A dual power of attorney or joint power of attorney is a legal document that gives rights and power to two named persons. These persons are referred to as agents or attorneys-in-fact, and they have the right to manage the financial affairs or make health care decisions for the principal, the person who grants them their authority and rights.

What are the three types of power of attorney?

Sep 09, 2021 · Power of attorney is a legal document that clearly defines the relationship between two parties. The first party referenced in the document is the principal — the individual who is giving another person a degree of power over their legal affairs. The other party is the agent, or the person being assigned that power.

What is power of attorney and how does it work?

Jul 13, 2021 · General Durable Power of Attorney Definition. A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances. The POA can take effect immediately or can become effective ...

What is the difference between durable and power of attorney?

Oct 21, 2021 · Principal: The principal creates the power of attorney, and chooses which person will represent them. The principal is sometimes called the “grantor.” Agent: The power of attorney “agent” is the person appointed to make decisions on the principal’s behalf. They’re also called the “grantee,” or in some states the “attorney-in-fact” (which is different from an attorney-at-law, or …

What is the difference between a power of attorney and a durable power of attorney?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself.

What does principal of mean on power of attorney?

A power of attorney (POA) or letter of attorney is a written authorization to represent or act on another's behalf in private affairs, business, or some other legal matter. The person authorizing the other to act is the principal, grantor, or donor (of the power).

Can there be 2 principals in a POA?

Most power of attorney agreements include just one principal and one agent. If a principal decides to elect two agents, however, this is certainly possible--provided that the powers granted to each agent do not overlap.

What happens if two power of attorneys disagree?

If power of attorney co-agents disagree on a financial decision and the principal is mentally competent and not physically incapacitated, then the principal's decision supersedes the representatives. The principal also has the authority to revoke an agent's authority.Feb 15, 2021

What is dual POA?

With a dual power of attorney, rights and powers are conveyed to two named individuals. A dual power of attorney or joint power of attorney is a legal document that gives rights and power to two named persons.Apr 17, 2022

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

How many power of attorneys should you have?

The answer is generally no, unless you have a specific reason and considered the potential problems. The reason why we do not advise more than one is in the event of a conflict. With multiple named attorneys-in-fact, there is always the ability for people to conflict on decisions.

Can a family member override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

What does durable mean in power of attorney?

A durable power of attorney refers to a power of attorney which typically remains in effect until the death of the principal or until the document is revoked.

Who makes medical decisions if there is no power of attorney?

The legal right to make care decisions for you If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

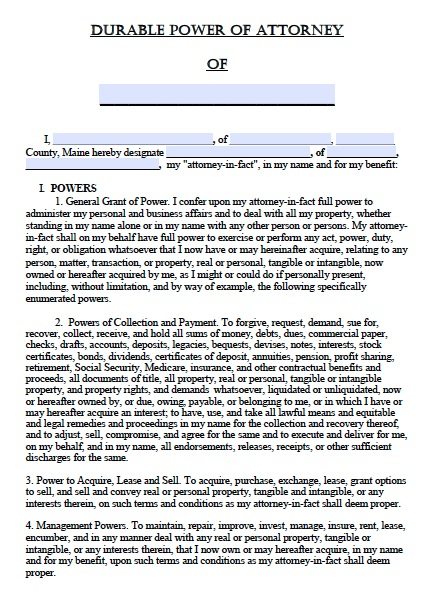

What Is a Power of Attorney?

Power of attorney is a legal document that clearly defines the relationship between two parties. The first party referenced in the document is the principal — the individual who is giving another person a degree of power over their legal affairs. The other party is the agent, or the person being assigned that power.

What Are the Responsibilities of a Power of Attorney?

The responsibilities of a power of attorney differ greatly. The type of power of attorney that has been granted determines the exact nature of the responsibilities. Some powers of attorney are strictly medical, while others are strictly financial.

Different Types of Power of Attorney

There are a variety of power of attorney types that meet different needs. A dual power of attorney assigns two people as an agent. Both agents have the same duties, and either one of them can act on behalf of the principal within the limits of the agreement.

How to End a Power of Attorney

Some power of attorney agreements expire automatically after their specified purpose is complete. However, the principal can complete a Revocation of Power of Attorney to rescind the agent’s rights at any time. An agent can also resign from their duties.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What is the principal of a power of attorney?

The principal is the person who needs to have decisions made for them. They typically create the power of attorney, and choose which person will represent them. The principal is sometimes called the “grantor.”

What is a power of attorney?

A power of attorney is an agreement between two people (or parties), called the “principal” and the “agent.”.

What is a POA in real estate?

This type of POA is often called a financial power of attorney because it’s commonly used for day-to-day financial matters.

How does a power of attorney work?

Here’s how power of attorney works: First, the principal chooses one or more people they trust to manage their affairs. All parties sign and date a power of attorney form, which describes the duration of the power of attorney, and the type of authority granted. The form can be edited to:

What is a POA?

Often abbreviated as a “POA”, a power of attorney is used to appoint someone to manage your financial or business affairs when you’re unable to. To have someone to make health care decisions for you, you can use a variation of this form called a medical power of attorney. Before you create a power of attorney, it’s crucial to understand ...

Why is it important to give someone a power of attorney?

Giving someone power of attorney is one of the most important legal decisions you can make, because it grants the other person significant authority over your life. An agent has a “fiduciary duty” to the principal to act in their best interests — which means they have a legal obligation to do what’s best for them.

What can an elderly person do with a power of attorney?

Here are some uses of a power of attorney, and what it allows you do: Estate planning: an elderly person may choose an adult child or loved one to make important decisions about their money or health, in order to plan for a time when they cannot make these choices themselves.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

How to start a power of attorney?

A better way to start the process of establishing a power of attorney is by locating an attorney who specializes in family law in your state. If attorney's fees are more than you can afford, legal services offices staffed with credentialed attorneys exist in virtually every part of the United States.

What is Durable POA?

A “durable” POA remains in force to enable the agent to manage the creator’s affairs, and a “springing” POA comes into effect only if and when the creator of the POA becomes incapacitated. A medical or healthcare POA enables an agent to make medical decisions on behalf of an incapacitated person.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is the name of the person who gives the POA?

The term for the person granting the POA is the "principal." The individual who receives the power of attorney is called either the "agent" or the "attorney-in-fact." Check whether your state requires that you use specific terminology.

What is a limited power of attorney?

A limited power of attorney gives the agent the power to act on behalf of the principal in specific matters or events. For example, the limited POA may explicitly state that the agent is only allowed to manage the principal's retirement accounts.

Why do you need a POA?

Creating a POA agreement to make healthcare choices or to manage your finances should you become unable is a crucial decision. An experienced Estate or Elder Law attorney can advise you of all contingencies and create the documents necessary to protect you.

What is required to sign a POA in New Jersey?

New Jersey POA agreements require that both the principal and the attorney-in-fact are determined to be competent when the POA agreement is created. A witnesses and a licensed Notary of the State of New Jersey must be present at the signing.

What does POA mean in a power of attorney?

The POA gave you the authority to act on his behalf in a number of financial situations, such as buying or selling a property for him or maybe just paying his bills.

Who can deal with a POA?

His estate owns it, so only the executor or the administrator of his estate can deal with it during the probate process. 1 .

Can you get a power of attorney after death?

You can't get a power of attorney to act for someone after he's died, and an existing power of attorney becomes invalid upon the death of the principal—the individual who gave you the right to take certain actions on his behalf. 1 . Someone is still going to have to take care of his affairs after his death, but it won't necessarily be ...

Can a power of attorney act on a deceased person's estate?

In either case, with or without a will, the proba te court will grant the authority to act on a deceased person's estate to an individual who might or might not also be the agent under the power of attorney. The two roles are divided by the event of the death. In some cases, however, the agent in the POA might also be named as executor ...

3 attorney answers

Theoretically, you could do a limited power of attorney to deal with specific transactions in one form, but I think it best that each principal execute these limited POAs separately. That way, if one principal drops out altogether or for any particular deal, or terminates the POA, you don't have to re-execute a document.

Thomas J Callahan

I agree that each of you need to separately execute a POA for the agent to conduct real estate transactions on your behalf. Because you want to limit the scope of their representation, it makes sense to work with an attorney to draft these for you.

David M Owens

It would be better and easier to manage if each principal did their own DPOA.

Popular Posts:

- 1. how to find out if there have been compaints against an attorney

- 2. who is the fulton county georgia district attorney

- 3. how can i become an attorney

- 4. what are the functions of the power of attorney

- 5. what do i do after i notarize a power of attorney

- 6. how to give parents power of attorney for traveling

- 7. how do you check up on your attorney

- 8. what does a juvenile attorney do

- 9. how long does the attorney general serve

- 10. what is the louisiana attorney fee to revoke a power of attorney and add a new one