- Estate planning attorney services include making wills, trusts, and power of attorney forms.

- Someone with a straightforward estate may not need to pay for an estate lawyer's help.

- An estate lawyer may charge a few hundred dollars for a simple will, but documents for more complex situations may cost you thousands.

What to look for in an estate planning lawyer?

Estate planning attorneys, also referred to as estate law attorneys or probate attorneys, are experienced and licensed law professionals with a thorough understanding of the state and federal laws that affect how your estate will be inventoried, valued, dispersed, and taxed after your death.In addition to educating you about the probate process, an estate planning attorney can …

How do you find an estate planning lawyer?

Estate planning is a process involving the counsel of professional advisors who are familiar with your goals and concerns, your assets and how they are owned, and your family structure. It can involve the services of a variety of professionals, including your lawyer, accountant, financial planner, life insurance advisor, banker, and broker.

What are the duties of an estate attorney?

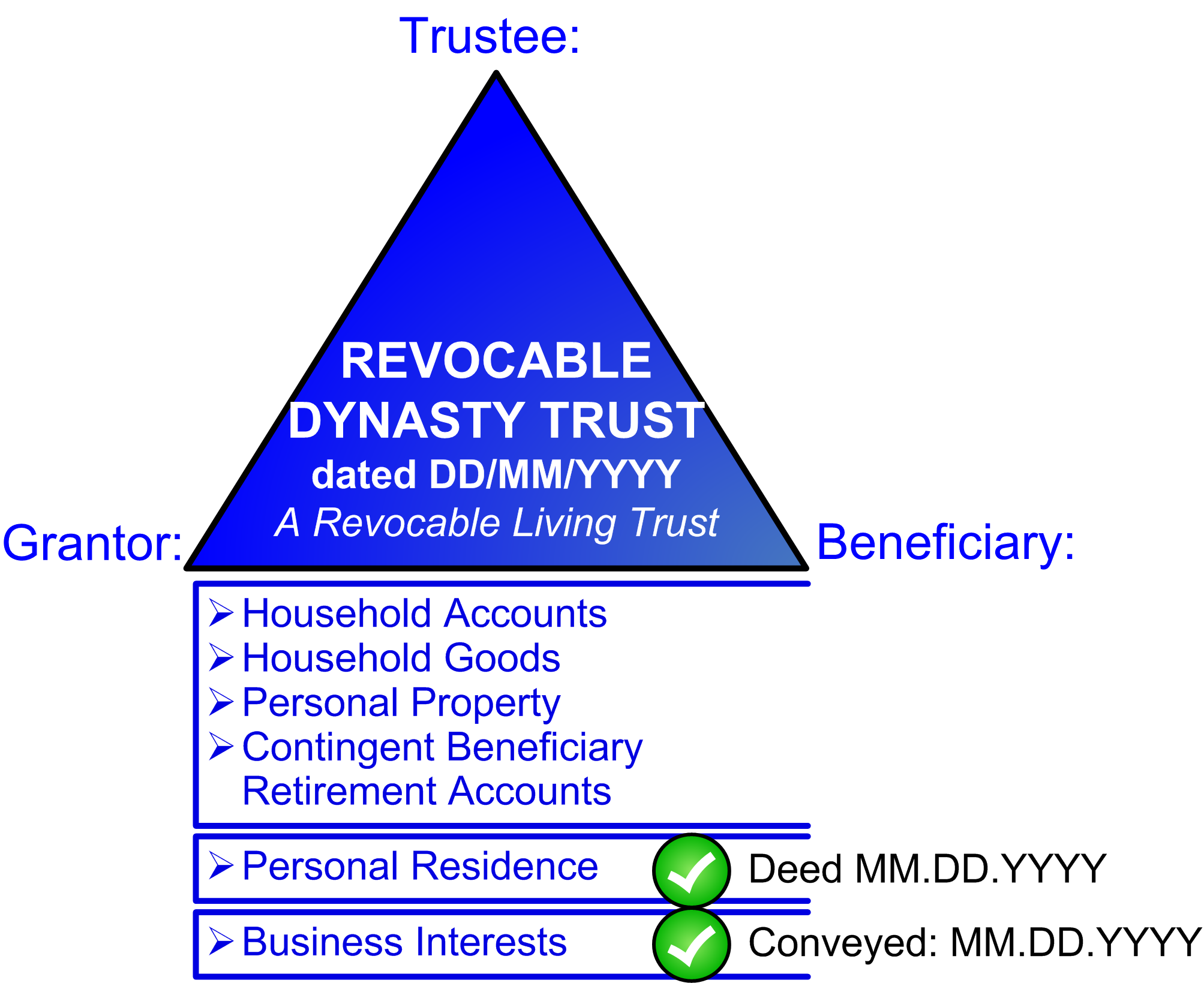

Q: What estate planning documents should I have? A comprehensive estate plan should include the following documents, prepared by an attorney based on in-depth counseling which takes into account your particular family and financial situation: A Living Trust can be used to hold legal title to and provide a mechanism to manage your property.

What does an estate planning attorney do?

Contact. (813) 983-8000. Directions. We Can Answer Your Estate Planning Questions. Talk to a lawyer in Tampa, FL about wills and trusts. You don't want to leave your loved ones guessing about the disposition of your estate. Speak with an estate planning attorney in Tampa, Florida today to build a comprehensive plan for your estate.

What is estate planning and why it is important?

Estate planning is all about protecting your loved ones, which means in part giving them protection from the Internal Revenue Service (IRS). Essential to estate planning is transferring assets to heirs with an eye toward creating the smallest possible tax burden for them.

What do you mean by estate planning?

Estate planning in simple terms refers to the passing assets / investments down from one generation to another. You decide how much of your estate – be it property(s), car(s), personal accolades, financial investments, etc. – you want to pass on to whom and how, after your demise.

How can a lawyer help in estate planning?

An estate planning attorney, also referred to as an estate law attorney or probate attorney, helps in the estate planning process by putting your wishes for incapacity and death into writing. This attorney will know the correct documents to use and will present options to ensure your goals are correctly carried out.

What do planning lawyers do?

Negotiating and drafting planning obligations for landowners, developers, local authorities and funders. Planning appeals, including advocacy at public inquiries and hearings. Interpretation of planning permissions and conditions, and advice on safeguarding planning consents.

What are the 5 components of estate planning?

A good estate plan is comprised of five key elements: Will, Trust(s), Power of Attorney, Health Care or Medical Directive and Beneficiary Designation. A will is a legally binding document that directs who will receive your property and assets after your death.Nov 8, 2017

What are the main steps in estate planning?

Seven steps to basic estate planningInventory your stuff.Account for your family's needs.Establish your directives.Review your beneficiaries.Note your state's estate tax laws.Weigh the value of professional help.Plan to reassess.Jan 11, 2022

Is estate planning for the rich?

No. When you think of estate planning, you may envision someone very wealthy and believe this doesn't apply to you. This is a common misconception.

What questions do they ask when making a will?

Some questions you should discuss with your wills and probate solicitor are:What will my funeral arrangements be?Who will get my property and assets?What happens to my debts?Who will look after my non-adult children?What will happen to my pets?What will happen to my business?Will Inheritance Tax be payable?More items...

What questions do you ask a living trust?

10 Questions to Ask an Attorney About Living TrustsWhat Property Can Go in a Living Trust? ... Who Should Be My Trustee? ... Does a Living Trust Avoid Estate and Probate Taxes? ... What Are the Benefits of a Living Trust? ... What Are the Drawbacks of a Living Trust? ... Do I Still Need a Power of Attorney?More items...

Is planning law interesting?

RW: Planning and environmental law is unique: it is highly specialised but affects people's everyday lives. It matters. Other areas of the law can be much more academic, whereas planning is very much grounded in decisions which have a real influence on our towns, cities and landscapes.

How much money does a lawyer make in South Africa?

Legal professionals are also proving to be highly mobile, with 19% surveyed being open to new job offers – mainly looking for a pay rise or career progression....Here's how much money lawyers earn in South Africa.Private Practice2022 annual salary rangeNewly QualifiedR580 000 – R650 000PartnerR1 400 000 – R2 200 000Senior AssociateR850 000 – R1 400 0002 more rows•Jan 6, 2022

What is a probate attorney?

A probate attorney usually handles the process of estate administration after a person dies. An estate planning attorney, on the other hand, works with living clients on how their client's estates should be administered. The attorney could do that by helping clients prepare trusts, wills, and other relevant documents.May 8, 2020

How to plan for a death?

That is estate planning—making a plan in advance, naming the people or organizations you want to receive the things you own after you die, and taking steps now to make carrying out your plan as easy as possible later. However, good estate planning is much more than that. It should also do the following: 1 include instructions for your care and financial affairs if you become incapacitated before you die 2 include arrangements for disability income insurance to replace your income if you cannot work due to illness or injury, long-term care insurance to help pay for your care in case of an extended illness or injury, and life insurance to provide for your family at your death 3 provide for the transfer of your business at your retirement, disability, incapacity, or death 4 name a guardian for your minor children’s care and inheritance 5 provide for family members with special needs without disqualifying them from government benefits 6 provide for loved ones who might be irresponsible with money or who may need protection from creditors or in the event of divorce 7 minimize taxes, court costs, and unnecessary legal fees, which may include funding assets into a living trust, completing or updating beneficiary designations, or otherwise aligning your assets with your estate plan

Why do people put off estate planning?

People put off estate planning because they think they do not own enough, they are not old enough, it will be costly or confusing, they will have plenty of time to do it later, they do not know where to begin or who can help them, or they just do not want to think about it. Then when something happens to them, their families have to pick up the pieces.

What is an estate?

Your estate consists of everything you own: your car, home, other real estate, checking and savings accounts, investments, life insurance, furniture, personal possessions. No matter how large or how modest, everyone has an estate and something in common—you cannot take it with you when you die. When that happens (and it is if not when), you ...

Is estate planning a one time event?

Importantly, estate planning is also an ongoing process, not a one-time event. You should review and update your plan as your family and financial circumstances (and the relevant laws) change over your lifetime.

What is estate planning?

Estate planning is one of the most thoughtful and considerate things you can do for your loved ones.

Is estate planning good for the wealthy?

Estate planning is not just for the wealthy either, although people who have accumulated wealth may think more about how to preserve it. Good estate planning is often more impactful for families with modest assets because the loss of time and funds as a result of poor estate planning is more detrimental.

What is pour over will?

The accompanying pour-over will is a backup measure in the event that any assets are not funded into your trust during your lifetime and provides that those assets should be poured over into your trust upon your death. Unlike a probate, which will end at some point, a trust can continue long after your death.

What is estate planning?

Estate planning is a process involving the counsel of professional advisors who are familiar with your goals and concerns, your assets and how they are owned, and your family structure. It can involve the services of a variety of professionals, including your lawyer, accountant, financial planner, life insurance advisor, banker, and broker.

What to do if a participant has a large estate plan?

If a participant has a large Plan balance or a complicated estate plan that involves, for example, distributing Plan assets to trusts for minor children or partially to charity and partially to children, the participant should consider working with an expert in this area to obtain the best tax planning advice.

What is beneficiary designation?

The beneficiary designation form governs. Participants routinely (and wrongly) assume that their wills govern the distribution of Plan assets. These assets are distributable to the beneficiary named on the form, or according to the default method in the Plan, regardless of the provisions of the participant’s will.

How is the minimum distribution determined?

The required minimum distribution is determined actuarially; basically, P divides the amount of assets held in the Plan in any given year by his or her remaining life expectancy. P must elect either to use a fixed life expectancy or to recalculate it each year.

When does the 5 year rule apply?

Note that the 5-year rule also applies if the DB fails to make his or her first required distribution by December 31 of the year after the year in which P dies. Third, if the beneficiary is not P’s spouse and if P dies after the RBD, the beneficiary must withdraw Plan assets “at least as rapidly” as P did.

Do qualified plans pay taxes?

Although assets held in qualified plans and IRAs (Plans) generate no income tax liability, the distribution of those assets to a participant (P) or P’s beneficiaries does, generally at ordinary income tax rates on every dollar. The IRS also imposes “penalty” taxes on withdrawals made either too soon or not soon enough.

What is a trust in a trust?

A trust is a legal agreement authorizing a third party – the trustee – to hold your assets on behalf of your beneficiaries. You would typically use a trust if, for instance, your children are too young to manage your transferred assets themselves. Your trustee would hold the assets for them until they are of age.

What is a Durable Power of Attorney?

For example, you may authorize a trusted friend to handle your finances, business, or healthcare. The most common is a Durable Power of Attorney which designates someone to handle your financial affairs even if you become disabled or lose capacity.

What is a will in Florida?

A will is a document that outlines terms for the allocation of property or assets when a person dies. If a person dies without a will, they are classified as dying intestate. In this situation, Florida Statutes determine who is responsible for managing the estate and how the property and assets of the estate will be distributed.

What is a trustee in a trust?

As a trustee, an individual can directly control his or her own resources and appoint a successor trustee to take their place upon death or incapacitation. The persons named as beneficiaries have their property released to them in accordance with the terms of the Trust Agreement.

Disclaimer

This site is provided as a public service by the ABA Real Property, Trust and Estate Law Section. While the information on this site is about legal issues, it is not legal advice or legal representation.

Send us your Feedback!

We'd like to read your questions, suggestions for future FAQs and comments.#N#Click the link to send us an e-mail.

Popular Posts:

- 1. a defense attorney who does not adequately represent her client could be guilty of

- 2. when the gal is colluding with opposing attorney

- 3. how to become admitted attorney in new york

- 4. what to do to get dismissed by attorney in jury

- 5. why it's important to speak to an experienced trial attorney nolo

- 6. how old is attorney danvers long in florida

- 7. what box on 1099 for attorney fees

- 8. "client, who is under indictment for homicide, is represented by attorney"

- 9. the person who prepares the trust agreement is the: a trust attorney

- 10. how to finish a memorandum for supervising attorney