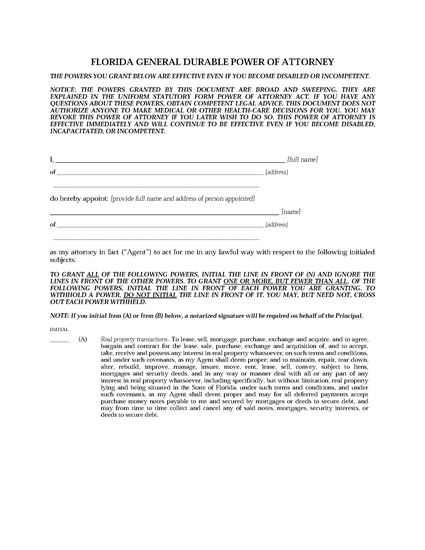

A “general power of attorney” grants the agent broad authority over legal and financial matters. In Florida, the document must identify each and every action the agent is authorized to take. A general delegation to act with regard to “all matters” is not valid.

Can someone in Florida get a power of attorney?

Dec 15, 2021 · A Florida power of attorney is a legal document that allows one person to legally act for another person. The person granted the power is often called the attorney-in-fact, or agent. The scope of the power of attorney, also called a general power of attorney, can range from very small—a short duration and only the power to do very few things—to all-encompassing.

What to know about Florida's Power of attorney law?

A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the “principal”) grants the right to act on the maker’s behalf as that person’s agent. What authority is granted depends on the specific language of the power of attorney.

What can you do with a power of attorney?

Jan 20, 2021 · A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the power to act on behalf of a third-party (the principal). Hence, the agent in question can have a broad or limited legal authority to make legal decisions about the principal’s property, finances, or medical care.

Who should get a power of attorney?

What can a power of attorney do in Florida?

In Florida, a general POA (also called a financial POA) gives your agent authority to handle your financial and business matters. For example, your agent could pay your bills, make bank deposits and withdrawals, file your taxes, and more.Sep 27, 2021

What three decisions Cannot be made by a legal power of attorney?

What can durable power of attorney do in Florida?

What powers do you have as power of attorney?

What are the disadvantages of power of attorney?

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.

What are the disadvantages of being power of attorney?

- A Power of Attorney Could Leave You Vulnerable to Abuse. ...

- If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ...

- A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.

Does a power of attorney need to be recorded in Florida?

What can I do with power of attorney?

Can a power of attorney transfer money to themselves?

Can I sell my mums house with power of attorney?

Can power of attorney keep family away?

What is the difference between power of attorney and lasting power of attorney?

Can a power of attorney be used for incapacitated principal in Florida?

However, there are certain exceptions specified in Florida law when a durable power of attorney may not be used for an incapacitated principal. A durable power of attorney must contain special wording that provides the power survives the incapacity of the principal. Most powers of attorney granted today are durable.

What is a power of attorney?

A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the “principal”) grants the right to act on the maker’s behalf as that person’s agent. What authority is granted depends on the specific language of the power of attorney.

How to determine if a power of attorney is valid?

The authority of any agent under a power of attorney automatically ends when one of the following things happens: 1 The principal dies. 2 The principal revokes the power of attorney. 3 A court determines that the principal is totally or partially incapacitated and does not specifically provide that the power of attorney is to remain in force. 4 The purpose of the power of attorney is completed. 5 The term of the power of attorney expires.

Can a limited power of attorney be used to sell a home?

For example, a person might use a limited power of attorney to sell a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be “limited” to selling the home or to other specified acts.

Do you have to understand the power of attorney?

Yes. The principal must understand what he or she is signing at the time the document is signed. The principal must understand the effect of a power of attorney, to whom the power of attorney is being given and what property may be affected by the power of attorney.

Can an agent sign a document stating that the principal has knowledge of certain facts?

An agent may not sign a document stating that the principal has knowledge of certain facts. For example, if the principal was a witness to a car accident, the agent may not sign an affidavit stating what the principal saw or heard. An agent may not vote in a public election on behalf of the principal.

Is a power of attorney a moral obligation?

While the power of attorney gives the agent authority to act on behalf of the principal, an agent is not required to serve. An agent may have a moral or other obligation to take on the responsibilities associated with the power of attorney, but the power of attorney does not create an obligation to assume the duties.

Does Florida have a power of attorney?

Florida law does not permit a springing power of attorney. It also does not provide an authorized form for financial power of attorney.

What is a power of attorney?

A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the power to act on behalf of a third-party (the principal). Hence, the agent in question can have a broad or limited legal authority to make legal decisions about the principal’s property, finances, or medical care. Commonly, powers of attorney are used in ...

Is a durable power of attorney effective?

In terms of time limitation and effectiveness, there is the durable power of attorney and the springing power of attorney. In the first case, the power of attorney is not terminated by the principal’s incapacity. Meanwhile, a springing power of attorney does not become effective unless/until the principal becomes incapacitated mentally ...

How old do you have to be to be a trust agent in Florida?

As provided by the state’s lay, an agent must be either a person that is over 18 years of age or a financial institution with specific requirements, including “trust powers,” a place of business in Florida and is authorized to conduct trust business in the state. In any case, the agent should be a trustworthy person that will act in ...

What is a power of attorney in Florida?

As an introduction, a power of attorney is a document in which a person (the “principal”) designates another person to act on the principal’s behalf (the “agent”). Florida law gives the option to create a “durable” power of attorney, which remains effective even if the principal becomes incapacitated—reducing the potential need for ...

Is an out-of-state power of attorney valid in Florida?

Valid, out-of-state powers of attorney are acceptable in Florida. If an out-of-state power of attorney and its execution were valid in another state, it is also valid in Florida. A third party who is called upon to accept an out-of-state power of attorney may request an opinion of counsel concerning the power’s validity, at the principal’s expense.

Can a third party get a power of attorney in Florida?

A third party who is called upon to accept an out-of-state power of attorney may request an opinion of counsel concerning the power’s validity, at the principal’s expense. Military powers of attorney also remain valid in Florida if executed in accordance with relevant federal law .

Do non-durable powers of attorney have to be signed by the principal?

Under the new law, durable and non-durable powers of attorney must be signed by the principal in the presence of two witnesses and acknowledged before a notary. 8.

Does a copy of a power of attorney have the same effect as an original?

The new law provides that photocopies and electronically transmitted copies of an original power of attorney have the same effect as an original. However, the new law does not eliminate the necessity of recording original powers of attorney in a county’s official records in order to use the power of attorney to convey real property. 9.

Do power of attorney agents keep records?

Under the new law, agents must keep records of all receipts, disbursements, and transactions made on behalf of the principal. Additionally, if the power of attorney authorizes the agent to access a safe-deposit box, the agent must render an inventory of the contents each time the agent accesses the box.

What is the new law for an agent?

The new law allows an agent to perform only those acts expressly granted in the document. If a document grants the agent authority to conduct “banking” or “investment” transactions, the new law lists certain banking or investment functions that an agent may perform without specific enumeration in the document. 5.

What Types of Power of Attorneys Are Available in Florida?

You can make several different types of POAs in Florida. In particular, many estate plans include two POAs:

What Are the Legal Requirements of a Financial POA in Florida?

For your POA to be valid in Florida, it must meet certain requirements.

Steps for Making a Financial Power of Attorney in Florida

Some private companies offer forms or templates with blanks that you can fill out to create your POA. For a more user-friendly experience, you can try a software program like WillMaker, which guides you through a series of questions to arrive at a POA that meets your specific aims and is valid in your state.

Who Can Be Named an Attorney-in-Fact (Agent) in Florida?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Durable Financial POA Take Effect?

In Florida, unless you've explicitly stated otherwise in the document, your durable financial power of attorney takes effect as soon as you've signed it before witnesses and a notary public. For the most part, Florida no longer allows " springing" powers of attorney, which are POAs that become effective only after some condition is met.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. It also ends if:

What is a power of attorney in Florida?

A power of attorney is a legal document that gives a person, called an "agent," the authority to act on behalf of another individual, called the "principal.". Some other helpful terms are:

How many witnesses are needed to sign a power of attorney in Florida?

In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

What is incapacitated in Florida?

This is defined by Florida law as: "The inability of an individual to take those actions necessary to obtain, administer, and dispose of real and personal property, intangible property, business property, benefits, and income.".

What is a POA?

A POA that gives the agent a broad range of powers to conduct all types of financial transactions. Limited or special power of attorney. A POA that limits the authority of the agent to a single transaction, certain types of transactions, or to a certain period of time. Durable power of attorney. A power of attorney that is not terminated by ...

What is Durable Power of Attorney?

Durable power of attorney. A power of attorney that is not terminated by the principal's incapacity. Springing power of attorney. A power of attorney that does not become effective unless and until the principal becomes incapacitated. Incapacity or incapacitated.

How old do you have to be to be a trust agent in Florida?

Under Florida law, your agent must be either a person who is at least 18 years of age or a financial institution that has "trust powers," a place of business in Florida, and is authorized to conduct trust business in Florida.

What is a Florida power of attorney?

A Florida real estate power of attorney is a limited POA. It can grant an agent authorization to handle your affairs regarding entering real estate contracts or buying or selling real estate. The best time to explore your medical, legal, and financial estate planning options is when you are healthy. Contact a trusted estate planning attorney at The Boutty Law firm to assist you with your estate planning journey.

What is a POA in healthcare?

Healthcare or medical POA is a type of power of attorney where you authorize a trusted agent the ability to make medical treatment decisions (specifically) on your behalf. There might be a situation where you cannot communicate your wishes. You will want a trusted agent to carry out your predetermined decisions. This type of POA can be set up while building your estate plan and drafting your Advanced Directives. Having your medical wishes in writing can reduce the worry and stress on your family during an already stressful event.

What is a POA for medical?

Healthcare or medical POA is a type of power of attorney where you authorize a trusted agent the ability to make medical treatment decisions (specifically) on your behalf. There might be a situation where you cannot communicate your wishes. You will want a trusted agent to carry out your predetermined decisions. This type of POA can be set up while building your estate plan and drafting your Advanced Directives. Having your medical wishes in writing can reduce the worry and stress on your family during an already stressful event.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Can a power of attorney go into effect if you are mentally incompetent?

Specify in the power of attorney that it cannot go into effect until a doctor certifies you as mentally incompetent. You may name a specific doctor who you wish to determine your competency, or require that two licensed physicians agree on your mental state.

What happens if you appoint only one power of attorney?

If you appoint only one agent, have a backup. Agents can fall ill, be injured, or somehow be unable to serve when the time comes. A successor agent takes over power of attorney duties from the original agent, if needed.

Can a successor agent take over power of attorney?

A successor agent takes over power of attorney duties from the original agent, if needed.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What happens if a power of attorney doesn't specify mental competency?

If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the competency issue in some circumstances.

Popular Posts:

- 1. why would an attorney lock your ssi case

- 2. how can the state attorney general file charges

- 3. how to close a case when an attorney wont

- 4. how are judge ordered attorney fees collected from opposing party

- 5. how much attorney fees is someone entitled to for breach of contract

- 6. cal. labor code provisions which require employer pay attorney fees

- 7. rise from the ashes ace attorney what to give edgeworth

- 8. how to renew notary for attorney in michigan

- 9. what is role of attorney general in nc

- 10. who was the attorney general during the boston tea party