Does limited power of attorney in Florida need two witnesses?

Whether general or special, state law determines signing requirements for powers of attorney. States such as Florida require that a financial power of attorney be signed by two witnesses and also notarized, whereas Georgia only requires two witnesses unless the use of the POA involves real estate.

Can someone in Florida get a power of attorney?

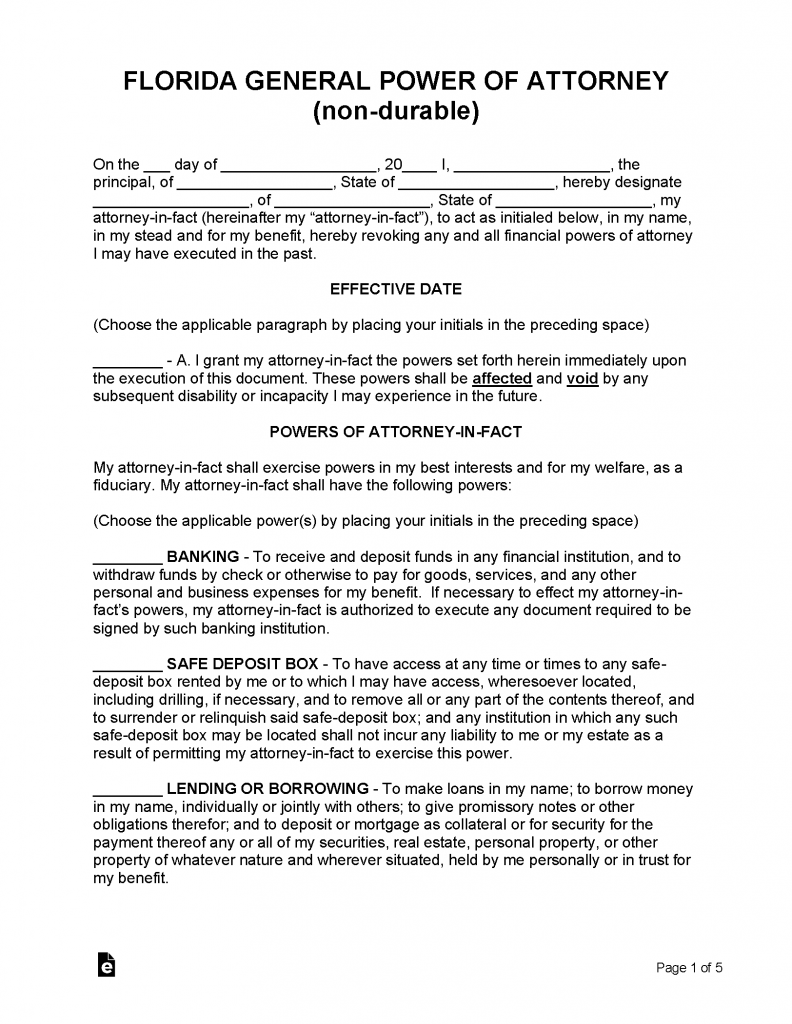

Unlike many other states, Florida does not allow a springing power of attorney and does not provide an authorized form for a financial power of attorney. The lack of an approved form makes obtaining a power of attorney in Florida more difficult than in many other states. Florida law says very little about the content of a power of attorney.

How to get power of attorney in Florida?

- Right to information. Your parent doesn't have to tell you whom he or she chose as the agent. ...

- Access to the parent. An agent under a financial power of attorney should not have the right to bar a sibling from seeing their parent. ...

- Revoking a power of attorney. ...

- Removing an agent under power of attorney. ...

- The power of attorney ends at death. ...

How does a Florida durable power of attorney work?

- The principal dies.

- The principal revokes the power of attorney.

- A court determines that the principal is totally or partially incapacitated and does not specifically provide that the power of attorney is to remain in force.

- The purpose of the power of attorney is completed.

- The term of the power of attorney expires.

Why would someone do a specific or limited power of attorney?

A Limited Power of Attorney can give someone the authority to sign a legal document for a specific transaction. For instance, a limited power of attorney may be used to enable a real estate agent to handle a closing on behalf of a buyer or seller who is far away.

How do I get a limited power of attorney in Florida?

In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

What are the types of power of attorney in Florida?

Four Types of Power of Attorney in Florida and What They MeanDurable Power of Attorney. This type of power of attorney is the most common. ... Special or Limited Power of Attorney. ... Healthcare or Medical Power of Attorney. ... Florida Real Estate Power of Attorney.

Is there any limitation on power of attorney?

Limitation of power of attorney At any moment, the POA cannot delegate authority to another Agent. After the Principal's death, the POA is no longer able to make legal or financial decisions, and the Executor of the Estate assumes control.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How Long Does power of attorney last in Florida?

But as a general rule, a durable power of attorney does not have a fixed expiration date. Of course, as the principal, you are free to set an expiration date if that suits your particular needs. More commonly, if you want to terminate an agent's authority under a power of attorney, you are free to do so at any time.

Can two siblings have power of attorney?

Generally speaking, while it is good to include your spouse or siblings, consider the fact that they may not be around or have the inclination to sort out your wishes when the time comes. If possible, include two attorneys as standard and a third as a back-up should one of the attorneys not be able to act.

How much does a power of attorney cost in Florida?

$250 to $500How much does a power of attorney cost in Florida? Though a power of attorney can be drafted online and later notarized for less than $100, it is best to consult a lawyer when completing such an important legal document. That being said, the average legal fees range from $250 to $500.

Can a property be sold with power of attorney?

A person given power of attorney over a property cannot sell the asset unless there is a specific provision giving him the power, the Supreme Court has held in a judgment.

Does next of kin override power of attorney?

No. If you have made a Will, your executor(s) will be responsible for arranging your affairs according to your wishes. Your executor may appoint another person to act on their behalf.

Can power of attorney holder sell property to himself?

when a registered PoA authorizes the agent to make the transaction, he can certainly do so however, it does require the free will of the original owner. If the Power of Attorney holder is following all the legal procedures then he cannot be barred by law from selling the property to himself.

What is a limited power of attorney?

The limited power of attorney is used to allow the attorney-in-fact/agent to handle specific matters when the principal is unavailable or unable to do so.

Who can give notice of revoked power of attorney?

The principal may give notice of the revocation to an agent who has accepted authority under the revoked power of attorney. Therefore, if the principal wishes to revoke the power of attorney he/she should send a written notice of revocation to the acting attorney-in-fact/agent and to all third parties relying on the authority ...

How to revoke a power of attorney?

You may revoke the power of attorney by executing another writing revoking the power of attorney or by creating a new power of attorney and expressing that the new power of attorney will revoke any previous authority given.

What happens to a durable power of attorney?

Durable Power of Attorney: the durable power of attorneys allows the authority you give to your agent to stay effective even after your incapacity. The durable power of attorney can be made general or specific. in order to create a durable power of attorney the document must state ...

What powers does a Florida attorney have?

The authority you give to your agent may be general in nature or very specific. In Florida you can create the following powers of attorneys: General Power of Attorney : the general power of attorney allows you to give your agent broad authority. Your agent will be able to do financial transactions like banking, buying or selling real estate, ...

What is a limited power of attorney?

Limited or Special Power of Attorney: the limited power of attorney is used when you need to give your agent authority only for a specified purpose and for a limited duration.

How many witnesses are needed to sign a power of attorney in Florida?

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary.

What is a POA in Florida?

A Florida power of attorney (“POA”) allows you (the “principal”) to designate an “agent” to act on your behalf. The power of attorney in Florida is primarily used for financial transactions. However, in Florida you can also allow the agent to make health care decisions for you, the Designation of Health Care Surrogate is a document better suited ...

How much does it cost to get a guardian?

From my experience, guardianship proceedings to appoint a guardian and declare someone incapacitated can cost in the low end at $3,500, but I seen them run as high as $7,500 depending on the complexity of the case.

What is a surrogate in health care?

A Health Care Surrogate is a person (agent) authorized via a Designation of Health Care Surrogate form to make medical decisions on behalf of a third-party (principal), in case of physical or mental incapacity to make sound decisions.

What is a power of attorney in Florida?

In many states across the nation, you can find what is called a healthcare power of attorney or medical power of attorney. In Florida, this document has a different name, called a Designation of Health Care Surrogate (Florida Statutes, Chapter 765).

What is the definition of incapacity in Florida?

We must notice that the terms incapacity and incapacitated are defined by Florida law, which describes it as: “The inability of an individual to take those actions necessary to obtain, administer, and dispose of real and personal property, intangible property, business property, benefits, and income.”

What is a general power of attorney?

A general power of attorney will give the agent plenty of authority to conduct all types of financial transactions on behalf of the principal. On the other hand, a limited (or special) power of attorney will limit the authority granted to the agent to perform a certain number of transactions or limit the period of financial governance.

How old do you have to be to be a trust agent in Florida?

As provided by the state’s lay, an agent must be either a person that is over 18 years of age or a financial institution with specific requirements, including “trust powers,” a place of business in Florida and is authorized to conduct trust business in the state. In any case, the agent should be a trustworthy person that will act in ...

Who is Romy Jurado?

Business & Immigration Lawyer to Entrepreneurs, Start-ups, Small Business and Foreign Investors. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. And today, she is living proof that dreams really do come true. As a founder of Jurado & Farshchian, P.L., a reputable business, real estate, and immigration law firm, Romy’s practice is centered primarily around domestic and international business transactions – with a strong emphasis on corporate formation, stock and asset sales, contract drafting, and business immigration. In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. She is fluent in two languages (English and Spanish) and is the proud author of Starting a Business in the US as a Foreigner, an online entrepreneurial guide. Call for a Consultation 305-921-0440.

Where did Romy get her law degree?

In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. She is fluent in two languages (English and Spanish) and is the proud author of Starting a Business in the US as a Foreigner, an online entrepreneurial guide. Call for a Consultation 305-921-0440.

Why is it important to consult a qualified attorney when establishing a power of attorney?

It is important to consult a qualified attorney when establishing a power of attorney to ensure that it satisfies Florida’s new power of attorney law. Estate Planning for Unmarried Partners.

What is a power of attorney in Florida?

As an introduction, a power of attorney is a document in which a person (the “principal”) designates another person to act on the principal’s behalf (the “agent”). Florida law gives the option to create a “durable” power of attorney, which remains effective even if the principal becomes incapacitated—reducing the potential need for ...

What is the new law that allows an agent to do everything the grantor could do?

The new law allows an agent to perform only those acts expressly granted in the document.

What does an agent need to know?

An agent is a fiduciary of the principal, who must act in good faith, preserve the principal’s estate plan, and may not delegate authority to a third party. Under the new law, multiple agents are presumed to be capable of acting independently.

What is the new law on banking?

If a document grants the agent authority to conduct “banking” or “investment” transactions, the new law lists certain banking or investment functions that an agent may perform without specific enumeration in the document. 5. “Qualified” agents may be compensated.

Does a copy of a power of attorney have the same effect as an original?

The new law provides that photocopies and electronically transmitted copies of an original power of attorney have the same effect as an original. However, the new law does not eliminate the necessity of recording original powers of attorney in a county’s official records in order to use the power of attorney to convey real property. 9.

Do you need a notary to sign a power of attorney?

7. All new powers of attorney will require two witnesses and a notary. Under the prior law, only durable powers of attorney had to be signed before two witnesses and a notary. Non-durable powers—i.e. those that terminate upon a person’s incapacity—did not require such formalities unless being used to convey real property. Under the new law, durable and non-durable powers of attorney must be signed by the principal in the presence of two witnesses and acknowledged before a notary.

What Is a Power of Attorney?

A power of attorney is a legal document that designates an individual, or “agent,” to act on behalf of another individual, the “principal.”

A Durable Power of Attorney

A durable power of attorney (DPOA) allows the agent to enact broad authority for the principal. This document allows the person to conduct all financial transactions for the individual, including their banking, signing checks, filing taxes, and selling their property, along with other scenarios that may arise.

Limited Power of Attorney

In contrast, a limited power of attorney gives the agent power for a specific purpose and timetable. For example, when some is selling or purchasing real estate and they are not available to sign the contract or the closing documents, they might give the ability to do that to someone they trust.

Florida Power of Attorney Requirements

Florida law requires individuals to meet several criteria before they can become a POA agent.

When to Execute a Durable Power of Attorney

Knowing when a loved one should execute a durable power of attorney can be challenging. In many cases, individuals may not want to admit that they need assistance making financial and legal decisions.

What is a durable power of attorney?

Durable power of attorney — Durable powers of attorney are used for estate planning purposes for assets that are outside of a trust. This power of attorney allows your agent to act on your behalf even after you become incapacitated. For example, if you fall into a coma, your agent can still make financial decisions on your behalf and handle your bills and other financial issues. The power can be general or specific in scope and certain powers such as the right to do Medicaid planning must be itemized and initialed in order to be valid.

What is a power of attorney in Florida?

Powers of attorney in Florida are primarily used for financial transactions for assets held outside of a trust. While a power of attorney can grant an agent the ability to make decisions regarding your health care, Florida offers a Designation of Health Care Surrogate document that is typically more suited for this purpose.

How old do you have to be to be an agent in Florida?

Under Florida law, an agent can be any person over 18 or a financial institution that does business in the state and is authorized to conduct trust business here. To be valid, the power of attorney (must be signed by the creator (known as the principal) and two witnesses, at the same time and in the presence of a notary public. (The notary can serve as one of the witnesses.)

Can a Florida power of attorney be used as an agent?

There may eventually be situations, such as your own incapacity or some other circumstance, in which you would like a trusted person to have the ability to make decisions or take actions on your behalf. A Florida power of attorney allows you to create this arrangement by designating someone as your agent for general or specific purposes.

Popular Posts:

- 1. my contractor is ripping me off what kind of attorney do i neeed

- 2. how do i call the fee for an attorney

- 3. how to lodge a price gouging complaint with florida attorney genera

- 4. when does an attorney have to stop representing client

- 5. trust when can the trustee sign a power of attorney

- 6. social security disability attorney representative how to set up

- 7. how long does it take to get a limited power of attorney to buy a car?

- 8. where to get durable power of attorney california

- 9. how do i get power of attorney for my elderly parent?

- 10. how to contact my district attorney