A durable power of attorney allows you to handle another person’s financial decisions on their behalf. All decisions made must be to the benefit of the person being represented. The one thing about the durable form that separates it from the rest is that it remains legal in the event the person being represented can no longer think for themselves.

How do you create a durable power of attorney?

Mar 02, 2021 · However, a special power of attorney can be made durable. A durable power of attorney is one that authorizes the agent to continue acting on behalf of the principal even after the principal becomes...

What are the benefits of a durable power of attorney?

What is the purpose of a durable power of attorney?

What is the value of a durable power of attorney?

May 02, 2022 · When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it …

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

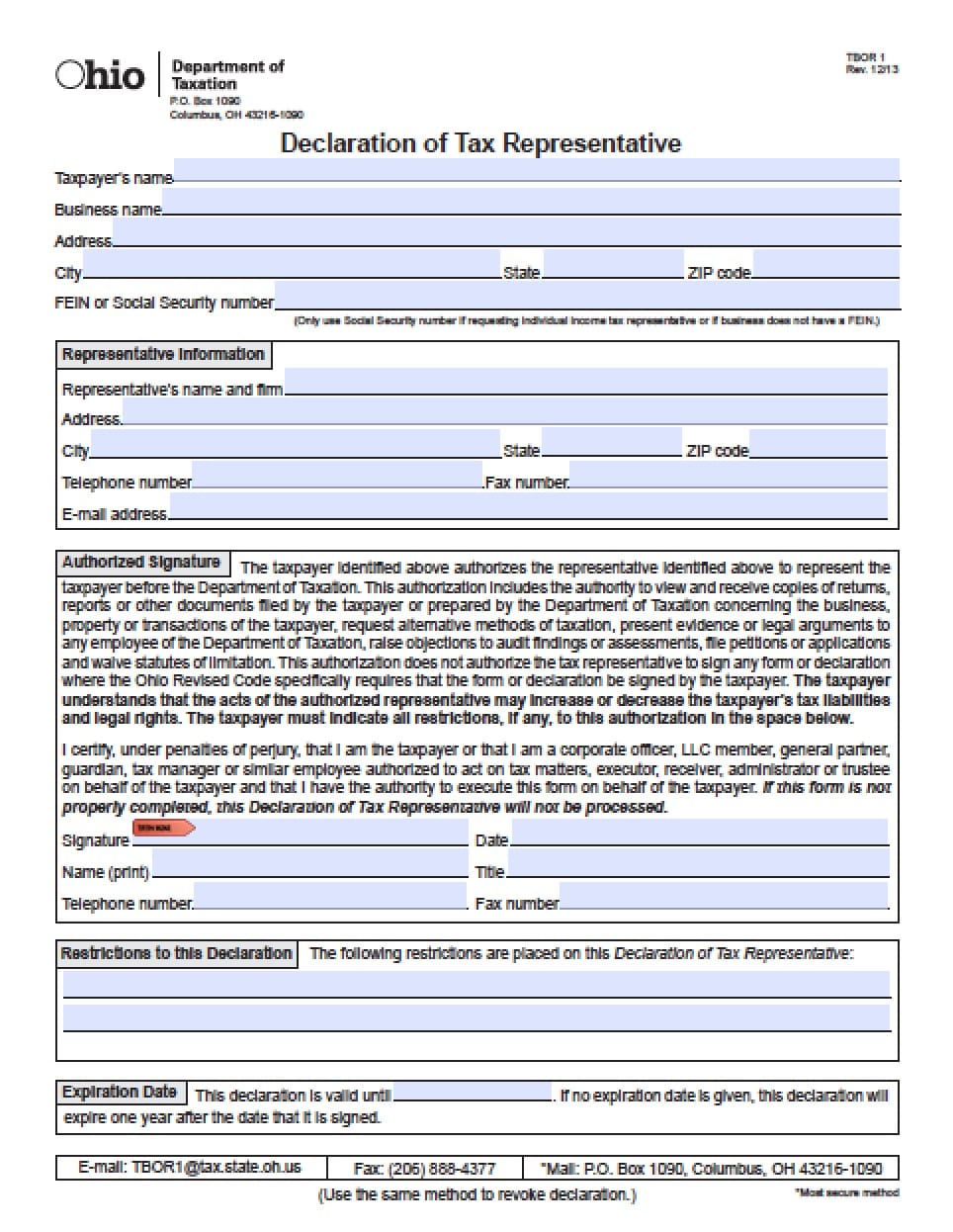

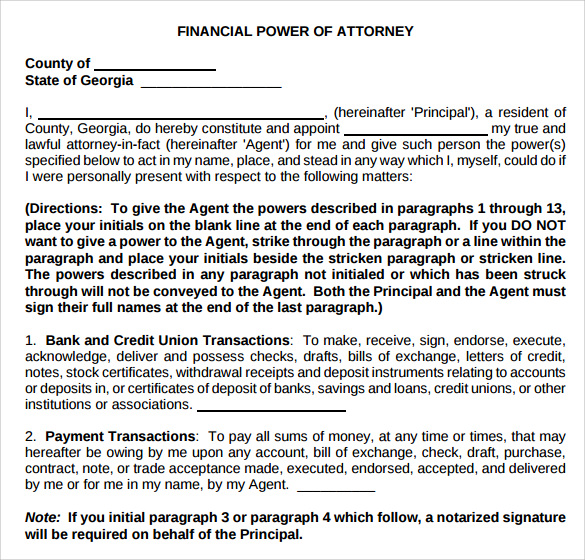

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

What Is A Durable Power of Attorney?

A Durable Power of Attorney (form) is for anyone wanting another person to handle matters on their behalf when incapacitated. It’s by far the most...

How to Get Durable Power of Attorney

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be abl...

Durable Poa vs General Poa

Both forms allow for the principal to select someone else to act on their behalf. Although, the durable allows for the relationship to continue in...

Agent’S Acceptance of Appointment

At the end of the form, the Agent must read and acknowledge the power that they have and how important their position is for the principal. This ad...

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

What happens to a durable power of attorney after death?

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it.

What do you do with your money?

buy, sell, maintain, pay taxes on, and mortgage real estate and other property. collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you.

How to collect Social Security?

collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you. file and pay your taxes. operate your small business.

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

Can a divorce be invalidated?

A court invalidates your document. It's rare, but a court may declare your document invalid if it concludes that you were not mentally competent when you signed it, or that you were the victim of fraud or undue influence. No agent is available.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What happens if you don't have a power of attorney?

An attorney-in-fact can handle many types of transactions, including: If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent before they can take care of your finances for you.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What is a POA?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What is a durable power of attorney?

A durable power of attorney allows you to handle another person’s financial decisions on their behalf. All decisions made must be to the benefit of the person being represented. The one thing about the durable form that separates it from the rest is that it remains legal in the event the person being represented can no longer think for themselves.

What powers does an agent have?

The agent that is selected can have very simple and basic powers, such as having the rights to pick up mail, to wide-ranging powers like having complete control over all the facets of the principal’s financial assets. It’s recommended that if an agent is to have such powers that they are the same person that is listed as a beneficiary in the principal’s last will and testament. In that case, if the agent makes a financial move that hurts the principal’s overall value, it will also affect the agent.

Do you need a notary public to sign a document?

The document is required to be signed in accordance with State law which usually requires the principal and agent signing in the presence of a notary public. In some States, only witnesses are required and in others witnesses and a notary public.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What is the meaning of section 114?

In accordance with Section 114 (page 23), the agent must act: To principal’s expectations while performing in their best interest; In good faith; Only with the scope of authority within the power of attorney. To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest;

What is the meaning of "in good faith"?

In good faith; Only with the scope of authority within the power of attorney. To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest ; To keep records of all receipts, disbursements, and transactions made on behalf of the principal;

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is personal maintenance?

Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported; Benefits from Governmental Programs or Civil or Military Service – To make claims for any government benefit or subsidy; Retirement Plans – To amend any retirement plan.;

Who determines if a disability form is effective?

The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

What is a special power of attorney?

Summary. A special power of attorney is a legal binding agreement between the principal and an agent, manifesting the former’s roles and responsibilities. Under the special power of attorney, the principal selects an agent based on capabilities, skill, and reputation. The principal must be clear on the special power of attorney contract ...

What are the duties of an agent to the principal?

Since an agent may also be liable for additional duties, the principal selects an agent based on skills, ability, and integrity.

How is the contractual duty of an agent to the principal determined?

The contractual duties of an agent to the principal are determined by the express and implied provisions of any agreement between the two. Since an agent may also be liable for additional duties, the principal selects an agent based on skills, ability, and integrity.

What is fiduciary duty?

Fiduciary Duty Fiduciary duty is the responsibility that fiduciaries are tasked with when dealing with other parties, specifically in relation to financial matters. In. , an agent owes the principal the duties of diligence, duty to inform, good conduct, duties of obedience, good conduct, and loyalty.

What is the duty of an agent?

In. , an agent owes the principal the duties of diligence, duty to inform, good conduct, duties of obedience, good conduct, and loyalty. Breaching these duties or exceeding the provided authority means that an agent is eventually liable for any losses caused to the principal. On the other hand, an agent acting within the authority given ...

What is a corporation?

Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial institutions.

What is the purpose of a notary?

Its purpose is to protect the author of the financial reports and. Notary. Notary A notary, also called as a notary public, is a person authorized to witness the signing of legal documents, usually concerned with deeds, estates, licenses, Types of Due Diligence.

What Is Power of Attorney

A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves.1 While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal trusts enough to make decisions in their best interest or as directed, ranging from financial to healthcare matters.2.

When to Use a General (Financial) POA

Let’s use a hypothetical to outline one example of how and when a general power of attorney can be useful:

When to Use a Durable (Financial) POA

Under the same hypothetical situation, how or when would a durable power of attorney be necessary?

Sources

https://www.investopedia.com/terms/p/powerofattorney.asp#:~:text=A%20general%20power%20of%20attorney%20acts%20on%20behalf%20of%20the,stocks%2C%20filing%20taxes%2C%20etc.

What is a guardian in Texas?

A guardian is appointed for the principal. If a spouse was appointed as the agent and the couple divorces or the marriage is annulled or declared void, Section 751.132 of the Texas Estates Code states that their authority as agent terminates.

What is a durable power of attorney?

A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances.

What is a durable power of attorney?

A durable power of attorney, sometimes called a DPOA for short, means there is language within the legal document providing that this power extends to your agent even in the event you become incapacitated and unable to make decisions for yourself.

How long does a durable power of attorney last?

A durable power of attorney generally remains in effect until the principal revokes the powers or dies, but can also be terminated if a court finds the document invalid or revokes the agent's authority, or if the principal gets divorced and the spouse was the agent.

Popular Posts:

- 1. who is a good protective order attorney

- 2. if you get arrested for something you didn't do what do you do get an attorney sue what youtube

- 3. why attorney dont close subject to deals

- 4. how old is maya wiley, attorney?

- 5. how to get the most out of your attorney

- 6. who was an attorney that defended the soldiers involved in hoston massacre

- 7. who is a reliable trust/will attorney in either hunt or rockwall county

- 8. what is the starting rate for an appeal attorney

- 9. how are state attorney general picked?

- 10. how do i contact the nj federal attorney general?