Full Answer

Is a power of attorney right for you and your heirs?

The power of attorney (POA) is essential for every estate plan, but it often is oversold by estate planners. The shortcomings of POAs aren’t well-known and could bite you or your heirs without proper preparation. You and your heirs need to know some things about the POA, both its uses and limits.

Who is the principal of a power of attorney?

A person who requires someone to make decisions and sign documents on their behalf can assign a Power of Attorne y to another individual. They can choose a trusted individual from among their friends and family, or they might choose their attorney. The person who designates the power of attorney is known as the principal.

Is a health care power of attorney the same as a will?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Does your estate plan need a power of attorney (POA)?

Your estate plan needs an up-to-date power of attorney (POA), but it also needs more. The power of attorney (POA) is essential for every estate plan, but it often is oversold by estate planners. The shortcomings of POAs aren’t well-known and could bite you or your heirs without proper preparation.

What makes someone an heir?

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

What is the difference between beneficiary and heir?

At a high-level, the main difference is an heir is a descendent or close relative who is in line to an inheritance if you don't properly set up your Estate Plans. By contrast, a beneficiary is somebody who you name, through a formal legal document, to be the recipient of your assets or property after you pass away.

Who are the heirs of a deceased person?

Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

What is the difference between a Devisee and an heir?

Heirs are generally related to a decedent by blood, adoption, or marriage. By contrast, a devisee can receive property from a decedent simply by being designated in the decedent's Will and does not necessarily have to be related to the decedent.

Who is a legal heir?

The parents, spouse and children are the immediate legal heirs of the deceased person. When a deceased person does not have immediate legal heirs, then the deceased's grandchildren will be the legal heirs.

Are siblings considered heirs?

When siblings are legally determined to be the surviving kin highest in the order of succession, they will inherit the assets in their deceased sibling's Estate. And they inherit it equally. If there is one surviving sibling, the entire Estate will go to them.

Who is the next of kin when someone dies without a will?

Parents, brothers and sisters and nieces and nephews of the intestate person may inherit under the rules of intestacy. This will depend on a number of circumstances: whether there is a surviving married or civil partner. whether there are children, grandchildren or great grandchildren.

What happens to bank account when someone dies without a will?

What happens to a bank account when someone dies without a will? If someone dies without a will, the bank account still passes to the named beneficiary for the account.

Does power of attorney override next of kin?

While next of kin is a relationship designation, power of attorney is a legal designation. You can choose almost any adult you want as your power of attorney. It's a good idea to make sure they're on board with this responsibility, though.

Can an executor decide who gets what?

Can an Executor Make a Decision about “Who gets What”? No. The Executor cannot decide who gets what . The executor, among other duties, is responsible for the distribution of your assets in accordance with the instructions contained in the will.

Is a Devisee the same as a beneficiary?

Beneficiary– a person entitled to any part or all of an estate. Legatee– a person designated by a will to receive a transfer of personal property. Devisee– a person designated by a will to receive a transfer of real property.

What is considered a Devisees?

Typically, a devisee is an individual who receives real estate property from another person through the latter's last will and testament. Their inheritance is strictly land and real estate, not personal property. These days, a devisee does not need to be related to the decedent.

Why do you need a power of attorney?

For starters, here’s why you need more than a power of attorney for you and the estate to be protected. Bills must be paid and assets managed, even if you aren’t able to do the tasks. In a power of attorney, you appoint an agent to step in and perform those tasks. An effective POA can protect your assets, smooth the transition of your estate, ...

What is POA in estate planning?

The POA is a time-tested legal document. Each state has settled law, and since 2006, over half the states updated their laws by enacting versions of the Power of Attorney Uniform Law. Estate planners are very comfortable with the document and recommend one for every estate plan.

How many states have adopted the Uniform Power of Attorney Act?

Your agent also should be aware that some responsibilities might come with the authority. The Uniform Power of Attorney Act has been adopted in more than 25 states, with more states likely to adopt it in coming years. The act imposes recordkeeping requirements on an agent, and many states that haven’t adopted the act impose similar ...

What is required of a POA?

The agent empowered under a POA is required to keep records of all transactions made under the POA. In addition, if a family member or other interested party requests to see the records or wants an accounting of how money was handled, the agent is required to comply.

How long does a POA have to be signed?

Many require the power of attorney to be signed within the last six months, and I’ve talked to financial firms that require the POA to be no more than 60 days old unless it has been certified by a bank officer.

Is a power of attorney necessary?

While a power of attorney is necessary, there are disadvantages and potential problems. An alternative, or better yet a complement, is the revocable living trust. The living trust often is recommended ...

Can an agent sue for a POA?

An agent can sue to have a POA recognized. But that will take time and money, defeating the purpose of the POA. Also, courts give financial firms a lot of leeway in declining to accept POAs, and your agent will have to pay the firm’s legal fees if the court sides with the firm.

David W. Jacobsen

I completely agree with my colleagues. I would add that your brother's power of attorney ends at your father's death and your brother must now be acting as the Personal Representative of your father's estate. As Personal Representative your brother has a fiduciary duty to you and your siblings which includes an accounting of all estate assets.

Joseph Franklin Pippen Jr

I agree with my colleagues-you need to hire your own attorney to get any results.

James P. Frederick

I agree with Mr. Hardesty. It is unlikely that you are going to be able to get the attorney's attention in the manner you have tried. Hiring an attorney would be best. At the very least, stop trying to call and create a documented paper trail, so if things continue in this manner, you have something you can provide to the judge.

Timothy Joseph Hardesty

You need to hire your own attorney. The attorney handling the estate represents the executor (your brother), not the estate and not the beneficiaries. If you think your brother is improperly utilizing the assets of the estate, you need to hire an attorney in MN to represent you and discuss your rights and options.

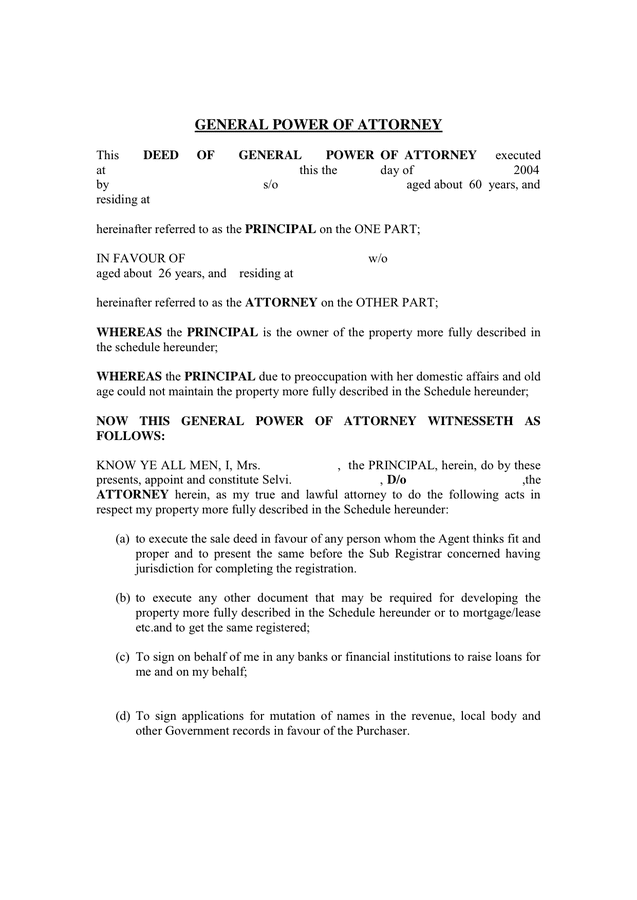

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Who is a fiduciary under a power of attorney?

A person who acts under a power of attorney is a fiduciary. A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing.

Can a power of attorney go into effect if you are mentally incompetent?

Specify in the power of attorney that it cannot go into effect until a doctor certifies you as mentally incompetent. You may name a specific doctor who you wish to determine your competency, or require that two licensed physicians agree on your mental state.

How Does Power of Attorney Work?

Power of Attorney works by allowing someone to make important decisions on your behalf, should you become incapacitated or medically unable to do so. The purpose of officially nominating a POA is to ensure that someone can act on your behalf in a timely manner should they ever need to.

What Are the Limitations of Power of Attorney?

While a Power of Attorney has robust legal rights when it comes to managing the affairs of the Principal, there are certain limitations to be aware of. These limitations are in place to help regulate the role of POA:

Common Questions About Power of Attorney Rights

The Power of Attorney rights and limitations exist to ensure both parties understand exactly what the role entails. However, there are a few gray areas that may require more context to understand:

What is a power of attorney?

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

What are the drawbacks of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if they are ignorant of the principal’s wishes, or it may be intentional because they’re acting in bad faith.

What does POA mean in a power of attorney?

The POA gave you the authority to act on his behalf in a number of financial situations, such as buying or selling a property for him or maybe just paying his bills.

Who can deal with a POA?

His estate owns it, so only the executor or the administrator of his estate can deal with it during the probate process. 1 .

What happens if you don't leave a will?

When There's Not a Will. The deceased's property must still pass through probate to accomplish the transfer of ownership, even if he didn't leave a will . The major difference is that his property will pass according to state law rather than according to his wishes as explained in a will. 3 .

When do you have to file a will for your parents?

Your parent's will must, therefore, be filed with the probate court shortly after his death if he held a bank account or any other property in his sole name. This begins the probate process to legally distribute his property to his living beneficiaries.

Can you pay bills after a deceased person dies?

You might think that you should continue paying those bills and settling his accounts after his death, but you should not and you can' t—at least not unless you've also been named as the executor of his estate in his will, or the court appoints as administrator of his estate if he didn't leave a will.

Can someone take care of his affairs after his death?

Someone is still going to have to take care of his affairs after his death, but it won't necessarily be the agent appointed in a power of attorney during his lifetime.

Can you get a power of attorney after death?

You can't get a power of attorney to act for someone after he's died, and an existing power of attorney becomes invalid upon the death of the principal—the individual who gave you the right to take certain actions on his behalf. 1 . Someone is still going to have to take care of his affairs after his death, but it won't necessarily be ...

What is a power of attorney?

The individual who is given legal power of attorney is called the agent. They can be given broad or limited is power of attorney good after death. With broad powers, the power of attorney has unlimited authority over legal and financial transactions, as allowed by state law.

What does a power of attorney represent?

So while a power of attorney represents a principal in life, the executor represents the principal in death. Though the executor is only required to follow the instructions laid out by the will. In the case there is no will, the intestate laws of that state decide the estate of the deceased.

What is a non-durable power of attorney?

There are two types of power of attorney: durable and non-durable. If a person is assigned non-durable power of attorney, their duty expires when the principal becomes incapacitated. When is power of attorney valid after death the principal of incapable of handling their own affairs, a non-durable power of attorney is power ...

What age do you need legal help with POA?

Need Legal Help? 58% of people age 53 to 71 have estate planning documents that will help manage their estate in the event of POA after death. When that happens, an estate executor is named that will take over the legal and financial obligations of the deceased.

Who takes care of a person's estate after death?

Following a death, the executor of the estate takes care of a person’s estate according to the term is power of attorney good after death. For more legal information regarding lawyer for estate planning and laws, be sure to check out our blog.

Who is responsible for legal and financial matters after the expiration of a power of attorney?

Following the expiration of the power of attorney, the executor of the state is responsible for legal and financial matters. Named by the will, the executor is bound by the provisions of that is power of attorney good after death.

Does a durable power of attorney expire?

On the other hand, a durable power of attorney would continue in their role despite incapacitation. This type of power of attorney doesn’t provide authority over life or death health care decisions. And although it provides a broader range of powers, it also expires upon death.

Popular Posts:

- 1. attorney general a. mitchell palmer hunted down what three groups

- 2. where do attorney fees go on tax return

- 3. how to find a qualified disability attorney

- 4. why doesn't the losing side have to pay the attorney fees

- 5. was does an attorney call when the contendant when a question leads to an answer.

- 6. if i fight a ticket in court and win who pays my attorney fee

- 7. lawyer title example

- 8. yahoo answers how to choose power of attorney for siblings

- 9. how long does an attorney keep a client file in north carolina?

- 10. how to file a proof of claim without attorney