Can an executor of an estate close a bank account?

Nov 08, 2019 · Learn how to set up power of attorney for banks accounts as part of estate planning or protecting your assets in the event that you become incapacitated. Life doesn’t always go as expected. At ...

Can a power of attorney close a deceased person’s account?

Otherwise, closing out accounts and settling your estate (paying taxes, sorting through any outstanding debts and getting your heirs the funds you intend for them to have) can all be delayed. It also creates a lot more work for your executor if they have to go on a scavenger hunt looking for your accounts and passwords.

Can a power of attorney control a bank account?

Jun 16, 2021 · To close the account, you’ll simply need to write a letter asking the bank to close that specific account and sign it. No death certificates or other information is needed beyond your request for closure.

How do I Close a single-holder bank account after death?

Create a bank account in the estate’s name and close decedent’s bank accounts As executor, you should never co-mingle your own money with the money of the estate. If you do, it could be grounds for punishment by the court. Only an executor with letters of testamentary may close the bank account of the deceased.

How do I close my deceased father's bank accounts?

How To Close A Deceased Person's Checking Account WITH A WillGet the death certificate.Present the will to the probate court.Receive the Letter of Testamentary from the probate judge (which legally names you as the estate administrator)Provide the bank with the Letter of Testamentary.More items...•Mar 1, 2018

How do you close the executors account?

Notify the probate court that there is no will. Receive a letter of testamentary. The judge will grant this document, which names you as the executor of the estate. The letter gives you the legal right to close the checking account for the estate.Nov 21, 2020

Can executor Use deceased bank account?

Once a Grant of Probate has been awarded, the executor or administrator will be able to take this document to any banks where the person who has died held an account. They will then be given permission to withdraw any money from the accounts and distribute it as per instructions in the Will.

What is revaluation account?

The revaluation account records the positive or negative holding gains accruing during the accounting period to the owners of financial and non-financial assets and liabilities.Nov 21, 2001

What happens when someone dies and closes their bank account?

How to close a bank account when someone dies. When a close friend or family member dies, there are a lot of loose ends that you may be responsible for resolving. One of those may be closing their bank accounts (such as checking, savings, CDs, etc.), especially if those funds are needed to pay funeral expenses or to settle ...

What does POA stand for in a bank account?

You will then have access to the account, allowing you to withdraw the funds as needed. If you have power of attorney: Power of attorney (POA) gives someone temporary or permanent legal authority to make decisions on behalf of another adult, such as an aging parent or loved one.

What do you need to act on behalf of an estate?

2. Proof that you can act on behalf of the estate. You'll also need proof that you have the authority to act on behalf of the estate. The documentation you need depends on your legal relationship to the deceased, such as in the scenarios outlined below. If you are a joint owner of the account: As a joint owner of the account, ...

What happens if you don't have a will?

If there's a will without a named executor, the court will issue a Letter of Testamentary; if there's no will, the court will issue a Letter of Administration. Present either of these letters to the bank along with the death certificate to close the account. The death of a loved one is challenging from both an emotional and logistical perspective.

What happens if there is no will?

If there's no will or no executor named in the will: If there is no will or the person who should handle the estate is not named in the will, a relative or legal representative must request permission from the probate court to close the account.

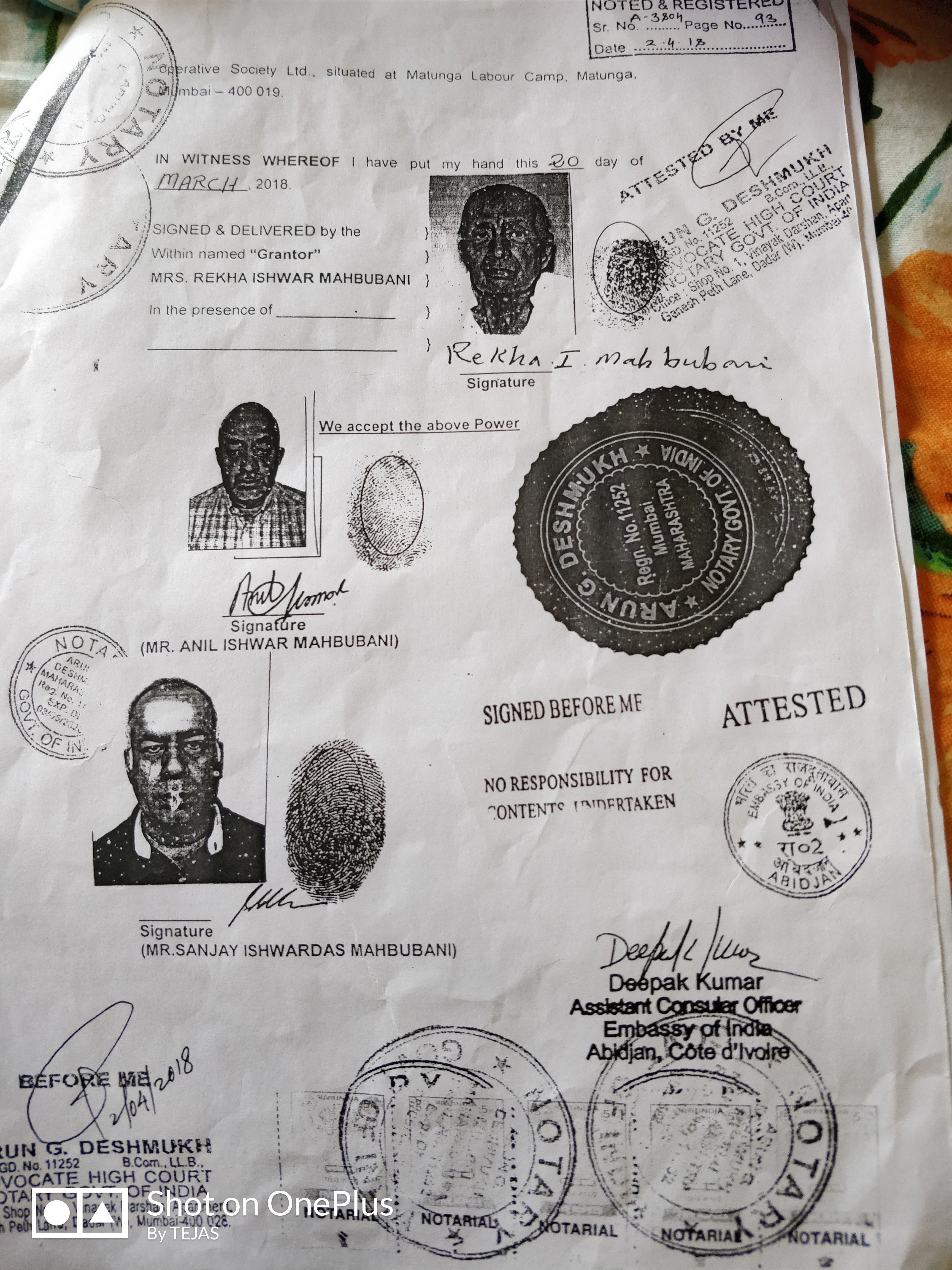

Can a POA be used to close a bank account?

POAs are important tools, but they cannot be used to close a bank account after someone passes away for the simple reason that a POA expires once the principal (the person granting authority to another) dies. 3. To handle financial affairs after death, the person named as Power of Attorney will either need to be named as executor ...

Can a beneficiary withdraw money from a bank account if the owner is alive?

The beneficiary is not entitled to money in the account while the owner is alive, but automatically becomes the owner of the account upon the original owner's death. In these cases, simply visit the bank with a valid ID and a certified copy of the death certificate. You will then have access to the account, allowing you to withdraw ...

How to close a joint bank account with a deceased person?

To close the account, you’ll simply need to write a letter asking the bank to close that specific account and sign it.

What happens if a bank account is left open?

If these accounts are left open and unused, they become prime targets for hackers. While the process is straightforward, there are several pieces of information required for a bank account to proceed with the closing process.

Why should I take care of my bank account after my death?

Taking care of a loved one’s bank and credit card accounts is essential to ensure no fraudulent activity occurs after their death. Bank accounts should never be left open and idle — especially if you’re a joint account holder. By closing these accounts, you ensure that the affairs of your loved one come to completion.

How to get a copy of a death certificate?

First, get a copy of the death certificate. For official business, you’ll want to obtain a certified copy. Some states require proof of executorship or proof of relationship in order to receive a certified copy. This can be obtained by contacting your state’s office of vital statistics.

Why do banks require you to submit documents in person?

Most banks require this information to be submitted in person to avoid fraud. Once you present the above documents at the bank, the funds will be released and the bank account closed. A letter requesting closure might be required and can be obtained during the same visit.

How long should I keep financial documents after my death?

It can be tricky to know how long to keep documents after a death, but in general, plan to keep all financial documents for a minimum of three years. Once you’ve gathered the above documentation, you’re ready to contact the bank.

Can the next of kin fill in for the executor?

In situations when there is no executor, the next of kin is allowed to fill in for the role to handle end-of-life affairs. If this is your case, the process is similar to the steps taken above, with one exception.

How to open a bank account in the name of an estate?

In order to open a bank account in the name of the estate, you will need to obtain a tax identification number for the estate. You should consult with the attorney or accountant for the estate to discuss obtaining the identification number.

What to do before closing an account?

Before closing the account. Before closing an account, it is important to check to see if there are any automatic payments from or to the account. Sometimes the bank will know about these, but sometimes you have to review old statements to figure it out. Also before closing an account, make sure any estate payments are not scheduled ...

Can an executor close an estate?

As executor, you should never co-mingle your own money with the money of the estate. If you do, it could be grounds for punishment by the court. Only an executor with letters of testamentary may close the bank account of the deceased. If you would like your attorney to manage this process for you, he or she will be happy to do so, and have you sign an authorization letter allowing him/her to close or open accounts on behalf of the estate.

How to take someone off a joint bank account?

Go to the bank. Go to the bank and provide them with the necessary paperwork. In the case of a joint account where you are the surviving owner, present the death certificate and proper identification and ask that the deceased's name is taken off the account.

What do you need to present to a trustee of a bank account?

In a situation where you are the trustee for a bank account held in trust, you need to present both the death certificate and a copy of the trust agreement along with proper identification. In the case of an account that is POD, you need the death certificate and proper identification. 4. Provide details for payment.

What is a joint account?

A joint account where one of the owners passes away. Accounts titled in trust. Payable on death (POD) accounts. While there are some steps that vary depending on the nature of the account, these are the main required steps for closing a bank account for a deceased person without a will or going through the probate process. 1.

What to do if your estate is not governed by a will?

If you are dealing with an estate that is not governed by a will or undergoing probate, it is a good idea to consult a trusts and estates attorney or an online service provider. This portion of the site is for informational purposes only. The content is not legal advice.

Can a bank account be closed without a will?

There are several situations wherein a bank account belonging to a deceased person can be closed even though the person hasn't left a will and without going through probate —the process of settling debts and distributing assets to the deceased's beneficiaries.

Can you transfer funds to a new account?

Alternatively , you may be required to transfer the funds to a new account. In a case where you are the successor trustee, you must provide the bank with information on who the funds should be made payable to. You can accomplish this with a certified check or an electronic transfer to the beneficiary's bank account.

Do you keep a copy of the disbursement of funds?

If you are a successor trustee, make certain to procure proof of the account's closure for your records. Similarly, keep a copy of proof of the disbursement of funds. Finally, for POD accounts, it is still a good idea to keep a copy of proof of the closing of the account. If you are dealing with an estate that is not governed by a will ...

What information do you need to close a bank account?

Depending on the bank, you might need to other information. (Bank of America requires the death certificate, the deceased’s social security number*, and a bank account number) After you submit that information, the bank will provide a case number, and contact you to finish closing the account.

How to close a deceased person's checking account?

How To Close A Deceased Person’s Checking Account WITH A Will. If a will is present, and you are named the estate administrator , you can close their bank account by following these steps: Get the death certificate. Present the will to the probate court.

What is the job of an estate administrator?

As an estate administrator, it is your job to give the money to whomever the probate court says is the beneficiaries.

What happens if a deceased person creates a trust?

If the deceased created a trust and named you as the trustee to the account, you must show the bank these items to close the account: If a beneficiary was appointed in addition to a trustee, the trustee must give the money to the heir.

How to show death certificate to bank?

Show the death certificate to the bank and inform them that you are a trustee or POD beneficiary of the deceased’s bank account. Make sure to provide a copy of the trust if you are closing a trust account. Also provide proper identification, such as a driver’s license or passport.

How to close a single signature checking account?

No will exists. You are the next of kin. If so, follow these steps to close a single signature checking account: Obtain a copy of the death certificate. Inform the probate court that there is no will. Obtain a Letter of Testamentary*.

Can a power of attorney close a checking account?

Power of Attorney. The Power of Attorney can use the account to pay the deceased’s bills. After the person passes away, you will not be granted access to their checking account, and you will not be able to close it. The only want you will be able to close/access the account is if you are also the joint account holder, a trustee, ...

Who closes bank accounts when someone dies?

When people die, you need to close their bank accounts. This is usually done by the executor of the will. If there is no will, it should be done by a court-appointed administrator who is usually a spouse, close family member or the major beneficiary of the deceased's estate.

What happens if you close a savings account?

If you are closing a checking or savings account, be sure to cancel any automatic payments – pensions, Social Security, dividends and so on. The bank may charge fees if payments are posted after the account is closed.

What to do if there are multiple beneficiaries of a deceased person's estate?

If there are multiple beneficiaries of the deceased's estate, and you suspect there may be disputes from one or more of them, you should consider probating the estate so as to avoid any future claims by a beneficiary against you.

What to do if you need a small estate affidavit?

If the state law requires any court filing to authorize the use of the small estate affidavit, you should consult with an attorney to assist you with this procedure.

What to do if there is no will?

If there is no will, then a relative or legal representative must ask the court for permission to close the deceased's bank accounts. The court will issue a document called "Letters of Administration.". Take this to the bank, along with some photo identification to prove who you are, and ask to close the account.

Can you transfer money from a deceased person's bank account?

Once you've opened the account, you can request to transfer the funds from the deceased's bank accounts to it . You'll use the estate account as a central repository to gather cash, pay taxes, settle bills and start making transfers to the deceased's beneficiaries.

Can a deceased person be a small estate?

If the value of the deceased's assets is small enough to qualify as a "small estate," then you have the option of using a simplified probate procedure. Rules vary by state but generally, the beneficiary will prepare a sworn statement stating that she is entitled to the money in the bank accounts under the deceased's will or state law.

What are the powers of executor of a will?

Among them are the following: Manage the estate assets including bank accounts, stock, bonds, retirement accounts, pensions. Take inventory of assets, including personal and real property. Pay creditors and other claims including funeral expenses and any estate taxes that may be due out of estate assets.

What does an executor do?

An executor has the power to initiate the filing of a probate proceeding with the Surrogate’s Court by filing the original will and death certificate with the court. He has the power to obtain and file any other necessary documentation that the court may require.

How to keep beneficiaries informed of important financial matters?

Make accountings to the beneficiaries and the court. Communicate with the beneficiaries on a regular basis to keep them informed of important financial matters. Resolve disputes that may arise between beneficiaries. Wind up and settle the estate. Distribute assets.

How to pay creditors and other claims?

Pay creditors and other claims including funeral expenses and any estate taxes that may be due out of estate assets. Contact an employer to find out about the testator’s employee benefits. Manage the testator’s business. Make accountings to the beneficiaries and the court. Communicate with the beneficiaries on a regular basis to keep them informed ...

What is the fiduciary duty of an executor?

Fiduciary Duty of an Executor as a Limit on Their Power. Because an executor has so much power and discretion over the affairs of the estate, an executor is held a higher standard of behavior and is expected to act in an honest, fair and ethical manner.

Who has the power to carry out the wishes and intent of the testator?

The executor is has the power to carry out the wishes and intent of the testator and must do so by acting in good faith and by representing the best interests of the beneficiaries at all times during the probate administration of the estate and winding up and closing of an estate.

Does an executor have to pay taxes?

The executor also has the power to NOT take compensation for their services, in order to not pay income tax on the compensation. When a spouse or a family member acts as executor, many times they do not take compensation for their services, especially when they are also a beneficiary receiving a distribution of assets under the will.

Popular Posts:

- 1. how long will ace attorney anime be

- 2. how many witnesses needed on a healthcare power of attorney

- 3. attorney who speaks spanish los angeles debt collection

- 4. attorney who represented clinton book desl

- 5. how much does a criminal attorney cost

- 6. who is the prosecuting attorney for roanoke circuit court

- 7. who won seattle city attorney

- 8. who was erin brockovich attorney

- 9. what does power of attorney mean in pennsylvania

- 10. my sons father died without a will. what type of attorney do i need to protect his interests?