What is the purpose of a real estate lawyer?

A Limited Power of Attorney is a POA that’s set up for a limited time frame, generally for a limited purpose. A good example of when a Limited POA might be helpful is if you ever need someone to act on your behalf during a real estate transaction that you can’t be present for.

What makes a good power of attorney for property?

May 27, 2021 · A limited power of attorney (LPOA) is an authorization for a portfolio manager to carry out an investment strategy on behalf of a client.

What does a limited power of attorney mean?

Feb 08, 2022 · The California limited power of attorney form, otherwise known as a “specific” power of attorney, allows a resident of the state to designate an agent to take care of a specific financial matter on their behalf. The matter can be as small as picking up a car to as big as selling or buying real estate.

Does limited power of attorney need to be notarized?

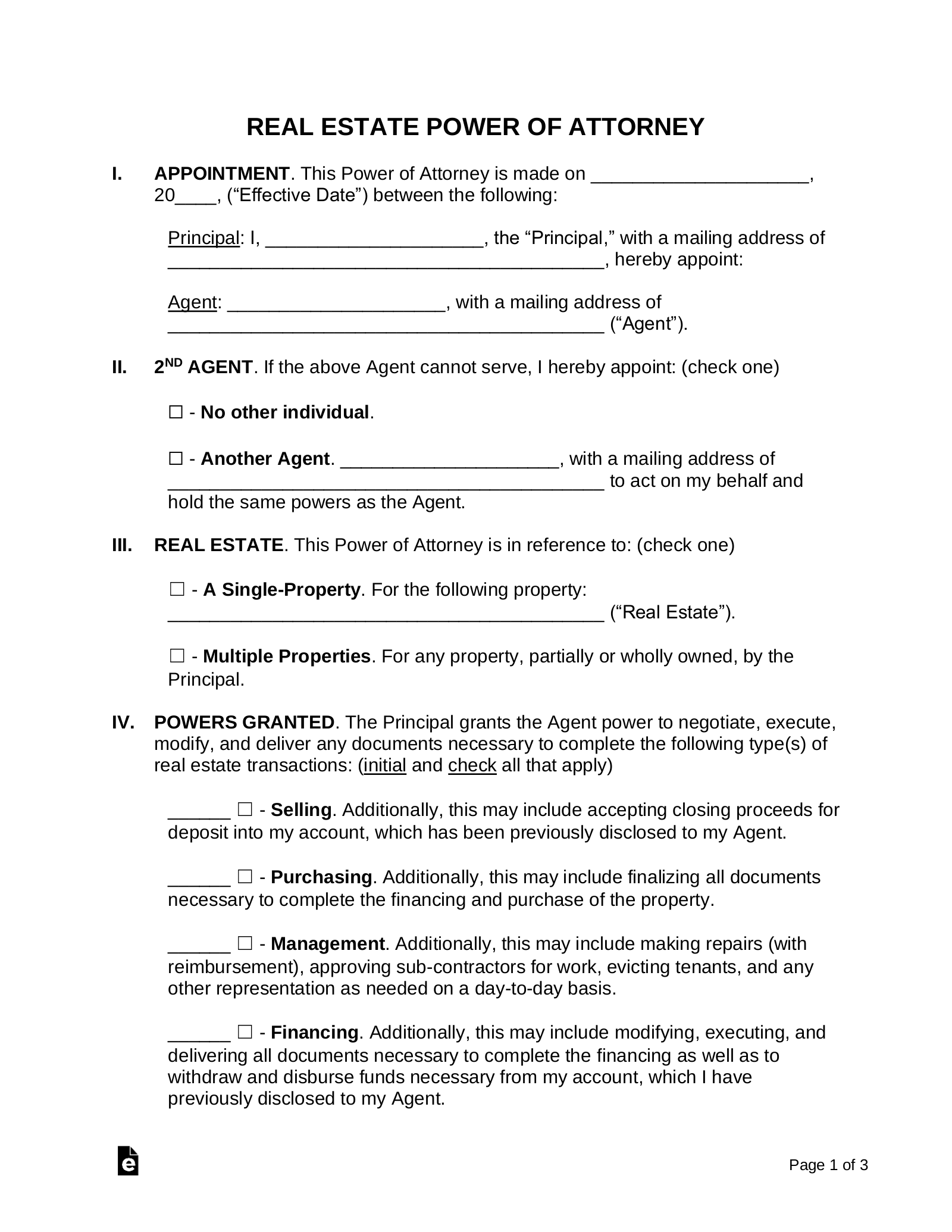

A real estate power of attorney form, also known as “limited power of attorney”, is a document that allows a landlord to delegate leasing, selling, or managing powers to someone else. This is often used by homeowners or business owners when their attorney is designated to handle a real estate closing on their behalf when signing all necessary documents.

What does limited power of attorney do?

Under a limited power of attorney agreement, the agent can only act and make decisions on specified activities, and only to the extent that the principal authorizes. A principal does not need to choose a lawyer to be their agent; attorney in fact differs from an attorney at law.

What is the difference between limited and power of attorney?

A general power of attorney gives an agent the power to handle your financial matters in your place. They can mostly do anything you could do, such as selling assets, transferring funds, or making gifts or investments. A limited power of attorney can handle a specific task or set of tasks for you.

What is the meaning of power of attorney of property?

Power of attorney (PoA) for property These legislations defined POA as an instrument empowering a specified person to act on behalf of the person executing the transaction. Basically, a person gives another person the legal right to present himself as his representative, to perform specific tasks on his behalf.Nov 9, 2021

Can a property be sold with power of attorney?

If the deed of power of attorney grants power to sell the property of the principal and to execute and register necessary documents in that regard, such a sale made by the agent will be valid, is binding on the principal, and will convey a proper title to the purchaser(s).Oct 29, 2021

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

Can I sell my mother's house with power of attorney?

Answer: Those appointed under a Lasting Power of Attorney (LPA) can sell property on behalf the person who appointed them, provided there are no restrictions set out in the LPA. You can sell your mother's house as you and your sister were both appointed to act jointly and severally.Apr 2, 2014

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can POA holder execute sale deed?

A power of attorney is not a valid instrument to transfer property titles when buying or selling a property. ... To transfer property titles, a sale deed must be completed, after which the buyer must pay stamp duty and registration fees.

Can power of attorney transfer property to himself?

Yes, a power of attorney can certainly legally inherit assets from the person they have the power over.Sep 2, 2019

How long is general power of attorney valid for?

Another important thing to note here is that a PoA remains valid only till the life of the principal. Within their lifetime also, one can revoke the PoA. An SPA gets revokes on its own as soon as the specific transaction for which it was executed is completed.Nov 12, 2021

Why is it important to review power of attorney?

When writing the power of attorney, it’s important to review any State laws to ensure that all codes and rules are being followed. For example, some States have a maximum time limit on real estate power of attorney documents while others only allow a durable provision to be included in their statutory form.

What is a power of attorney?

A real estate power of attorney form, also known as “limited power of attorney”, is a document that allows a landlord to delegate leasing, selling, or managing powers to someone else. This is often used by homeowners or business owners when their attorney is designated to handle a real estate closing on their behalf when signing all necessary ...

Who has the power of attorney to evict tenants?

The owner of an apartment complex gives real estate power of attorney to their son. The son will have the right to sign leases, evict tenants, and perform maintenance on the property. Although, all rents collected must go to the owner unless a separate agreement is made.

Can a power of attorney be durable?

In most cases, a real estate power of attorney is not durable, meaning, it does not terminate if the principal becomes mentally incapacitated. If the principal is seeking to have this option, although not required in most States, a durable power of attorney form should be completed.

What is the first paragraph of a delegation?

The initial paragraph of this delegation paperwork will serve as a declaration identifying the Principal and his or her Attorney-in-Fact. The individual who intends to authorize an Agent to represent him or her in matters of real estate or the Principal must have his or her “Full Name” displayed on the first blank space while his or her “Street Address,” city, and state should be presented on the three empty lines that follow.

Who is the agent in fact?

Agent (“Attor ney-in-Fact”) which may be anyone that the Principal chooses; 2nd Agent in case the original agent is not available to act; Real Estate Power of Attorney Document; Notary Public; and/or. Two (2) Witnesses.

What is assignment of authority?

Assignment Of Authority” has been set to enable the Principal to name the decisions and actions that he or she authorizes the Attorney-in-Fact to undertake on his or her behalf. This will be accomplished with the Principal’ s review and direct permissions. The real estate powers available to the Attorney-in-Fact will be summarized across four paragraph descriptions – each with attached to a blank space and check box. The Principal must initial and check the paragraph he or she wishes applied to the Attorney-in-Fact’s abilities of representation. Any paragraph without these items or missing information will not be applied to the principal powers being designated here. At least one and as many as all of these paragraphs may be within the scope of principal powers assigned through this document.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

When does a power of attorney go into effect?

A springing (or conditional) power of attorney only goes into effect if a certain event or medical condition (typically incapacitation) or event specified in the POA occurs. For example, military personnel may draft a springing power of attorney that goes into effect when they’re deployed overseas.

Can a power of attorney be restricted?

The powers granted under a general power of attorney may be restricted by state statutes. Who can legally override your power of attorney depends on which type of POA you select. 4. Limited (Special) Power of Attorney.

What happens to a non-durable power of attorney?

Non-Durable Power of Attorney. A non-durable power of attorney expires if you become incapacitated or die. For instance, if you fall into a coma, your agents will lose any authority previously granted. After that, only a court-appointed guardian or conservator will be able to make decisions for you.

What is a POA?

It is a type of Limited POA, meaning that the decision making powers granted to the Agent are only applicable in the limited contexts provided in the form. The Agent may be any person or any entity the Principal believes will perform their role in line with the Principal’s best interests.

What happens to a power of attorney when the principal dies?

If the Principal dies, the Power of Attorney will end upon their death. The contract will terminate, and the Agent will need to relinquish any and all authority they have been bestowed to act on the Principal’s behalf.

What is a power of attorney in NC?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. The meaning of authority over subjects listed on this form is explained in the North Carolina Uniform Power of Attorney Act.

Can an agent exercise the grant of specific authority?

(_____) UNLESS INITIALED, an agent MAY NOT exercise any of the grants of specific authority initialed above in favor of the agent or an individual to whom the agent owes a legal obligation of support.

What is a power of attorney in Florida?

Florida Statutes, Chapter 709, deal with Powers of Attorney, which are inapplicable for: A proxy or other delegation to exercise voting rights or management rights with respect to an entity ( 709.2103 (1)); A power created by a person other than an individual ( 709.2103 (4));

Can a power of attorney sign a closing document?

However, the person who can sign on behalf of the entity is unavailable on the day of closing, so they ask us to prepare a Power of Attorney to sign the closing documents. Unfortunately, a Power of Attorney will be ineffective to transfer the authority of a corporate officer, LLC authorized person, or trustee to sign on behalf of the entity .

Popular Posts:

- 1. books on how to defend yourself against an attorney ethics complaint in nj

- 2. who pays for workers compensation attorney in california

- 3. who makes a decison tp arrest the police or the county attorney\

- 4. how to contact attorney general kentucky

- 5. what is the job of an attorney general

- 6. pittsburgh attorney who passed away in 2018

- 7. how to contact the attorney general of mn

- 8. how to obtain durable power of attorney in florida

- 9. when does the prosecuting attorney get involved in a murder case?

- 10. when does a power of attorney become effictive after death of someone