Use Form ET-14, Estate Tax Power of Attorney , when you (the executor) want to give one or more individuals the authority to obligate, bind, or appear on your behalf before the New York State Department of Taxation and Finance with respect to estate tax matters.

Does your estate plan need a power of attorney?

A power of attorney is the single most important estate document that you can sign. In fact, I like to think it's a gift you can give to your family and loved ones. Something that will make their …

What is a power of attorney?

The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death ( Refer to …

What is estate tax?

Mar 02, 2022 · About Form 2848, Power of Attorney and Declaration of Representative. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize …

When does a power of attorney expire?

Apr 09, 2022 · Power of attorneyis a legal document that gives an individual the authority to make decisions on behalf of someone else, often when the latter person has become …

Who files an estate tax return?

What assets are included in estate tax?

What is a final estate tax return?

What is an ET 85?

How can I avoid estate tax?

- Give gifts to family.

- Set up an irrevocable life insurance trust.

- Make charitable donations.

- Establish a family limited partnership.

- Fund a qualified personal residence trust.

How is estate tax calculated?

Do beneficiaries pay taxes on estate distributions?

Who gets a deceased person's tax refund?

What happens when a deceased person gets a tax refund?

Where do I mail form ET 133?

What is a power of attorney?

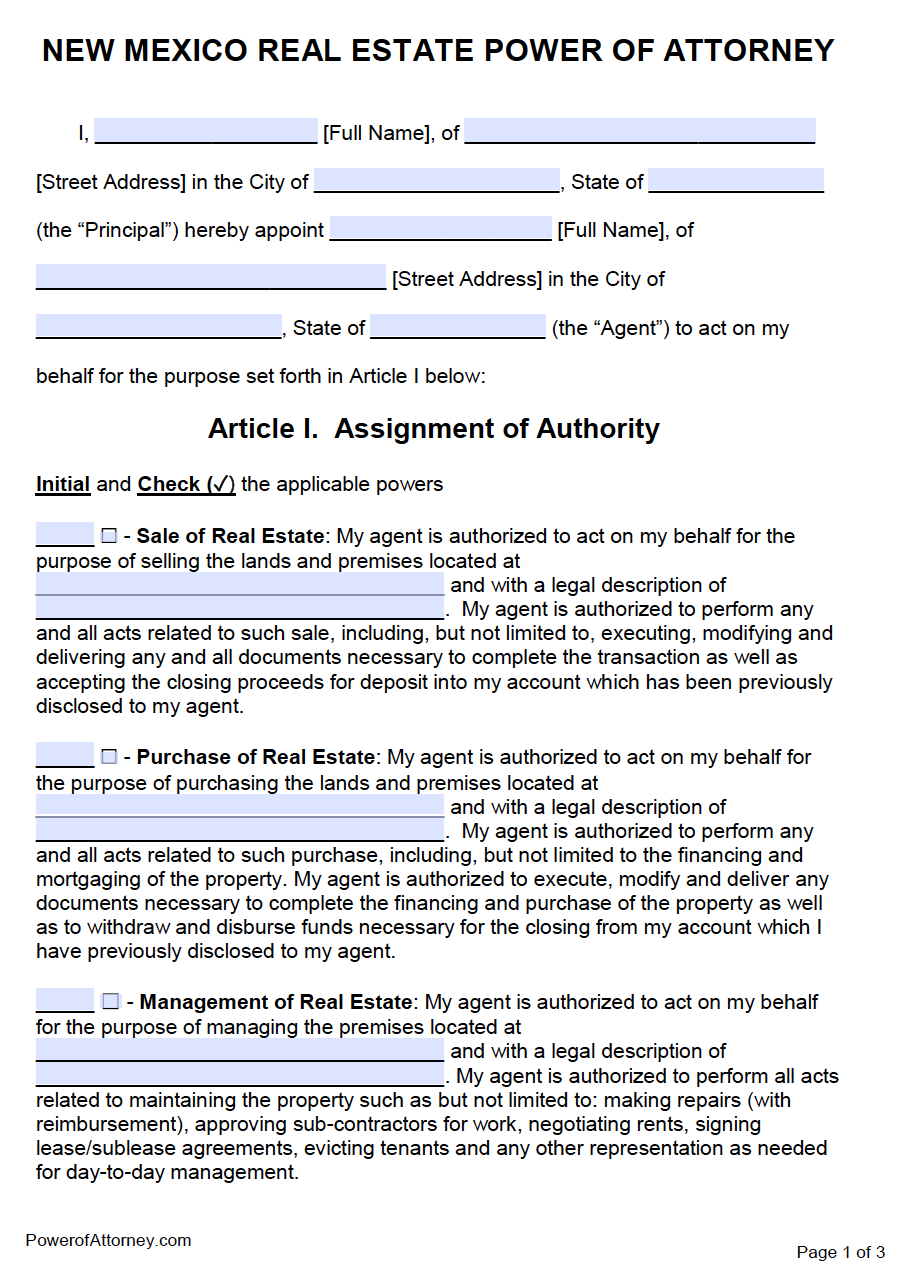

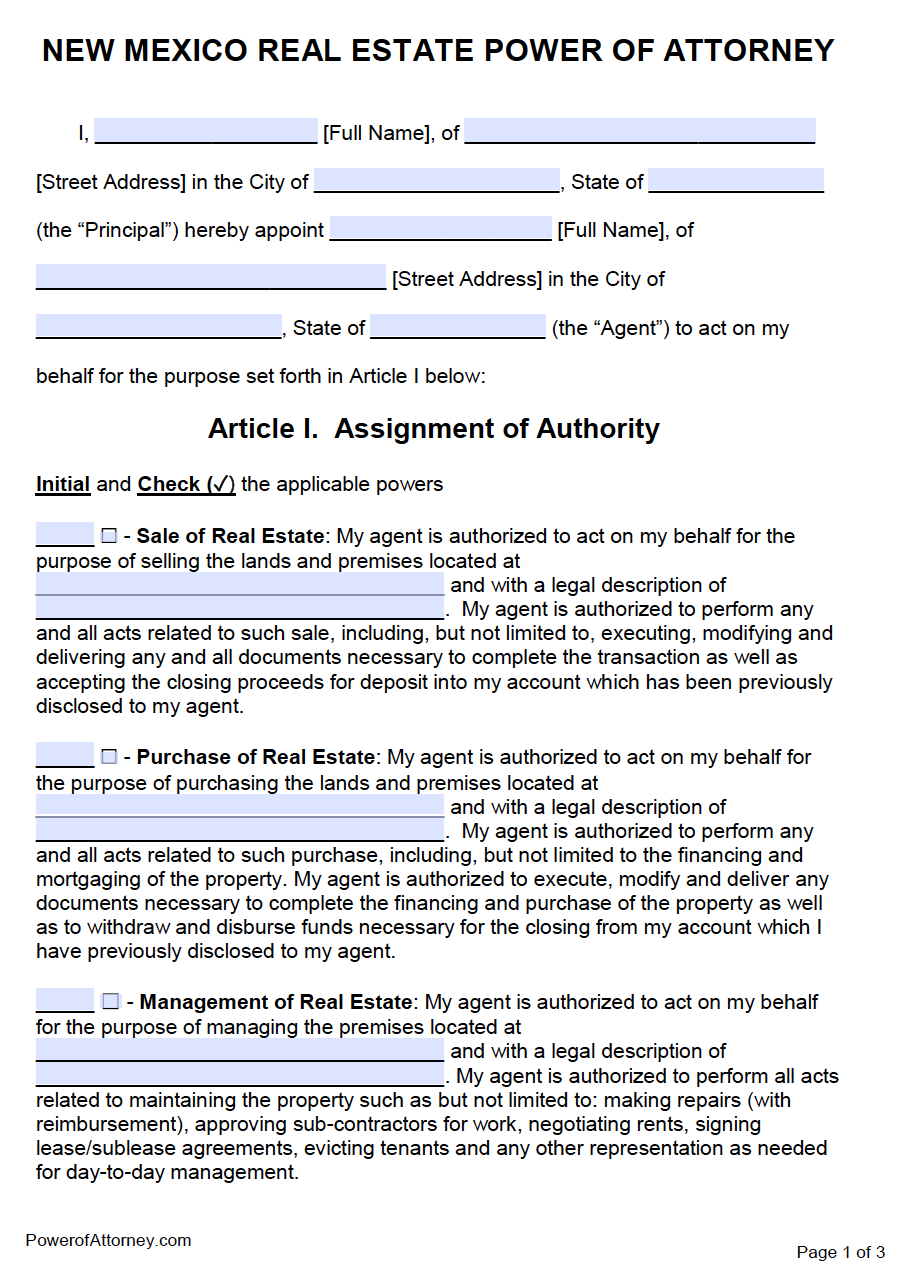

A power of attorney is a complex form and you really have to work with a dedicated professional... somebody who spends their professional time working on estate planning matters. They're pretty much two players in a power of attorney situation. There's the principal, and that's going to be you.

Can I have more than one power of attorney?

The answer is yes . You can have more than one, but then if you have more than one well there's each one has the authority to sign your checks? Do they both have to have a signatory on the account? Again, it's up to you. So there's a lot of flexibility in how you do it. The point is you just have to decide how you want to do it. The states have all different kinds of laws on how you make sure that the power of attorney that you sign is actually valid. How many witnesses do you need? Do you need a notary public? Cause what's the point of doing a power returning and then your agent goes to use it and the bank says, we're sorry you didn't course this T or dot that I, and it's not valid and now mom's already sick, and she had a stroke, and she could no longer sign a power of attorney.

Do you want a power of attorney that is void?

You definitely don't want a power of attorney that is going to become void once you have that stroke. So you got to make sure it's a durable power of attorney. If you talk to your attorney in your professional about this they’ll make sure that you get a power of attorney that's durable.

Can a power of attorney get sick?

And you want to make sure you pick the right person. Well, who do you pick? You don't have to pick a family member.

Can a power of attorney look like someone else's?

No one power of attorney is going to look like somebody else’s. So this is not something you take down to the Senior Center on a Friday night and show your power of attorney to the next person... how come yours is different than mine? The truth is they can all be different, but they can all be valid. So this is a personalized customized document that you have to make sure it's going to work for you. You must make sure you have capacity when you execute it, and you must make sure that the power of attorney is durable. If it's not, then the person on the power of attorney is not going to have any authority to act for you.

What is estate tax?

Estate Tax. The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death ( Refer to Form 706 PDF (PDF)).

What deductions are allowed in taxable estate?

These deductions may include mortgages and other debts, estate administration expenses, property that passes to surviving spouses and qualified charities.

Do you have to file an estate tax return?

Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return.

What is a power of attorney?

Power of Attorneyis a legal document that gives an individual the authority to make decisions on behalf of someone else, often when the latter person has become incapacitated or is otherwise unable to make her own decisions. Someone with power of attorney is often referred to as the agent.

What are the different types of power of attorney?

There are a few different kinds of power of attorney. The two most common two varieties are general power of attorney and medical power of attorney. General power of attorney gives an agent the power to make a wide range of decisions on financial matters, business transactions, retirement accounts and more.

What is probate process?

The probate processis the act of filing the deceased’s will with the appropriate probate court, locating and collecting all the assets, paying off all debts associated with the estate and distributing what’s left to the proper beneficiaries. The executor must be extremely organized and detail-oriented.

What is the difference between an executor and an agent?

Additionally, the job description for each role is slightly different, even though both deal with managing your affairs when you can’t. Your executor has a very specific and limited job to do: Making sure there’s enough money in your estate to pay off any debts and then channeling the rest to your heirs. Your agent, on the other hand, is more wide-ranging in their duties. The job could involve ruling on all kinds of decisions – financial, legal and medical – depending on what aspects of your life you’ve granted power of attorney over.

What are the roles of an estate planner?

Two of the most prominent of these roles are the executor of your estate and your agent with power of attorney. The two roles may be filled by the same person, but the roles themselves are very different.

Can a power of attorney be durable?

Power of attorney can be either durable or springing. If you sign a document giving durable power of attorney, your agent can immediately start making decisions on your behalf. With springing power of attorney, your agent will assume authority only once certain conditions has been satisfied.

Can a person be both an executor and an agent?

One person can serve as both your agent and the executor of your will. This is not uncommon, especially if you’ve chosen a child or other trusted relative for the roles. The two roles won’t overlap. Power of attorney is only effective while you’re alive and executors only assume responsibilities once you pass away.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

When does a power of attorney go into effect?

A springing (or conditional) power of attorney only goes into effect if a certain event or medical condition (typically incapacitation) or event specified in the POA occurs. For example, military personnel may draft a springing power of attorney that goes into effect when they’re deployed overseas.

What is a POA?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent.

When does a durable power of attorney end?

A durable power of attorney ends automatically when you die. You can rescind a durable POA using a revocation of power of attorney form as long as you’re competent.

When does a medical power of attorney become effective?

A medical power of attorney becomes effective immediately after you’ve signed it, but can only be used if you’ve been declared mentally incompetent by physician (s). Once you’ve selected an agent, make sure they know how to sign as power of attorney on your behalf. 3. General Power of Attorney.

Can a power of attorney be restricted?

The powers granted under a general power of attorney may be restricted by state statutes. Who can legally override your power of attorney depends on which type of POA you select. 4. Limited (Special) Power of Attorney.

Can you use a power of attorney for a short period?

Given the extensive control it affords your agent, you may only want to use this kind of power of attorney for a short period when you physically or mentally cannot manage your affairs. For example, during an extended period of travel outside of the country.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

What is a general power of attorney?

General Power of Attorney is another form of POA that essentially accomplishes the same goal of ensuring a trusted, competent person can make decisions on your behalf should the time come. Powers to act can be very specific, or they can be pointedly broad.

When does a financial power of attorney go into effect?

A Financial Power of Attorney goes into effect whenever you appoint them. Often, language in the document will read as a safeguard to ensure someone is there to step in should you become incapacitated, but it could also be for a specific time period (for example, you will live abroad for 2 years, or you can’t make it to a signing for a real estate deal). As noted, Financial Power of Attorney extinguishes automatically upon your passing. At that point, the Executor of your Will or Trustee of your Trust would step in.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Can a medical power of attorney make decisions?

Durable Medical Power of Attorney can make any and all healthcare-related decisions for you should you suddenly become unable to make them on your own.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

How to avoid federal estate taxes?

If you want to reduce your estate taxes before you die, there are some tactics you might use to protect your property. They include: Spending your assets. If you're not afraid of running out of money before you die, enjoy your wealth. Spreading your assets.

How much estate tax will be paid in 2021?

The IRS exempts estates of less than $11.7 million from the tax in 2021 (up from $11.58 million in 2020), so few people actually end up paying it. Plus, that exemption is per person, so a married couple could double it. The IRS taxes estates above that threshold at rates of up to 40%.

How many states have inheritance tax?

A few states have an inheritance tax, which is different because heirs pay the tax. Six states have an inheritance tax, and one collects both estate and inheritance taxes. Inheritance tax rates often depend on the heir’s relationship to the deceased. A surviving spouse is usually exempt from state inheritance tax.

What is the estate tax rate for 2021?

In 2021, federal estate tax generally applies to assets over $11.7 million. Estate tax rate ranges from 18% to 40%. Some states also have estate taxes. Assets spouses inherit generally aren't subject to estate tax.

How many steps are there in estate planning?

Now is the time to make sure your family is taken care of. Here are seven steps to estate planning.

Do you have to subtract your estate tax from your taxable estate?

If you live in a state with an estate tax, the good news is that (generally speaking) your estate tax bill is subtracted from the value of your tax able estate before you calculate what you might owe the IRS.

Can you shield your assets in a trust?

Shielding your assets in a trust. Properly created irrevocable or bypass trusts could provide a way to legally shelter some of your assets from state and federal estate tax. Moving to a more favorable tax environment. Since most states don't have estate tax or inheritance tax, you have many relocation options.

What happens when a firm recognizes a POA?

Of course, once a firm recognizes the POA, your agent has to convince the financial firm that he or she is the person empowered by the POA.

What is a POA?

The POA is a time-tested legal document. Each state has settled law, and since 2006 over half the states updated their laws by enacting versions of the Power of Attorney Uniform Law. It is widely-recognized by financial firms and other businesses. After you sign the POA, you let the agent know about it and where copies are located ...

How long does a POA have to be signed?

Many require the POA to be signed within the last six months, and I’ve talked to financial firms that require the POA to be no more than 60 days old unless it’s been certified by a bank officer. So, for your POA to be effective when you need it, you might have to generate a signed, notarized version on a regular basis.

Does a POA give an agent authority?

While the POA gives the agent authority, no one has to recognize it. Financial firms, especially since the financial crisis and the publicity received by cases of fraud and abuse, developed their own standards for accepting POAs.

Is a POA needed for an estate?

Your estate plan needs an up-to-date power of attorney (POA), but it also needs more. The power of attorney (POA) is essential for every estate plan, but it often is oversold by estate planners. The shortcomings of POAs aren’t well-known and could bite you or your heirs without proper preparation.

Do financial firms have to have POA?

Many financial firms have additional requirements. Some require that the POA be on their forms and require those forms to be re-executed every year or so. Some firms won’t accept a POA executed in a state other than the one where you’re resident.

Is a POA necessary?

While a POA is necessary, there are disadvantages and potential problems.

What is the purpose of POA?

The key goal of having a POA is to ensure someone can pay bills and otherwise manage your finances if you should become unable to. But nothing can happen until financial services firms accept the POA. They won't even tell the agent anything that's going on in an account until the POA is accepted.

What is the second mistake in power of attorney?

Mistake #2: Expecting too much from a power of attorney.

Why do we need POA?

You need a POA, because someone needs to manage your assets, pay bills, and make decisions if you become incapacitated. The alternative is for your loved ones to ask a court to declare you incompetent and appoint someone to act on your behalf, known as guardianship in most states.

Can a bank guarantee a POA?

The firm said the signature on the POA had to be guaranteed, which usually is done by a bank. But the bank said it only guaranteed signatures on its own forms. It wouldn’t guarantee signatures on POAs drafted by my parents’ lawyers. After a few weeks of back-and-forth on the phone we finally found someone at the mutual fund firm who offered an alternative and eventually accepted the POA.

Can you act on POA?

At many institutions, the “front line” people won’t be able to act on the POA once they receive it. It will be referred to in-house attorneys or POA specialists who will review it and decide whether it will be accepted. The standards of one one-of-town mutual fund were especially difficult to work with.

Should I switch financial institutions when I have a POA?

Then, try to comply with them. I've recommended that people switch financial institutions when their POA requirements had too many hurdles.

Do you have to prove a POA?

Once a firm accepts the POA, the agent still has to prove he’s the person named in the POA. Most firms will accept a photocopy of a driver’s license, but some require additional verification before letting someone act.

Popular Posts:

- 1. how register power of attorney document nri in subregistrar office

- 2. what happens if there is no power of attorney

- 3. how do i file complaint against attorney in nc

- 4. payment to consultant when attorney as agent of client

- 5. how can i file chapter 7 without an attorney?

- 6. what is a shadow attorney general

- 7. why did the assistant state's attorney sent a notice to jail inmate?

- 8. how to talk to cumberland county dictric attorney

- 9. what do i do if an attorney says i owe more money than i really owe

- 10. how to endorse check as power of attorney