Why do you need durable power of attorney for finances?

A durable power of attorney for finances is an inexpensive, reliable legal document. In it, you name someone who will make your financial decisions if you become unable to do so yourself. This person is called your attorney-in-fact, or in some states, your agent.

What does a durable financial power of attorney do?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

Do I need a financial durable power of attorney?

There are two types of durable powers of attorney: An immediate durable power of attorney goes into effect as soon as you sign it. The person you designate as your agent can immediately make financial decisions on your behalf, even if you are able to make them yourself. A springing durable power of attorney only goes into effect after one or two doctors indicate that you are …

What is the purpose of a durable power of attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - …

What can you do with a durable power of attorney?

It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What does the term durable power of attorney mean?

A durable power of attorney refers to a power of attorney which typically remains in effect until the death of the principal or until the document is revoked.

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

Does a power of attorney need to keep receipts?

You have a duty to ensure that your personal interests do not conflict with your duties as an attorney. For example, if you are acting as financial attorney, the adult's funds must be kept separate from your own and you should keep accounts and receipts.

Can a family member override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Can family members witness a power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.Aug 26, 2021

Does power of attorney end at death?

Termination of an enduring power of attorney An EPA ceases on the death of the donor. However, there are other circumstances in which an EPA ceases to have effect.Mar 18, 2021

When can I use power of attorney?

If you want to manage the affairs of someone who you think might lose their mental capacity and you don't already have an EPA, a lasting power of attorney should be used. Even if you already have an EPA, it can only be used to look after someone's property and financial affairs, not their personal welfare.

Who has power of attorney after death if there is no will?

What Happens After Death of the Principal? Upon the death of the principal, the power of attorney is no longer valid and instead the will is executed. Instead of the agent, now the executor of the will is responsible for carrying out the demands of the principal through the will.Jun 25, 2021

Who makes medical decisions if there is no power of attorney?

The legal right to make care decisions for you If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

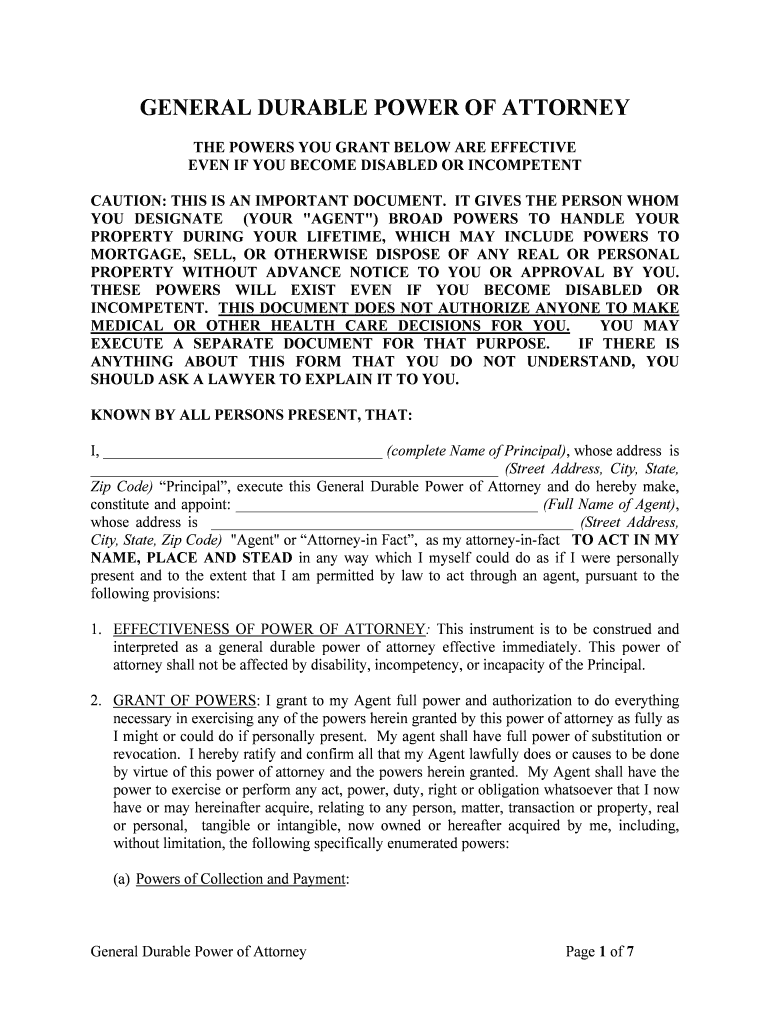

Making A Financial Power of Attorney

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

Popular Posts:

- 1. how to make an ace attorney game

- 2. how to execute a durable power of attorney for incapacitated

- 3. who elects the general attorney of texas

- 4. why trump attacked his deputy attorney general

- 5. who is the prosecuting attorney for patrick frazee

- 6. how to become a court appointed attorney akron ohio

- 7. what is an attorney trust account

- 8. which quickbooks for solo attorney

- 9. if a partner business, who signs power of attorney

- 10. why does seller of vehicle have to sign power of attorney over tot the lending bank