What kind of lawyer do I need to make a will?

An estate planning attorney may help people plan for the future by creating a will and outlining how they want their estate managed after they pass. Alternatively, they can also help surviving family members execute the estate by ensuring all wills and instructions are followed around the management of assets.

How much do lawyers charge for Wills?

The cost of a will varies more with hourly fees. The average hourly rate for an attorney is $200 to $350 per hour, depending on where you live and the attorney’s experience. Let’s say you need a simple will. Paying an experienced, big-city attorney by the hour will run you about $300 to $400.

What kind of lawyer handles wills and estates?

These types of attorneys specialize in obtaining compensation in the form of damages for injuries caused by other parties. The estate planning lawyer specializes in wills and trusts, and can help you to draw up a will to pass on your assets.

Which lawyers do Wills?

Top San Antonio Wills Lawyers - Texas

- Wilson Brown, PLLC

- The Law Office of Kevin H. Berry, P.C.

- Davidson Troilo Ream & Garza, PC

- Gerhardt Law Firm PLLC

- Rebecca J Carrillo

- The Law Offices of Jon R. Disrud

- Golden Law - A Professional Corporation

- Tiwari & Bell, P.L.L.C.

- Rosenblatt Law Firm

- Clayton & Ramirez, P.L.L.C

What type of law handles wills?

estate planning attorneyAn estate planning attorney handles wills and trusts. Due to complexities of laws, attorneys typically focus their expertise on several practice areas.

What are the 4 major components of a will?

Table of ContentsTestator Information and Execution.The Executor and Their Powers.Guardianship of Dependents.Disposition of Assets.

What are the four must have documents?

This online program includes the tools to build your four "must-have" documents:Will.Revocable Trust.Financial Power of Attorney.Durable Power of Attorney for Healthcare.

What questions to ask about a will?

5 Questions to Ask Before Writing Your WillHow should I express my intentions? ... Who makes sure my intentions are carried out? ... What is a trust? ... How much inheritance tax will my heirs owe? ... What if I want to leave money to charity?

What are the key components of a will?

The 10 MUST HAVE Parts of a WillHeading, Marital History, and Children. ... Debts and Taxes. ... Disposition of Assets. ... Guardianship. ... Executor and Trustee. ... Executor and Trustee Powers. ... No Contest Provision. ... General Provisions.More items...

What assets should be included in a will?

Your will should state who gets what from your savings and property, including your home, investments and cash. It should cover all the things you own, such as cars, furniture, pictures and jewelry.

What are the elements of a valid will?

The will must have been executed with testamentary intent; The testator must have had testamentary capacity: The will must have been executed free of fraud, duress, undue influence or mistake; and. The will must have been duly executed through a proper ceremony.

What should be included in a simple will?

What should I include in a simple will?Property, like your home, vehicles, and other real estate you own.Bank and retirement accounts.Life insurance policies.Pets.Family heirlooms or personal items.

How Do I Know I Need An Estate Planning Attorney?

Knowing when and for what reasons to hire an estate planning attorney can be challenging if you have never been informed of the appropriate circumstances in which to do so. Throughout your life, there are many things that can prompt the need to hire an estate planning attorney. Some of these things include:

What Does A Probate Attorney Do?

A probate attorney is basically an advisor to the beneficiaries of an estate or personal representative on how to handle any final matters of someone who is deceased.

What Are The Benefits Of Hiring An Estate Planning Attorney?

The benefits and security that come from taking this route produce a vast amount of benefits for you and your family.

How Much Does It Cost To Hire A Probate Attorney?

The important thing to understand when it comes to hiring a probate lawyer and how much it will cost you is that there are two separate areas of cost.

How Do I Find The Right Probate Lawyer?

When looking to hire a probate lawyer, it can be tempting to say yes to the first lawyer and jump right in to start going through the nitty-gritty of all the details immediately . While this may be time-efficient, it may be damaging to the long term results of your case.

How to protect assets from creditors?

There are quite a few methods put in place created to protect your assets from creditors like irrevocable trusts, ownership insurance, asset protection trusts, and limited liability entities. The attorney that you hire will be able to walk you through each and every part of this process and help you pick the plan that will ensure that the wealth of your family stays as secure as it can be.

What is a lawyer able to assist in?

Some other things that this type of lawyer is able to assist in are in matters that deal with tax issues, retitling of a decedent’s assets and requesting court permissions for a variety of reasons.

What are the two aspects of wills, trusts, and estates?

There are two aspects to the wills, trusts, and estates field: estate planning (the planning we do while you’re alive) and estate/trust administration ( the work we help your executor, trustee. and heir s do after you die). I think it’s important for an attorney practicing in this field to understand both, and it’s often convenient (and more efficient) for your executor or trustee to be able hire your planning attorney for the administration.

What is the field of elder law called?

The field is sometimes called trusts and estates, wealth planning, private client services, or estate planning and administration. Note that some lawyers call estate planning for business owners business planning or business succession planning. Elder law and family law are separate fields of law, though they may overlap to some extent with wills, trusts, and estates.

Do I have to share personal information with a lawyer?

You will probably have to share personal information with the lawyer planning your estate or working with you on an estate or trust administration. Discussions about family issues and money are unavoidable. I recommend choosing a lawyer you feel comfortable talking to.

What Kind of Lawyer Does Wills?

To make extra certain that your wishes are followed, you should see a will attorney about writing your will. This is also a good idea if you have a lot of assets or an uncommon situation.

How do I write a will without a lawyer?

If you’re going to do a holographic or handwritten will, after verifying if your state allows it, you’ll want to include the following components, minimally:

What is a handwritten will?

A handwritten will is also known as a holographic will (although clearly there are no holograms involved).

What is the branch of law that deals with estate planning?

The branch of law that deals with these matters is called estate planning. A good estate planning attorney can help you set up trusts, powers of attorney, and even avoid estate taxes as much as possible.

Why is it bad to have no will?

Because without a will there’s a very strong possibility of family members fighting, arguing and possibly becoming completely estranged by it not being clear who you wanted to give certain things to.

How much does a lawyer charge for a will?

More common, however, is for lawyers to charge a flat fee of around $1,000 for a will. If you have a lot of assets (houses, cars, money, investments, etc) most likely you’ll need an entire estate planning package and that would most likely start around $1,500.

What is the benefit of having a lawyer do it?

The benefit of having a lawyer do it is simply your time.

What does a probate lawyer want to know?

In addition to a general understanding of your legal needs, the lawyer may want to know who else is involved with the case and their relationship to you. For example, in some probate matters, a client visits the lawyer to seek help for his or her parents or siblings.

How to find a good estate lawyer?

Expertise. Specifically, find out if the lawyer will handle a case like yours. Trusts and estates lawyers often specialize in a particular area— in estate planning, probate, trust administration, special needs issues, elder care, or other specific legal issues. You want an attorney who is experienced in the area you need, but not necessarily highly specialized in other areas—otherwise you might end up paying a higher rate for specialization that doesn’t apply to your situation. You could ask how many similar matters the lawyer has handled, or what percent of the lawyer's practice is in the area of expertise that you need.

What to talk about at a lawyer consultation?

At the consultation, be prepared to talk about your case. The lawyer may not too many details of your case before you sign a fee agreement, but you should be prepared just in case.

How to save money with a lawyer?

To save money and to make the most of your time with your attorney, learn about your legal issue before you talk with the attorney. For example, if you’re interested in estate planning, learn the difference between a will and a living trust. Or, if you’re looking for a lawyer to help with a probate proceeding, take a bit of time to learn about probate, what a probate lawyer does, and what parts of a probate proceeding you might be able to take care of yourself.

What to do if a lawyer doesn't ask for documentation?

Even if a lawyer doesn't ask for documentation beforehand, it's still a good idea to bring a copy of all relevant documents to the meeting. Spend some time thinking about what you may have on hand. Try to organize the documents in a logical manner before you meet with the lawyer.

How to save money on trust and estates?

Do everything you can to reduce the time that lawyer will have to spend on your case. Even eliminating one email exchange could save you hundreds of dollars. ...

How to start a relationship with an attorney?

After you decide on which attorney to hire, you’ll sign a fee agreement and officially begin your relationship with your lawyer. The first meeting with an attorney usually involves the exchange of a lot of information. You will spend a good deal of time explaining to the attorney the details of your legal issue and answering his or her questions. He or she will spend a good amount of time discussion and laying out a plan. If you think you might get nervous or forget something, you could practice this conversation with a friend, or you could write down what you want to say.

Why are lawyers so successful?

Our Lawyers are successful because we understand our clients' legal objectives. Our clients hear what they ought to hear; not what they want to hear... Read More

Why is the law important?

The law is the most valuable when it prevents people, familes, businesses and communities are protected from wrongful actions and from suffering inju... Read More. stices. In instances where injustice has already occured, then the law must ensure that those injured are fairly compensated.

Can a PPED handle probate?

pped to, and do not, handle probate proceedings which occur in a courtroom. I have loads of experience in both of these, which saves you the burden of finding two separate lawyers.

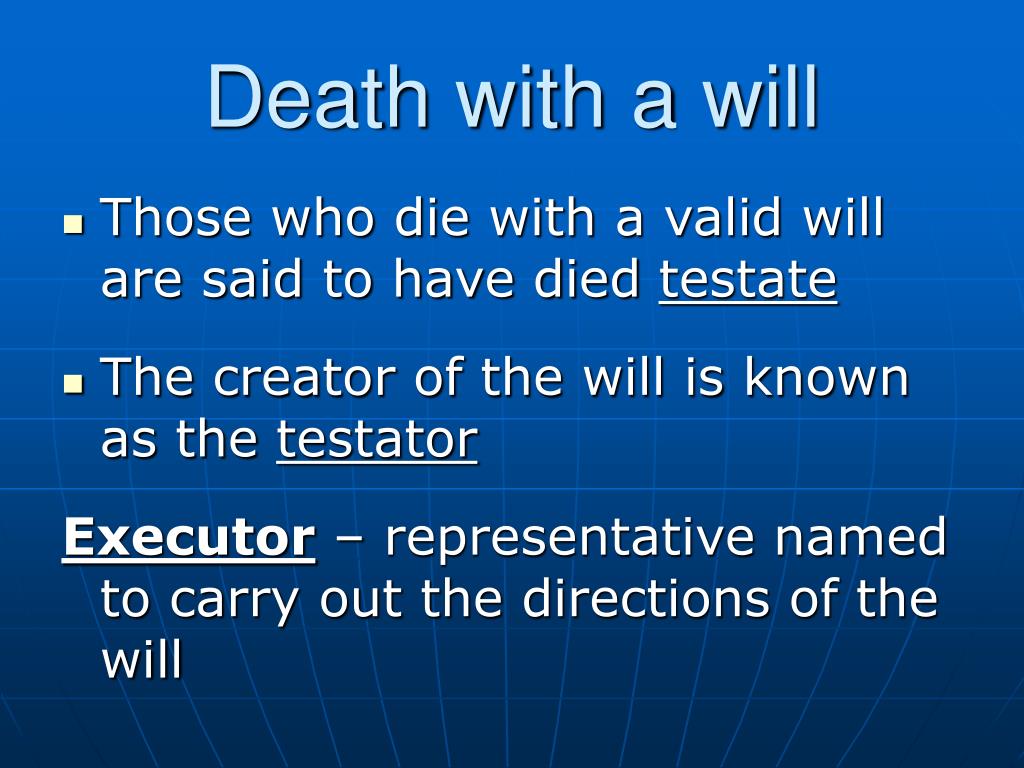

Who is the person who signs a will?

This person is called the "testator ." The testator chooses an executor to handle the distribution of the estate. The testator must also sign and date the document, typically in front of one or more witnesses, and the will may also need to be notarized.

What are the different types of wills?

The four main types of wills are simple, testamentary trust, joint, and living. Other types of wills include holographic wills, which are handwritten, and oral wills, also called "nuncupative"—though they may not be valid in your state. Your circumstances determine which is best for you.

What is a testamentary trust?

A testamentary trust will places some assets into a trust for the benefit of your beneficiaries and names a trustee to handle the trust. This is useful if you have beneficiaries who are minors or who you don't want to inherit your assets to handle on their own.

What is the best way to decide who will receive your assets?

Your circumstances determine which is best for you. Here is some basic information to help you decide. 1. Simple Will . A simple will is the one most people associate with the word "will.". Through a simple will , you can decide who will receive your assets and also name a guardian for any minor children.

What is the last will and testament?

updated July 22, 2021 · 3 min read. A last will and testament is one of the most important estate planning documents you can prepare. Not only does it allow you to direct where your property will go upon your death, but it can also provide you great peace of mind during your lifetime, knowing that your affairs will be taken care ...

Why is it important to have a last will?

You know having a last will is important—it protects your family and provides for your final wishes. Now that you're finally sitting down to write that will, be on the lookout for these common but easy-to-avoid mistakes.

Can you have more than one will?

Note that you can have more than one type of will at the same time and different wills can all be valid. A living will, for example, can legally co-exist with a simple will since they serve entirely different purposes.

Popular Posts:

- 1. how to answer a summons without an attorney sc

- 2. what to ask a trust attorney in fl.

- 3. what is medical power of attorney called

- 4. what fee can a power of attorney charge in north carolina

- 5. how much does a dui attorney cost?

- 6. how to unbundle attorney fees

- 7. attorney generals who got unanimouzly got approved by both parties

- 8. how to ask for an attorney

- 9. where can i find a free l and i attorney in washington state

- 10. attorney who received dr. blasey ford's letter accusing kavanaugh of sexual assault