What does General Durable Power of attorney mean?

Jan 27, 2022 · A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can still act on your behalf. Since most older adults need a POA only in case they become incapacitated, this is the preferred type. Medical Power of …

What does "durable" mean with regard to powers of attorney?

A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in that it continues the agency relationship beyond the incapacity of the principal. The two types of durable power of attorney are immediate and "springing."

What does a durable financial power of attorney do?

Jan 06, 2022 · A durable power of attorney is one that either takes effect upon or lasts after the principal's incapacitation. This is different from a general power of attorney, which would terminate at this point.

What are the disadvantages of a power of attorney?

Feb 11, 2022 · A durable power of attorney (DPOA) is the designation of allowing an agent to handle financial responsibility even if the principal becomes incapacitated. The financial responsibilities may be broad or limited. A durable power of attorney (DPOA) has the option of allowing an agent to act immediately or at a future time or event (such as when the principal …

What is the difference between a POA and a durable POA?

A general power of attorney ends the moment you become incapacitated. ... A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.Sep 11, 2018

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How do I get a durable power of attorney?

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Do spouses automatically have power of attorney?

If two spouses or partners are making a power of attorney, they each need to do their own. ... A spouse often needs legal authority to act for the other – through a power of attorney. You can ask a solicitor to help you with all this, and you can also do it yourself online. It depends on your preference.Mar 26, 2015

Who makes medical decisions if there is no power of attorney?

The legal right to make care decisions for you If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Who has power of attorney after death if there is no will?

Is power of attorney valid after death? Unfortunately, if the principal dies, a power of attorney ceases to exist. The purpose of a POA is for the agent to act on behalf of the principal when the principal is unable to carry out their own legal matters.Jun 25, 2021

What are the 2 types of power of attorney?

Generally speaking, power of attorney is used for two concerns:Power of attorney for financial issues (financial power of attorney).Power of attorney for health and welfare issues (medical power of attorney).Jan 29, 2020

Who can override a power of attorney?

PrincipalThe Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Does power of attorney end at death?

Termination of an enduring power of attorney An EPA ceases on the death of the donor. However, there are other circumstances in which an EPA ceases to have effect.Mar 18, 2021

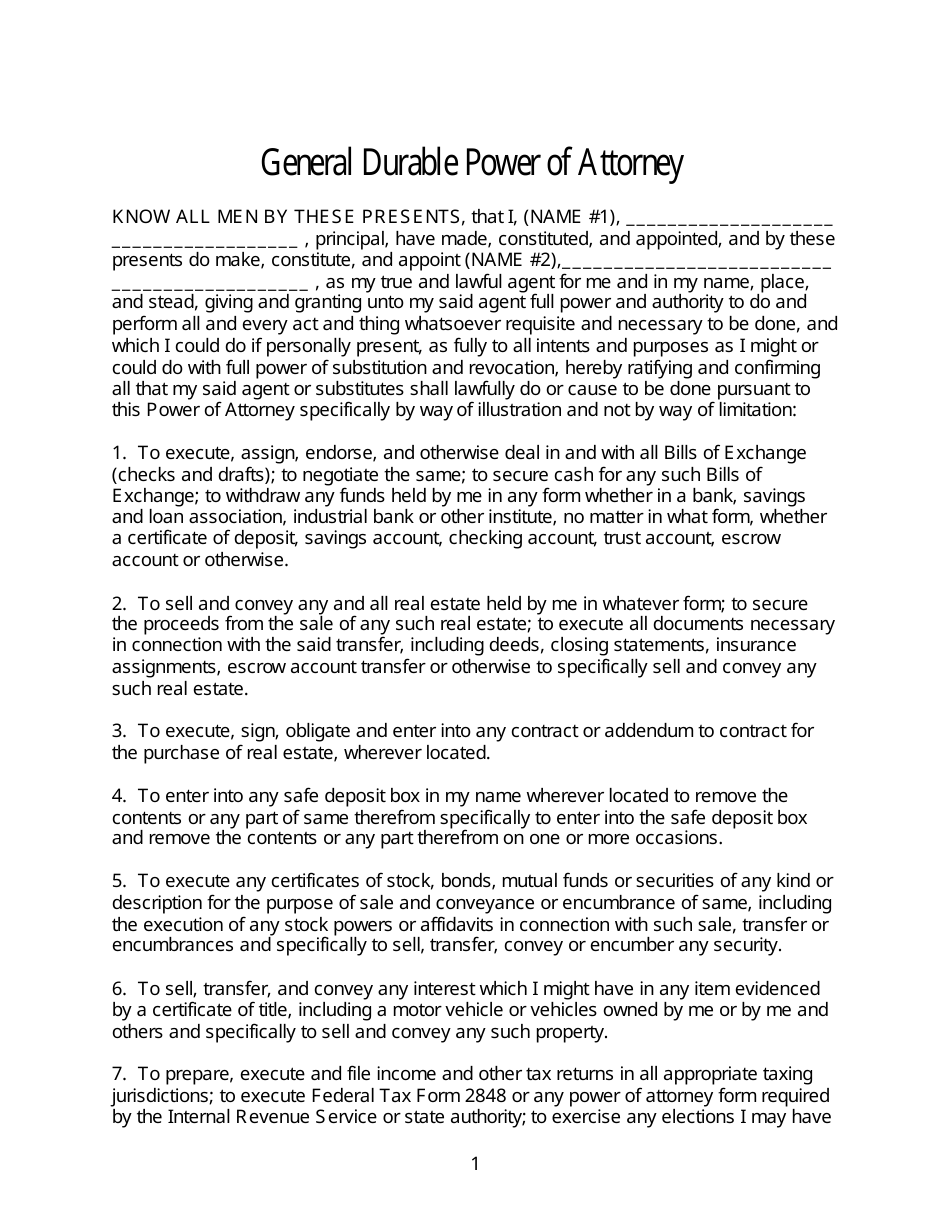

What Is A Durable Power of Attorney?

A Durable Power of Attorney (form) is for anyone wanting another person to handle matters on their behalf when incapacitated. It’s by far the most...

How to Get Durable Power of Attorney

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be abl...

Durable Poa vs General Poa

Both forms allow for the principal to select someone else to act on their behalf. Although, the durable allows for the relationship to continue in...

Agent’S Acceptance of Appointment

At the end of the form, the Agent must read and acknowledge the power that they have and how important their position is for the principal. This ad...

What is a durable power of attorney?

A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in that it continues the agency relationship beyond the incapacity of the principal. The two types of durable power of attorney are immediate and "springing.".

Why are durable powers of attorney important?

Durable powers of attorney have become popular because they enable the principal to have her or his affairs handled easily and inexpensively after she or he has become incapacitated.

How many states recognize durable power of attorney?

All fifty states recognize some version of the durable power of attorney, having adopted either the UDPA or the Uniform Probate Code, or some variation of them. Versions of the durable power of attorney vary from state to state.

What are the different types of advance directives?

Most states recognize four types of advance directives: living wills, durable power of attorney(DPA) for health care, do-not-resuscitate orders and organ donation. Your will be done: advance directives can help your family honor your wishes and lessen their grief in the worst of times.

When does a power of attorney expire?

A power of attorney may expire on a date stated in the document or upon written cancellation. Usually the signer acknowledges before a notary public that he/she executed the power, so that it is recordable if necessary, as in a real estate transaction. Copyright © 1981-2005 by Gerald N. Hill and Kathleen T. Hill.

Can a principal appoint a power of attorney?

With a durable power of attorney, on the other hand, a principal can appoint someone to handle her or his affairs after she or he becomes incompetent, and the document can be crafted to confer either general power or power in certain limited circumstances.

Can a power of attorney be written to be general?

Powers of attorney can be written to be either general (full) or limited to special circumstances. A power of attorney generally is terminated when the principal dies or becomes incompetent, but the principal can revoke the power of attorney at any time.

What does a financial durable power of attorney do?

It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What is the Texas estate code for a power of attorney?

The agent's authority has been terminated under Texas Estates Code 751.132 and the power of attorney does not provide for a replacement; or. A guardian is appointed for the principal.

What is incapacitated power of attorney in Texas?

According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

What is a durable power of attorney?

A durable power of attorney allows you to handle another person’s financial decisions on their behalf. All decisions made must be to the benefit of the person being represented. The one thing about the durable form that separates it from the rest is that it remains legal in the event the person being represented can no longer think for themselves.

What powers does an agent have?

The agent that is selected can have very simple and basic powers, such as having the rights to pick up mail, to wide-ranging powers like having complete control over all the facets of the principal’s financial assets. It’s recommended that if an agent is to have such powers that they are the same person that is listed as a beneficiary in the principal’s last will and testament. In that case, if the agent makes a financial move that hurts the principal’s overall value, it will also affect the agent.

What does "acting as attorney in fact" mean?

If the agent is to sign legal documents on behalf of the principal, the agent would sign the principal’s name followed by the word “by” with the Agent’s signature followed by “acting as attorney-in-fact”.

Can an agent be a beneficiary of a will?

It’s recommended that if an agent is to have such powers that they are the same person that is listed as a beneficiary in the principal’s last will and testament. In that case, if the agent makes a financial move that hurts the principal’s overall value, it will also affect the agent.

Do you need a notary public to sign a document?

The document is required to be signed in accordance with State law which usually requires the principal and agent signing in the presence of a notary public. In some States, only witnesses are required and in others witnesses and a notary public.

Popular Posts:

- 1. how long do power of attorney papers last

- 2. what can i charge for real estate closing attorney

- 3. whu should i use an attorney when i buy a house

- 4. how to get power of attorney of a mentally ill parent

- 5. what attorney do you hire to fight home owners insurance

- 6. how much to a pay tax attorney

- 7. how much dies it cost to file bankruptcy with a attorney indiana

- 8. how much for attorney first owi

- 9. how do you go about getting a power of attorney in florida for a senior citisin

- 10. who is attorney darrin nye of cincinnati, oh