What is interest on Lawyer Trust Accounts (IOLTA)?

Interest on Lawyer Trust Accounts (IOLTA) is a method of raising money for charitable purposes, primarily the provision of civil legal services to indigent persons, through the use of interest earned on certain lawyer trust accounts.

What is IOLTA?

What is IOLTA? Is IOLTA available in my state? Try Bench. When law firms hold on to their clients’ money, they’re required to keep it in a separate trust account called an “IOLTA”—short for “Interest on Lawyer Trust Accounts.” Lawyer trust accounts are tricky—they have very specific rules around what you can and can’t do with them.

Can an IOLTA account be treated as a bank account?

Most banks treat IOLTA accounts as Negotiable Order of Withdrawal ("NOW") or other Business Interest Checking accounts. Banking regulations hold that attorneys can set up the accounts as NOW accounts even though the attorney-depositor may be a for-profit corporation, because the interest goes to a not-for-profit charitable entity.

Can a lawyer withdraw fees from an IOLTA?

Lawyers may not under any circumstances withdraw fees from an IOLTA account before earning those fees. This is sometimes referred to as “borrowing,” and attorneys do it for many reasons: because they have short-term cash flow problems due to unexpected expenses, or simply because they’ve told themselves they’ll replace the funds right away.

Who owns the funds in an IOLTA account?

IOLTA accounts are trust accounts managed by lawyers. It holds money that was received from the client for the purposes of funding their matter. Mismanagement of an IOLTA account is one of the most common ethical violations committed by lawyers.

How does Iola account work?

An IOLTA account is a type of trust account that can collect the interest, then transfers the interest collected to the state bar, usually for charitable purposes, primarily the provision of civil legal services for poor people (such as landlord/tenant issues, custody disputes, and advocacy for people with disabilities ...

Are IOLTA accounts safe?

The firm merges the money and keeps it safe in the IOLTA account. The account is accessible by the client as well as the law firm. IOLTA is an interest bearing trust account. This means the amount kept in an IOLTA account generates money in the form of interest.

Why do attorneys keep two separate types of bank accounts?

Separate Client Funds Account The attorney trust account ensures the separation and security of client funds and helps law firms avoid accidently comingling client funds with law firm funds.

Can you withdraw cash from IOLTA account?

Withdrawing Funds from an IOLTA Account to Pay Yourself You do not have to remove the earned money on a daily basis. However, you will want to keep accurate records (and notes) of your time spent and work performed. Then, at the end of your chosen billing period, you may withdraw the funds.

Who gets the interest on an IOLTA account?

If there is a large sum of money involved or held for a long time, an attorney can hold the client's funds in an individual account, known as a Client Trust Account, and the interest earned will go to the client.

What is it called when lawyers take clients money just to keep it?

With a contingency fee agreement, your attorney will only get paid when you recover compensation —by settlement or court judgment—in your personal injury case. By Curtis Lee. In most kinds of law practice, attorneys receive compensation for the legal services they provide.

What are the three types of IOLTA participation?

Status of IOLTA ProgramsMandatory, in which all lawyers in the jurisdiction who maintain client trust accounts must participate.Opt-out, in which all lawyers participate unless they affirmatively choose not to participate.Voluntary, in which lawyers must affirmatively decide to participate.

Can a law firm have more than one IOLTA account?

Most lawyers or law firms will not have more than one IOLTA account because eligible deposits can all be pooled in one IOLTA account. Information for attorneys about opening and maintaining attorney-client trust accounts can be found on the State Bar's website at www.calbar.ca.gov.

Why must an attorney have a trust account?

Why do lawyers use trust accounts? Trust accounts are used by legal practitioners for holding money on behalf of a client, in connection with the provision of the type of legal service the client needs. For example, where funds are received towards the deposit on the purchase of a property.

Do attorneys get interest from trust funds?

There is no legal basis for a law firm or attorney to receive any interest that is derived from any trust account whatsoever. It is a misconception that a law firm or any attorney is legally allowed to keep the interest generated from any trust account.

Do lawyers trust accounts earn interest?

Contrary to a common misconception, Solicitors do not earn any interest on clients funds held in their Trust account. In this state, all interest earned on funds in Solicitors Trust accounts is paid directly to the Law Society of New South Wales.

What is an Iola escrow account?

The New York State Interest on Lawyer Account Fund (“IOLA”) helps low income people in New York State obtain help with civil legal problems affecting their most basic needs, such as food, shelter, jobs and access to health care. The IOLA program is a partnership of lawyers, banks and community organizations.

What is the difference between Iola and IOLTA?

Interest on Lawyers Accounts (IOLA) and Interest on Lawyers Trust Accounts (IOLTA) are checking accounts limited to attorneys and law firms. M&T can reconcile your trust accounts into a single interest-bearing account. Interest earned, minus fees, is then forwarded by M&T to state-controlled IOLA and IOLTA funds.

What is an Iola fund?

In 1983, with the strong support of the New York State Bar Association, the legislature created the New York State Interest on Lawyer Account Fund ("IOLA") as a means to provide additional financial support to civil legal service organizations that had been decimated by federal budget cuts.

What is an Iola check?

An IOLA is a checking account which is limited to use by lawyers and law firms for such attorneys to deposit funds received from their clients' in interest bearing accounts.

What is an IOLTA account?

An IOLTA account is a type of trust account that can collect the interest, then transfers the interest collected to the state bar, usually for charitable purposes, primarily the provision of civil legal services for poor people (such as landlord/tenant issues, custody disputes, and advocacy for people with disabilities). For a clearer definition, it is a method of raising money to fund civil legal services to low-income people through the use of the interest earned on the attorney trust account.

What is an attorney trust account?

An attorney trust account is the second type of trust account, which may or may not be interest-bearing. For most attorneys, it is a non-IOLTA trust account used for an individual client with a large balance held, such as payments for personal injury. If the account accumulates interest, the interest will be transferred to the customer.

Do you have to pay fees to separate operating account?

Whatever it is called, we need to make sure with the bank that the fee cannot be charged to that account. A separate operating account or credit card has to pay all fees so that the customer’s money is never touched.

Can a lawyer withdraw money from a trust account?

Nowadays, all 50 states and the District of Columbia have IOLTA programs. However, only 44 states require lawyers to participate. In states with mandatory IOLTA participants, the lawyer must place client funds into a trust account and cannot withdraw the money until they have earned the fee.

What is an IOLTA account?

IOLTA is an acronym for Interest on Lawyer Trust Accounts. It simply describes a type of trust account designed to keep client funds in trust. Holding client funds in trust is a requirement of the professional conduct rules, although in some states it is voluntary.

When you should use an IOLTA account?

According to the Rule of Professional Conduct 1.5, lawyers much hold client funds in one of two types of client trust accounts – the first is an IOLTA account and the second is a separate non-IOLTA trust account created for the benefit of an individual client. In both cases, the client trust account must be an interest-bearing account.

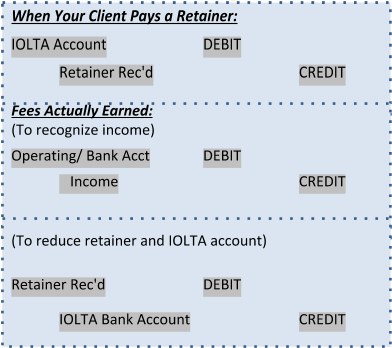

IOLTA account process

Merchant processing is very similar whether you are a medical practice, a dry cleaner, a restaurant, a B2B, or a mail-order company. Law practices are quite different in one regard – there is an Operating account and a Trust account. So, at law firms, the process would look something like this:

Bottom Line

Let’s summarize everything above, so you have a clear image of what the basic compliance requirements are.

What is an IOLTA account?

IOLTAs are special accounts that earn interest for the IOLTA program, which uses the money to provide legal services to people who otherwise couldn’t afford an attorney. The funds are also used to improve the legal system in each state. Most of the United States have a requirement that every attorney maintain an IOLTA for the small retainers. These programs are strict about how the funds are used, how they should be recorded, and how an attorney should handle the account.

How is IOLTA used?

Once the interest reaches the IOLTA program, it is used in one of two ways: either providing legal services for the indigent, or going to improve the legal system in the state. Civil services can greatly benefit people going through hard financial times, and will help them improve their lives without the burden of a large legal debt.

What happens if an attorney does not record IOLTA?

If her bookkeeper does not record the deposits and withdrawals properly, the attorney will face severe consequences, possibly even losing her license.

Can an attorney use IOLTA money for business?

She now has freedom to use the money for bills, expenses, or payroll. Attorneys should never, under any circumstances, use IOLTA money for business expenses. IOLTAs should not even include an ATM card with the account, to prevent such mistakes.

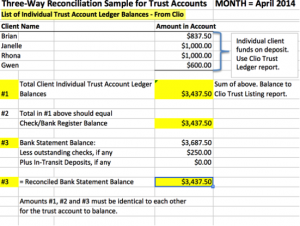

Can IOLTA be recorded in the books?

The next step, transferring interest to the IOLTA program, is done by the bank, but it can still be recorded in the books. Every month, the IOLTA must be reconciled using bank statements and the IOLTA records. It would be wise to have a bookkeeper on board with a good understanding of the methods needed to keep everything in order.

Does IOLTA pay bank fees?

Attorneys and bookkeepers must be sure that the IOLTA does not pay bank fees directly from the funds in the account. The bank fees must be paid by the attorney, from a normal checking account. This is a common problem when operating an IOLTA, but can be arranged correctly with proper communication between the attorney and the bank.

What Is IOLTA?

IOLTA – Interest on Lawyers' Trust Accounts – is a method of raising money for charitable purposes, primarily the provision of civil legal services to indigent persons. The establishment of IOLTA in the United States followed changes to federal banking laws passed by Congress in 1980, which allowed some checking accounts to bear interest. IOLTA programs currently operate in 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

What is IOLTA funding?

IOLTA is among the most significant sources of funding for programs that provide civil legal services to the poor, with close to 90 percent of grants awarded by IOLTA programs ($230.4 million in 2008) supporting legal aid offices and pro bono programs. In 2009, IOLTA grants dropped significantly in several states due to a decline in interest rates.

How many states have IOLTA?

IOLTA programs currently operate in 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

Which court did the ABA file a brief in support of the IOLTA?

Also at the ABA Commission on IOLTA’s request, the ABA filed two amicus curiae briefs in support of the Washington state IOLTA program, one before the Ninth Circuit Court of Appeals and one before the U.S. Supreme Court, as well as one in support of the Massachusetts IOLTA program before the First Circuit Court of Appeals.

What does a lawyer do with money?

Lawyers often handle money that belongs to clients, such as settlement checks, fees advanced for services not yet performed, or money to pay various court fees. Sometimes the amount of money that an attorney handles for a single client is quite large. In such cases, lawyers deposit the funds into trust accounts, ...

Can an attorney set up a bank account as a NOW account?

Banking regulations hold that attorneys can set up the accounts as NOW accounts even though the attorney-depositor may be a for-profit corporation, because the interest goes to a not-for-profit charitable entity.

What is an IOLTA account?

Interest on Lawyer Trust Accounts ( IOLTA) is a method of raising money for charitable purposes, primarily the provision of civil legal services to indigent persons, through the use of interest earned on certain lawyer trust accounts. The establishment of IOLTA in the United States followed changes to federal banking laws passed by Congress in 1980 ...

What is IOLTA program?

IOLTA programs were first established in Australia and Canada in the late 1960s to generate funds for legal services to the poor and other charitable purposes. In the U.S., IOLTA programs are state-specific, and operate under their own rules and regulations. Most of the U.S. IOLTA programs have been created by Court Rule, while several have been established through state legislatures. In many states the IOLTA program is administered by the charitable arm of the state bar association, whereas some states have created other entities to operate the IOLTA program. IOLTA revenue has become a major source of funding for civil legal services in the United States. It is also, however, an unpredictable revenue stream because IOLTA income is entirely dependent on the current interest rate environment and economic conditions.

What is IOLTA exempt from?

Explicitly, IOLTA applies only to funds that are " nominal in amount or held for a short period of time". So larger amounts of money held for single clients are exempt from the IOLTA program. That means, typically, that client funds eligible for IOLTA involve small amounts of money held for a long time, or significant amounts ...

Why is IOLTA not taking money?

Legal Foundation of Washington, reasoning that there is no "taking" of client money, because the money being held on behalf of the individual client would not have generated any net interest for the client.

Why can't a lawyer earn interest on a client's account?

In addition, the lawyer could not earn interest on the account because it is unethical for attorneys to derive any financial benefit from funds that belong to their clients. With the inception of IOLTA, lawyers who handle nominal or short-term client funds that cannot earn net interest for the client place these funds in pooled, ...

Who administers the IOLTA program?

In many states the IOLTA program is administered by the charitable arm of the state bar association, whereas some states have created other entities to operate the IOLTA program.

Is IOLTA a revenue source?

IOLTA revenue has become a major source of funding for civil legal services in the United States. It is also, however, an unpredictable revenue stream because IOLTA income is entirely dependent on the current interest rate environment and economic conditions.

What is IOLTA account?

Any lawyer who handles client funds that are too small in amount or held too briefly to earn interest for the client must participate in the Interest on Lawyers’ Trust Accounts (IOLTA) program. IOLTA accounts can only be kept at approved financial institutions.

What is IOLTA in California?

The interest earned from pooled IOLTA benefits nearly 100 nonprofit legal service organizations throughout California. IOLTA increases access to justice for individuals and families living in poverty and improves our justice system. State Bar Rule 2.2 requires a licensee to report to the State Bar and verify their IOLTA account information with the State Bar at least annually through their My State Bar Profile. Find the rules for managing a client trust account on the State Bar website.

What is the name of the account that an attorney holds money in?

If there is a large sum of money involved or held for a long time, an attorney can hold the client's funds in an individual account, known as a Client Trust Account , and the interest earned will go to the client.

What is the purpose of the Iola fund?

In 1983, with the strong support of the New York State Bar Association, the legislature created the New York State Interest on Lawyer Account Fund ("IOLA") as a means to provide additional financial support to civil legal service organizations that had been decimated by federal budget cuts.

Why are trust accounts pooled?

Without taxing the public, and at no cost to lawyers or their clients, interest from lawyer trust accounts is pooled to provide civil legal aid to the poor and support improvements to the justice system.

Popular Posts:

- 1. what if my attorney lies to withdrawl from my case

- 2. how to write an attorney wanted ad

- 3. power of attorney effective immediately or when i am no longer able

- 4. how to write a character letter to the attorney

- 5. how to remove your name from the mormon church using attorney

- 6. who is the magoffin county attorney

- 7. how to make business as an attorney in a big law firm

- 8. who can have power of attorney for a real estate closing

- 9. hire traffic attorney who did not lift warranty

- 10. which cases would an attorney cite unreasonable search and seizure illinois