What is a power of attorney in a contract?

The power of attorney held by the agent, is clearly specified within the contract on how to act on behalf of the principal. The agent in this case may also be referred to as an attorney-in-fact. The term attorney-in-fact has been implemented to decipher between them and attorneys of the law.

What is an independent contractor agreement?

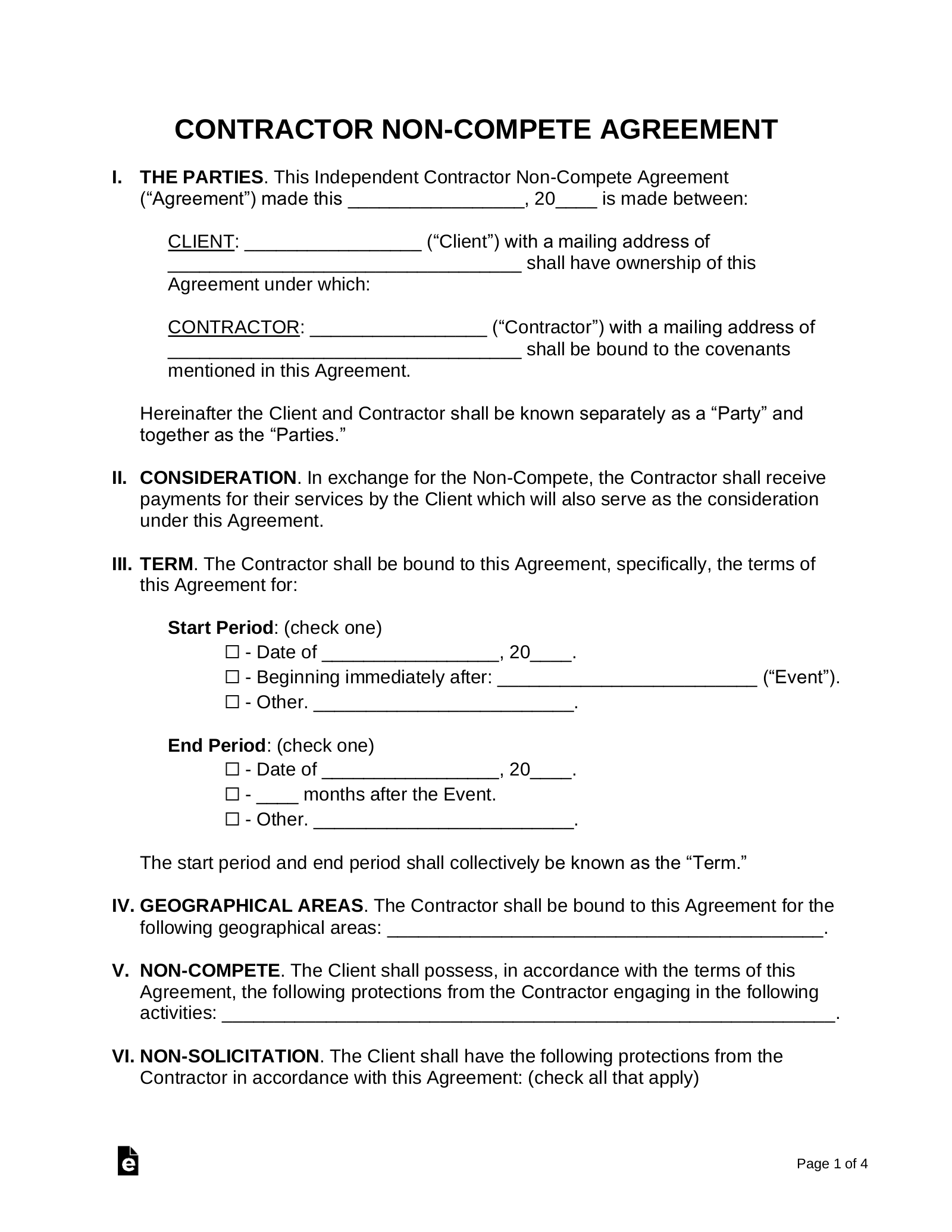

This very important part of the agreement clearly defines the worker as an independent contractor, not an employee. It lists the rights of the contractor to perform services for others unless they directly conflict with or compete with the work for your company.

What is a principal agent and power of attorney?

When a principal agent relationship is created based on an arrangement of a contract, the power of attorney rights are automatically conveyed to the agent. The power of attorney held by the agent, is clearly specified within the contract on how to act on behalf of the principal. The agent in this case may also be referred to as an attorney-in-fact.

Does a power of attorney have to be in writing?

Although the general power of attorney may be either written or oral, most entities require it to be in writing. When an attorney-in-fact, the agent has to be completely loyal and honest with his or her principal. There are many examples of principal agent relationships within real property law.

What should be included in an independent contractor agreement?

7 Terms you should include in an independent contractor agreement?Statement of Relationship. ... Project Description. ... Payment and Billing Terms. ... Responsibilities of Each Party. ... Project Timeline and Deadlines. ... Termination Conditions. ... Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What responsibility comes with power of attorney?

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

What are the three types of power of attorneys Poas?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.

What is the purpose of an independent contractor agreement?

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

What is the best form of power of attorney?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

What are the 2 types of power of attorney?

Generally speaking, Power of Attorney is used for two concerns: Power of Attorney for financial issues. Power of Attorney for health and welfare issues.

What are the disadvantages of being an independent contractor?

Cons of Independent Contracting Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS. In most cases, contractors aren't eligible for state unemployment benefits, because they're self-employed, and they must fund their retirement accounts.

Who is the client in an independent contractor agreement?

An independent contractor is a self-employed individual or business entity which provides a product or service for a customer in exchange for monetary compensation based on a verbal or written contract with the client or customer.

How can I get out of an independent contractor contract?

Instead, ending a contractor relationship involves terminating the professional services agreement and statement of work between your company and the contractor. For this reason, as long as you have correctly classified your independent contractor, labor laws do not apply to your relationship with this individual.

What is a power of attorney?

There are many examples of principal agent relationships within real property law. Power of attorney is granted to a real estate broker to place offers on a house, when the principal is buying; or when accepting an offer on behalf of the principal, when the principal is the seller . An attorney becomes the agent when overlooking and creating ...

When is a power of attorney automatically conveyed to the principal?

Modified date: December 22, 2019. When a principal agent relationship is created based on an arrangement of a contract, the power of attorney rights are automatically conveyed to the agent. The power of attorney held by the agent, is clearly specified within the contract on how to act on behalf of the principal.

What is an attorney in fact?

The term attorney-in-fact has been implemented to decipher between them and attorneys of the law. The fact is represented by the fiduciary duty labeled based on the facts of the contract arranged. The power of attorney is usually stated separately from the contract. This is due to the fact that others are to be shown that the agent has ...

When does an attorney become an agent?

An attorney becomes the agent when overlooking and creating the various contracts required, since the principal may not have the knowledge to do so, hence he relies on the attorney while the attorney is being compensated. General power of attorney can be granted in most circumstances.

When does a power of attorney get revoked?

The power of attorney will automatically be revoked upon the death of the principal, or if he or she become mentally ill.

Can a power of attorney be written?

This is due to the fact that others are to be shown that the agent has the right to act on behalf of his or her principal. Although the general power of attorney may be either written or oral, most entities require it to be in writing.

What is an independent contractor?

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Is an employer employee considered an independent contractor?

If an employer-employee relationship exists (regardless of what the relationship is called), you are not an independent contractor and your earnings are generally not subject to Self-Employment Tax.

Is an individual an independent contractor?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

What is an independent contractor agreement?

An independent contractor agreement, also known as a ‘ 1099 agreement ‘, is a contract between a client willing to pay for the performance of services by a contractor. In accordance with the Internal Revenue Service (IRS), an independent contractor is not an employee and, therefore, the client will not be responsible ...

What are the requirements for independent contractors?

An independent contractor is classified by the IRS, under 26 CFR 31.3121 (d)-1, as someone who conducts the following activities: 1 Able to control how their services are completed; 2 Able to work their own schedule and hours; 3 May control their work attire; 4 Salespersons paid solely on commission (except insurance salespersons); 5 Uses their own tools and equipment when performing services; and 6 Part-time corporate officers.

When do I file 1099 for independent contractor?

If payment to the independent contractor is more than $600 over the course of a calendar year, the client will be required to file IRS Form 1099 with the Internal Revenue Service (IRS) when they pay their taxes on April 15.

Why do you hire independent contractors?

Hiring independent contractors eliminates your need to pay wage taxes, to offer benefits or to provide office space, which can save you 30 - 40% on labor costs*. In order to be considered an independent contractor, the relationship must meet the following criteria.

What does a contractor do?

The contractor controls how the work will be done. The contractor controls where and when the work will be done. Speaking with an experienced employment attorney is an easy way to ensure your situation meets the requirements and you avoid penalties and back taxes.

What to do if you have hired a worker who is misclassified as an independent contractor?

If a worker you have hired files a complaint or a labor auditor is investigating whether a worker is misclassified as an independent contractor, it’s important that you speak with an experienced employment attorney as soon as possible.

What is an independent contractor?

The independent contractor is an individual or a business that is usually self-employed and provides a service or product in exchange for compensation in the form of monetary payment. Therefore, a contractor agreement is a written document that states the terms and working agreement between yourself and the contractor.

What is a contractor contract template?

A contractor contract template usually includes the following elements. Hiring company, which is the entity in need of a contractor. Contractor, which is the entity hired for a task or project. Services, which are the specific descriptions of tasks to perform or products to deliver.

What does "include clause" mean in a contract?

This means that the contractor won’t receive coverage from the liability insurance policy of your company. Including this clause gives your company protection in case any loss or injury happens that the contractor causes. Termination of the Contract.

What is the binding effect of a contract?

Binding Effect. The agreement remains in effect if another company or person takes over the contractor or your company. Entire Agreement. Any previous agreements you may have are no longer valid and you must make any future modifications in a written amendment. Expenses.

What should a contract include?

Your contract should also include a statement that clarifies that the contractor understands that they aren’t entitled to or eligible for retirement or pension benefits, holiday pay, vacation pay, health insurance, sick pay, or other fringe benefits provided by employers. Insurance.

Can an independent contractor terminate a contract without notice?

Since this is an agreement between your company and an independent contractor, not an employee, the agreement must specify that either party may terminate the contract without or with notice, depending on how your project pushes through or how your relationship evolves.

Can a contractor take part in fringe benefits?

Fringe benefits, which state that the contractor can’t take part in any of your company’s employee benefits. Assistants of the contractor whom they hire on their own, but the contractor bears responsibility for the assistants’ expenses.

What is an independent contractor?

An independent contractor is a freelancer or self-employed person who provides a service and is hired by a company or individual to perform a specific task.

What is a written contract between a contractor and a company?

In most cases there is a written agreement or contract between the contractor and the company which details the rights and responsibilities of both parties. There are standard independent contracts, but these agreements can be modified to address the concerns of either party.

Why are independent contractors increasing in numbers?

Independent contractors are increasing in numbers as both large and small companies realize the cost-effectiveness of hiring people to just do a specific job when needed instead of having full-time employees on staff.

Do independent contractors get paid?

As independent contractors they do not receive a salary, health benefits, paid vacations or holidays or a retirement plan. No taxes are withheld from their paychecks. Independent contractors are strictly work-for-hire and as such are responsible for paying their own taxes and in some cases their expenses as well.

What is an independent contractor?

An independent contractor is anyone who does work on a contract basis to complete a particular project or assignment. They can be a sole proprietor, a freelancer with an incorporated business, a professional with a Limited Liability Partnership (like a lawyer)—it really doesn’t matter what kind of business entity they run.

Is a freelancer considered an independent contractor?

Most people who call themselves “freelancers” are considered to be independent contractors by the IRS—the two terms are basically interchangeable. If you’re doing work for someone, you’re not on their payroll, and you signed a contract with them, you’re probably an independent contractor.

Do independent contractors have to pay health insurance?

If you’re an independent contractor, employers don’t have to pay into your health insurance, life insurance, bonuses, stock options, worker’s compensation, unemployment taxes, payroll taxes, or 401 (k) contributions. Independent also don’t get employee benefits, or protection from employment laws, like the Fair Labor Standards Act (FLSA), ...

Can an employer penalize an independent contractor?

And if an employer treats an independent contractor as an employee, the IRS might penalize them for “misclassification.”.

Do you have to sign a contract before you start doing work?

Clients will usually ask you to sign a written contract before you start doing work for them (that’s where the “contractor” part comes from). If you’re looking for a good template contract for an independent contractor agreement, the plain contract is a good place to start.

Is an independent contractor an employee?

By definition, an independent contractor is not an employee. Employees get paid a regular wage, have taxes withheld from those wages, work part or full-time, and have their work and schedule dictated by the employer. Independent contractors are the reverse. They tend to get paid for projects, they worry about their own taxes, ...

When identifying someone as an independent contractor, what considerations should be considered?

Other considerations when identifying someone as an independent contractor may include: If the worker supplies his or her own equipment, materials and tools. If all necessary materials are not supplied by the employer.

What are the safe harbors for independent contractors?

Safe harbors which allow employers to use the independent contractor status and avoid penalties include: prior practice of treating similar employees as independent contractors and the existence of a prior IRS audit where no taxes were required to be paid.

Is an independent contractor liable for unemployment?

When a worker is an independent contractor, the hiring party is not required to make any of these payments. Should employers incorrectly define a worker as an independent contractor, they may find themselves liable for past taxes including FICA and federal unemployment tax.

Popular Posts:

- 1. when writing a letter to a district attorney do we address them as the honorable

- 2. phoenix wright ace attorney trilogy where to buy

- 3. how to address cover letter to attorney generals office

- 4. how to get power of attorney of a minor in state of tn

- 5. what type of attorney

- 6. ok im an attorney now what

- 7. how can an attorney get a death certificate from the coroners office

- 8. in huntsville alabama is there a attorney which will help people start their disability claim

- 9. attorney who specializes in military divorce

- 10. when does the allegan prosecuting attorney have to run for reeelection?