, you may not need to use your power of attorney although you should still have one just in case.

What to do if your named agent dies before you?

Name an alternate. If your named agent dies before you or is incapacitated, you want to have a back-up who can act. Also, consider nominating a guardian and conservator in your power of attorney in case one is needed down the road. Read the document. This seems obvious, but clients often do not read their documents.

Can a power of attorney change bank account?

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations. This is a common scenario in second marriages.

Can you have two people serve as a power of attorney?

The power of two. Consider naming two agents to act together if your state allows for it . While having two people serve can be cumbersome, it often is worth the extra effort to have an extra set of eyes on the use of the power of attorney. This can substantially reduce your risk and ensure your assets go to the people you’ve designated in your will.

Can a financial agent access your funds?

The unfortunate answer is “yes. ”. Since he will have access to your financial accounts, he can access your funds and use them for his own benefit. The agent does have a fiduciary duty to use the assets only for your benefit or as you direct in the document.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to appoint someone?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

Can you get yourself in trouble with a power of attorney?

At times, it is very easy to unintentionally get yourself in trouble through the use of a power of attorney. The guiding north star for any agent should always be to act solely in the best interests of the person who granted the power of attorney. You cannot use the power of attorney to provide any benefit to yourself.

Is a power of attorney valid if you are incapacitated?

There are powers of attorney that are limited in time. There are also powers of attorney that are no longer valid if you become incapacitated.

Can a power of attorney be used without oversight?

They are typically able to engage in such actions, without your direct oversight, because the document allows for that. There are many different types. People often think that one power of attorney document is like all others. This is simply not the case. There are powers of attorney that are limited to healthcare.

How Does a Power of Attorney Work?

A power of attorney is a substantial legal document that allows you—as a principal—to appoint an agent (attorney-in-fact) to make certain decisions on your behalf. Whether it’s out of convenience or mental or physical illness, an agent has a responsibility to handle your medical, financial, or personal matters. The attorney-in-fact is expected to put your interests before their own and act in good faith and according to your expectations.

How many notices do you get for a power of attorney?

You will receive a personalized power of attorney document and two notices.

Can Two Siblings Have the Power of Attorney?

Yes. It is common for two siblings to have shared power of attorney. Parents usually do this to be fair to all of their children and avoid conflicts between them, which can sometimes backfire. You should consider the relationship between the siblings before deciding whether to make one or all of them agents.

What is an attorney in fact?

The attorney-in-fact is expected to put your interests before their own and act in good faith and according to your expectations. The given powers, duration of the agreement, and other specifics of a power of attorney depend on your preferences and the POA type.

How long does a power of attorney last?

The authority of a power of attorney is in effect as long as the person who granted the authority is alive.

Can a POA agent be a successor?

Having a successor agent provides security in case the POA agent dies, resigns, or becomes incapacitated. The successor doesn’t have any authority over the principal’s assets and decisions if ...

Is every POA with multiple agents the same?

Not every POA with multiple agents is the same because the relationships between the agents aren’t. Here are the most common multiple-agents relationships, based on their roles in the POA: Agent and successor agent. Joint agents vs. co-agents.

What is a durable power of attorney?

A durable power of attorney can be used to name a representative who would be empowered to act if the grantor was to become incapacitated. A durable power of attorney for health care could be used to name a medical decision-maker.

Can a power of attorney be used after you die?

The power of attorney would no longer be in effect after you pass away. As a result, the agent that you name to handle your financial affairs would not be empowered to administer your estate after you die.

Can a successor trustee be an agent under a power of attorney?

You can make the successor trustee the agent under the power of attorney. When this document is in place, the person or entity that you are empowering could administer the trust, but the representative would also be able to handle assets that you never conveyed into the living trust.

Can you have a durable power of attorney if you become incapacitated?

Even if you have a living trust with a successor trustee who can act for you if you become incapacitated, you should still have a durable power of attorney. You can make the successor trustee the agent under the power of attorney.

Popular Posts:

- 1. when can a defendant ask for attorney fees in new mexico

- 2. when should an attorney request a competency evaluation

- 3. how do you refer to an attorney who has died

- 4. what do defense attorney

- 5. how to remove attorney lien michigan

- 6. who is the district attorney for alamance

- 7. in what cases do courts refer you to an attorney for representation? message boards

- 8. who was the orange county district attorney in 2012

- 9. in a settlement who pays the attorney fees

- 10. what happens when you just hired an attorney and i just got a lawsuit