Financial power of attorney (POA

Poa

Poa is a genus of about 500 species of grasses, native to the temperate regions of both hemispheres. Common names include meadow-grass, bluegrass, tussock, and speargrass. Poa is Greek for "fodder". Poa are members of the subfamily Pooideae of the family Poaceae.

What are the duties of the financial power of attorney?

What do I need to do next?

- Don’t panic. Do start reading. ...

- Figure out what you are in charge of. Make a list of the principal’s assets and liabilities. ...

- Protect the principal’s assets. Make sure the principal’s home is secure. ...

- Pay bills as necessary. ...

- Pay the taxes. ...

- Estate planning. ...

- Keep excellent records. ...

- Act in the principal’s best interest. ...

Why do I need a financial power of attorney?

Three Main Roles of a POA (Power of Attorney)

- Making decisions on the behalf of someone who has lost their mental capacity

- Handling legal and financial matters on behalf of the principal

- Making medical decision on behalf of the principal

Who needs a financial power of attorney?

Powers of attorney are very important, especially when an individual becomes incapacitated. If an individual becomes incapacitated and does not have a financial power of attorney, then a family member will need to file an application to be appointed as the loved one's guardian at the probate court in the county where the loved one was residing.

What is a general financial power of attorney?

A general (financial) power of attorney is usually used by people who wish to have someone manage their financial affairs on their behalf. These could be businessmen who are caught up with too much work or retirees who wish to enjoy retirement on other things.

What responsibility comes with power of attorney?

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

What does it mean to be someone's financial POA?

A financial power of attorney is a legal document that lets you appoint someone to manage your finances and property for you. These tasks could include paying bills, making bank deposits, collecting your insurance benefits, and more.

What are the disadvantages of being power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who can override a power of attorney?

principalA power of attorney (POA) is a legal contract that gives a person (agent) the ability to act on behalf of someone (principal) and make decisions for them. Short answer: The principal who is still of sound mind can always override a power of attorney.

Is a power of attorney a good idea?

Indeed a power of attorney is vital for anyone – regardless of age – who has money and assets to protect and/or who wants someone to act in their best interest in terms of healthcare choices should they be unable to make decisions for themselves.

What are the two types of power of attorney?

There are different types of power of attorney and you can set up more than one.Ordinary power of attorney.Lasting power of attorney (LPA)Enduring power of attorney (EPA)

When can I use power of attorney?

You can give someone power of attorney to deal with all your property and financial affairs or only certain things, for example, to operate a bank account, to buy and sell property or change investments.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

What is the authority of a POA?

The authority outlined in the POA can be fairly broad or, in some cases, restrictive, limiting the agent to very specific duties. Agents named in POAs are legally able to make decisions about the principal's finances, property, and/or medical health.

What is POA in real estate?

This POA gives the agent the power to manage the financial life of the principal when that person is unable to do so . The agent can legally manage the principal's finances and property, make all financial decisions, and conduct all financial transactions that are within the scope of the agreement. The individual granted POA is limited to ...

What is a POA?

A financial power of attorney (POA) is a legal document that grants a trusted agent the authority to act on behalf of the principal-agent in financial matters. The former is also referred to as the attorney-in-fact while the principal-agent is the person who grants the authority. This kind of POA is also referred to as a general power of attorney.

What is a limited POA?

A limited POA gives the agent very limited power and normally gives a specific end date for the agreement. For example, someone may appoint a family member or friend as a limited POA if they are not available to sign important paperwork themselves at a specific time. In other cases, this POA may give the agent the ability to make cash withdrawals from the bank for the principal. A limited POA is also a type of nondurable power of attorney.

When does a POA go into effect?

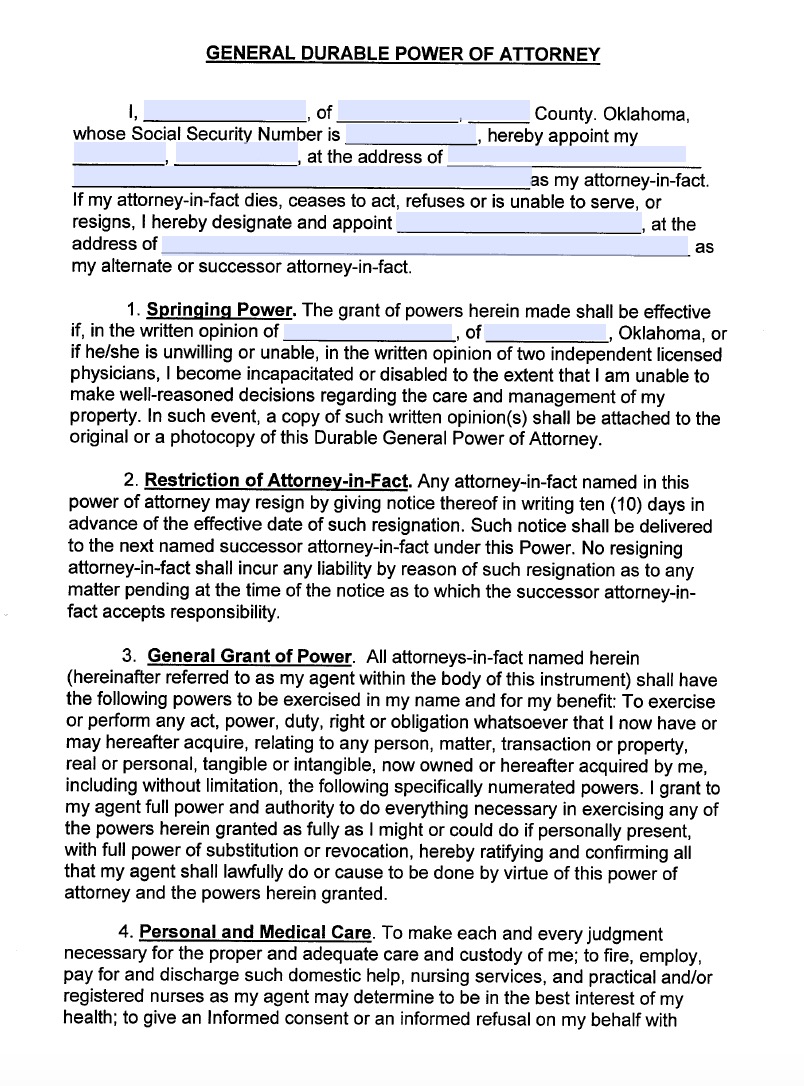

A springing POA only goes into effect once the principal becomes incapacitated and cannot make decisions on their own. In order to be effective, the document should outline the exact definition of incapacity so there is no confusion as to when the agent can begin acting on the principal's behalf.

What is the role of an agent in a court of law?

The agent is legally obligated to make decisions consistent with the wishes of the principal but has full authority to make autonomous decisions until that authority is challenged and/or revoked in a court of law.

When is a POA issued?

Most POAs are issued when the principal is ill, disabled, or is physically not present to sign important paperwork. A financial power of attorney document is also referred to as a general power of attorney or a power of attorney of property. This POA gives the agent the power to manage the financial life of the principal when ...

Financial Power of Attorney Explained in Less Than 5 Minutes

Jessica Walrack is a personal finance writer who has written hundreds of articles about loans, insurance, banking, mortgages, credit cards, budgeting, and general personal finance over the past five years. Her work has appeared on The Simple Dollar, Bankrate, and Supermoney, among other publications.

Definition and Example of Financial Power of Attorney

When an individual puts a financial power of attorney in place, they are permitting someone else to act on their behalf in financial matters. The person giving the power is called the “principal” while the person receiving the power is called the “agent” or “attorney-in-fact.”

How Financial Power of Attorney Works

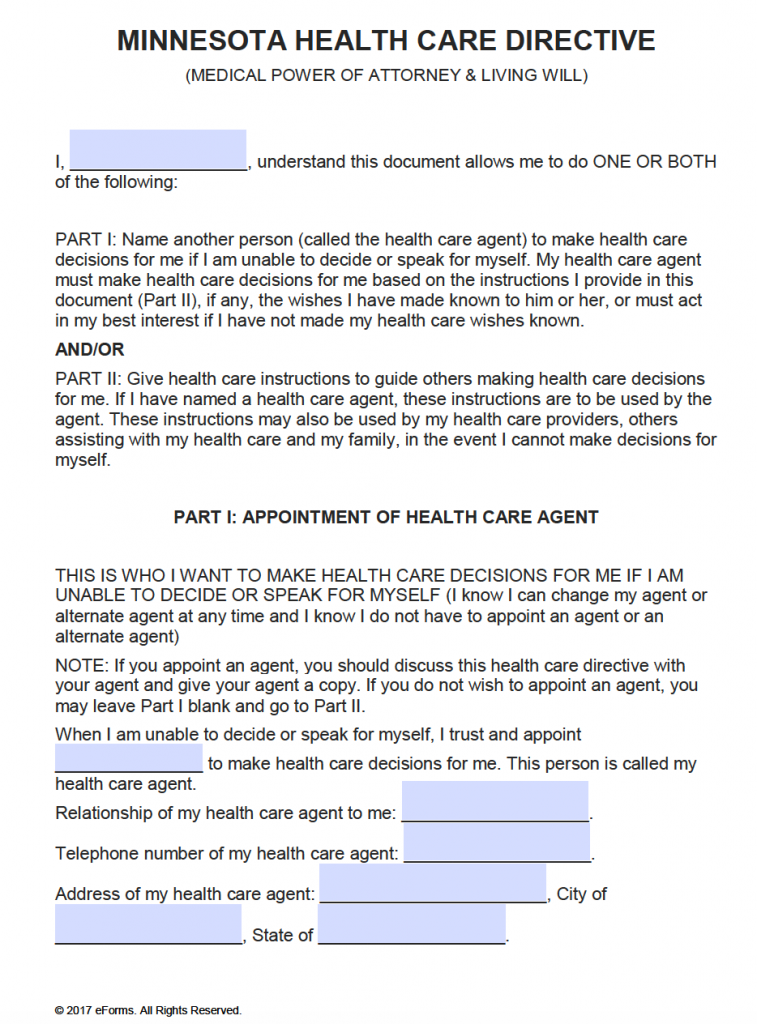

If a person is in a situation where they want to assign financial power of attorney to someone they trust, they will need to find the power of attorney form that’s required by their state.

General Power of Attorney vs. Limited Power of Attorney

If you are assigning financial power of attorney to someone, you can decide how much authority they will have over your affairs. General power of attorney gives the broadest powers, where the agent will be able to pretty much do anything you can do.

What is a financial power of attorney?

For instance: A service member is deployed overseas: A financial POA can manage a service member’s property and pay their bills while they’re away.

What is a power of attorney responsible for?

But while someone with power of attorney is responsible for major decisions on your behalf — like where your belongings go after you die — there are some things they aren’t responsible for, including much of your debt.

What is a power of attorney?

A power of attorney isn’t a person, but rather a document that gives someone the power to act on your behalf in case you die or become incapacitated. You can name someone to make decisions for you when you can’t.

Can you have a POA with someone you have never met?

Appoint someone you trust: A POA shouldn’t be with someone you’ve never met. You should create a power of attorney with a lawyer, nurse, friend or relative with mutual trust. If you’ve only known someone a short time, you might not be working with someone who has your best interests in mind.

Who is responsible for paying off debts?

The executor is responsible for using estate assets to pay off debts, says attorney Chas Rampenthal, attorney assist segment leader at LegalZoom. “There’s an order of debt priority that’s generally the same in most jurisdictions,” he says.

Do spouses share debt?

In these states, spouses share equal responsibility for debts. “Under these state guidelines, spouse property is viewed as communal — both assets and debts — so you may be on the hook for debt after a loved one dies,” says Adem Selita, CEO and co-founder of The Debt Relief Company in New York City.

Is a POA fraud real?

Power of attorney fraud is real: If you don’t do your homework, your potential agent could create a forged POA document or give themselves more power than you’d like to hand over. Power of attorney abuse means that they can have access to your bank and other financial assets, possibly depleting them.

What is a nondurable power of attorney?

A nondurable financial power of attorney could be used if you want someone to handle a financial decision when you’re not physically able , like if you are leaving the country, but need someone to sign some papers to complete a business transaction while you are away. If you get into an accident that leaves you in a coma, the power of attorney would end and the agent could no longer make decisions on your behalf. Some states allow for springing POA , which take effect only after you become incapacitated.

Can an attorney in fact transfer property into a trust?

An attorney-in-fact can transfer property into a living trust that you’ve already created, but their powers are limited beyond that. A trust is a separate entity that holds assets on your behalf. It has its own set of rules about who receives the assets and how they are used. You cannot grant your agent the ability to change its terms or use the money in the trust through a financial power of attorney. The trustee is the only person who can manage the trust — this strict measure regarding trust property is one reason why a trust can be a useful tool for managing your assets.

Power of Attorney: A Brief Overview

The two primary types of power of attorney are financial power of attorney and medical power of attorney. While the financial power of attorney’s role concerns legal and financial affairs, the medical power of attorney handles health and medical decisions. For the purposes of this article, we’ll focus on financial power of attorney.

Eye-Opening Life Considerations for a Power of Attorney

Becoming a power of attorney sheds light on the many responsibilities someone may need to take on for you one day. If you haven’t already, consider who you may want to name as your own power of attorney in case you become ill or incapacitated in the future.

Power of Attorney Limitations

There are specific limitations for a power of attorney; you aren’t all-powerful even when you’re granted that role. Power of attorney is useful for making sure your loved ones are protected, but there are certain things you don’t have the authority to do. For example, you can’t:

Need More Information?

If you want to know more about your role as a power of attorney, take a look at 24 Hours as Power of Attorney Holder. This article will take you through what a day in your life might look like, now that you’ve been appointed as power of attorney. Click here to read more.

Duties and Responsibilities

The Power of Attorney Act specifies exactly the duties that an attorney is agreeing to when signing the agreement. According to s.19, the underlying principles and philosophies an attorney must adhere to are to:

Rights and Powers

While the attorney is able to make any financial or legal decisions that arise (barring restrictions in the agreement), there are some cases where the attorney can act proactively or completely at their own discretion. An example could be electing to give gifts or loans on the person’s behalf.

Popular Posts:

- 1. divorce attorney for military man whose spouse is trying to get it all

- 2. what is attorney fee

- 3. why would u higher an attorney for bebeficiary of ret fund

- 4. driving while license suspended 1st degree what to do with out attorney

- 5. who won mchenry county states attorney

- 6. court costs attorney fees when spouse does not comply with divorce decree

- 7. how to.request attorney for unemployment pa

- 8. what does attorney-in -fact mean

- 9. what can you ask a witness about their attorney-client relationship

- 10. what does an attorney require to file bankruptcy