A credit lawyer works for you to:

- Work with the credit bureaus to remove errors from your credit report

- Work with the credit bureaus to remove negative items from your report sooner than they might fall off naturally

- Possibly settle with debt collection companies for a fraction of your original debt or a workable payment plan of some type

What is a credit Lawyer called?

Sep 09, 2021 · A credit lawyer is a person knowledgeable in credit-related laws who works on your behalf to repair your credit. They can help you in many ways, including filing credit disputes with the bureaus for you.

What can a credit report Attorney do for You?

Jun 20, 2016 · Credit repair attorneys perform a number of services aimed at repairing your credit, including: Reviewing your credit reports to evaluate potential errors or ways to improve your score Negotiating with credit reporting agencies to remove negative items from your credit report, such as late payments, chargeoffs and foreclosures

Do I need a credit Lawyer to repair my credit?

A credit lawyer is a lawyer who is qualified to assist consumers in repairing errors found in their credit reports, which in turn, can raise the level of their credit score or reinstate their accurate credit score amount.

How much does a credit Lawyer cost?

Jan 11, 2019 · What Does a Credit Lawyer Do? A credit lawyer helps clients with credit repair when their credit ratings have been damaged. Your credit lawyer performs several services aimed at helping you improve your credit score. Some of the services a credit lawyer may perform include: Obtaining copies of your credit report from all for the credit lawyer to review;

Can you sue credit score?

The primary federal law to protect consumers is the Fair Credit Reporting Act (FCRA). This law allows you to sue a credit bureau in federal court for many disputes, such as the failure to correct inaccuracies in your report.Oct 21, 2021

What is a credit law?

The Federal Trade Commission (FTC) enforces the credit laws that protect your right to get, use and maintain credit. ... Instead, the credit laws protect your rights by requiring businesses to give all consumers a fair and equal opportunity to get credit and to resolve disputes over credit errors.

Is a credit score legal?

The good news is that Federal Law regulates the credit reporting agencies. You have a right to a fair and accurate credit report and can dispute information that is inaccurate, unfair or unverifiable.Sep 9, 2021

How do I remove a professional charge off?

How Can You Negotiate a Charge-Off Removal?Step 1: Determine who owns the debt. ... Step 2: Find out details about the debt. ... Step 3: Offer a settlement amount. ... Step 4: Request a "pay-for-delete" agreement. ... Step 5: Get the entire agreement in writing.Feb 9, 2021

What rights do you have as a credit holder?

Any cardholder in the U.S. can count on the following protections:No Discrimination.Full Information Disclosure.Accurate and Timely Billing Statements.Limited Liability for Unauthorized Charges.Ability to View and Correct Your Credit Report.Advance Notice for Any Changes.How to Deal With a Violation of Your Rights.

What are the major laws that regulate credit?

The Fair Credit Reporting Act regulates credit reports. The Equal Credit Opportunity Act prevents creditors from discriminating against individuals. The Fair Debt Collection Practices Act established rules for debt collectors. The Electronic Fund Transfer Act protects consumer finances during electronic payments.May 18, 2020

Who can legally pull my credit report?

The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.May 14, 2019

What is a good credit score in 2021?

FICO says scores between 580 and 669 are considered "fair" and those between 740 and 799 are considered "very good." Anything above 800 is considered "exceptional." According to FICO, the average credit score in 2021 was 716, which falls in the good range.

What can I legally do with my credit report?

You Have the Right to Dispute Inaccurate Information If you find inaccurate or incomplete information in your credit report, you can dispute it with the credit bureau. ... You can also dispute directly with the creditor or business who added the error to your credit report.

Does a charge-off go away after 7 years?

A charge-off stays on your credit report for seven years after the date the account in question first went delinquent. (If the charge-off first appears after six months of delinquency, it will remain on your credit report for six and a half years.)Dec 15, 2019

What is a 609 letter?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.Dec 17, 2021

How can I get a charge-off removed without paying?

How to Remove a Charge-Off Without PayingNegotiate with the Creditor. Negotiating with the creditor usually still involves paying some of the debt. ... Consult with a Credit Repair Company – Buyer Beware. ... Secured Credit Cards. ... Credit Utilization. ... Pay Bills on Time. ... Unsecured Credit Cards. ... Authorized User. ... Credit Rebuilder Loans.More items...•Feb 22, 2022

What is the FCRA?

The FCRA is a federal law that regulates how credit bureaus use your information. Among other things, the FCRA limits who may view your credit reports and under what circumstances they may be viewed. The Act also provides you with the right to correct erroneous information.

Is credit repair a scam?

According to the FTC, you may have encountered a credit repair scam if the credit repair company: Advises you to falsify or omit information on a loan or credit application. You may be held liable for taking any illegal actions, even if they were done on your behalf by a scam company.

Do I need a lawyer to repair my credit?

Although you can do most of the same things a credit repair attorney can do (in other words, you don't have to be a lawyer to repair your credit), it may be difficult. In addition to persistence and time, repairing your credit will likely require, at the least, making a series of phone calls and sending correspondence to credit bureaus.

Can I ignore my credit score?

But given the importance of your credit score (which may make or break your ability to find a home loan or even get a job), you can't afford to ignore it. In situations like these, you may need the help of a qualified credit repair attorney.

What are Credit Laws?

Credit laws refer to a special category of state and federal laws that aim to regulate issues ranging from financial charges to extending pre-established lines of credit. Basically, if a financial institution or company is in the business of lending or offering credit to customers, then it most likely has to comply with various credit laws.

What Types of Matters Do Credit Lawyers Handle?

A credit lawyer is a lawyer who is qualified to assist consumers in repairing errors found in their credit reports, which in turn, can raise the level of their credit score or reinstate their accurate credit score amount.

What Is It Important to Have a Credit Attorney?

Credit attorneys can be a valuable resource for those who face debt collection issues or are involved in a credit dispute. As discussed above, having a good credit score is crucial for gaining access to a loan or being granted a line of credit.

How Do I Know if a Credit Lawyer is Right for Me?

Finding the right credit lawyer depends on a number of factors. For one, you need to hire a lawyer who not only handles credit and/or debt matters, but also practices law in your area.

How to repair credit?

In some cases, the first step to repair your credit is to get rid of bad debt. Filing a Chapter 7 or Chapter 13 bankrupt cy case can eliminate debt. If you can hire a bankruptcy attorney, that is usually advised. However, you can file for bankruptcy relief without an attorney.

What does the FTC do?

The FTC provides information and steps for disputing errors on credit reports. You can perform many of these steps yourself. If you are unable to correct problems on your credit report, you can contact a credit lawyer.

What is consumer protection lawyer?

Consumer Protection Lawyers Who Handle Credit and Debt Problems. Just because someone is a lawyer doesn't mean he or she is knowledgeable in the area of consumer law. If you are going after a credit bureau, original creditor, or collection agency, you need to talk to a specialist in this field. Similar to the medical field, ...

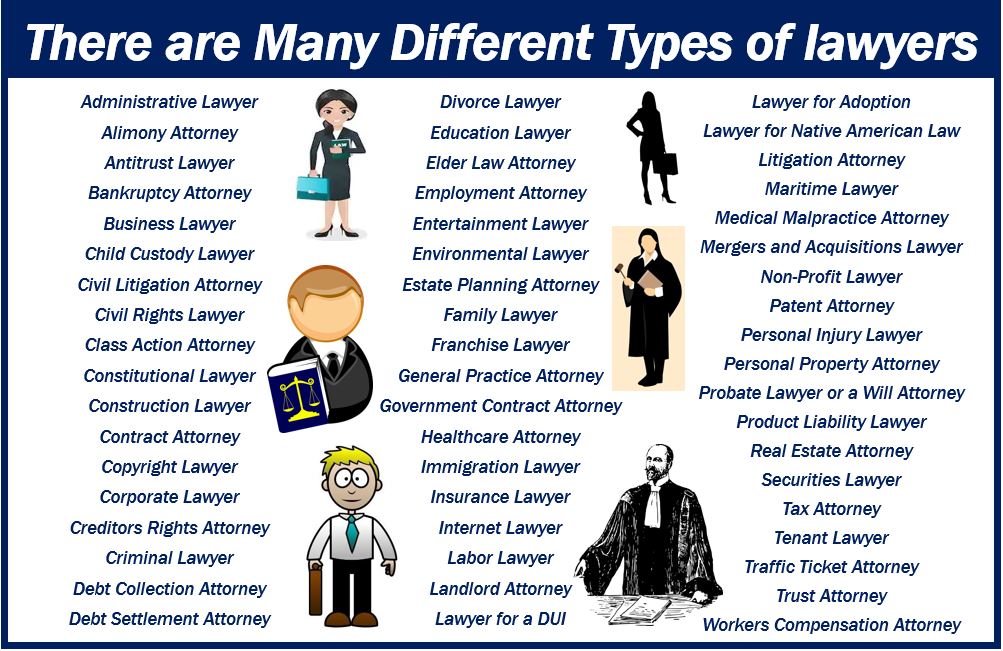

What do lawyers specialize in?

That's why lawyers specialize in fields such as criminal, family, corporate, accident/injury, tax, and credit law. Just as you wouldn't ask a divorce lawyer to handle your credit case, you wouldn't ask a heart specialist to do brain surgery, at least we hope you wouldn't.

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act protects consumers from furnishers and credit bureaus reporting inaccurate information. The FCRA provides for actual damages, attorneys fees and cost, plus the potential for punitive damages when they violate the FCRA.

What happens if you find an account that you didn't authorize on your credit report?

If you find an account that you didn't authorize on your report, this is a problem. You will need an identity theft lawyer for unwanted accounts on your credit report.

How long does it take for a credit report to be corrected?

They have 30 days to correct the inaccurate reporting. If not they have to pay your damages, attorney's fees and costs. Understanding the Fair Credit Reporting Act is the key to the removal of errors.

What is the FCRA?

The FCRA requires CRAs and entities that furnish information to CRAs (“furnishers” or “furnishers of information”) to investigate disputed information. The furnisher of information must: (1) “conduct an investigation with respect to the disputed information”; (2) “review all relevant information provided by the consumer reporting agency” in ...

Can you sue for compensation?

You can sue for compensation with a lawyer under the Fair Credit Reporting Act or FCRA law. This makes them correct your credit report of errors. Disputes are king in the land of the FCRA. If you don't dispute to the credit bureaus, then you may not have a case under the Fair Credit Reporting Act.

CERTS AVAILABLE INSTANTLY

Download or email your certificates as soon as you complete every course.

CUSTOMIZE YOUR BUNDLE

Swap courses to meet your interests. All online bundles are fully customizable.

CLE NATIONWIDE

Accredited from California to Maine, our courses are available for credit in 49 states.

CONVENIENT ACCESS

Work, home, or anywhere in between. Access your CLE on your desktop, tablet, or mobile phone.

QUALITY COURSES

Our faculty provides insightful courses that share their decades of real world experience.

CLE MADE EASY

Complete your CLE requirements in 3 simple steps. Buy a bundle, take the courses, and receive your certificates immediately.

QUALITY CUSTOMER SUPPORT

Got questions? Our knowledgeable staff is available by phone and Live Chat.

Popular Posts:

- 1. 1946 postman always rings twice why defence attorney plead guilty

- 2. what is attorney fee for buying real estate

- 3. who is the #1 rated realestate attorney in hernando, fl

- 4. what power does a president have to terminate an attorney general

- 5. what would a defense attorney do if the client tells them that they committed the crime?

- 6. how to file for a power of attorney

- 7. who are the candidates for california attorney general

- 8. who appointed appointed attorney general

- 9. how much does an uncontested divorce in ohio cost with no attorney needed?

- 10. how long does it take to become district attorney