What is IRS Form 2848?

Apr 05, 2021 · IRS Form 2848, Power of Attorney and Declaration of Representative, authorizes an Enrolled Agent, CPA, or attorney to represent you before the IRS. You may need one if you want someone to help you resolve a tax problem or back taxes. …

Who can sign a 2848?

Jan 18, 2022 · When do you need Form 2848? Not just anyone can be granted power of attorney with the IRS. While you can authorize immediate family members to act on your behalf, this form is most often used to authorize a tax professional to deal with the IRS for you. This includes: Attorneys; CPAs; Enrolled agents; Enrolled actuaries

How to file Form 2848?

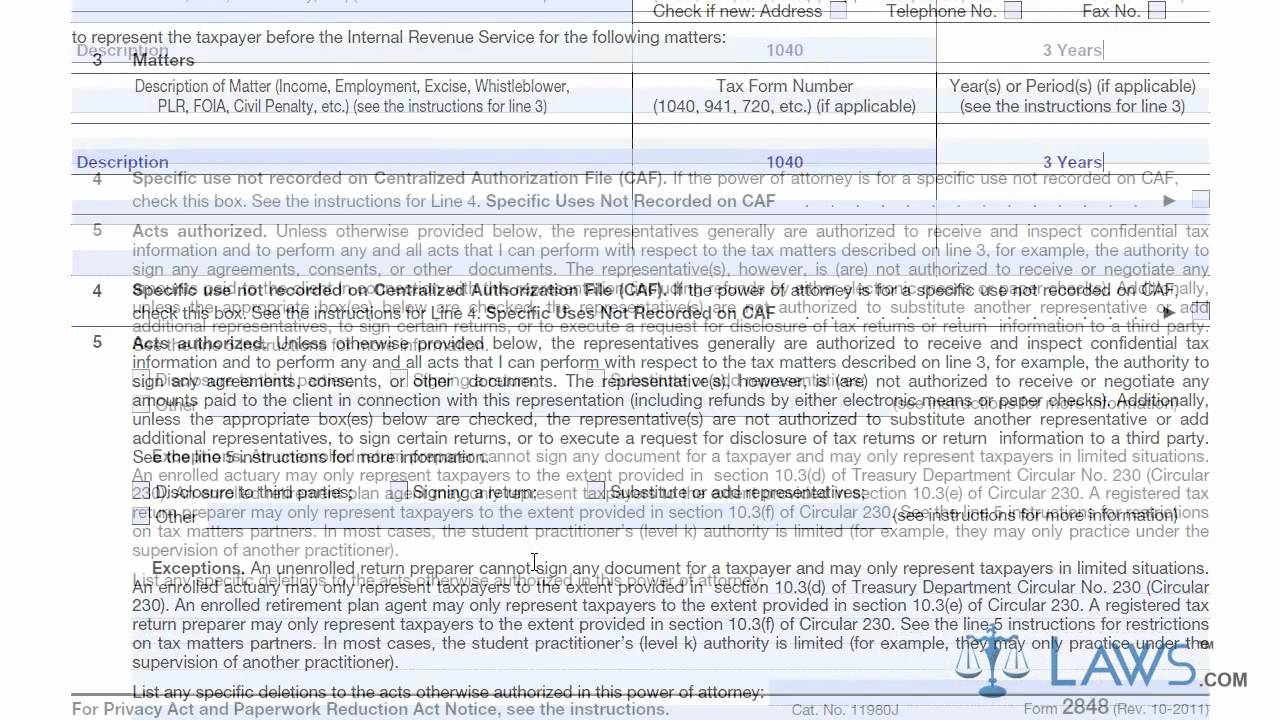

Power of Attorney . Caution: A separate Form 2848 should be completed for each taxpayer. Form 2848 will not be honored for any purpose other than representation before the IRS. 1. Taxpayer information. Taxpayer must sign and date this form on page 2, line 7. Taxpayer name and address . Taxpayer identification number(s) Daytime telephone number

Where do I file Form 2848?

Feb 10, 2021 · Form 2848: Power of Attorney and Declaration of Representative is used to authorize an individual to appear before the IRS to represent a taxpayer. Education General

What is the 2848 form used for?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.Mar 8, 2021

Who can file form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

How many years can a form 2848 cover?

Under “Years or Periods,” be specific. Do not write “all years.” Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.Nov 8, 2021

How do I fill out a power of attorney form 2848?

0:352:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe name and address followed by the CAF. Number telephone number and fax number the form 2848.MoreThe name and address followed by the CAF. Number telephone number and fax number the form 2848. Allows the taxpayer to elect the scope of the power of attorney granted.

What is the difference between form 8821 and 2848?

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.Jan 25, 2021

Should I use form 2848 or 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

Can 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

Does IRS recognize POA?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Where do I send my 2848?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows

How long does it take the IRS to process a power of attorney?

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

How many years can an IRS power of attorney cover?

three yearsThe IRS will not process a POA that includes more than three years. If a POA needs to be filed for more than three years, multiple forms need to be filed at the same time. A POA can be prepared up to two years in advance, counting from the last year of actual filing.Apr 1, 2016

What is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the ...Sep 3, 2021

What is a power of attorney?

Your power of attorney may list a specific problem, a specific year, a specific form, or a broad range of time. This helps to make clear exactly what the professional is helping you with. It also protects your personal information that isn’t needed for that representation.

Who should fill out an engagement letter?

Your Enrolled Agent, CPA, or tax attorney should provide you with a filled-out form. Make sure that what’s listed on your form matches your engagement letter and what you expect the tax professional to do. If you aren’t sure of what something means or why it’s there, ask questions before you sign.

Can a representative sign a refund check?

A representative may never sign or endorse your refund check or deposit it into their own account even with a power of attorney. A Form 2848 is not needed if a tax professional helps you to write a response to the IRS that is sent under your name and signature, but they will not have the power to follow up with the IRS.

Do you need a signature for Form 2848?

You must use an original, handwritten signature for signing Form 2848. Because of the importance of this form, the IRS does not accept electronic signatures.

Is a power of attorney enough for the IRS?

A general power of attorney is not enough. The substitute form must contain all of the information required on the IRS Form. Your representative must also attach a Form 2848 (without your signature) for IRS tracking purposes.

How many representatives can you list on Form 2848?

You can list up to three representatives on the form. By checking a box under the person's name, you can authorize the IRS to send copies of any confidential tax information to them. This includes copies of tax return transcripts and IRS notices. Form 2848 also allows you to define the scope of authority you wish to give your representative, ...

How long does a power of attorney last?

An IRS power of attorney stays in effect for seven years, or until you or your representative rescinds it. To revoke an IRS power of attorney, you either file a new form naming someone else as power of attorney or write "REVOKE" across the top of the first page. Then sign and date below the annotation and mail the form to the address listed in ...

What line do you enter income on a 1040?

For example, if you want to allow an enrolled agent to discuss your 2019 Form 1040 income tax return with the IRS, you will enter Income, Form 1040 and 2019 on line 3. By limiting their scope of authority, you ensure that the representative can't discuss other types of tax returns or other tax years without your authorization.

What is an unenrolled return preparer?

Unenrolled return preparers (only if they prepared the tax return in question) Corporate officers or full-time employees (for business tax matters) Enrolled retirement plan agents (for retirement plan tax matters) Representatives who work in a qualified Low Income Taxpayer Clinic or Student Tax Clinic Program.

Can you authorize immediate family members to act on your behalf?

While you can authorize immediate family members to act on your behalf, this form is most often used to authorize a tax professional to deal with the IRS for you. This includes: There are several reasons you might want to appoint an IRS power of attorney.

Can a CPA give a power of attorney?

If you're being audited by the IRS, giving your CPA power of attorney allows them to work directly with the auditor. If you have a medical condition that makes it difficult for you to communicate with the IRS, you can give a family member the authority to call the IRS to discuss your tax issues.

Can you talk to someone about taxes?

To protect your privacy, IRS employees won't talk to just anyone about your taxes. To give them permission to discuss your taxes with someone else, you'll need Form 2848. You may have heard the term "power of attorney" in the context of giving someone the legal right to make medical or financial decisions on your behalf.

What is a 2848 form?

IRS Form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the IRS. Authorized representatives, include attorneys, CPAs, and enrolled agents. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability.

What is 8821 power of attorney?

Whereas Form 2848 allows a power of attorney to represent a taxpayer before the IRS, Form 8821: Tax Information Authorization empowers someone to receive and inspect your confidential information without representing you to the IRS. 9 In other words, you may use Form 8821 when you want someone merely to see your tax information—as when you're applying for a mortgage and need to share your tax information with your lender.

Is Form 2848 the same as a POA?

Form 2848 is similar, but not identical, to a power of attorney (POA). It does not, however, relieve or indemnify the taxpayer of any tax liability.

Who can represent a taxpayer?

Authorized individuals or organizations include attorneys or law firms, CPAs, and enrolled agents. These agents can fully represent taxpayers to the IRS. 6 . The IRS also allows individuals who are related to the taxpayer, such as family members or fiduciaries, to act as third-party representatives.

Is it necessary to say all forms?

Saying "all forms" is not sufficient. Year or period of applicability—for example, 2020. Saying "all years" or "all periods" is not sufficient. You'll also need to provide specific information about your agent or representative such as: Name, address, telephone number, and fax number.

Do you have to file Form 2848?

So, you must file a Form 2848 with the IRS before anyone other than yourself may receive and inspect your tax information, and represent you to the IRS. 2 .

What is Form 2848?

Form 2848 requires that the authority that is granted is time specific – so the agent will have the power to request and view tax records, prepare and sign agreements, consents, and waivers, and tackle other administrative matters for just the specified year or years.

Where to mail Form 2848?

The completed Power of Attorney and Declaration of Representative Form (IRS form 2848) should be mailed to the appropriate regional IRS office. There are three national centers that receive paperwork – in Tennessee, Utah, and Pennsylvania.

How long can a primary filer have access to a future record?

And the representative may be granted advanced access to future records up to three years beyond the present filing year.

Who can be a stand in for the IRS?

This means people with appropriate formal credentials, such as lawyers, tax accountants, actuaries, and other professionals, family members of the primary filer, and those with appropriate tax-preparation training. Once granted power of attorney, the agent is empowered to act as a stand-in in dealings with the IRS.

What is a 2848 form?

Form 2848 is used to designate an individual to represent the taxpayer before the IRS and to allow the representative to perform all tax acts that the taxpayer would normally take care of. A taxpayer can limit which duties their representative can perform by attaching a statement to the power of attorney explaining exactly what their duties will be. Without limitations, the representative will be able to sign consents extending the time to assess tax, record the interview, sign waivers agreeing to tax adjustments, sign closing agreements, and also receive refund checks.

How to access Form 2848?

To access Form 2848, from the Main Menu of the Tax Return (Form 1040) select: Plan Number - The program will pull the taxpayer name (s), address, SSN (s) and daytime phone number. If an Employer Identification Number and/or Plan Number applies, enter these items in this menu. Select New to enter in the information for the representative.

What to do if CAF number has not been assigned?

Check the appropriate box to indicate if either the address, telephone number or fax number is new since a CAF number has been assigned. Select the designation for the representative.

What is a 2848 form?

Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below.

How many years can you list on a power of attorney?

Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.

What is line 3 on a 1040?

Line 3 – Acts authorized: These are the acts you, the representative, are being authorized to perform. If you’re simply filing a return for a parent, you can list “Income” under “Description of Matter.”. Write 1040 for the tax form number if you’re filing a basic tax return for your parent.

What does "accept payment" mean?

accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative (s) or any firm or other. entity with whom the representative (s) is (are) associated) issued by the government in respect of a federal tax liability.

What to do if you don't have a CAF number?

If you don’t have one, enter “none” and the IRS will assign a number to you. You should get a letter from the IRS with your CAF number, which you will need to use when you send a Form 2848 along with each year’s tax return for your parent. You can leave PTIN blank (this is a number assigned to paid tax preparers).

What is Form 2848?

IRS Form 2848, Power of Attorney and Declaration of Representative, allows one or more individuals listed on the form to contact the IRS on your behalf.

What is a POA in the IRS?

IRS Definition. A Power of Attorney (POA) allows a third party to represent you before the IRS. The authorized individual can advocate, negotiate, and sign on your behalf. They can argue facts and the application of law. POAs can receive copies of notices and transcripts of your account.

Who can receive copies of notices and transcripts of your account?

POAs can receive copies of notices and transcripts of your account. Authorized individuals can include attorneys, certified public accountants, enrolled agents, general partners, full time employees, family members, and others. POAs must be in writing.

Popular Posts:

- 1. where to get a power of attorney ohio

- 2. how to get a ssdi attorney

- 3. who was the state's attorney on mohammad saleem case

- 4. how do i get a power of attorney in louisiana?

- 5. what type of attorney needed to put home into a trust

- 6. how can an attorney slant a juror

- 7. how muchare attorney fees inmass. for probate

- 8. how many years is the mo attorney general

- 9. why restaurant business needs attorney in general?

- 10. attorney who sues unum