Where do I file Rt 6 in Florida?

The fastest and most efficient way to file a Florida RT-6 Form is online. You need to register on the DOR website at floridarevenue.com. The DOR will then send you a User ID, PIN or Password, and instructions for filing and paying the reemployment tax.

What is a Florida revenue number?

Taxpayer Assistance: 850-488-6800. For assistance with Florida taxes. (Sales and Use, Reemployment, Corporate Income, Documentary Stamp, etc.)

How do I get a Florida RT number?

The easiest way to get a Reemployment Tax Account Number is to register for an online account with the Florida Department of Revenue (DOR). Once you successfully enroll, you'll receive your seven-digit Reemployment Tax Account Number.

Is there a Florida state tax form?

Since Florida does not collect an income tax on individuals, you are not required to file a FL State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

Is Ein the same as tax ID?

Your Employer Identification Number (EIN) is your federal tax ID. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It's free to apply for an EIN, and you should do it right after you register your business.

Does the Florida Department of Revenue call you?

The FL DOR now uses an automated calling system to call taxpayers when the DOR thinks taxpayers are delinquent on tax returns, late on payments, haven't filed some obscure form, or checked the right box on an online tax application.Jul 28, 2013

What is a 941 form?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.Nov 24, 2021

How do I get my Florida unemployment 1099 G?

The fastest way to receive a copy of your 1099-G Form is by selecting "electronic" as your preferred method for correspondence. You can log-in to your Reemployment Assistance account and go to "My 1099-G" in the main menu to view the last five years of your 1099-G Form document.

What is a Florida Certificate of Registration?

Simply put, a certificate of good standing, also called a certificate of status, serves as legal proof that you properly registered your business with the Florida Secretary of State. The certificate shows that your company is authorized to conduct business in the state of Florida.Feb 12, 2021

Does Florida have a w4 form?

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.Jan 20, 2022

What information does the W 2 form provide?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck.Feb 25, 2022

Does Florida have state and federal taxes?

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn't tax earned wages. States with no income tax often make up the lost revenue with other taxes or reduced services.

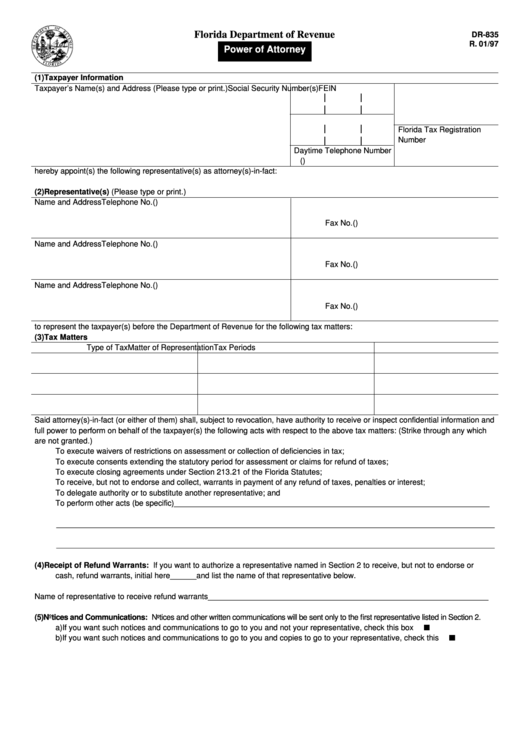

What is a power of attorney in Florida?

A Power of Attorney is a legal document authorizing someone other than yourself to act as your representative.

Do you have to complete section 3 of DR-835?

Complete this section only if you wish to appoint an agent for unemployment taxes on a continuing basis. You should not complete Section 3 or Section 6, but you must complete the remaining sections of Form DR-835.

Do husband and wife sign a joint return?

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate officer, partner, member/managing member, guardian, tax matters partner/person, executor, receiver, administrator, trustee, or fiduciary on behalf of the taxpayer, I declare under penalties of perjury that I have the authority to execute this form on behalf of the taxpayer.

Is a social security number public records in Florida?

Social security numbers are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes and are confidential under sections 213.053 and 119.0721, Florida Statutes, and not subject to disclosure as public records.

How to fill out and sign DR-904 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

Handy tips for filling out Florida Department Of Revenue Power Of Attorney Form online

Printing and scanning is no longer the best way to manage documents. Go digital and save time with signNow, the best solution for electronic signatures.

How to create an eSignature for the florida department of revenue power of attorney 2009 form

Speed up your business’s document workflow by creating the professional online forms and legally-binding electronic signatures.

Government Leasehold Intangible Personal Property Tax

Learn more about Government Leasehold Intangible Personal Property Tax.

Property Tax (Ad Valorem Tax)

If you're looking for a property tax form not listed below, contact your local county official (Property Appraiser, Tax Collector, Clerk of Court, Board of County Commissioners, or Value Adjustment Board).

Refunds

Learn more about Refunds, except Fuel Tax. Learn more about Fuel Tax Refunds.

Ordering Forms

If you need multiple copies of a tax form or cannot print tax returns in color, you can order forms to be mailed to you. You can also check your order status.

Florida Alternative Tax Forms

Developer companies can create products to produce hardcopy forms called alternative tax forms. For more Information, visit the Department's Florida Alternative Tax Forms Vendor Information webpage. The Approved Alternative Form Vendors list is available for your convenience.

Popular Posts:

- 1. who can be named as a durable power of attorney surrogate

- 2. why injury attorney begin to fight with me

- 3. how a michigan attorney files to practioce in another state

- 4. who who top attorney

- 5. how to use bank account with durable power of attorney

- 6. attorney neal who work at larry pitts office

- 7. who does the district attorney work for

- 8. which branch is the fulton county ga district attorney

- 9. an attorney who represents himself quote

- 10. why would the attorney general want to confirm my address