Does durable power of attorney cover health care matters?

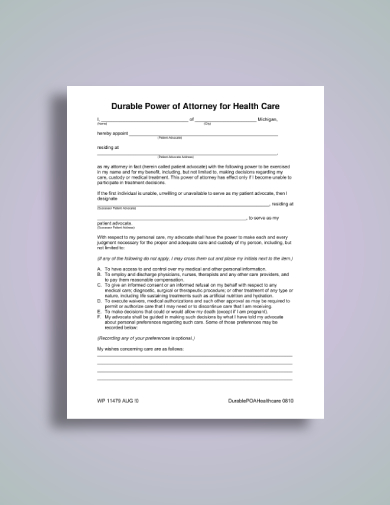

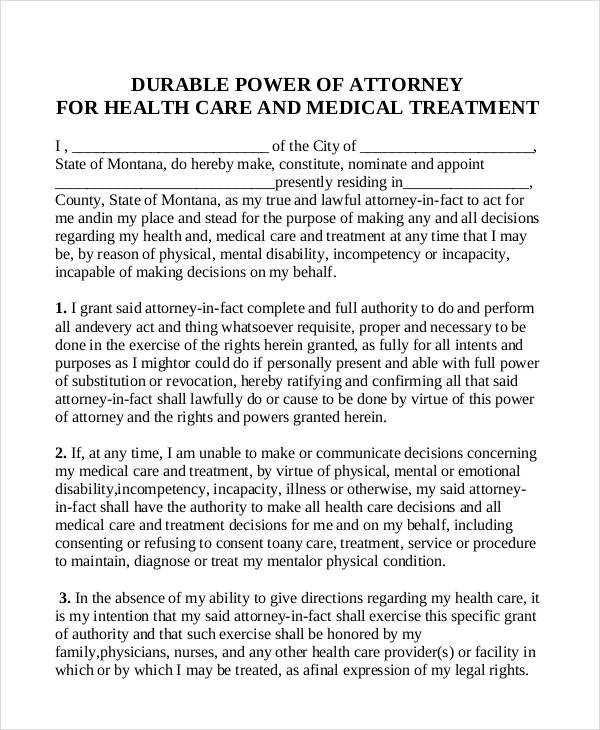

What is a Durable Power of Attorney for Health Care? A Durable Power of Attorney for Health Care (DPOA-HC) is a legal mechanism which allows you to appoint a person (agent/patient advocate) to make health care decisions for you should you become unable to do so. For many years, a Durable Power of Attorney was available to allow another person to handle personal,

What is the purpose of a durable power of attorney?

Durable power of attorney for health care is a legal document that gives another person the authority to make a medical decision for an individual. The person named to represent the individual is referred to as an agent or attorney-in-fact.

What does durable mean in a durable power of attorney?

How to enforce durable power of attorney?

What does Durable power of attorney mean in medical terms?

What is durable healthcare power?

What is the difference between a living will and a durable power of attorney for healthcare quizlet?

How does a living will differ from a durable power of attorney for health care?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What is the best power of attorney to have?

What do a living will and a durable power of attorney for health care share in common quizlet?

Why might a person choose a living will over a durable power of attorney?

A Living Will is useful for both families as well as medical teams and doctors. They can consult your Living Will if you ever become incapacitated and unable to make decisions on your own.

What is the purpose of a durable power of attorney for health care Dpoahc )? Quizlet?

What are the 3 types of advance directives?

- Common Law Advance Care Directives which are recognised by the common law (decisions made by judges in the courts) and generally must be followed. ...

- Statutory Advance Care Directives which are governed by State and Territory legislation.

What is the difference between a health care directive and a living will?

What's the difference between a living will and a healthcare proxy?

What Is A Power of Attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitate...

Medical Power of Attorney

A medical power of attorney is one type of health care directive -- that is, a document that set out your wishes for health care if you are ever to...

Financial Power of Attorney

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf....

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

How many separate documents do you need for a power of attorney?

To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances. Fortunately, powers of attorney usually aren't difficult to prepare.

What can an agent do for you?

Your agent can handle mundane tasks such as sorting through your mail and depositing your Social Security checks, as well as more complex jobs like watching over your retirement accounts and other investments, or filing your tax returns. Your agent doesn't have to be a financial expert; just someone you trust completely who has a good dose of common sense. If necessary, your agent can hire professionals (paying them out of your assets) to help out.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

Why do you need separate documents for your health insurance?

Making separate documents will keep life simpler for your agent and others. For example, your health care documents are likely to be full of personal details, and perhaps feelings, that your financial broker doesn't need to know. Likewise, your health care professionals don't need to be burdened with the details of your finances.

Can a power of attorney be used to pay bills?

With a valid power of attorney, the trusted person you name will be legally permitted to take care of important matters for you -- for example, paying your bills, managing your investments, or directing your medical care -- if you are unable to do so yourself. Taking the time to make these documents is well worth the small effort it will take.

What is a power of attorney?

A power of attorney is a legal contract that grants someone the authority to act on someone else’s behalf. The elected person will be able to make important decisions regarding your assets, wealth, mortgages, loans, trade deals, and healthcare.

How much does a power of attorney cost?

You will be glad to hear that the cost of a power of attorney is nothing! The only thing you need to pay for is the document where everything will be written and finalized with your, the attorney’s, and the lawyer’s signature. You need to notarize the paper which is around $50.

What do medical attorneys do?

These medical attorneys will also take care of you when you are conscious. They will take you to the doctor for regular checkups and make sure that you are taking your medicines properly and following the doctor’s prescription.

Is a durable power of attorney the same as a power of attorney?

Although the base concept of a power of attorney and a durable power of attorney is kind of similar, they have some vital differences.

Is it hard to elect a power of attorney?

Electing a power of attorney is not difficult but trust and loyalty are two of the most important characteristics you should have in your nominee. The elected person can be a relative, a trustworthy friend, or a close neighbor.

Who sign a medical document?

They will be the ones overlooking the document. The document must be signed by you, the person you are going to appoint, and the lawyer. It will also be signed by two witnesses who are licensed medical practitioners ( e.g. doctor, nurse).

Can a power of attorney make healthcare decisions?

Most of us are fortunate enough to be able to make our own decisions regarding healthcare. However, there are certain situations and instances where individuals are unable to make these decisions. This is when a ‘Durable Power of Attorney for Healthcare’ comes into play. The power of attorney entrusts someone else to make the best decision for you when you are unable to.

Durable Power Of Attorney

When you grant someone as the durable power of attorney, they are in charge of making important financial decisions on your behalf if you were to ever become incapacitated. This includes financial, legal, and business interests.

Health Care Power Of Attorney

When it comes to granting someone as the health care power of attorney, that person is responsible for making important medical decisions on your behalf if you were to ever become incapacitated.

Popular Posts:

- 1. how to.get a power of attorney

- 2. who arr district attorney for douglas county colorado

- 3. how to get an attorney appointed to.you in ct

- 4. how to pay yourself as a self employed attorney s-corp

- 5. why did my attorney make me have my fingerprints done?

- 6. who pays attorney fees in real estate transaction

- 7. what to look for in an elder law attorney

- 8. how does an undocumented immigrant become an attorney

- 9. district attorney who over sees dsuphin county pa

- 10. what is the average cost of a disability attorney in ohio