How do you obtain power of attorney in Illinois?

A power of attorney allows you to appoint someone to make decisions about your financial or medical matters if you ever become incapacitated or unavailable. Learn how to how to make a financial POA in Illinois.

Does Illinois allow joint power of attorney?

Aug 02, 2021 · An Illinois Power of Attorney for Health Care has been created by the Illinois legislature. This form must be signed by the principal and one witness. It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness.

How to establish a power of attorney?

All About the Illinois Power of Attorney Act Posted on July 30, 2019 A power of attorney allows a person (known as a “principal”) to appoint a representative (or agent) to manage their property and affairs in the event they are no longer able to do so for themselves. At some point, nearly everyone will need a power of attorney to represent them.

Is it legal for a person with power of attorney?

State of Illinois . Illinois Department of Public Health . Illinois Statutory Short Form . Power of Attorney for Health Care . NOTICE TO THE INDIVIDUAL SIGNING . THE POWER OF ATTORNEY FOR HEALTH CARE . No one can predict when a serious illness or accident might occur. When it does, you may need someone else to speak or make health care decisions for you.

What is a general power of attorney in Illinois?

The Illinois general power of attorney is a document that transfers authority to an agent to act on behalf of the principal (individual creating the document) so long as the principal can make decisions for themselves.

Do I need a lawyer for power of attorney in Illinois?

The person making a power of attorney must be of sound mind, but the exact contours of this mental capacity requirement are open to interpretation by Illinois courts. If you're helping someone make a POA and are unsure whether the person has the necessary mental capacity, you should consult an attorney.

How do I get a power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must:Designate the agent and the agent's powers.Be properly signed (executed) by the principal.Be signed by at least one witness to the principal's signature.More items...•Aug 2, 2021

Can power of attorney withdraw money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

Can family members witness a power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.Aug 26, 2021

Can a family member override a power of attorney?

If your loved one made an Advance Decision (Living Will) after you were appointed as their attorney, you can't override the decisions made in their Advance Decision.

How long does it take for power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Does power of attorney need to be registered?

Power of Attorney: Registration: In many cases, a general or specific power of attorney need not be registered. The question of registration arises only if a power is given for the sale of immovable properties. The Indian Registration Act does not make a power of attorney compulsorily registerable.

Does Illinois recognize out of state power of attorney?

Uniform Power of Attorney Act It is best to consult a Power Of Attorney lawyer to make sure that if you are the agent of a POA, or you want to grant POA authority to someone, your Illinois POA will be recognized in another state where you own property or other assets or have business interests.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can POA use online banking?

Online and mobile banking cannot be provided if you have a general power of attorney.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

How old do you have to be to get a power of attorney in Illinois?

The basic requirements for a power of attorney in Illinois for financial matters are that it must: For both financial and healthcare POAs, agents and witnesses must be at least 18 years of age. There are limitations as to who may be a witness.

What is a POA in Illinois?

Let's look at the state of Illinois requirements for granting Power of Attorney. A legal document called a power of attorney ( or POA) can assure that your financial and healthcare matters are taken care of in the event you can't be present to sign documents, or if you become incapacitated.

What is a POA in financial terms?

A financial POA giving the agent broad powers to represent the principal in just about any matter is called a "general" POA. A "limited" or "special" POA is one that limits the agent's authority in some way, such as limiting it to a single transaction, a certain type of transaction, or to a limited amount of time.

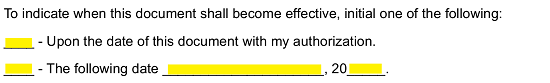

When does a POA end?

Traditionally, a POA ended if the principal became mentally incapacitated, and became effective as soon as it was signed. Under Illinois law, you can have a POA that continues in effect after incapacity (called a "durable" POA) or one that does not go into effect unless the principal becomes incapacitated (called a "springing" POA).

When to use a POA?

Use a health care POA when you are undergoing a medical procedure where you might be unable to make decisions for yourself. In that case, you want to appoint someone who understands what you want and can act on your behalf.

Do you have to file a document in Illinois?

In Illinois, you do not have to file your document with the court. However, it's a good idea to make copies of it while keeping the original in a safe location.

Have A Discussion

Create The Power of Attorney

- Once you've had the discussion with your agent and they are comfortable taking on those responsibilities, it's time to create the document. In Illinois, there are two types of powers of attorney: property and health care. It's important that you understand what your needs are so you can choose the right form. Use a health care POA when you are unde...

Execute The Document

- Each state has its own guidelines for proper execution. In Illinois, you must sign the document in the presence of two witnesses and a notary. When choosing these people, keep in mind that your agent cannot be a witness or the notary. If you do not sign the document under Illinois law, it won't be official. This means your agent may not be able to act on your behalf.

Make Copies

- In Illinois, you do not have to file your document with the court. However, it's a good idea to make copies of it while keeping the original in a safe location. Keep one copy for yourself. Provide several copies to your agent. If you have a health care power of attorney, the doctor or medical office may require a copy on file so they can deal directly with your agent. If you executed a prop…

Popular Posts:

- 1. how to file a grievance in illinois against an attorney

- 2. how your date with my attorney doesn't communicate back.

- 3. how long should it take for my attorney to pay me from my verdict?

- 4. what can i do if my attorney is not acting in my best interest?

- 5. how to reverse the power of attorney

- 6. how many ssd frog situations get dismissal from an attorney

- 7. how much does it cost to pay attorney to file bankruptcy chapter 7

- 8. what happens if the lawyer doesnt honor attorney client priveledge

- 9. who is attorney 2

- 10. my very intelligent friend who is an attorney said to post this just for you