What is the purpose of a Power of Attorney for Personal Care?

- Ability to choose one’s decision-maker. For a variety of reasons, patients do not always want their SDMs selected by default in accordance with the Health Care Consent Act.

- Ability to make specific health care wishes. ...

- Broader scope of authority. ...

- Increased chance that wishes will be followed. ...

What can you do with a power of attorney?

What is the purpose of having a Power of Attorney? A Power of Attorney is a document in which an individual appoints someone to serve as his Attorney-in-Fact or as his agent. This individual may handle the financial affairs of such a person as if the agent or Attorney-in-Fact owned the property himself. A durable Power of Attorney becomes effective the date it is signed and …

What is power of attorney and how does it work?

Oct 22, 2020 · What is the purpose of a power of attorney? A power of attorney allows you to give authority to an agent to make decisions on your behalf if you are unable to do so yourself. You will need one power of attorney for your finances and one for your health care decisions.

What is the point of a power of attorney?

Mar 17, 2022 · A power of attorney (POA) is a legally binding document that allows you to appoint someone to manage your property, medical, or financial affairs. Although it can be uncomfortable to think about needing it, a POA is an important part of your estate plan. A POA is typically used in the event that you become unable to manage your own affairs.

What kind of power does a power of attorney actually have?

Oct 27, 2020 · A power of attorney allows you to designate a person, called the mandatary, to act on your behalf in certain circumstances. It may provide for a series of acts for which you wish to entrust responsibility to your mandatary.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

What are the duties of a power of attorney?

What Are the Duties of Power of Attorney? What Are the Duties of Power of Attorney? A power of attorney is a legally enforceable document that grants one person, the agent, the ability to act on behalf of another person, the principal, in specific matters ranging from health care to the management of personal property and finances.

What powers does a principal have?

A principal may execute a limited power of attorney for a specific purpose, such as for the purchase or sale of property or handling a certain bank account. A principal can also grant an agent powers to make health care decisions on the principal's behalf.

What are the duties of an agent?

Through one or more powers of attorney, the principal can authorize an agent to manage numerous tasks, including entering into contracts, dealing with real and personal property, handling the principal's financial and tax affairs, and arranging for the principal's housing and health care. The agent's primary duty is ...

What is a power of attorney?

A power of attorney allows you to designate a person, called the mandatary, to act on your behalf in certain circumstances. It may provide for a series of acts for which you wish to entrust responsibility to your mandatary. A power of attorney allows you to designate a person, called the mandatary, to act on your behalf in certain circumstances.

When does a power of attorney cease to be valid?

In principle, the power of attorney ceases to be valid when the court recognizes your incapacity. A protection mandate is a document in which you choose one or more people to take care of you and your property if you become incapable. Back to top.

What can a mandatary do?

If you leave the country for some time, you may allow the mandatary to carry out acts for you that you would normally do yourself. For example, paying your rent or mortgage instalments, making certain banking transactions, renewing your insurance, etc. It is always best to clearly delineate the powers of the mandatary.

What is a protective mandate?

A power of attorney is for a person of sound mind, whereas a protective mandate is for a person who has lost their faculties. Are you going on a trip?

Why do you need a power of attorney?

There are many good reasons to make a power of attorney, as it ensures that someone will look after your financial affairs if you become incapacitated. You should choose a trusted family member, a proven friend, or a reputable and honest professional.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is Durable POA?

A “durable” POA remains in force to enable the agent to manage the creator’s affairs, and a “springing” POA comes into effect only if and when the creator of the POA becomes incapacitated. A medical or healthcare POA enables an agent to make medical decisions on behalf of an incapacitated person.

How to start a power of attorney?

A better way to start the process of establishing a power of attorney is by locating an attorney who specializes in family law in your state. If attorney's fees are more than you can afford, legal services offices staffed with credentialed attorneys exist in virtually every part of the United States.

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

What is a power of attorney?

Powers of attorney and similar directives are just one piece of your overall legal and financial planning puzzle. You'll also want to make sure you create a will and/or trusts and review them regularly, as well as regularly reviewing beneficiary designations on insurance policies, retirement plans and other property and accounts.

What is a financial power of attorney?

When you are ill or incapacitated — either for the short- or long-term — you'll need someone to pay your bills, make investment decisions and handle other financial matters. This person is known as your agent. You will specify your agent and your wishes in a document called your financial power of attorney. There are several types of financial powers of attorney to consider:

When to use limited power of attorney?

It's often used when you can't handle certain affairs due to other commitments or short-term illness.

What is advance directive?

An advance directive essentially combines a living will and a health care power of attorney into one document. This document will indicate your health care preferences as well as an agent to make additional health care decisions for you and is often the strongest option if you have strong preferences regarding end-of-life care as well as someone ...

Is it good to be proactive in life?

Being proactive in life is a good thing — especially if you’ve taken the time to prepare a will or trust to reflect how you want personal and financial matters handled after death.

Can you name someone as executor of a will?

If you want the same agent to manage your financial affairs after your death, you should name that person as the executor of your will. Your power of attorney will generally otherwise remain in effect unless you later revoke it.

What is POA in health care?

Ability to make specific health care wishes. A POA can be used as a living will to make specific wishes known. For example, grantors may indicate that they would like their organs to be donated for therapeutic purposes, medical education or scientific research.

What is POA in psychology?

A POA significantly enhances the probability that someone will make the same decisions that the grantor would otherwise have made for himself or herself. In conclusion, the purpose and attraction of a POA is ultimately the ability to control one’s future and dictate what will happen to one’s body when the grantor is no longer able to make his ...

What happens if a person's wishes are not documented in writing?

If a person’s wishes are not documented in writing, then it will be up to the decision-maker (s) to accurately recall or infer what the person would have wanted. Absent a known prior capable wish, the attorney must decide in the grantor’s best interests.

Why do people not want SDMs?

Some people do not have a good relationship with their parents, do not want to burden their children, or would rather leave the decision-making to a person with health care knowledge. Some people would rather keep their personal health information private from family; executing a Power of Attorney for Personal Care can prevent family members from having access to one’s health information.

What is power of attorney?

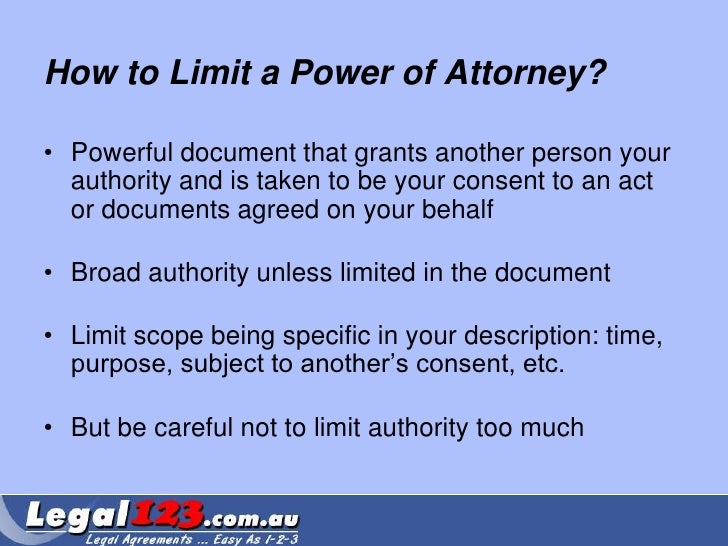

A power of attorney can be as broad or as specific as you need them to be. They can be limited to financial or medical decisions, for example.

Why do people need power of attorney?

There are different reasons why someone would wish to get power of attorney, such as: 1 Making financial decisions 2 Buying life insurance 3 Settling claims 4 Operating business interests 5 Protecting or claiming personal or estate assets 6 Making health or medical decisions, including the ability to withhold or stop medical procedures, treatments, and services

What is a POA?

What is a power of attorney? A power of attorney (POA) is a document that lets you appoint a person or organization to manage your financial or medical decisions on your behalf if you aren’t able to, due to sickness or death. This person or organization is called an attorney-in-fact or agent.

How many witnesses are needed for a power of attorney?

For a Power of Attorney form to be legal, the signer must be mentally competent, acting by choice, and with at least two witnesses present. Some states also require that your signature on your Power of Attorney form be notarized. Read more below to learn how to give, obtain or revoke power of attorney.

When is a power of attorney needed?

That way, doctors won’t have the final say. A power of attorney needs to be established when you are mentally stable enough to make the necessary decisions.

What happens if you give someone a power of attorney?

Literally. “If you give someone a power of attorney, you give them a tremendous power to do whatever they want with your money or whatever it may be,” said Andrew Traub, an attorney in Austin, Texas. “It’s very important that you select the right people, and those are the people you can trust.”.

What is a formal document?

The formal document, or plan, determines the amount of power the chosen agent will have in making decisions for you, your property, or both. The chosen individual takes full responsibility for the choices made under the power-of-attorney guidelines. This person is usually required to keep a record of financial transactions or medical decisions.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What is a POA?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

Popular Posts:

- 1. florida state attorney how to file charges

- 2. who gets served notice of withdrawal of attorney

- 3. irs tax attorney

- 4. what happens to checks given to a probate attorney in alabama

- 5. how much does it cost to hire an estate attorney

- 6. how to file a claim with the attorney general

- 7. how old is attorney danielle banks in pa

- 8. what right does an attorney testifying in court violate

- 9. how did kazuma survive ace attorney

- 10. what are next steps after hospital bill going to attorney