How much does UM/UIM insurance cost?

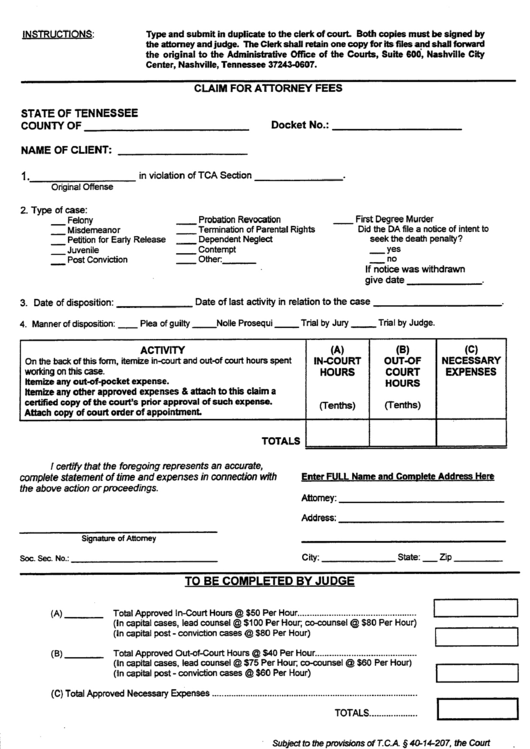

Sep 16, 2021 · Failure to move for attorney's fees within 10 days, or such additional time as the court may allow, shall be construed as a waiver of the party's right to recover attorney's fees. A motion for attorney's fees in a default case must specify actual fees. (d) Determination of Award. Attorney's fees upon entry of judgment by default may be ...

Do all states require Umum and UIM coverage?

We strongly encourage Alaskans to buy more U/UIM coverage – at least 100/300. Consider buying 250/500 or buying an “umbrella” policy that provides you with $1M/$2M of U/UIM coverage. Higher limits cost more, but are not proportionally more expensive. The first 50/100 of U/UIM is the expensive part.

What is underinsured motorist (UIM)?

Jan 15, 2008 · The offset was deemed proper based on the language of the Alaska statutes, the purpose of UIM coverage, and the terms of the Allstate policy. A second issue was whether Allstate had to pay interest and attorney fees on the entire $118, 432, which included $50,000 of the insured’s damages that had been paid by Safeco.

Does um insurance pay out for pain and suffering?

Mar 15, 2021 · Key Facts About Uninsured Motorist Coverage in Alaska: Minimum Uninsured Motorist Bodily Injury: $50,000 per person and up to $100,000 per accident; Minimum Uninsured Motorist Property Damage: $25,000 per accident; Uninsured Drivers on the Road: 15%; Crashes per Year: $72 Million

What is underinsured motorist coverage?

Underinsured motorist coverage is insurance protection that kicks in to help cover the cost of your medical bills or to repair damage to your vehicle caused by a driver who is at fault but who is carrying coverage limits too low to cover your expenses.

What does it mean to be uninsured?

An uninsured is someone who does not have any car insurance or has insurance coverage that doesn't meet state-mandated minimum liability requirements. Uninsured coverage may also come into play if the other driver's insurance company denies their claim or is not financially able to pay it.

What is UMBI insurance?

Uninsured motorist (UM) coverage for uninsured motorist bodily injury (UMBI): UMBI can pay for injuries to people protected under your policy -- including family members in other cars and passengers in your insured cars -- resulting from a car accident caused by an uninsured driver.

What happens if you don't have collision insurance?

If you are carrying collision coverage your vehicle will be repaired regardless of whether the person who hit you has insurance or not. However, if you are not carrying collision insurance, you will be on your own when it comes to fixing your vehicle after an accident if you are not covered by UM insurance.

What is the duty of an insurer to defend its insured?

An insurer’s duty to defend its insured arises whenever a lawsuit is filed against the insured alleging facts and circumstances arguably covered by the policy. [i] This duty has been described as “one of the main benefits of the insurance contract.”.

What should defense counsel do?

Defense counsel should periodically analyze whether the insured’s exposure approaches policy limits, and advise both adjuster and insured client. Excess insurers should also be notified. Defense counsel should proactively request documentation of damages from plaintiff’s counsel, especially if the insured’s exposure seems to exceed policy limits.

Does an insurer have to indemnify the insured?

Under these circumstances, the insurer would not have to indemnify the insured, but it would still have to pay the insured’s attorney fees for defense of the lawsuit.

Popular Posts:

- 1. what amendment allows asking for a new attorney

- 2. what if you get a judgement but cant afford an attorney?

- 3. how much does an attorney win in a qui tam suit

- 4. who do civil litigation attorney rep

- 5. how do i choose attorney general

- 6. when is the assistance attorney general goingtotestify

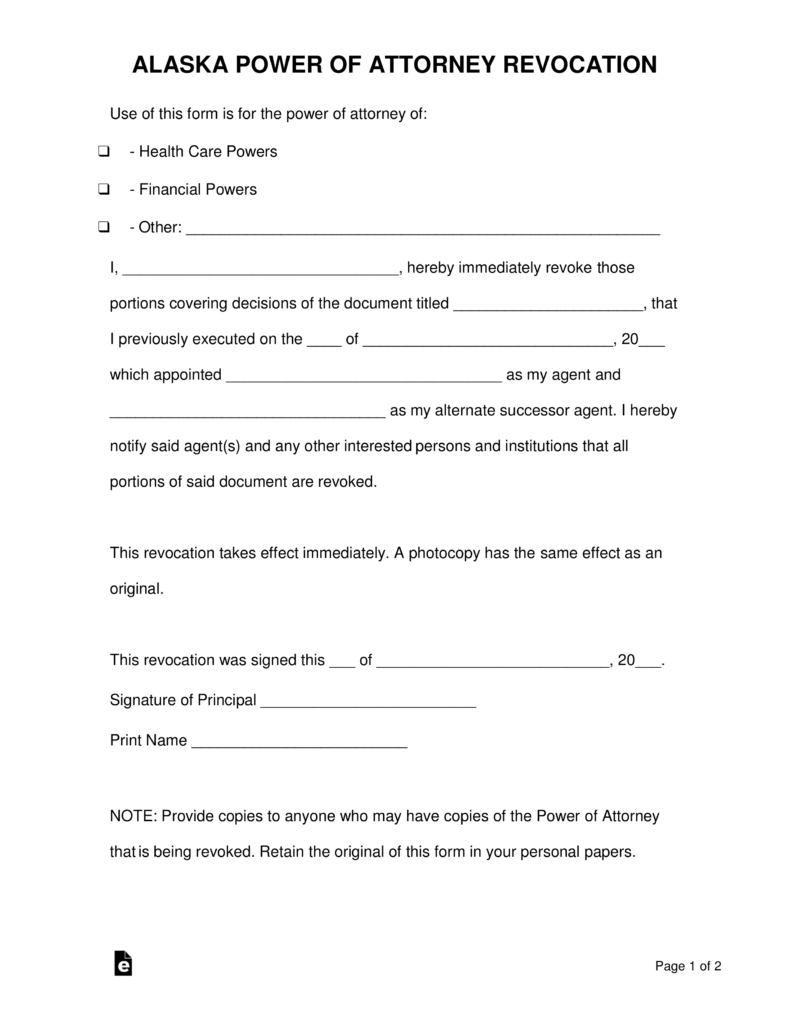

- 7. what if an elderly is not able to sign power of attorney?

- 8. how to know if you have an attorney general case

- 9. who was the defense attorney for brown v board of education

- 10. how to sign as agent under power of attorney