A demand letter from an attorney for collection of debt is a formal notice sent to a debtor by a lawyer on behalf of their client to request the payment of an outstanding bill. It provides details of the debt in default, including the date it was accrued and the total amount.

What is a demand letter from an attorney for collection?

A demand letter from an attorney for collection of debt is a formal notice sent to a debtor by a lawyer on behalf of their client to request the payment of an outstanding bill. It provides details of the debt in default, including the date it was accrued and the total amount.

What is a demand letter for debt?

Jun 27, 2019 · A demand letter is a letter that explains why a person or company owes you money and formally requests that they pay it to you. A demand letter may also be referred to as a debt collection letter. You might need to write such a demand letter to a service person or company, such as a contractor, who took your money and then didn't do the work promised.

Do I need a lawyer to send a demand letter?

If a debt collector contacts a debtor by phone, the wise debtor will demand in writing that the debt collector contact them in writing. The collector's written demand will verify the demand for payment. After the debtor's request for a written demand, the law then requires the debt collector to provide an FDCPA debt validation letter within 5 days.

What should be included in a demand letter?

The demand letter is an official indication that you are informing the debtor of your grievances, and you demand a claim to your payment following legal action. Therefore, your attorney will ensure that the letter is worded appropriately to ensure it is admissible in court. It helps in organizing your case

What does it mean when your lawyer sends a demand letter?

A demand letter is a document sent by one party to another in order to resolve a dispute. The letter requests some form of restitution to the aggrieved party and is often preceded by amicable attempts to remind a recipient of the obligation. Most demand letters are written by lawyers.

How serious is a demand letter?

A demand letters shows that the sender is serious. If a sender of a demand letter has hired an attorney, they're clearly spending money to protect their rights and it demonstrates that they're more serious than if they're just emailing or calling and making the legal claims themselves.

What happens if you don't respond to a demand letter?

The fact that you ignored the demand letter will be used against you in court. The demand letter will likely end up as an exhibit to the court and jury in any subsequent litigation, and your response to the demand will be judged accordingly.Mar 24, 2019

What is the next step after a demand letter?

In rare cases, it can be because the defendant party does not respond to the demand letter in the first place. Regardless, the next step for most attorneys is to initiate a lawsuit. It is crucial that lawyers initiate this process quickly once it becomes clear that reaching a settlement will be impossible.Aug 22, 2018

Can you ignore letter of demand?

Do not ignore the letter of demand. The debtor will have provided a time frame for responding, after which time it intends to issue a court claim against you. If it follows through with this and issues a formal court claim the costs of litigation accrue quickly.

What happens when you receive a demand letter?

If you've received a demand letter, it means someone is expecting you to do something and they are giving you one last chance to do it, before taking you to court. Should you accept to do what they are asking, refuse to do it, or simply ignore the letter?

Can an attorney ignore a letter?

Do not ignore the letter. If you fail to take any action, legal proceedings may be commenced against you. This could expose you to the risk of paying your opponent's legal costs, even if you successfully defend the claim.Jan 21, 2021

How long does it take to hear back from a demand letter?

After You Send Your Letter Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

How much does a letter of demand cost?

A letter of demand issued by a solicitor to a debtor can often result in prompt payment of outstanding debts. This can be a cost-effective means of recovering money. At Bartier Perry we offer an online letter of demand service for just $55.May 31, 2021

How do you respond to a demand letter from a lawyer?

Here are 6 things you should do if you receive a demand letter:Take It Seriously. There can be serious consequences for completely ignoring a demand letter. ... Be Honest With Yourself. ... Consider the Evidence. ... Consider an Offer. ... Speak to a Lawyer. ... Verify Receipt.Jan 20, 2021

What is a demand letter for wrongful termination?

A demand letter, as the name suggests, is a letter that an employee (often through an attorney) sends to a former employer “demanding” that the employer do something to avoid the filing of a lawsuit.Jul 11, 2017

Is a letter of demand legal?

It is usually the last step taken before commencing legal proceedings. A letter of demand states the amount owed, what it is owed for and when the amount needs to be paid. It often includes a warning that legal action will be taken if the money is not paid by the date nominated.

How to write a demand letter?

A demand letter is written notice to the debtor that includes a formal demand for payment of the debt. A well-crafted demand letter will include the following basic information: 1 A description of the amount owed 2 How the debt was incurred (e.g. unpaid fees for services rendered) 3 The amount of interest or penalties for late payment 4 The consequences of not paying (e.g. a lawsuit) 5 Reference to the relevant documents such as invoices, contracts or other relevant communications

What is a demand letter in Pennsylvania?

If Pennsylvania law or the contract terms require a demand letter, then a demand letter must be sent; otherwise, the debtor may be able to successfully challenge a subsequent lawsuit.

What are the legal remedies for a money judgment?

Legal remedies include the initiation of a lawsuit, litigation and a money judgment. After a money judgment is entered, enforcement of the judgment is the next step. A demand letter may avoid all of that. A demand letter does not get filed with the court (at least not when you send the demand letter). The purpose is simply to give the debtor one ...

What is the first step in collecting a debt?

But before that happens, often the first step in collecting a debt is to draft a demand letter and send it to the debtor.

What happens after a demand letter is sent?

What Happens After The Letter Is Sent? Once the demand letter is sent, the ball will be in the debtor’s court, at least for a time. The ideal situation is that the debtor simply pays the debt promptly. If the debtor does not or cannot pay the debt in full, then your lawyer can help negotiate a reasonable solution.

What to do if a debtor cannot pay in full?

If the debtor does not or cannot pay the debt in full, then your lawyer can help negotiate a reasonable solution. A solution may include an agreement on a discount of the full balance owed in exchange for prompt payment, installment payments for the entire balance, or some other solution.

When is a demand letter not required?

When a demand letter is not required, it is usually advantageous to send a demand letter in order to put the debtor on notice that continued refusal to pay will have more severe consequences.

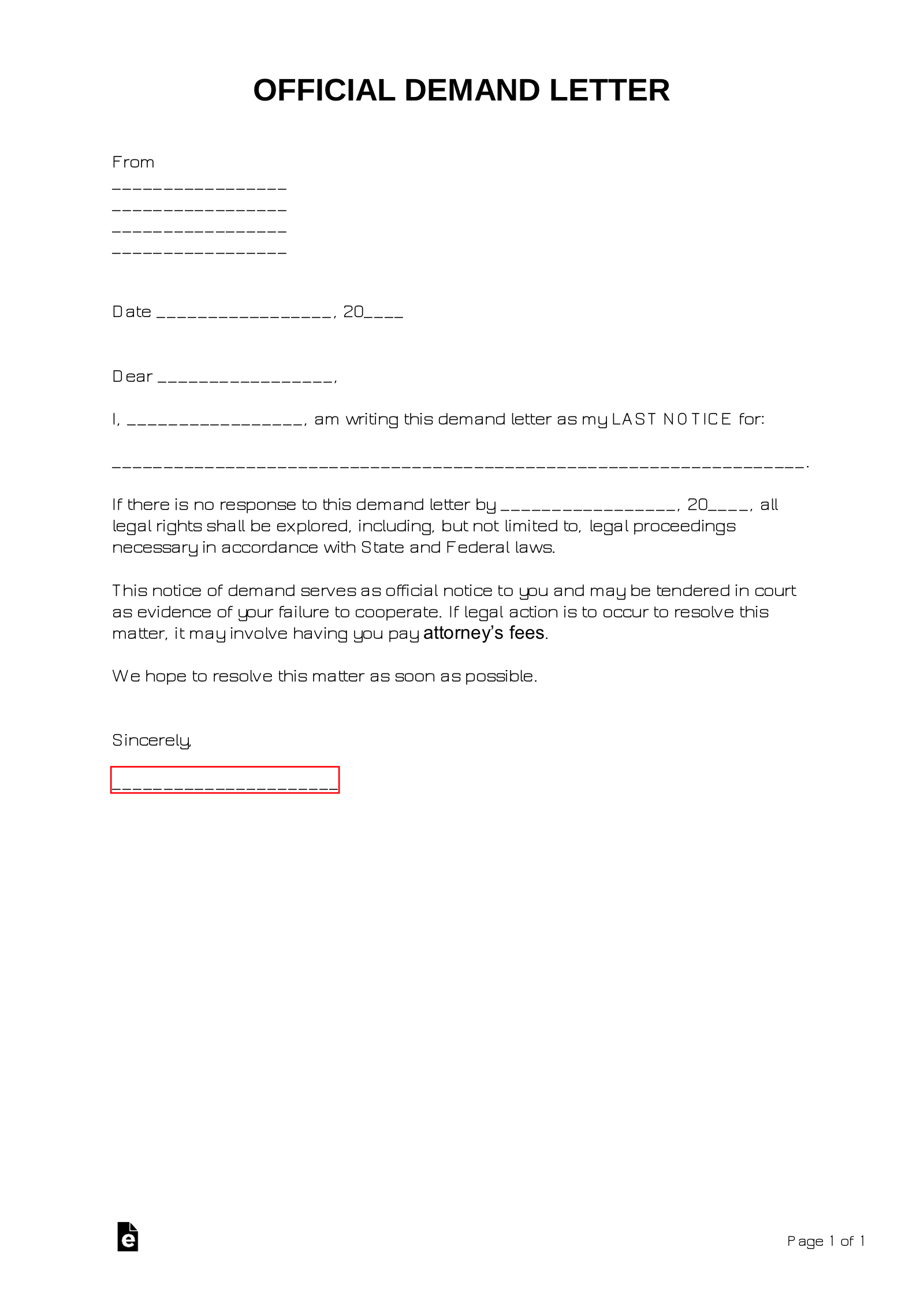

What is a demand letter for an attorney?

There are a wide-range of demands an attorney can make on behalf of their client. The letter is outlined to have the full contact details of the attorney along with the items being “demanded” and a date that requires the other party to respond or else legal action may take place.

What does a letter of compliance mean?

The letter will need to mention a specific time period (number (#) of days) that the receiving party will have to follow through with the demands.

What happens if a letter is not received?

After the letter is received by the recipient, the attorney will have the option to further negotiate with the recipient if contact is made. If contact is not made, or the recipient of the letter does not adhere to the terms of the letter, the attorney may not have a choice but to seek their legal options through the local court.

What is demand letter?

A demand letter is a letter that explains why a person or company owes you money and formally requests that they pay it to you. A demand letter may also be referred to as a debt collection letter. You might need to write such a demand letter to a service person or company, ...

Why is a demand letter important?

Importance of a Demand Letter. Writing a demand letter is an important first step in legally attempting to collect money owed to you. Writing and sending the letter provides proof that you have notified the other person of this outstanding debt and have requested payment. If you skip this step and go right to court, ...

What is demand for payment on promissory note?

1. Overview Some promissory notes, by their nature, require that the lender demand full payment of a loan before it will receive any amounts. Such notes are called demand promissory notes.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) applies to debt collectors who attempt to collect a debt. If you as a consumer receive a demand letter from an attorney or debt collection agency, it must comply with this law, which requires that the notice must state it is an attempt to collect a debt and any information obtained will be used for that purpose. As an individual or company, if you seek to collect a debt owed to you personally, you are not required to comply with this law.

How long does it take for a collection agency to process a debt?

It's basically the same as a demand letter, except that it states that if payment is not made within 10 days , the debt will be handled by the collection agency. Generally, collection agencies charge no fee to the person owed the debt (the person hiring the collection agency) if the debtor pays within this 10-day period.

What does it mean to ask for more money?

Asking for more money creates room for negotiation, but be aware that it might also mean the debtor will simply refuse to pay anything. Keep several copies of the demand letter and send it certified mail, return receipt requested so you can have proof it was received by the debtor.

What is a demand letter from an attorney?

A demand letter from an attorney is a legal letter claiming for restitution of some performance based on the client breach of contract. This notice is given by an attorney to have something paid, returned, or requested for action. The letter has an outline of the attorney contacts and the items that have been demanded. The demand letter is a precursor before filing a lawsuit, but it can be a better way of resolving a dispute. They can be used to demand monetary compensation or prompt action to be taken for the issue being addressed.

What is a demand letter?

The demand letter is an official indication that you are informing the debtor of your grievances, and you demand claim to your payment following legal action. Therefore, your attorney will ensure that the letter is worded appropriately to ensure it is admissible in the court.

How long does a formal demand letter have to be?

A formal demand letter from the attorney should give a specified dateline, which is normally a period of 7 days. It should also include a precautionary note that failure to comply within the stipulated time might attract legal remedies.

Why is a demand letter important?

Giving detailed facts is essential because you might want to file a lawsuit, and the demand letter will be among the reference documents that will be used by the judge. If you have any supporting documents like receipts or any other important document, you can attach to make the demand letter formal and authentic.

What is a letter that addresses injuries that occurred due to negligence and carelessness from the other part that is legible

Injury – This is a letter that addresses injuries that occurred due to negligence and carelessness from the other part that is legible for compensation. Malpractice – This is a letter drafted by the attorney to address any malpractice, which is contrary to the normal procedures. For instance, it can address medical malpractice in cases ...

Why do you need a letterhead for a demand letter?

Writing a demand letter from an attorney will save you from attending court summons because you have a legal firm letterhead that implies you are working hand to hand with the attorney straight from the beginning. This also implies that you are ready to take legal action if the notice is ignored.

What do you need to give in a letter?

You need to give the details of the exact demands in the letter, which will be vital when the situation required litigation. Courts will need to do a review of the language used and the clarity of instructions from the defendant.

Why is a demand letter written by an attorney?

That’s often why it’s written by an attorney because you want to be very careful about what is said in a demand letter.

What does a demand letter mean?

1. A demand letter shows the other party you’re serious. 2. A demand letter is generally seen by the court as a sign of good faith. 3. The information in a demand letter may be used against you. 4. Sending a demand letter can save you money and time in the long run. 5.

What happens if you don't respond to a demand letter?

Some people think if they don’t respond, the sender will go away. This is usually not the case — especially if the other party has retained an attorney. Respond and try to resolve the issue or you run the risk of going to court. And courts may not look favorably on those who simply ignore demand letters.

Why do businesses send demand letters?

Commonly used by businesses, demand letters are often sent to demand money owed or restitution , but they can also be used to demand specific actions.

Why do we need demand letters?

They can expedite a successful outcome and avoid costly litigation. Even if you do end up filing a lawsuit, a demand letter shows the court that you reasonably tried to work with the other party to settle the problem.

How long does it take to settle a lawsuit?

A lawsuit often takes months, if not years. Fifth, don’t ignore a demand letter.

Do you have to write a demand letter to an attorney?

A demand letter does not have to be written by an attorney but a letter coming from a law firm is generally taken more seriously and will provide the protections listed above. 5. Never ignore a demand letter. If you receive one, contact your attorney immediately.

What is a demand letter?

A demand letter is a type of written correspondence that states a claim and makes a strong request for payment. This document could be drafted by an attorney or a debt collector. It usually states the amount ...

What is the first paragraph of a demand letter?

The first paragraph of a demand letter normally states the circumstances under which the debt occurred. It may refer to a contract or bill of sale. This is typically followed by a synopsis of the efforts taken to rectify the situation. It generally closes with a demand for payment and outlines the course of action that will be taken should ...

Can a debt collector threaten a debtor?

This means the debt collector may not threaten the debtor, use foul language, make unjustified claims, or claim to be an attorney or police officer if he is not. When a defendant to a lawsuit is represented by legal counsel, the demand letter must be sent directly to this attorney.

How to write a debt collection letter?

Typically, a lawyer debt collection letter may be used to: 1 Inform a client that their payment has surpassed the due date and is now overdue. 2 Start the process of setting up a repayment program with a client who cannot pay in full. 3 In certain situations, initiate legal proceedings when a client refuses to pay.

What is a collection letter?

A debt collection letter is a formal notice that businesses—including law firms— give to a client who hasn’t paid their bill by the agreed-upon date. This type of letter informs the recipient of their outstanding debt, requests that they pay by a certain date, and lets them know what will happen should they fail to pay.

How to avoid unpaid bills?

The first step to avoiding unpaid client bills is to set up a solid collections process. That way, you can make it easy for clients to pay in the ways that best suit them. If you still don’t receive payment, you may want to consider creating a professional, clear, and straightforward lawyer debt collection letter.

What to do if client refuses to pay?

Start the legal process. Unfortunately, in some situations, you may decide to pursue legal action if a client refuses to pay. For example, you may be able to report the non-paying client to a credit reporting agency, hire a collections agency, or file a lawsuit.

Do lawyers need a collection letter?

Before reaching the point where a collection letter is necessary, lawyers should ensure that they’ve set up a sound system for their law firm billing. The goal for attorneys is to get paid for the work they complete—while maintaining good relationships with their clients.

Do lawyers need to know the rules for debt collection?

However, before creating or sending any debt collection letters, lawyers need to check, know, and abide by the rules for debt collection in their area. Once you know the rules, you can research and create your own debt collection letter template.

What happens after a demand letter is sent?

After a demand letter is sent, there are various outcomes that could occur. This could include: 1 The demand is met. The best possible scenario of a demand letter is that the party you sent the letter to accepts all aspects of the demands and makes payment or restitution. 2 A counter-offer is made. The party that receives the demand letter may send back a counter-offer. While this means that they did not agree with all of the demands or amounts, it does mean that they are willing to pay something. A counter-offer does not have to be accepted, and the demanding party may choose to send back another counter-offer of their own. 3 The demand is refused. The party that received the demand letter may completely refuse any payment. In this case, it may be necessary to move forward with a lawsuit.

Why do you send a demand letter?

This could be due to a mutually agreed upon contract, because of a party’s unlawful activity ended up costing another person, or various other reasons.

What is the best scenario for a demand letter?

The best possible scenario of a demand letter is that the party you sent the letter to accepts all aspects of the demands and makes payment or restitution. A counter-offer is made. The party that receives the demand letter may send back a counter-offer.

Can someone not pay what they owe?

However, there are times when a person may not pay what they owe. Someone owes you an obligation in some way. It could be the case that an agreement was in place for one party to complete some kind of job for the other party, but they failed to follow through on their obligations.

What Is An Attorney Demand Letter?

- An attorney demand letter is a useful way to get someone’s attention. It serves as a serious warning that legal action will occur unless there is, at the very least, a response from the other party. The attorney demand letter should be sent by certified mail, with return receipt, which will give the sender confirmation that it was received.

How to Write An Attorney Demand Letter

- Writing an attorney demand letter is all about carefully choosing the words written to clearly show a position of power. The recipient will need to have fear instilled in them after reading to compel a response. If a response is not made after successful delivery of the letter, there may be no other course except legal action.

Sample 1 – Collection of Debt

- Dunn & Associates Attorneys at Law 155 W 70th St. New York, NY 10023 November 19, 2017 Mr. Calvin Jones Baxter Construction LTD. 201 Ann St. Newburgh, NY 12550 Re: Final Demand Letter Prior to Legal Action On behalf of our client Tottman Supplies Corp., we at Dunn & Associates are writing to inform you of an overdue payment owed to our client. According to the construction m…

Sample 2 – Medical Malpractice

- Law Offices of Adelman, Hodes & Cunningham, PLLC 151 E Congress St Tucson, AZ 85701 July 20, 2016 Lillian Hart, RN, J.D. Claims and Litigation Carondelet St. Mary Hospital 1601 W St Mary’s Rd Tucson, AZ 85745 Re: Medical Malpractice Claim of Sarahjeet Patel Harry S. Cohen & Associates, representatives of the family of the late Mrs. Sarahjeet Patel, are writing you in an ef…

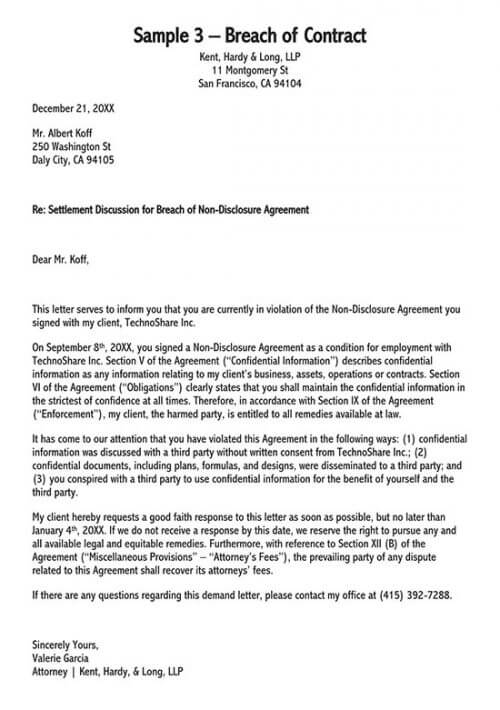

Sample 3 – Breach of Contract

- Kent, Hardy & Long, LLP 11 Montgomery St San Francisco, CA 94104 December 21, 2018 Mr. Albert Koff 250 Washington St Daly City, CA 94105 Re: Settlement Discussion for Breach of Non-Disclosure Agreement Dear Mr. Koff, This letter serves to inform you that you are currently in violation of the Non-Disclosure Agreement you signed with my client, TechnoShare Inc. On Sept…

Popular Posts:

- 1. signing power of attorney when person is of sound mind but physically unable to in calif sign

- 2. how to get health care power of attorney without consent

- 3. what type of attorney do i need when a companies employee assults me

- 4. who is hallandale beach city attorney

- 5. what is an intake attorney and are they good

- 6. how to file a motion to dismiss a court appointed attorney

- 7. how to sign loan documents as power of attorney

- 8. what is the difference between a durable general power of attorney and a general power of attorney?

- 9. if married who can be medical power of attorney

- 10. general power of attorney definition