What happens when my social security case comes up for review?

Apr 14, 2016 · Social Security conducts a disability review of your case approximately every three years depending on the nature and severity of your medical condition and whether it’s expected to improve. If we don’t expect improvement, we’ll review your case every seven years. When we conduct a disability review, if we find that your medical condition hasn’t improved and is still …

What is a Social Security disability review?

This is an action seeking court review of a decision of the Commissioner of the Social Security Administration. Jurisdiction for such proceedings can be based on two statutes. If this complaint seeks review of a decision regarding Disability Insurance Benefits under Title II of the Social Security Act, jurisdiction is proper under 42 U.S.C. § 405(g).

What are the exceptions to the Social Security disability review rule?

Your file should also include copies of all disability applications, forms, and appeals that have been filed, as well as copies of all medical records gathered by disability examiners at Disability Determination Services (DDS). It should also contain your Social Security earnings record, any letters sent by you, your family, or your employer ...

How long does it take for the SSA to review evidence?

Aug 05, 2011 · Review In Federal Court. The review of a final decision of the Social Security Administration concerning disability benefits pursuant to the Social Security Act, 42 U.S.C. 39-406, is limited to two determinations. First, whether the Social Security Administrations findings of fact are supported by substantial evidence.

How long does it take Social Security to do a medical review?

Generally, it takes about 3 to 5 months to get a decision. However, the exact time depends on how long it takes to get your medical records and any other evidence needed to make a decision.

What happens when Social Security reviews your case?

Social Security periodically reviews your medical impairment(s) to determine if you continue to have a disabling condition. If we determine that you are no longer disabled or blind, your benefits will stop. We call this review a continuing disability review (CDR).

How often does Social Security review your case?

If improvement is possible, but can't be predicted, we'll review your case about every three years. If improvement is not expected, we'll review your case every seven years. Your initial award notice will tell you when you can expect your first medical review.

What is the most a disability lawyer can charge?

First, the basics: Federal law generally limits the fees charged by Social Security disability attorneys to 25% of your backpay, or $6,000, whichever is lower. Back payments are benefits that accrued while you were waiting for Social Security to approve your case.

What does it mean final review to make sure that you still meet the non medical requirements for disability benefits?

Non-medical redeterminations are reviews of all of the non-medical factors of eligibility to determine whether a recipient is still eligible for Supplemental Security Income (SSI) and still receiving the correct payment amount.Jul 31, 2018

At what age does SSDI reviews stop?

age 65If you receive benefits until age 65, your SSDI benefits will stop, and your retirement benefits will begin. In other words, your SSDI benefits change to Social Security retirement benefits. Sometimes, SSDI benefits will stop before age 65.

Do denied SSDI claims go to quality review?

Cases are pulled at random to be reviewed by the Disability Quality Branch. These claims include Social Security Disability claims which have been accepted and claims which have been denied. Roughly one in 100 claims is selected to be reviewed by the Disability Quality Branch.

Does Social Security Disability spy on you?

Unlike private insurance companies the SSA does not generally conduct surveillance investigations, but that doesn't mean that they can't or never will. Once you file a disability claim, the SSA looks for proof of your disability.

How do I pass a continuing disability review?

If you want to keep yours, here are some tips on how to pass a continuing disability review:Follow Your Treatment Protocol. ... Learn More About Your Condition. ... Answer the Short Form Honestly. ... Keep Copies of Your Medical Records. ... Inform the SSA of Any Change in Address.Apr 22, 2020

What is the monthly amount for Social Security disability?

Social Security disability payments are modest At the beginning of 2019, Social Security paid an average monthly disability benefit of about $1,234 to all disabled workers.

How is Social Security disability calculated?

Your SSDI payment will be based on your average covered earnings over a period of years, known as your average indexed monthly earnings (AIME). A formula is then applied to your AIME to calculate your primary insurance amount (PIA)—the basic figure the SSA uses in setting your actual benefit amount.

How is SSDI back pay calculated?

Back Pay is determined in relation to the date you filed your disability claim and the date that the Social Security Administration (SSA) decides that your disability began, also known as the “established onset date.” The established onset date is determined by a DDS examiner or an administrative law judge, based on ...

Frequency of Continuing Disability Reviews

- Continuing disability reviews are performed at different frequencies for different recipients, depending on their age and medical condition.

Continuing Disability Review Process

- If your Social Security claim is up for review, the SSA will notify you by mail. The SSA will send you either a copy of the short form, Disability Update Report (SSA-455-OCR-SM), or the long form, Continuing Disability Review Report (SSA-454-BK). The short form is generally for those whose condition is not expected to improve, and is only two pages. If your condition could improve, or i…

Medical Improvement Review Standard

- Assuming you haven't returned to work, Social Security will first determine if there has been medical improvement in your condition. If the answer is no, the continuing disability review process is complete, and your benefits will not be affected. If the answer is yes, the SSA will then decide if th...

If Social Security Finds You Are No Longer Disabled

- If Social Security decides to terminate your benefits because you are no longer disabled and are able to work, you can appeal the CDR decision. See our article on continuing disability benefits while you appealfor information on when your disability benefit checks will stop.

Fee Agreements and Fee Petitions

- To get their fees paid, Social Security lawyers enter into written fee agreements with their clients and submit those fee agreements to Social Security for approval. If Social Security approves the fee agreement, it will pay your attorney for you directly out of your backpay. The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whiche…

What Should Be in A Fee Agreement?

- An attorney must submit a written fee agreement to Social Security before Social Security issues a favorable decision on the claim. Most lawyers will submit the fee agreement when they take your case. Social Security has suggestions for the language in the fee agreements, but there are really only two main requirements. First, the amount of the fee cannot be more than the maximu…

Who Pays For Legal Costs?

- There are two kinds of expenses in a case: the amount the lawyer charges for her time and the expenses she pays for while working on your case. In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled. Those records mig...

Popular Posts:

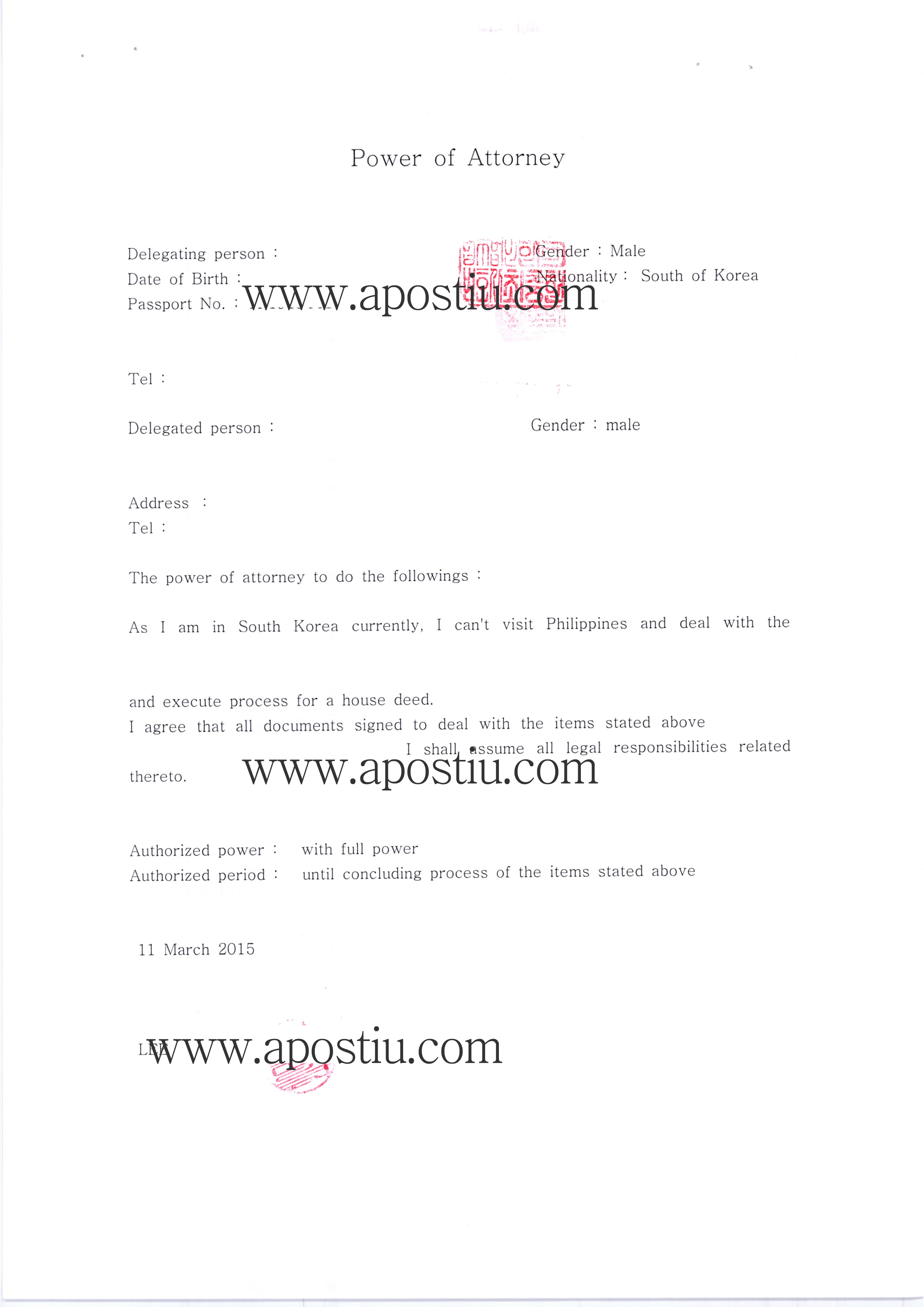

- 1. who gets copies of power of attorney forms

- 2. who to designate as medical power of attorney

- 3. how to obtain power of attorney for parents

- 4. judgement for attorney fees colorado how to file

- 5. my attorney failed to include expenses in my lawsuit - now what

- 6. where can i find mailable power of attorney forms in missouri

- 7. who is the district attorney of minneapolis

- 8. how to sign check as power of attorney

- 9. how is the illinois attorney general checked by the governor

- 10. how to schedule a meeting with district attorney orange, ca