What are the requirements for power of attorney in North Carolina?

Dec 01, 2018 · 5G.S. 7A-307(a)(4) requires a filing fee of $200.00 for a caveat filed in an estate for which the decedent died on or after January 1, 2012. For decedents dying on or before December 31, 2011, there is no filing fee for a caveat, but a bond of $200.00 shall be required.

How much can an executor’s attorney charge in North Carolina?

May 17, 2018 · A Statutory Short Form Power of Attorney has been created by the North Carolina legislature. The form may be found in the North Carolina General Statutes, Chapter 32C, at Section 32C-3-301. Although the law states that POAs created before the new law are still effective, it would be a good idea to create a new one using the current form.

How much does it cost to get power of attorney?

If the responsibilities of the attorney are limited to assisting the executor with the estate administration process, then the North Carolina statutory law provides that the attorney’s fees must be reasonable and not exceed 5% of the estate . Furthermore, the fees will offset the executor’s commission. So, for example, if the executor hires an attorney to do the majority of …

Is there a cap on the amount of attorney fees?

Aug 02, 2021 · Basic Power of Attorney $35 Get started Attorney Assist Kelly, attorney serving NC Comprehensive Power of Attorney $45 Legal advice renews monthly at $25. Cancel anytime.* Get started BEST VALUE Attorney Assist Kelly, attorney serving NC Estate Plan Bundle Starts at $249 Save $100+ Legal advice renews annually at $199. Cancel anytime.** Get started

How much does it cost to get power of attorney in NC?

A power of attorney can be created without legal assistance and almost free of charge. In fact, one can find a free POA form online and simply print it and fill it out. One can also have a POA created online for as little as $35.

How Much power of attorney does it cost?

A durable power of attorney for finances or healthcare can be completed for little to no charge. Some states offer free fillable POA forms online or consumers can work with a local legal aid office to obtain a POA. There are also legal websites that sell POA templates for under $50.Feb 15, 2022

Does a power of attorney have to be filed with the court in NC?

When a power of attorney is used to transfer land or to do business on behalf of a person who has become incapacitated, it must be recorded. As a general rule, however, a power of attorney does not need to be recorded in North Carolina in order to be effective.

What is required for power of attorney in NC?

North Carolina durable power of attorney laws require that the appointed individual be at least 18 years old, have the capacity to understand this responsibility, and that the document be signed in the presense of two witnesses acknowledged by a notary.Mar 8, 2021

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

Can power of attorney withdraw money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

Do you need to register a power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Where do I file power of attorney in NC?

the Register of Deeds officeYou may file your power of attorney document with the Register of Deeds office. You will need to present the original notarized document in person or through the mail.

Is it hard to lose a loved one?

Losing a loved one is hard. The days and weeks after a loss are often fraught with grief, questions, and unfortunately, family complications. It’s a terrible time to try to think through a legal process clearly. It’s often a challenge just to know where to start .

Is there a cap on attorney fees?

However, if the attorney provides legal services that are beyond routine estate administration, there is no cap on the amount of attorneys’ fees. They must simply be reasonable under the circumstances. This might include handling a will contest or estate litigation, lawsuits brought by creditors, wrongful death lawsuits, and similar services. ...

What is a living will?

Last will or living trust. Last wills and living trusts are state-specific documents that let you decide what happens to your property after you die.

What is a living trust?

Last wills and living trusts are state-specific documents that let you decide what happens to your property after you die. One thing that makes a living trust different from a last will is it can help your loved ones avoid the probate court system which can involve added delays and expenses.

What is a power of attorney?

For many people, the power of attorney, sometimes referred to as a “DPOA,” acts a piece of paper that authorizes another person to do legal tasks and actions on their behalf. These legal actions and tasks most often have to do with money, but it can also involve medical decisions.

Why do people need power of attorney?

Because of the personal nature of these decisions, you are able to choose whomever you would like. Essentially, the power of attorney is given when the person becomes incapacitated to do work or to fulfill their own obligations. In other cases, the document is applied temporarily when the person cannot be in that particular place ...

What does it mean to have a lasting power of attorney?

The lasting Power of Attorney is something that you have to work and deal with if you are someone who is mentally and physically incapacitated due to some accident or ailment.

How much does a lawyer charge for a POA?

A consumer could probably expect to pay a lawyer less than $200 for a POA in most cities. Many also offer reasonably priced estate planning packages that include a financial power of attorney, a medical power of attorney, a living will and a last will and testament. All these documents are important for ensuring an elder’s wishes are respected and their affairs are taken care of both in life and after their passing.

What is a POA?

A power of attorney (POA) document is one of the most important legal tools that family caregivers must have to effectively manage their aging loved ones’ health care and/or finances. Without these documents, a caregiver (known as the agent) lacks the legal authority to handle important decisions on behalf of their elder (known as the principal).

Why is POA important?

This is particularly important when drawing up a financial POA because it grants the agent legal authority over all financial decisions, including selling property, paying taxes, managing investments, Medicaid planning, paying for where the principal will live and deciding how their money will be spent.

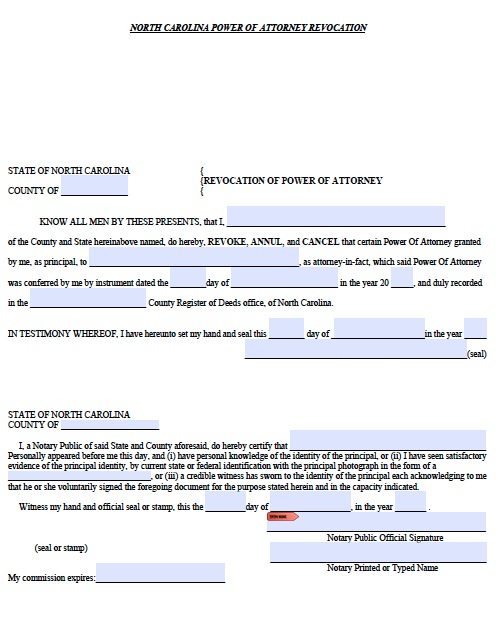

Power of Attorney Forms in North Carolina

The state of North Carolina recognizes two different forms of power of attorney. The first is called a financial power of attorney. A financial power of attorney allows you, the principal, to authorize another person, known as your agent, to act on your behalf in a legal capacity.

Hiring an Attorney for A Power of Attorney Agreement

Although North Carolina has a suggested statutory power of attorney form, it is not appropriate for everyone. Each of us has specific needs and assets and the power of attorney should be drafted with the guidance of a qualified attorney.

Popular Posts:

- 1. what did reverdy johnson do while attorney general

- 2. what do you need to get a lemon law attorney

- 3. what does power of attorney do for the irs

- 4. can the agent be present in illinois when signing a power of attorney

- 5. when providing pro bono as physical therapist, do you have to consult an attorney

- 6. what does an property insurance attorney do

- 7. who is the state's attorney for bowie md

- 8. what does a legal secretary do at hawaii state attorney general office

- 9. when does the power of attorney go into effect

- 10. attorney how to write terms