The Social Security Administration (SSA

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

How much will I pay in SSDI attorney fees?

Sep 10, 2021 · Social Security disability attorneys charge their attorney fees on a contingency fee basis. Under this type of agreement, you would not owe any up-front attorney fees. Here’s how payment of the fees works: You would only owe attorney fees if you win your case. If you do not receive SSDI benefits, you would owe no attorney fees. Your lawyer cannot charge you more …

How much does a Social Security disability lawyer cost?

Our survey showed that the overall average attorney's fee was $2,900 in SSI cases. When Disability Lawyers Don't Charge Anything. Aside from the fact that lawyers generally won't receive a fee if their clients don't get an award for Social Security disability, a few of our readers' attorneys didn't take any payment even when they won the case.

Does social security pay the disability attorney fee?

Feb 08, 2022 · Again, the maximum a disability attorney or nonattorney advocate can charge is 25% of your backpay, up to a maximum of $6,000. For example, if your back-dated benefits are calculated to be $10,000, your representative will be paid $2,500 and you will receive $7,500.

When to talk to a Social Security disability lawyer?

What is the maximum fee a Social Security Disability attorney can charge? If you decide to get representation for your disability claim with the social security administration, you can choose to be represented by an attorney or a non-attorney. This may be surprising to some, the fact your claim may be represented by someone who is not a lawyer.

What can disability money be spent on?

How does SSDI calculate back pay?

Count the months between your EOD and application date to determine retroactive months. The number of months between the EOD and approval date, minus the five-month waiting period, plus the retroactive months, times your monthly payment equals the total amount of back pay due.

What is the minimum payment for SSDI?

How is SSDI calculated?

What is the maximum back pay for SSDI?

How many months does SSDI back pay?

Is there really a $16728 Social Security bonus?

How can I get more money from SSDI?

...

Cost of Living Adjustment

- 2018 – 2.8%

- 2019 – 1.6%

- 2020 – 1.3%

What disability pays the most?

- According to the Social Security Administration (SSA), the maximum monthly Social Security Disability benefit is $3,345 per month in 2022-up from $3,148 in 202. ...

- Our disability lawyers understand how the SSA determines the benefit amount for disability recipients.

How is disability calculated if you never worked?

Unfortunately, if you've never worked, you will not be eligible to receive SSDI payments. The SSDI program is meant for people who are injured during their work, and the number of payments a person receives is directly related to their work and income history.Mar 16, 2017

Is Social Security giving extra money this month?

Is SSDI taxed?

As of 2020, SSDI payments are considered taxable for individuals who have over $25,000 in yearly income or married couples with over $32,000 in yearly income. (Your income is one-half of your SSDI benefit plus the full amount of any other sources of household income.)

How much can an attorney charge for Social Security?

The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whichever is less. That limit on fees is a part of Social Security law, and in most cases, an attorney can't charge more than that.

How much can a disability lawyer charge?

If a disability case requires multiple hearings or an appeals to the Appeals Council or federal court, a disability lawyer is permitted to file a fee petition with SSA to request to be paid more than the $6,000 limit. Social Security will review the fee petition and will approve it only if it is reasonable. To learn more, read Nolo's article on when a lawyer can file a fee petition to charge more than $6,000 .

What expenses do lawyers pay for Social Security?

In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled.

What does a disability lawyer do?

A disability lawyer generally gets a quarter of your Social Security back payments, if you win. Social Security attorneys work "on contingency," which means that they collect a fee only if they win your disability claim. Whether you are applying for SSDI (Social Security disability) or SSI (Supplemental Security Income), ...

How much can a lawyer collect on Social Security backpay?

For example, if your backpay award is $20,000 , your attorney can collect $5,000 (25% of $20,000). Second, the agreement must be signed by the Social Security claimant and the attorney. If the claimant is a child, a parent should sign for the child. If the claimant is an adult with a guardian, the guardian should sign.

How much does it cost to copy a medical record?

Usually, copying and mailing costs in a case are not more than $100 - $200.

Do you get paid for SSDI if you have an attorney?

Even if your case goes on for years, an attorney will not get paid until it is over (and won).

Social Security Disability Fee Agreement

The SSA regulates the payment of SSD attorney’s fees. Before accepting your case, the attorney will have you sign an SSD fee agreement, which covers how the attorney’s fees will be paid, and how much that payment will be. The SSA must approve the fee agreement.

Determining SSD Attorney Fees

Federal law limits attorney’s fees in SSD cases. The maximum amount of attorney’s fees that can be collected in an SSD case is 25% of any back pay awarded, up to a maximum fee of $6,000 (there are a few exceptions which allow an attorney to receive an increased fee, as discussed below).

How much do disability representatives get?

In the vast majority of cases, representatives (whether they are attorneys or, like Citizens Disability, specialized advocates) will receive 25% of any back due benefits you may be entitled to, up to $6,000. Even if 25% of your back due benefits equals more ...

What is disability advocate?

Disability advocates (and attorneys who provide this service ) perform a wide range of responsibilities at all stages of the application process, including helping to file your application, ensuring appeal deadlines are met, collecting evidence, and most critically, developing the strategies and arguments that will help ensure a successful outcome.

What is Citizens Disability?

Since 2010, Citizens Disability has been America’s premier Social Security Disability institution. Our services include helping people in applying for SSDI benefits, managing the process through Reconsideration, and representing people in person at their Hearing, and if necessary, bringing their case to the Appeals Council. Our mission is to give a voice to the millions of Americans who are disabled and unable to work, helping them receive the Social Security Disability benefits to which they may be entitled. Learn more about us and disability benefits like SSDI & SSI or give us a call (800)492-3260.

Can a representative charge a fee?

There are two situations where a representative can charge a fee higher than the $6,000 maximum described above: when a case requires multiple hearings, or where a case is appealed successfully at the Appeals Council or federal court. In those situations, since the representative had to put extra time and resources into the claim, the representative can file a “fee petition” and request a higher fee. The fee petition will then be reviewed by the SSA, and approved only if it is reasonable.

Do you have to pay a representative fee for disability?

Almost all disability advocates (including Citizens Disability) work on “contingency,” meaning they don’t collect a fee unless you win your claim. If you are found to be not disabled, you don’t have to pay anything to your representative. Representative fees in disability claims are determined by the Social Security Act.

How much can a lawyer charge you?

Your lawyer cannot charge you more than 25% of your back pay or $6,000 , whichever is less.

Do lawyers have to pay extra fees?

Some lawyers will require you to pay these extra costs as they are incurred while others will pay them and get reimbursed when they are paid their attorney fees. Your retainer agreement should spell out how you must pay these costs.

How much does a disability lawyer cost?

Our survey showed that the overall average attorney's fee was $2,900 in SSI cases.

How much do disability attorneys get paid?

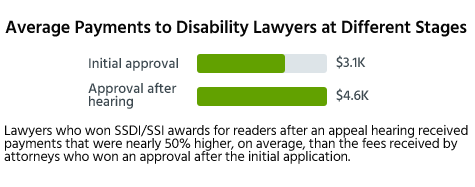

Even though disability attorneys' fees are usually capped at $6,000, nearly seven in ten of our readers (68%) told us their attorneys received less than that amount. The overall average was $3,750—quite a bit lower than the cap. For those whose initial application was approved, the average was even lower: $3,100. When a case went to an appeal hearing, the average amounts were higher. More than half of readers who got an award after a hearing decision reported that their lawyers were paid the maximum of $6,000, with an average fee of $4,600.

What happens if you don't get disability?

If you don't get benefits, the lawyer doesn't get paid. But if the Social Security Administration (SSA) approves your disability application, it will pay your attorney a percentage of your past-due benefits (or " backpay "). For cases that are resolved at the hearing stage and have a fee agreement, there's an upper limit on the lawyer's fee: 25% ...

Is it easy to get disability?

It isn't easy to get Social Security disability benefits, and the application process can be complicated and lengthy. But our survey showed that having a lawyer nearly doubled applicants' chances of getting an award. Of the readers who hired a lawyer at some point along the way—to help with the application and/or represent them at the appeal hearing—60% were ultimately approved for benefits, compared to 34% of those who didn't have a lawyer's help. (For more details, see our survey results on whether a disability attorney is worth it .)

Do disability lawyers charge fees?

When Disability Lawyers Don't Charge Anything. Aside from the fact that lawyers generally won't receive a fee if their clients don't get an award for Social Security disability, a few of our readers' attorneys didn't take any payment even when they won the case.

How much can a disability attorney charge?

Again, the maximum the disability attorney or nonattorney advocate can charge is 25% of your backpay for his or her services, up to a maximum of $6,000. For example, if your back-dated benefits are calculated to be $10,000, your representative will be paid $2,500 and you will receive $7,500. However, an experienced representative is likely to be able to get you more in backpay by negotiating your disability onset date with the SSA —s omething you can't do without a hearing (in an "on-the-record" ALJ decision) if you're not represented.

What does a disability attorney do?

During the course of representation, a disability attorney or nonlawyer advocate usually has to request a claimant's medical, school, work records, and occasionally medical or psychological examinations; these can be expensive. The client must pay these costs separately from the attorney's fee (of 25% of their backpay).

What is a contingency fee agreement?

Contingency Fee Agreement. When you first hire a disability attorney or nonlawyer advocate, whether you are filing for SSDI or SSI, you typically sign a fee agreement that allows the Social Security Administration (SSA) to pay your representative if your claim is approved.

Can a Social Security representative be paid out of past due benefits?

The representative will be paid only out of your past-due benefits, or "backpay." If no back-dated benefits are awarded, the representative will not receive a fee. However, in this situation and a few others, the representative is allowed to submit a fee petition to Social Security to request a higher fee.

Does it cost to hire a disability representative?

It doesn't usually cost you anything to hire a representative; the fee will be paid out of the disability award you eventually receive. Some representatives, however, will ask you to pay a nominal amount for costs (see below) at the beginning of your case.

Can a representative ask for money in advance?

Sometimes a representative will ask for money in advance to pay for these items. This is permitted so long as the representative holds the money in trust until it is needed. However, attorneys usually front these costs for their clients. Then, once the case has closed, regardless of whether you win or lose, the attorney will send the client a bill requesting reimbursement for any funds fronted on behalf of the client.

Do disability attorneys get paid?

Social Security Disability attorneys and advocates work "on contingency," meaning they get paid only if you win your case. Unlike many attorneys, disability lawyers do not charge up-front fees or require a retainer to work on a Social Security disability case. Most disability attorneys and nonlawyer representatives will be paid a fee only ...

How is the fee for representation determined?

How is the fee for representation determined? The fee that is charged by a disability representative is based on the amount of back pay that is won by a claimant. It is equal to 25 percent of whatever back pay a disability claimant is eligible to receive. However, it is also capped at a maximum fee amount, which is the very most a representative can receive regardless of how much back pay a claimant wins.

Is SSDRC a SSA website?

For the sake of clarity, SSDRC.com is not the Social Security Administration, nor is it associated or affiliated with SSA. This site is a personal, private website that is published, edited, and maintained by former caseworker and former disability claims examiner, Tim Moore, who was interviewed by the New York Times on the topic ...

Can a non-advocate work for SSA?

On the other hand, there are many non attorney representatives who used to work in social security field offices and used to work as disability examiners for SSA. These individuals are intimately familiar with the Social Security Disability system and can provide extremely able representation.

Can you be charged for representation if you win?

In other words, if you have representation and your case is not won, you cannot be charged a fee for representation. However, win or lose, you can be charged for other expenses that are not related to the fee for representation, such as reimbursing your representative for the cost of obtaining medical records, or the cost of postage, or travel expenses.

Is Social Security law a law?

However, Social security law is not law per se. At the early levels, it is administrative regulation and procedure. In fact, this is why disability applications and reconsideration appeals ( the request for reconsideration is the very first appeal you can file) are actually processed by disability examiners, individuals who have been trained ...

Do you have to take your SSA claim to the Federal Court?

Answer: In reading the SSA regulations, it appears that this may very well be normal. You do not have to take your claim to Federal Court, you could file a new disability claim and go through the process again. The protected maximum on a fee agreement appears to end at the Appeal Council.

Can a non-attorney be charged for Social Security Disability?

The maximum fee that can be charged by either a Social Security Disability attorney or a non-attorney Social Security Disability representative is the same amount. And it is only paid in the event that a case is won.

How much do disability lawyers charge?

Under federal law the standard amount is what you suggested: 25% of your back pay up to a maximum of $6,000.

What happens when a lawyer has had to perform more work than normal?

For example, if your case dragged on for years with multiple hearings and an Appeals Council hearing. This could also occur if you had a lawyer and fired them and hired a second attorney.

Can the SSA approve a disability fee?

Its important to note that the SSA will only approve a fee higher than the standard amount if the disability lawyer submits a fee petition to the SSA and they approve it. The SSA does not take this action on their own unless the attorney initiates the request.

Is it frustrating to get a disability back pay check?

Congratulations on finally winning your SSDI case. Understandably it might be frustrating to receive your disability back pay check after several years only to realize that your lawyer has taken a large part of it.

Can you charge for out of pocket expenses on SSDI?

It doesnt sound like this is your issue . But some disability claimants also complain that they were charged additional fees for out of pocket expenses the SSDI lawyer paid. Although many lawyers will waive these fees, it is legal for them to charge for a variety of expenses not related to the fees. For example, they may charge for requesting your medical records, sending you to see a medical specialist, copying costs or paid postage expenses.

Do disability lawyers get paid if they win?

Consider also, a disability lawyer is generally only paid if they win your case . In fact, most agreements are contingency fee agreements and spell out this contingency. If you and your disability lawyer did not sign a contingency fee agreement, however, they may request a fee (even if they lost the case) by submitting a fee petition to the SSA.

What happens if a claimant appoints a representative after submitting a fee agreement?

Therefore, if the claimant appoints a representative after submitting a fee agreement, the representative must sign onto the first agreement or the claimant and representative must submit an amended agreement signed by all.

Who will share the authorized fee with another person who referred the case?

The representative will share the authorized fee with another person who referred the case.

What happens if SSA makes a favorable decision?

If SSA makes a favorable decision on the claim, SSA will either approve or disapprove the fee agreement when it issues the favorable decision. If SSA's decision on the claim is unfavorable, SSA does not make a determination on the fee agreement and will not provide notice about the fee agreement.

What is fee agreement?

A fee agreement is a written statement signed by the claimant and the claimants appointed representative (s) who expect to charge and collect for services before us (the Social Security Administration). This written statement details the fee arrangement between the parties. The appointed representative must submit the fee agreement before ...

What percentage of past due benefits exceeds the specified amount?

If 25 percent of the past-due benefits exceeds the specified dollar amount (e.g., $6000), the representative receives a fee equal to the specified dollar amount and retains the right to petition for an additional fee. (Representatives retain the right to request administrative review under the fee agreement process; however, they may not substitute the fee petition process for the fee agreement process once SSA issues a favorable decision.)

When does a claimant file an agreement with SSA?

The claimant or representative filed the agreement with SSA before the date SSA made a favorable decision. In concurrent titles II and XVI claims, the date of the favorable decision under the first title decided is controlling for both titles.

When do we approve a fee agreement?

If the representative submits a fee agreement before the date we make a favorable decision, we will approve the fee agreement at the time of the favorable decision if the statutory conditions for approval are met and no exceptions to the fee agreement process apply. Once we approve the fee agreement, the fee specified in the agreement is the maximum fee the representative may charge and collect for all services in relation to the claim.

Fee Agreements and Fee Petitions

- To get their fees paid, Social Security lawyers enter into written fee agreements with their clients and submit those fee agreements to Social Security for approval. If Social Security approves the fee agreement, it will pay your attorney for you directly out of your backpay. The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whiche…

What Should Be in A Fee Agreement?

- An attorney must submit a written fee agreement to Social Security before Social Security issues a favorable decision on the claim. Most lawyers will submit the fee agreement when they take your case. Social Security has suggestions for the language in the fee agreements, but there are really only two main requirements. First, the amount of the fee cannot be more than the maximu…

Who Pays For Legal Costs?

- There are two kinds of expenses in a case: the amount the lawyer charges for her time and the expenses she pays for while working on your case. In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled. Those records might be located at hospitals, doctors' offices, scho...

Popular Posts:

- 1. do i need to get power of attorney over my mother who is now in a nursing home

- 2. how to request information from prosecuting attorney

- 3. attorney who handle prenuptial agreements

- 4. stanley p walker attorney at law how to mid him

- 5. how to sign tax returns as powe of attorney

- 6. what is anestate planning attorney

- 7. who is the current attorney general for new york state

- 8. what can an appellate attorney do in georgia

- 9. how to get a free durable power of attorney

- 10. who can witness a power of attorney victoria