Full Answer

What is the average hourly rate for an attorney?

Jun 23, 2020 · The client and lawyer will agree on the hourly rate before getting started with the case. A lawyer's hourly rate varies drastically based on experience, location, operating expenses, and even education. Attorneys practicing in rural areas or small towns might charge $100-$200 per hour. A lawyer in a big city could charge $200-$400 per hour.

What is the average cost of an attorney?

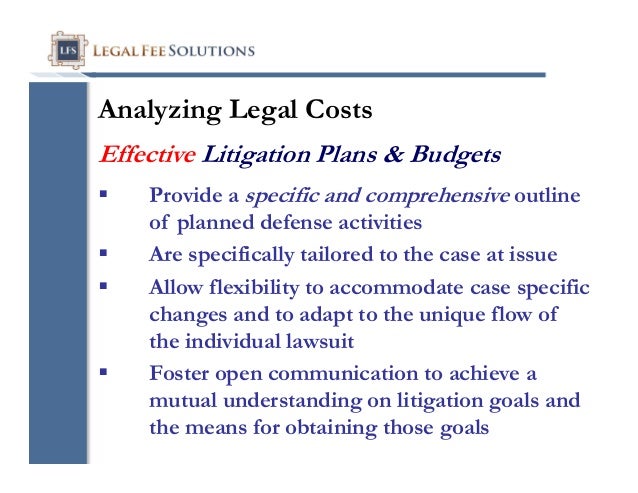

Jul 14, 2020 · Updated July 14, 2020: Attorney Fees and Costs. Attorney fees and costs are one of the biggest concerns when hiring legal representation. Understanding how attorneys charge and determining what a good rate is can be confusing.

How much do lawyers charge per hour?

Average Flat Fee Costs. If you’ve been charged with a misdemeanor offense and hire an attorney who uses a flat fee, you may pay between $1,500 and $3,500. If the case goes to trial, it may cost between $3,000 and $5,000. For felony charges, your lawyer may charge between $3,000 and $6,000, or $10,000 to $20,000 for a felony trial case.

What is the highest hourly rate for a lawyer/attorney?

Jun 16, 2021 · A good attorney (such as the ones at the Eastman Law Firm) charge around $350/hour. How much should simple probate cost? Probate is a complicated process that can take years to complete.

See more

Power of Attorney in a Nutshell. A power of attorney is a legal document used to transfer rights and responsibilities between two parties: Principal. Agent or attorney-in-fact. With a POA, the principal grants the agent legal authority to act, make important decisions, and sign legal documents in their stead.

How Much Does A Lawyer Cost?

When clients ask, "how much does a lawyer cost," the answer can vary from $50 to $1000 or more per hour. But if you're facing a legal issue, workin...

Why Is The Cost of A Lawyer Important?

Understanding the cost of a lawyer before you enter into an agreement can help prevent unpleasant surprises or costs that you cannot afford. Some p...

Reasons to Consider Not Using A Lawyer Based on Cost

Many people don't have enough money to hire a lawyer for legal help. The United States of America offers rights to its citizens, called Miranda Rig...

Reasons to Consider Using A Lawyer Based on Cost

The cost of the lawyer will certainly factor into your decision, but remember that cheaper does not equal better. A lawyer who charges more per hou...

What Could Happen When You Use A Lawyer?

When you use a lawyer in any type of legal proceeding, you now have someone on your side who understands the complex legal system. Even something t...

What Could Happen When You Don't Use A Lawyer?

Without legal representation, you could miss a due date for forms or documents, causing delays in your case or even a ruling that is not in your fa...

Frequently Asked Questions

1. How much will a lawyer cost for a divorce?Some lawyers offer flat-rate pricing for simple, uncontested divorce proceedings. But when a divorce i...

What is statutory fee?

A statutory fee is a payment determined by the court or laws which applies to your case. You'll encounter a fixed statutory fee when dealing with probate or bankruptcy, for example.

What to ask when hiring an attorney?

When hiring your attorney, ask for a detailed written estimate of any expenses or additional costs. They may itemize each expense out for you or lump their fees all together under different categories of work. Lawyers may bill you for: Advice. Research.

How to pay retainer fees?

Make sure that your contract includes the details of: 1 Contract – The agreement should list the total amount of any retainer deposit that you pay upfront. It should also state when you need to pay additional fees, if necessary. 2 Hourly Fee – Don't look only for the hourly rate of your lawyer on the agreement. Make sure you also see a description of the different hourly rates for each person who might contribute to your case. Ask for your payment schedule. Ask if you get a discount for early payment or if you pay penalties for late fees. 3 Contingency Fee – In a contingency case, the lawyer profits by the percentage they earn upon winning the case. The lawyer's contingency percentage and the payment-collection process should appear clearly outlined in your agreement. Sometimes, a lawyer will not collect any fees from you if they lose a contingency case, such as in personal injury disputes. In other situations, they may demand payment from their client only if they lose the case. 4 Costs of Suit – Check for clear terms to describe who pays for all of the different litigation costs involved. You should anticipate possible charges for court appearances and filing fees, hiring a private investigator, the cost of bringing in an expert witness, costs for officially serving and delivering legal documents, and travel fees.

How to avoid disagreements with your attorney?

Either way, most states require evidence of a written fee agreement when handling any disputes between clients and lawyers. You must have written evidence of what you agreed to pay for anyone to hold you accountable for what you have or have not spent.

What is contingency fee?

An attorney contingency fee is only typical in a case where you're claiming money due to circumstances like personal injury or workers' compensation. You're likely to see attorney percentage fees in these situations to average around a third of the total legal settlement fees paid to the client.

Do lawyers charge retainers?

Sometimes lawyers may charge a retainer if they find themselves in high demand. Other lawyers who work more quickly and efficiently may see no need for charging you a retainer fee. Call different lawyers in your area to see if retainers are standard practice for your particular case.

What are the expenses of a lawyer?

Clients may also be responsible for paying some of the attorney or law firm’s expenses including: 1 Travel expenses like transportation, food, and lodging; 2 Mail costs, particularly for packages sent return receipt requested, certified, etc; 3 Administrative costs like the paralegal or secretary work.

Why do attorneys get smaller cut?

For example, the attorney will usually obtain a smaller cut if a settlement was reached before trial – because less time and expense was expended – than if the case goes to trial. When contingency fees are used the fees and costs of the suit are often deducted from the monetary recovery before the percentage is taken.

How to resolve a disagreement with a lawyer?

The first step to resolving these disputes is communication . If there is a disagreement, clients and attorneys should first seek to discuss it and try to reach a mutually agreeable solution. Often, small disagreements balloon merely because both the attorney and the client avoided talking to the other out of fear.

What is flat rate legal fees?

Flat rate legal fees are when an attorney charges a flat rate for a set legal task. The fee is the same regardless of the number of hours spent or the outcome of the case. Flat rates are increasingly popular and more and more attorneys are willing to offer them to clients.

How much does a retainer agreement cost?

A retainer agreement is an agreement under which the client agrees to pay the attorney a large sum up-front, usually ranging from $2,000 - $10,000 as essentially security for future payments.

What is contingency fee?

Contingency fees are only utilized where there is a dispute, otherwise there would be no objective way to determine whether the attorney had been successful. Contingency fees are most commonly available in automobile accident cases, medical malpractice cases, and debt collection cases.

Do attorneys have to be reasonable?

Attorneys typically have great discretion in deciding on what their fees will be. In most states and under ethical rules governing attorneys, the fees only need to be “reasonable.”. There is no black and white test for what is reasonable, instead a number of factors are considered.

How probate attorneys charge for their services

Probate attorneys charge for their services in many ways. In some states, probate fees are set by statute—often as a percentage of the value of the estate.

How much should simple probate cost?

Probate is a complicated process that can take years to complete. The cost of probate will depend on the total value and complexity of your estate, but you should plan for it is at least 3% – 7%. In some cases, this fee may be waived if there are no assets or heirs requiring distribution from the deceased’s estate.

What increases the cost of a probate attorney?

Regardless of the method, an attorney uses to charge clients, their fees will increase if there are complications with probate. Some examples of issues that may result in increased costs include:

Power of Attorney in a Nutshell

A power of attorney is a legal document used to transfer rights and responsibilities between two parties:

What Is a Power of Attorney for Grandparents?

If the parents are alive and can be located, they can write a power of attorney letter and give the grandparents legal authority to take full care of the child.

All About the Grandparent Power of Attorney Ohio Law

Grandparents’ rights are not the same everywhere. Some states took better care when regulating the legal authority people can obtain over their grandchildren, and Ohio is one of them.

When Does the Grandparent Power of Attorney End?

A power of attorney for grandparents terminates whichever of the following occurs first:

You Can Count on DoNotPay To Draft a Rock-Solid Grandparent Power of Attorney

Once you and the child’s parent (s) agree to execute a grandparent power of attorney, the next step is writing one. You can do so in a few ways, but one stands out—DoNotPay!

DoNotPay Answers All Your Questions About Powers of Attorney

A power of attorney is a substantial legal document, so it’s no wonder you have some questions regarding it. DoNotPay has answers to many of the POA-related questions, such as:

DoNotPay Covers All the Bases

From getting you ready for various government tests to helping you reduce your property taxes, DoNotPay offers valuable assistance with the tasks that make most people at least roll their eyes. Dealing with bureaucracy isn’t fun, but it also doesn’t have to be as difficult as it is.

How much does a real estate lawyer cost?

Real estate lawyer fees usually wind up being around $1,500. But like with anything else, you get what you pay for here. If you decide hiring a real estate attorney is the right thing to do, whether your transaction is complex or you simply want the peace of mind, don’t go bargain hunting.

How much does a closing attorney charge?

Closing attorney fees vary greatly from one state to another, and can reach $1,000 - $2,000 depending on the complexity of the transaction. Some attorneys charge a flat fee, while others will charge an hourly rate, usually $100 - $300. You can compare real estate attorneys capable of helping you with the closing process on WalletHub.

Do attorneys cost money?

However, attorneys cost money. In some cases, you might even find that your lender has already hired a closing attorney, and the fees for that attorney are part of your closing costs. It’s important to find out ahead of time if this is the case and decide whether you want your own attorney as well.

How much does it cost to get a deed?

It also depends on the type of transaction (s) the attorney will be handling. Some attorneys start at a $100 - $150 flat fee to prepare a deed, and then go up to $1,000 or more for a “complete package.”. Many packages start at around $500 or $600, depending on what you have done.

Do you need a real estate attorney for closing?

For some homebuyers, adding a real estate attorney to the proceedings can provide peace of mind. A knowledgeable and reputable real estate attorney can help you navigate the closing process and make sure that your interests are represented. However, attorneys cost money. In some cases, you might even find that your lender has already hired ...

How much does a lawyer charge for a will?

Depending on where you live and how complicated your family and financial circumstances are, a lawyer may charge anything from a few hundred to several thousand dollars for a will and other basic estate planning documents.

What is a durable power of attorney?

Durable power of attorney for finances. Advance directive (durable power of attorney for health care and living will—these may or may not be combined into one document, depending on state law) This is good advice because every adult should have these durable powers of attorney.

How much does a divorce attorney charge per hour?

20% paid $400 or more per hour. The more complicated the divorce, the higher attorneys' fees -- especially if the proceedings take a long time or if going to trial to resolve contested issues is necessary. Some attorneys offer a flat fee, which can help you budget for your divorce case.

How much does a divorce cost?

The median cost of a divorce is $7,500. An uncontested divorce or one with no major contested issues costs, on average, $4,100. Disputes over child support, child custody, and alimony raise the average cost of a divorce significantly. Divorces that go to trial on two or more issues cost, on average, $23,300.

How long does it take to get divorced in NC?

Divorces take, on average, between 12 and 18 months to finalize. Filing fees range from $75 in North Carolina to $435 in California. Divorced men and women have less money in independently owned defined-contribution retirement accounts than married men and women.

How much does a family therapy session cost?

Family therapy for yourself or your child: Rates are typically $75 to $200 per session, according to the National Directory of Marriage and Family Counseling.

Do you have to pay a fee to dissolve a marriage?

The court must legally dissolve your marriage. You have to pay a filing fee in court for this. Filing fees vary a lot by state, with some states showing significantly higher divorce costs than others.

How much does it cost to draft a will?

Setting up a will is one of the most important parts of planning for your death. Drafting the will yourself is less costly and may put you out about $150 or less. Depending on your situation, expect to pay anywhere between $300 and $1,000 to hire a lawyer for your will.

What is a living trust?

A living trust, on the other hand, is a more comprehensive estate planning tool that covers not just the issues that a will addresses, but also allows for the establishment of medical and legal power-of-attorney if you become incapacitated.

What to do when you die and have a will?

While the decisions of what happens to your estate after you die are yours, an attorney can guide you through the process and help you word your will properly so there are no mistakes.

Is it easy to draw up a will?

A Complicated Process. Drawing up a will isn't as easy as you may imagine. Most people hear the word will and think it's a fairly simple process. The idea most people have is that it requires a few minutes to designate the recipients of all your worldly belongings. But that isn't true.

Can I draft a will myself?

You can try drafting the will yourself or you can hire a lawyer to do the work for you. But even if you hire an attorney, you'll still have to make these important decisions on your own. We'll look at the benefits and drawbacks of both a little later in this article.

Who is Khadija Khartit?

Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, an entrepreneur and an adviser for 25 + years in the US and MENA. Let's face it. The last thing people want to do is plan for their death.

Popular Posts:

- 1. how to sign a real estate document as power of attorney for

- 2. what to do when your estate attorney won't return your calls

- 3. when asked for the power of attorney

- 4. when was rod rosenstein nominated for deputy attorney general

- 5. how to become an attorney uk

- 6. lawyers who provide power of attorney in west palm beach

- 7. how to know if he has attorney

- 8. what items should we have available for will/trust attorney

- 9. what is attorney-in-fact?

- 10. how to hire an attorney in us?