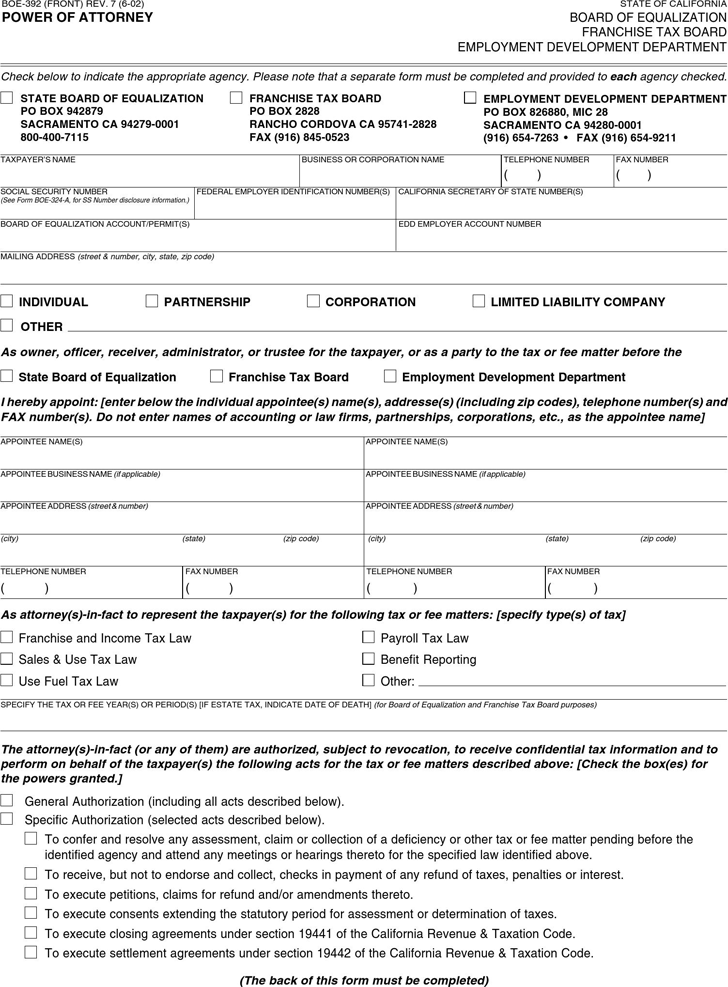

Franchise Tax Board Power of Attorney Declaration

United States Declaration of Independence

The United States Declaration of Independence is the statement adopted by the Second Continental Congress meeting at the Pennsylvania State House in Philadelphia, Pennsylvania, on July 4, 1776. The Declaration announced that the Thirteen Colonies at war with the Kingdom of Great Britai…

Full Answer

Can I sue Franchise Tax Board?

· The Power of Attorney for Franchise Tax Board (FTB) requires the person to fill out Form GEN-58. This form is a legal document that allows the person to make decisions regarding tax matters. The power of attorney must be signed by the person who is giving the POA authority. The form must be in the name of the individual who is revoked.

What is the tax form for power of attorney?

Franchise Tax BoardIndividual or Fiduciary Power of Attorney Declaration CALIFORNIA FORM 3520-PIT Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB). Part I – Taxpayer Information Check only one box below.

Can I pay the Franchise Tax Board online?

Help with managing your power of attorney relationships. ... Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. ... 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government ...

What is a franchise tax board number?

Franchise Tax Board Business Entity or Group Nonresident Power of Attorney Declaration CALIFORNIA FORM 3520-BE Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB). Part I – Business Entity Information. Check only one box below.

What is the Franchise Tax Board Power of Attorney?

A POA declaration gives a representative the right to: Talk to us about your account. Receive and review your confidential account information. Represent you in FTB matters.

How do I add POA to FTB?

Submit the form Online through MyFTB . In the services menu, select File a Power of Attorney. Mail your form.

What is the Franchise Tax Board POA Tia unit?

Generally, a tax information authorization (TIA) only allows representatives to review your tax account information for: Individuals. Fiduciary (estates and trusts) Group nonresident....Tax information authorization vs. power of attorney.No headingPOATIADuration (typical)6 years13 months3 more rows•Sep 23, 2021

What is a FTB 3536 form?

LLCs should use form FTB 3536, Estimated Fee for LLCs, to remit the estimated fee payment. A penalty will apply if the LLC's estimated fee payment is less than the fee owed for the taxable year.

Where do I file Form 3520?

Send Form 3520 to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409. Form 3520 must have all required attachments to be considered complete.

Does Power of Attorney need to be notarized in California?

California requires that the signature of the principal of the Power of Attorney must be acknowledged and recorded by a notary or acknowledged by two witnesses. Every witness to the power of attorney document must witness the principal signing the document or the notary's acknowledgment.

How do you revoke a power of attorney in FTB?

Mail a signed and dated statement instructing FTB to revoke the entire POA Declaration and include: Individual's name, address, phone, social security number (SSN), representative's name, and address.

Is FTB CA Gov legitimate?

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.

What is TIA client?

Last Updated 01/13/2020. Page | 1. Tax Professional: Tax Information Authorization (TIA) – Add TIA. Client. TIA relationships cover clients you add or renew through MyFTB or when you file form FTB 3534, Tax Information Authorization.

Who files form 3536?

Form 3536 only needs to be filed if your income is $250,000 or more. You use Form FTB 3522, LLC Tax Voucher to pay the annual limited liability company (LLC) tax of $800 for taxable year.

What is form 568 used for?

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 3522 with the Franchise Tax Board of California.

Who must file form 3522?

LLCEvery LLC that is doing business in California or that has articles of organization accepted or a certificate of registration issued by the SOS is subject to the $800 annual LLC tax.

3. Sign the form

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following:

5. Submit the form

Online through MyFTB#N#11#N#. In the services menu, select File a Power of Attorney.

6. After you submit

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

If we reject a POA

We’ll send a letter to the taxpayer with the reason for the rejection. Tax professionals can review the rejection reason in MyFTB.

Death of an individual with a POA

When an individual dies and we are notified of their death, we’ll revoke their POA declaration (s) because it is no longer valid.

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What happens if you revoke a power of attorney?

When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization. Authorize Power of Attorney for a new representative for the same tax matters and periods/years.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

Popular Posts:

- 1. which workers comp attorney in biloxi ms has the highest percentage of recovery for injured workers

- 2. what are the fees for an active attorney apprenticeship

- 3. who was the guy that played states attorney on chicago pd?

- 4. attorney generals who got unanimously confirmed by both parties

- 5. when an employee gets an attorney

- 6. what type of attorney do i need to start a business

- 7. who is minessota attorney general

- 8. what is the time frame for being awarded attorney fees in illinois

- 9. what do you have that proves the bullet hole in the door was related to this incident ace attorney

- 10. who is louis tumolo attorney