Why hire a qualified attorney for a QDRO?

Aug 23, 2010 · This is basically a document issued by the court that orders how retirement assets are to be divided between you and your (soon-to-be) former spouse. A QDRO (Qualified Domestic Relations Order) used correctly can protect your share of IRA money (and other retirement assets) in case of divorce.

What does QDRO stand for?

A “QDRO” is a term of art defined by section 206 (d) of the Employee Retirement Income Security Act of 1974 (“ERISA”). Specifically, a QDRO is a domestic relations order issued by a state agency or institution (usually a state court) with the authority to issue an order or garnish wages. Typically, the order stems from a need to: divide retirement benefits that are marital property in …

How do I get a QDRO for a divorce?

A QDRO is a court order which directs the administrator of a benefits plan to divide the interest in a deferred compensation account between the employee and spouse. WHEN DO I NEED A QDRO? If one of the spouses in a divorce is asking the court to divide either a Defined Benefit Plan or a Defined Contribution Plan, then a QDRO will likely be required.

Do you follow through on a QDRO?

Mar 05, 2021 · A QDRO is a document filed with the court. In many cases, it’s filed right alongside the final decree of divorce. It’s entered by the judge, and returned to the attorney or party to the suit, so that it can be sent to the plan administrator for the retirement plan in question. It essentially authorizes the division of the retirement account.

What does a QDRO do?

What are the rules of a QDRO?

How long does it take to get money from a QDRO?

Can ex wife claim my pension years after divorce?

How is a QDRO paid out?

Who is responsible for filing a QDRO?

Can a QDRO be denied?

Can I cash out my QDRO?

Is money from a QDRO taxable?

How much of my retirement is my ex wife entitled to?

What is ex wife entitled to after divorce?

Do I get half my husband's pension if we divorce?

What is a QDRO in divorce?

How a QDRO Works in a Divorce. A QDRO is a court order used to divide specific types of retirement plans, including qualified and 403 (b) plans. According to the Internal Revenue Service (IRS), a QDRO is “a judgment, decree, or order for a retirement plan to pay child support, alimony, or marital property rights to a spouse, former spouse, child, ...

What is a QDRO?

A qualified domestic relations order (QDRO) is a decree requiring a portion of a retirement plan to be assigned or paid to another person, such as a spouse following a divorce. A QDRO helps the division of assets to be done more efficiently as a result of a divorce.

How to divide 401(k) in divorce?

During the divorce proceedings, both parties agreed on the assets that need to be divided amongst them, including the 401 (k). The court-ordered QDRO was drafted by a divorce attorney and submitted to David's retirement plan administrator. The plan administrator approved the QDRO, which has the following terms: 1 David keeps $50,000 that was in his 401 (k) before the marriage. 2 The remaining $150,000 in the 401 (k) Will be split evenly between David and Kristen since those funds are considered a marital asset. 3 Kristen can withdraw $75,000 from David's 401 (k) and roll those funds over into another retirement account in Kristen's name.

What is QDRO in retirement?

A QDRO allows the creation of alternate payees from a retirement plan provided they're a dependant, spouse, or ex-spouse of the plan participant . The beneficiary is granted the funds and can have the money transferred to an existing or new retirement account in their name.

Why is QDRO important?

By assigning the benefits, the QDRO helps ensure that the ex-spouse will have a retirement nest egg.

How much tax is owed on IRA withdrawals?

Typically, the IRS charges a 10% tax penalty on any funds withdrawn from an IRA if the person is under the age of 59½. 3.

Can QDRO be transferred?

Limitations of a QDRO. Although there are benefits, there are also some limitations to a QDRO . Assets within a retirement plan will not be transferred under a QDRO if those funds are already promised to another alternate payee via another QDRO.

Who owns QDRO consulting?

There is also a QDRO Consultants based in Reno, NV, which is owned by Melinda C. Cameron. The firm has a very clean website, which describes the drafting process. They offer a QDRO that costs $725, and they also have packages for initial consultations.

What is QDRO in divorce?

A QDRO is necessary if you were awarded a share in your spouse’s retirement or pension funds during the divorce proceeding through settlement or litigation . It is the only effective way to notify a plan administrator, and ensure that you receive the funds.

How to obtain a QDRO?

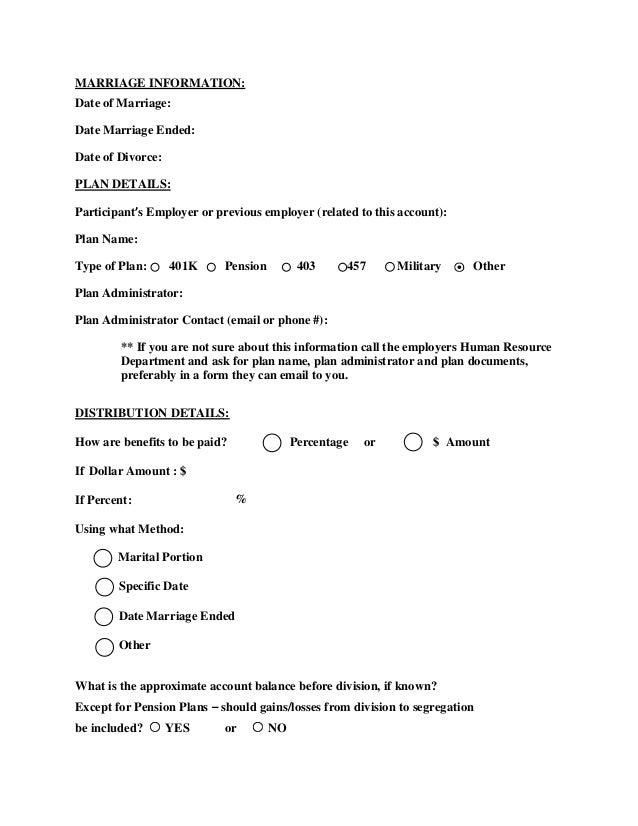

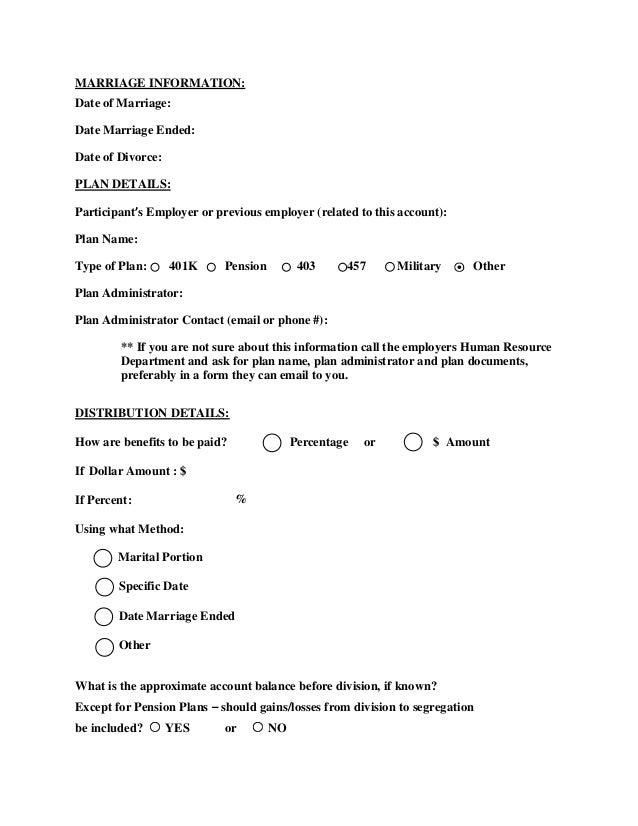

Obtaining a QDRO can be quite time-consuming, so be certain to understand each of the basic steps prior to beginning. The first stage may be relatively easy. You will gather all of the information that is necessary for the order, including: 1 The name of the plan 2 The name of the plan administrator 3 A copy of the summary of the plan 4 Their QDRO procedures

What is a QDRO?

QDRO stands for Qualified Domestic Relations Order, which is a court-ordered document used to split certain types of retirement plans during divorce . It is essential that you know the details of what a QDRO covers, because it is not necessarily a given in every divorce.

What are the requirements for QDRO?

However, there are four key areas that every QDRO requires: 1) Name , Social Security Number, and Current Address of the Participant (plan owner) and the Alternate Payee (non-employee spouse) 2) Exact name of the plan that is being divided. 3) The way that the benefits will be divided.

Where is QDRO based?

There is a QDRO Consultants firm based in Medina, OH. While the information about their team is not clear, members of the firm have authored two books: Dividing Pensions in Divorce and Value of Pensions in Divorce. This Ohio-based firm also has a website dedicated to attorneys at https://www.qdrodrafting.com.

Where is QDRO Express located?

QDRO Express is based in Taylor, Michigan. Owned by Robert Treat, the firm specializes in QDROs in Michigan and Ohio, but it also works nationally. Their QDRO fees start at $500, and increase from there.

What is QDRO in divorce?

While the term ‘QDRO’ is technically only correct when used to refer to private entity retirement plans governed by ERISA (non-governmental), QDRO is commonly used by divorce professionals to refer to any separate court order that is specific to the division of a retirement asset.

When should a QDRO be filed?

If this is not possible, it should be filed as soon as possible after the divorce is finalized.

Can you divide your pension in divorce?

To divide pension and retirement accounts in divorce, a divorce decree must order that these assets be divided.

How to divide retirement and pension in divorce?

To divide pension and retirement accounts in divorce, a divorce decree must order that these assets be divided. When specified in a divorce decree, the mechanism that is used to split retirement accounts in divorce is as a Qualified Domestic Relations Order, or QDRO (pronounced “quadro”).

What is defined benefit plan?

A defined benefit plan is a traditional pension that pays a retiree a specific amount during retirement. An accrued benefit is the amount of benefits a participant has earned under a defined benefit pension plan as of a particular date.

Can a settlement agreement be divided?

Settlement agreements are often written a bit vague and only describe “retirement plans to be divided” without specifying whether they are defined benefit or defined contribution plans. In some cases, retirement plans are a hybrid of both, which can make the tasks of division more challenging.

Who is Jason Crowley?

Jason Crowley is a divorce financial strategist, personal finance expert, and entrepreneur. Jason is the managing partner of Divorce Capital Planning, co-founder of Divorce Mortgage Advisors, and founder of Survive Divorce. A leading authority in divorce finance, Jason has been featured in the Wall Street Journal, Forbes, and other media outlets. He is a Chartered Financial Analyst, Certified Financial Planner practitioner, and Certified Divorce Financial Analyst. You can email him at [email protected].

What is a QDRO order?

If you are getting divorced from your spouse and are seeking a portion of your spouse’s retirement account , you will likely need a QDRO (Qualified Domestic Relations Order) or a QILDRO (Qualified Illinois Domestic Relations Order) drafted and entered in court to successfully obtain your portion of these accounts. Having an experienced family law attorney to carefully draft these orders is important as these orders are very complex and require nuanced provisions and protections that must comply with federal and state law. At The Law Office of Tiffany Hughes, our attorneys are experienced in preparing and entering QDRO’s and QILDRO’s to get you the money that you are entitled to.

What is a QDRO in Illinois?

Qualified Domestic Relations Order (QDRO): If your spouse does not work for the State of Illinois or the City of Chicago, and has a retirement account, you will need to have a QDRO drafted, approved by the financial institution and then entered in court to obtain your portion of your ex-spouse’s account. A QDRO allows the funds in your spouse’s ...

What is QDRO in retirement?

A QDRO allows the funds in your spouse’s retirement account to be divided, creating a new account in just your name with your portion of the monies, without tax penalties. QDRO’s are controlled by and must comply with federal law.

Popular Posts:

- 1. what is attorney-client privilege quizlet

- 2. what can and cannot a power of attorney do

- 3. where in carmi can i get power of attorney form

- 4. quickbooks 2013 why won't attorney show up on 1099 summary?

- 5. how much time does an attorney need to work on a case

- 6. attorney how to get cost for va treatment

- 7. what enables an attorney to charge collection fees?

- 8. how do i get a court appointed attorney in california

- 9. what branch is attorney general

- 10. who can use attorney