Texas has separate power of attorney requirements for financial matters and for healthcare. Power of Attorney Basics A power of attorney is a legal document, whereby one person, called the "principal," gives another person, called the "agent" or the "attorney in fact," the authority to take certain actions on behalf of the principal.

What are the rules for power of attorney?

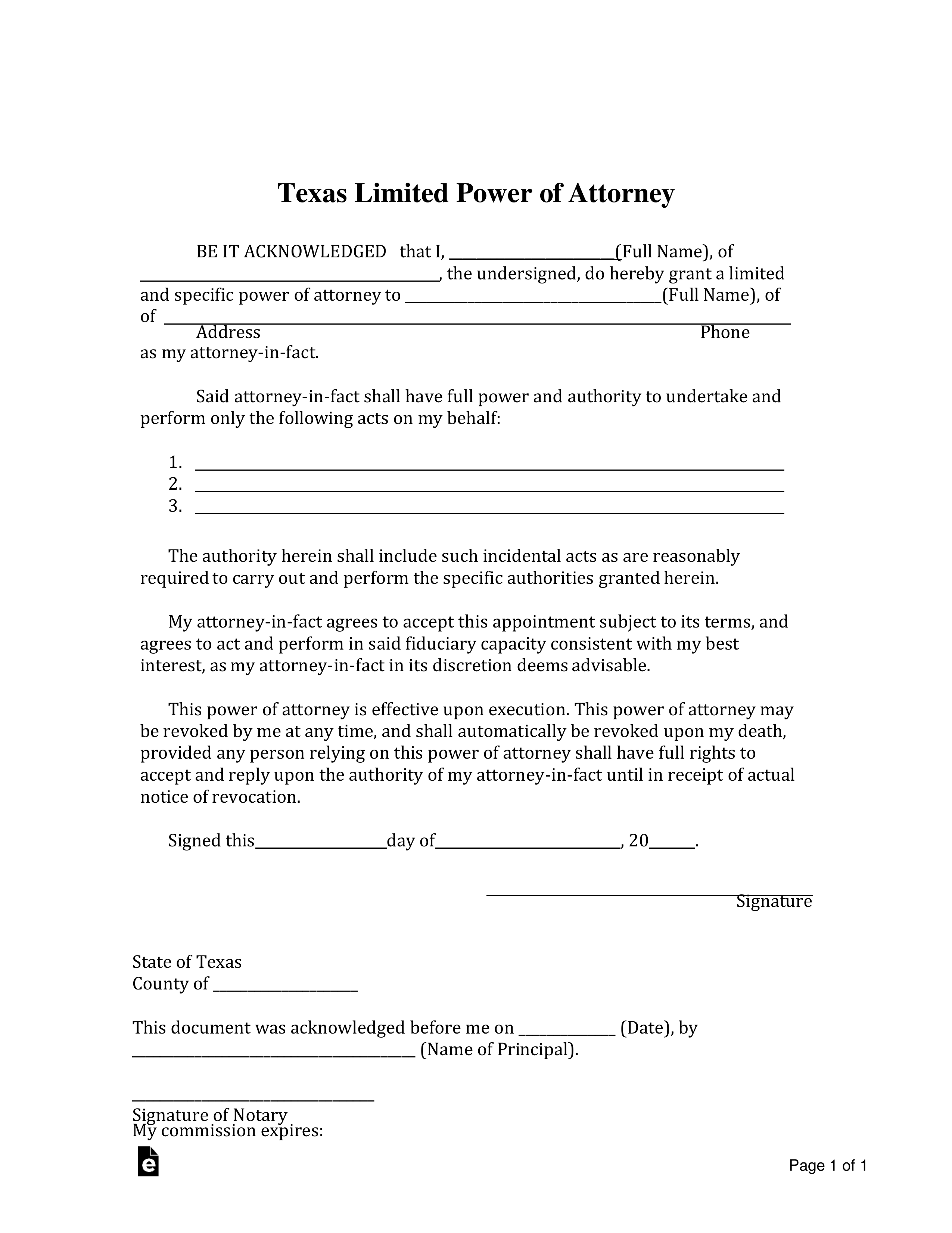

Jan 06, 2022 · A “power of attorney” is a written document that authorizes someone (referred to as the agent) to make decisions or take actions on someone else's (known as the principal) behalf. In Texas, there are several kinds of powers of attorney that will grant the agent the right to accomplish different things on the principal's behalf.

What are general powers of attorney?

Aug 01, 2016 · The formal name for Power of Attorney in Texas is statutory durable power of attorney. What does that mean? A Power of Attorney document gives a person you name – the agent – the power to act as you in financial and legal matters. Power of Attorney gives that person the ability to handle your finances for you – your house, car, bank accounts, your …

What is a durable power of attorney?

May 25, 2021 · A power of attorney (or a “POA” for short) is a legal document that gives one person, usually called the “agent,” the legal authority to make certain types of decisions for another person, usually called the “principal.”. Some people use a power of attorney to allow an agent to manage real estate, handle financial affairs, or run a ...

What is a durable financial power of attorney?

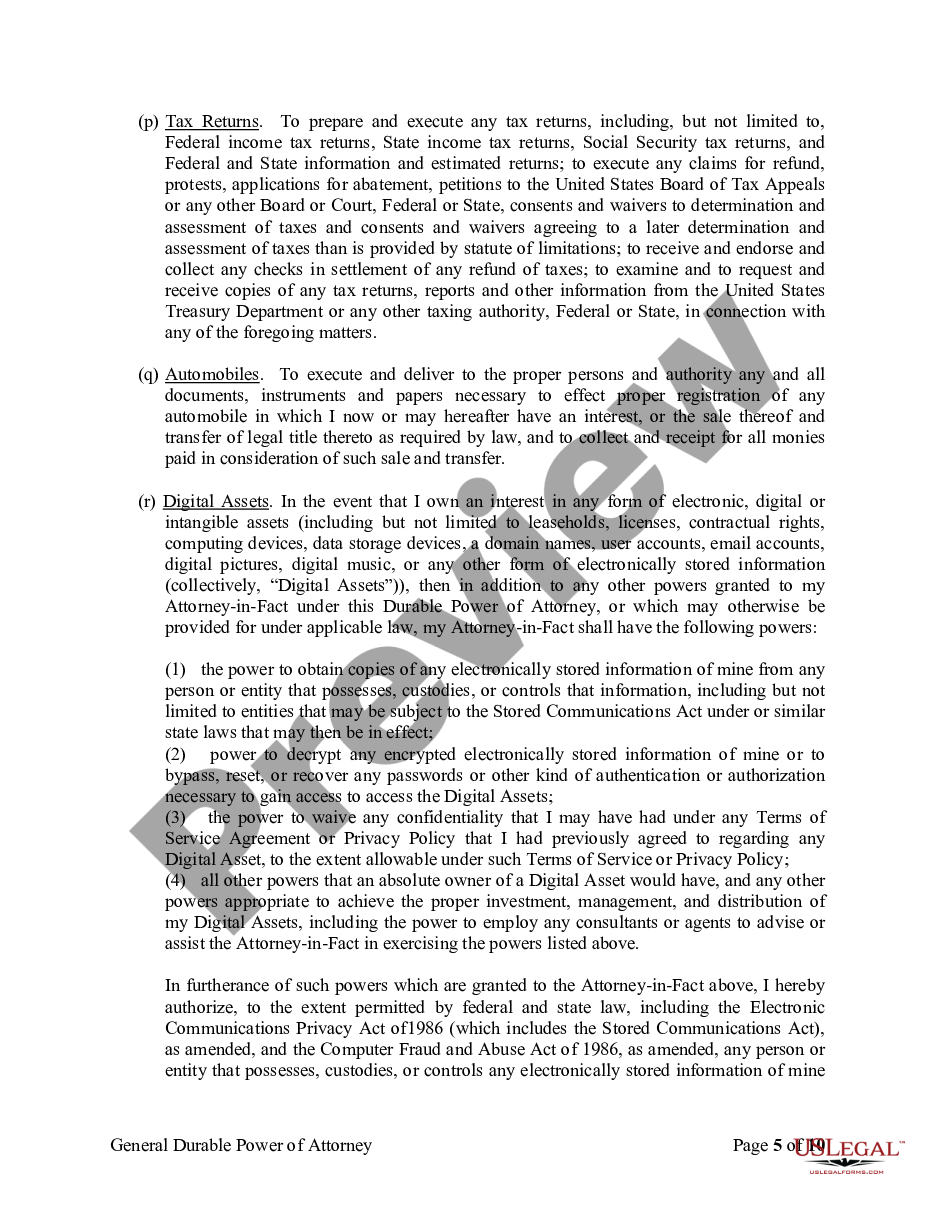

Jan 06, 2022 · Texas's statutory form of durable power of attorney is found in Section 752.051 of the Texas Estates Code. It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What does a power of attorney do in Texas?

A “power of attorney” is a written document that authorizes someone (referred to as the agent) to make decisions or take actions on someone else's (known as the principal) behalf.Jan 6, 2022

Does power of attorney override a will in Texas?

Can a Durable Power of Attorney Override a Living Will? No. Your living will is a core estate planning document. A valid living will takes precedence over the decisions of a person with power of attorney.Jun 26, 2019

What type of power of attorney covers everything?

General power of attorney With a general power of attorney, you authorize your agent to act for you in all situations allowed by local law. This includes legal, financial, health, and business matters.Jun 11, 2021

Does a power of attorney have to be recorded in Texas?

WHY ARE POWERS OF ATTORNEY FILED IN THE LOCAL RECORDS? Section 489 of the TEXAS PROBATE CODE actually requires recording of the Power of Attorney when it is durable and the durability feature is being relied on in the transaction.

How long is a power of attorney valid in Texas?

A statutory or durable power of attorney gives an agent permission to access bank accounts, sell property and make other important decisions when the principal becomes incapacitated or unable to make decisions. It stays in effect until revoked or until the principal dies.Dec 10, 2018

Can power of attorney withdraw money?

Can a power of attorney borrow money? So, a property and financial Power of Attorney can give themselves money (with your best interests in mind). But you may be concerned about them borrowing money from you, or giving themselves a loan. The answer is a simple no.Jun 18, 2021

What happens to power of attorney after death?

A Lasting Power of Attorney only remains valid during the lifetime of the person who made it (called the 'donor'). After the donor dies, the Lasting Power of Attorney will end.Jan 4, 2019

Can POA spend money on themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

How long can a power of attorney last?

Once an LPA has been validly executed, it will last indefinitely unless revoked by the donor, the attorney, the Court of Protection or by operation of law.May 25, 2021

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

What does an enduring power of attorney cover?

An EPA gives the person appointed as attorney the power to dispose of property, deal with financial affairs, sign documents and make purchases on behalf of the individual and make usual gifts. The attorney does not have the power to make substantial or unusual gifts, or make decisions about personal care and welfare.

What is a durable power of attorney in Texas?

What does that mean? A Power of Attorney document gives a person you name – the agent – the power to act as you in financial and legal matters.

Why do you need a power of attorney?

Make sure your lawyer helps you draft a Power of Attorney document to protect your family and assets in case the worst happens.

When is a power of attorney effective?

More often, Power of Attorney is effective in the case of incapacity or disability, meaning that if you were to become unable to handle your finances, your agent would take over.

What happens if you are disabled and unable to handle your own finances?

If something were to happen to you, leaving you disabled or incapacitated and unable to handle your own finances, all the assets in your name would be stuck in limbo.

Do you need a power of attorney for a living trust?

If you are establishing a living trust instead of a will as part of your estate planning, you may not need Power of Attorney, as most trusts are set up to automatically transfer power of assets to a beneficiary or trustee. Talk to your lawyer to make sure.

What is a power of attorney in Texas?

A general legal power of attorney in Texas allows the agent to complete a variety of transactions on behalf of the principal, essentially to enter into and complete nearly any business that the principal could themselves do.

What is a POA in Texas?

POA laws in Texas generally follow the Restatement of the Law on agency, as follows: A general power of attorney in Texas terminates when the principal becomes incapacitated or can no longer make decisions for himself or herself, which status is generally determined by a court of law. (See Restatement of the Law – Agency, 3d § 3.08). Other circumstances under which a general power of attorney under Texas law could terminate include: 1 After a time period specified in the POA (Restatement of the Law – Agency, 3d § 3.09); 2 Once a specified task has been accomplished (Restatement of the Law – Agency, 3d § 3.09); 3 When the principal dies (Restatement of the Law – Agency, 3d § 3.07); or 4 When the power of attorney is revoked by the principal ( Restatement of the Law – Agency, 3d § 3.10).

What is a durable power of attorney?

A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances.

What is a guardian in Texas?

A guardian is appointed for the principal. If a spouse was appointed as the agent and the couple divorces or the marriage is annulled or declared void, Section 751.132 of the Texas Estates Code states that their authority as agent terminates.

What is a power of attorney in Texas?

Texas has some unique requirements for granting power of attorney that you need to know before setting yours up. A power of attorney or POA can enable you to engage in financial transactions when you can't be present to sign documents.

What is a general power of attorney?

General power of attorney. This gives the agent authority to act in a broad range of matters. Limited or special power of attorney. This gives the agent authority to act in a limited way, such as to engage in a specific transaction or for a limited period of time. Durable power of attorney.

Is a springing power of attorney durable?

By its very nature, a springing power of attorney is also a durable power of attorney. Medical power of attorney. This gives the agent the authority to make medical treatment decisions for you if you become mentally or physically unable to make your own decisions. By its very nature, a medical power of attorney is both durable and springing.

What is a power of attorney?

It is a written document that authorizes a trusted friend or family member to act as your agent in making medical decisions for you in the event you were to become ill and could not communicate with your doctor. (for financial decisions see Power of Attorney)

How many witnesses do you need to sign a power of attorney?

You can execute it by either getting it notarized or getting it signed by two witnesses. If you execute your medical power of attorney by getting it signed by two witnesses, then each must be a competent adult.

What is an agent in medical?

a person you are designating as your agent to make medical decisions for you; someone related to you by blood or marriage; a person who would inherit something from your estate upon your death; someone who has a claim on your estate; your attending physician; an employee of your attending physician; or. an employee of the health care facility that ...

What is an attending physician?

your attending physician; an employee of your attending physician; or. an employee of the health care facility that you are in at the time if the employee is providing direct patient care to you or if that employee is an officer, director, partner, or business office employee of the health care facility or of any parent organization ...

Can a power of attorney make medical decisions?

Even if the medical power of attorney is legally effective, the designated agent can make medical decisions for you only if you are certified as incompetent by your attending physician. If you later become competent again, then your agent can no longer exercise this authority.

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What is a durable power of attorney?

You might also sign a durable power of attorney to prepare for the possibility that you may become mentally incompetent due to illness or injury. Specify in the power of attorney that it cannot go into effect ...

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

What is a fiduciary?

A fiduciary is someone responsible for managing some or all of another person's affairs. The fiduciary must act prudently and in a way that is fair to the person whose affairs he or she is managing. Someone who violates those duties can face criminal charges or can be held liable in a civil lawsuit.

What to do with a power of attorney?

It is important to understand what you are trying to accomplish with a power of attorney and then make certain that you have such a document crafted for that purpose. Appoint someone you trust. This can’t be overstated. You are appointing someone to make all of your business, financial, and medical decisions for you.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to trust your child?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority. If you have a child that has made poor financial or personal decisions, don’t give them the opportunity to make similar poor decisions on your behalf. You must trust them.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Can you put toothpaste back in the tube?

You can’t put the toothpaste back in the tube. If it is discovered that your power of attorney abused that position and has taken money from you, it can be difficult to recover all of the property. It is like putting toothpaste back into the tube at times.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

When does a power of attorney go into effect?

A springing (or conditional) power of attorney only goes into effect if a certain event or medical condition (typically incapacitation) or event specified in the POA occurs. For example, military personnel may draft a springing power of attorney that goes into effect when they’re deployed overseas.

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

What happens to a non-durable power of attorney?

Non-Durable Power of Attorney. A non-durable power of attorney expires if you become incapacitated or die. For instance, if you fall into a coma, your agents will lose any authority previously granted. After that, only a court-appointed guardian or conservator will be able to make decisions for you.

Can a power of attorney be restricted?

The powers granted under a general power of attorney may be restricted by state statutes. Who can legally override your power of attorney depends on which type of POA you select. 4. Limited (Special) Power of Attorney.

Popular Posts:

- 1. attorney who chained and arrested columbus

- 2. how much do we pay attorney general sessions annually?

- 3. attorney who sued the denver athelethic club for blind manager

- 4. how much does us attorney make

- 5. what kind of attorney handles homeowner associaiton problems

- 6. who needs a poa

- 7. what are reasonable attorney fees in alaska

- 8. how to get a real attorney on retainer

- 9. how to file lawsuit without an attorney

- 10. who is trump's pardon attorney