What is a captive insurer?

Jul 01, 2021 · The captive manager and/or the attorney can handle incorporation and drafting bylaws and other formal operating documents. Most domiciles require some referencing to ensure the directors and officers are in good standing.

Why consider a captive?

Lawyer Up. Attorney-Led Captive Planning. Lawyer Up. Attorney-Led Captive Planning. Since 1998, Capstone Associated Services, Ltd. has supported mid-market businesses in forming their own captive insurance companies. Captive insurance is a sophisticated risk and financial planning strategy that is often carried out by self-proclaimed “captive managers” without the requisite …

What does a captive manager do?

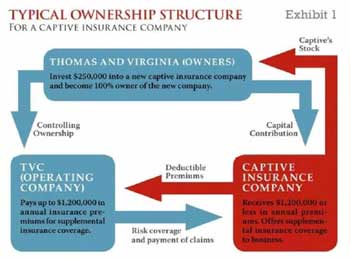

Aug 08, 2018 · August 08, 2018. A "captive insurer" is generally defined as an insurance company that is wholly owned and controlled by its insureds; its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer's underwriting profits. These points do not clearly distinguish the captive insurer from a mutual insurance company.

Does a captive insurance company get a tax break?

A captive insurance company is one that is owned and controlled by those that it insures. Companies of all sizes often will set up captive insurance entities as an alternative to being self-insured. In these arrangements, the captive insurance company is a separate entity with its main purpose being to insure the risks of its owner.

How does a captive work?

The captive provides the owner or its affiliates with insurance coverage for risks that the owner wishes to retain, and the insured entities pay premium to the captive. Any profits made by a captive are retained within the parent company's group rather than being 'lost' to the insurance market.

What are the benefits of a captive?

The advantages of going captive are:Coverage tailored to meet your needs.Reduced operating costs.Improved cash flow.Increased coverage and capacity.Investment income to fund losses.Direct access to wholesale reinsurance markets.Funding and underwriting flexibility.Greater control over claims.More items...

Is captive insurance a good idea?

Captive insurance entities offer a vehicle to self-insure that can be especially cost- and tax-effective. ... Some professionals recommend captive insurance as the greatest thing since sliced bread. Others are wary of getting their clients involved in creating a captive, knowing that the IRS closely scrutinizes them.Jun 1, 2018

What is a captive program?

Defining Captive Insurance. A captive is a licensed insurance company fully owned and controlled by its insureds – a type of “self-insurance.” Instead of paying to use a commercial insurer's money, the owner invests their own capital and resources, assuming a portion of the risk.Oct 6, 2021

How do captives make money?

Like any business, a captive investor and shareholder enter into a transaction to earn a profit and retain the important ability to manage the operating company's risks. Once profitable, dividends are generally available within the purview of the department of insurance and its regulatory scheme for shareholders.Nov 20, 2019

How are captives taxed?

Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes. Captive owners may also deduct losses on unpaid losses as they are incurred, providing an accelerated deduction timeframe from typical insurance arrangements or traditional self-insurers.

What are the disadvantages of captive insurance?

The Disadvantages of Captive InsuranceRaising Capital. Because the entity is essentially self-insured, it needs to raise a substantial amount of capital to keep in reserve to pay for claims. ... Quality of Service. ... No Tax Benefits. ... Inability to Spread Risk. ... Additional Management. ... Difficulty of Entrance and Exit.Sep 26, 2017

Why do companies form captives?

The Purpose of a Captive To be very clear, the purpose of an insurance company and, therefore, a captive is to pay losses (your own losses) and to afford you (the owner) more control over your risk and any losses that do occur. Put another way, captives are an alternative risk transfer mechanism used to finance risk.

What is an example of a captive insurance company?

For example, British Petroleum wisely set up a captive insurance company (Jupiter Insurance Ltd.) to provide environmental insurance to its operating units, and the moneys from its captive were used to fund in substantial part the Gulf cleanup.Feb 22, 2014

What are the three components of any captive?

A captive, an insurance program, and a claims handling operation are all risk management tools that enable the insured organization's owners to decide and follow through on how they would prefer to deal with the risks facing their company. They will need to first identify those risks, to the best of their ability.Jun 26, 2019

What is a P&C captive?

A Captive Insurance Company (captive or CIC) is a property and casualty insurance company established to provide coverage primarily for a parent company. ... Captives often are set up to insure enterprise risk, risk for which commercial insurance is not available or may be too expensive.

What is a reinsurance carrier?

The Reinsurance Carriers industry provides insurance services for insurance companies. Reinsurers assume part or all of the liability for one or more insurance policy and compensate insurers within contracted parameters for prescribed losses incurred under that insurance policy.Oct 26, 2021

What is a captive insurer?

August 08, 2018. A "captive insurer" is generally defined as an insurance company that is wholly owned and controlled by its insureds; its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer's underwriting profits. These points do not clearly distinguish the captive insurer from ...

Why is captive insurance important?

Because captive insurance inherently offers financial rewards for effectively controlling losses, safety and loss control get a higher level of attention. The underwriting profits and gains from the invested premiums that would otherwise be held by a conventional insurer are retained by the captive.

How do captives put their own capital at risk?

Insureds in a captive choose to put their own capital at risk by working outside of the traditionally regulated commercial insurance marketplace. The traditional insurance regulatory environment tries to "protect" the insured from the insurer. Regulations are expensive to implement, costly to monitor, and sometimes fail.

What is ownership and control by its insureds?

Ownership and control by its insureds distinguish a captive insurer from a commercial insurer. This is not the type of ownership or control evidenced by a nominal percentage share in the company's surplus. It means ownership in the company's strategic business purpose.

What is a pure captive?

The term "pure captive" is generally used to describe captives insuring only the risks of their owner or owners. Single-parent captives have only one owner. Group captives have multiple owners. A group captive is formed by a group of individuals or entities that come together to jointly own a captive insurance company.

How does pricing stability work?

Pricing stability is achieved over time as a captive matures and expands its own risk retention capability. The more capital that is accumulated, the greater the captive insurer's ability to retain risk and insulate itself from changes in the commercial insurance market. A captive insurer can also provide stability in the availability of coverage.

Why Representation Is Necessary

Each year, the IRS lists a “dirty dozen” list of items that it considers abusive. For three years in a row, it has included the abusive use of “micro” captive insurance companies.

Let Us Help You

The IRS will be litigating captive insurance companies for the foreseeable future. For a detailed analysis of your captive insurance audit or case related to a captive insurance company, contact Bomar Law Firm at (404) 841-6561. Cal Bomar represents taxpayers in captive insurance cases as well as other tax controversies.

What is captive insurance?

A captive insurance company is a wholly-owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to ...

Why do companies form captive insurance companies?

Forming a captive insurance company can lower a company's insurance costs and provide more specific coverages, but also comes with the additional overhead of running a distinct insurer. Many larger companies will form a captive insurance company primarily due to the tax advantages that it may confer.

Where do captive insurance companies pay taxes?

A parent company will locate the captive insurance company in tax havens, such as Bermuda and the Cayman Islands, to avoid adverse tax implications. Today, several states in the US allow the formation of captive companies. The protection from tax assessment is a sought-after benefit for the parent company.

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction ...

Is BP self insured?

At that time, reports circulated that BP was self-insured by a Guernsey-based captive insurance company called Jupiter Insurance and that it could receive as much as $700 million from it.

Team

Our team is comprised of corporate, transactional, and other attorneys experienced in the formation and regulation of captive and traditional insurance companies.

Our clients span many different industries across the country

We help our clients determine how a captive insurance company might help them reach their goals, and we advise clients regarding the options for structuring their captive in order to maximize the benefits of a captive. Our clients who own captives include companies in the following industries:

Experience to navigate the maze of formation, license applications, statutes, and regulations important to captives

We actively participate in captive industry trade associations and work face-to-face with our clients, insurance regulators, and other insurance industry service providers to help us maintain very good working relationships.

Popular Posts:

- 1. how to settle a personal injury claim without an attorney

- 2. how long after attorney sends bills to liability adjuster will you receive offer on settlement

- 3. can hearing for custody take place when attorney disqualification is pending in pennsylvania

- 4. comedy film where attorney has speech imipediment

- 5. who is prosecuting attorney in bay city michigan

- 6. how do i find out if attorney waived fee or not

- 7. when was jeff sessions elected to attorney general office?

- 8. how much is the attorney general of us paid

- 9. how to get proof of power of attorney

- 10. how to get an ecuador 9-1 residency visa - pensioner: how to do it yourself, without an attorney