Special Power of Attorney

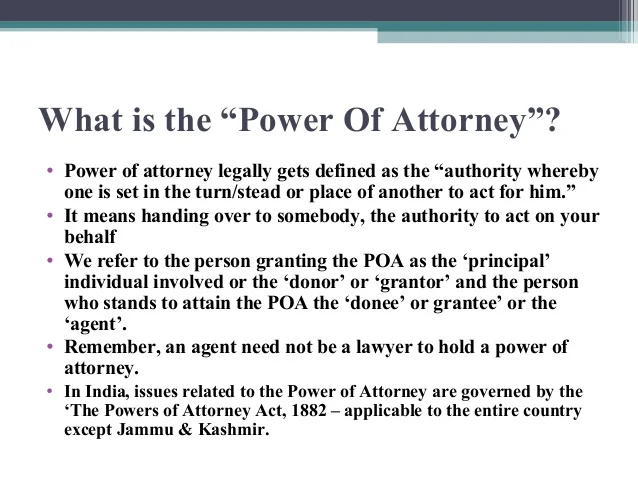

- Understanding Special Power of Attorney. A power of attorney refers to an agreement between two individuals that allows one individual to act on the other's behalf.

- General Power of Attorney vs. Special Power of Attorney. ...

- Special Considerations. ...

What is power of attorney and how does it work?

Mar 02, 2021 · A special power of attorney is a legal document that authorizes one person to act on behalf of another under specified circumstances.

What does special power of attorney mean?

Nov 25, 2003 · A special power of attorney is a legal document that authorizes one person to act on behalf of another under specified circumstances.

How to make a special power of attorney?

Oct 21, 2021 · This type of POA is often called a financial power of attorney because it’s commonly used for day-to-day financial matters. It can be durable or non-durable. Special/Limited Power of Attorney. Unlike a general power of attorney, a limited power of attorney (also called a special power of attorney) only authorizes the agent to handle specific matters. For example, …

What are the different types of power of attorney?

— special power of attorney : a power of attorney authorizing the agent to carry out a particular business transaction for the principal — springing power of attorney

What are the requirements for special power of attorney?

How to get special power of attorneyThe name and address of the principal.The ID, physical address, and agent's details.A reason to get the SPA.Date and the place where one will sign that form.The principal's signature.The principal's name, identification number, and the ID expiry date.More items...•Apr 2, 2020

What is the difference between a special power of attorney and a general power of attorney?

What is the difference between a Special Power of Attorney and a General Power of Attorney? ... A General Power of Attorney is used to grant the agent broad powers to handle the principal's affairs. On the other hand, a Special Power of Attorney is used to grant the agent only limited or specific powers.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How long does special power of attorney last?

However, the Special Power of Attorney is already expired as it is indicated in the document that its validity is only one year from the date of the sale of the property to my seller. How do I go about it?Jul 18, 2013

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Does a special power of attorney need to be registered?

Special Power of Attorney deed has to be compulsorily registered from a Sub-Registrar office where the property is situated, if immovable property of value of Rs. 100 or above is the subject matter of the deed. Appropriate Registration charges are to be paid as per the State Rules.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Is special power of attorney valid?

Keep in mind that the special power of attorney is only valid for the duration of your life. If you were to die, the special power of attorney (real estate) would be revoked. Your assets would then be managed according to the terms of your will or trust if you have one.Nov 1, 2021

Does a special power of attorney need to be notarized?

A general power of attorney grants the agent the legal right to make all financial and legal decisions on behalf of the principal. ... A special power of attorney may need to be notarized to have legal authority.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What happens if you can't review updates?

If you are unable to review updates yourself, direct your agent to give an account to a third party. As for legal liability, an agent is held responsible only for intentional misconduct, not for unknowingly doing something wrong. This protection is included in power of attorney documents to encourage people to accept agent responsibilities.

Why do you need multiple agents?

Multiple agents can ensure more sound decisions, acting as checks and balances against one another. The downside is that multiple agents can disagree and one person's schedule can potentially delay important transactions or signings of legal documents. If you appoint only one agent, have a backup.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

What is a limited power of attorney?

A limited power of attorney gives the agent the power to act on behalf of the principal in specific matters or events. For example, the limited POA may explicitly state that the agent is only allowed to manage the principal's retirement accounts.

What is Durable POA?

A “durable” POA remains in force to enable the agent to manage the creator’s affairs, and a “springing” POA comes into effect only if and when the creator of the POA becomes incapacitated. A medical or healthcare POA enables an agent to make medical decisions on behalf of an incapacitated person.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is the name of the person who gives the POA?

The term for the person granting the POA is the "principal." The individual who receives the power of attorney is called either the "agent" or the "attorney-in-fact." Check whether your state requires that you use specific terminology.

Can a POA be broad?

A POA can be as broad or as limited as the principal wishes. However, each of the powers granted must be clear, even if the principal grants the agent "general power of attorney.". In other words, the principal cannot grant sweeping authority such as, “I delegate all things having to do with my life.”.

What is a power of attorney?

A power of attorney is an agreement between two people (or parties), called the “principal” and the “agent.”.

What is the principal of a power of attorney?

The principal is the person who needs to have decisions made for them. They typically create the power of attorney, and choose which person will represent them. The principal is sometimes called the “grantor.”

What is a POA in real estate?

This type of POA is often called a financial power of attorney because it’s commonly used for day-to-day financial matters.

How does a power of attorney work?

Here’s how power of attorney works: First, the principal chooses one or more people they trust to manage their affairs. All parties sign and date a power of attorney form, which describes the duration of the power of attorney, and the type of authority granted. The form can be edited to:

What is a POA?

Often abbreviated as a “POA”, a power of attorney is used to appoint someone to manage your financial or business affairs when you’re unable to. To have someone to make health care decisions for you, you can use a variation of this form called a medical power of attorney. Before you create a power of attorney, it’s crucial to understand ...

Why is it important to give someone a power of attorney?

Giving someone power of attorney is one of the most important legal decisions you can make, because it grants the other person significant authority over your life. An agent has a “fiduciary duty” to the principal to act in their best interests — which means they have a legal obligation to do what’s best for them.

What can an elderly person do with a power of attorney?

Here are some uses of a power of attorney, and what it allows you do: Estate planning: an elderly person may choose an adult child or loved one to make important decisions about their money or health, in order to plan for a time when they cannot make these choices themselves.

What is a durable power of attorney?

A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in that it continues the agency relationship beyond the incapacity of the principal. The two types of durable power of attorney are immediate and "springing.".

Why are durable powers of attorney important?

Durable powers of attorney have become popular because they enable the principal to have her or his affairs handled easily and inexpensively after she or he has become incapacitated.

How many states recognize durable power of attorney?

All fifty states recognize some version of the durable power of attorney, having adopted either the UDPA or the Uniform Probate Code, or some variation of them. Versions of the durable power of attorney vary from state to state. Certain powers cannot be delegated, including the powers to make, amend, or revoke a will, ...

When does a power of attorney expire?

A power of attorney may expire on a date stated in the document or upon written cancellation. Usually the signer acknowledges before a notary public that he/she executed the power, so that it is recordable if necessary, as in a real estate transaction. Copyright © 1981-2005 by Gerald N. Hill and Kathleen T. Hill.

Can a power of attorney be written to be general?

Powers of attorney can be written to be either general (full) or limited to special circumstances. A power of attorney generally is terminated when the principal dies or becomes incompetent, but the principal can revoke the power of attorney at any time. A special type of power of attorney that is used frequently is the "durable" power of attorney.

Can a principal appoint a power of attorney?

With a durable power of attorney, on the other hand, a principal can appoint someone to handle her or his affairs after she or he becomes incompetent, and the document can be crafted to confer either general power or power in certain limited circumstances.

What is a power of attorney in the Philippines?

A Special Power of Attorney, better known simply as “SPA”, is a legal document used in the Philippines which authorizes another person to do things on your behalf. Said document must be notarized, which means that it should be signed in front of a notary public.

What is the person signing a SPA?

The person signing the SPA is called the principal or grantor while the person being authorized is called the agent or attorney-in-fact. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations.

What does "obtaining school transcripts" mean?

Having someone file a court case on your behalf; Having someone apply for a loan or claim funds on your behalf; or. Having someone obtain your school transcript of records.

Do you need a SPA to buy soy sauce?

You do not need an SPA if you want someone to buy “toyo” (soy sauce), “suka” (vinegar) or “patis” (fish sauce) for you. It is best to confirm with the persons or offices that you need to deal with in the Philippines.

Can a SPA be used in the Philippines?

It is a process by which your SPA (or any legal document) executed abroad is made valid for use in the Philippines. For example, if your SPA was executed in any of the provinces or territories of Canada by a notary public (or a commissioner for taking oaths), it needs to be authenticated or consularized so that it can be used in the Philippines.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to appoint someone?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority.

What to do if you do not believe a will is in keeping with your wishes?

If you do not believe that the document is in keeping with your wishes, then you should certainly consult with an attorney about how to get the document changed to reflect those wishes. They do not “trump” a will.

Why do parents want to appoint their children?

They do this because they want to be fair to all of them and don’t want anyone to feel slighted. While these are valid reasons, it can create issues down the road.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Can you put toothpaste back in the tube?

You can’t put the toothpaste back in the tube. If it is discovered that your power of attorney abused that position and has taken money from you, it can be difficult to recover all of the property. It is like putting toothpaste back into the tube at times.

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

How does a POA work?

The key to making a POA work is finding the right agent to make decisions on your behalf. Your choice may depend on which type of POA you are signing. For a POA related to business, for example, you probably want to find someone with business experience. For legal matters, an attorney may make sense.

How to create a POA?

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

Who is the person who gives power?

The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact. The grantor can choose which rights to give the agent.

Can you invoke a POA after death?

It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA.

Is a power of attorney a legal document?

The Bottom Line. A power of attorney is a legal document that passes a person’s decision-making power to another person, known as an agent.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

Popular Posts:

- 1. when attorney discipline cleared

- 2. how to get a pi attorney to lower their fee

- 3. don't settle for less than what you deserve attorney

- 4. how to present evidence in ace attorney online

- 5. if i'm an attorney in california how do i become an attorney in oregon

- 6. who is fogle's attorney

- 7. what is indiana "county attorney"

- 8. how to ensorse check as power of attorney

- 9. what is the hourly rate of an attorney?

- 10. attorney who handles neck injury in green bay wi