Types of Power of Attorney

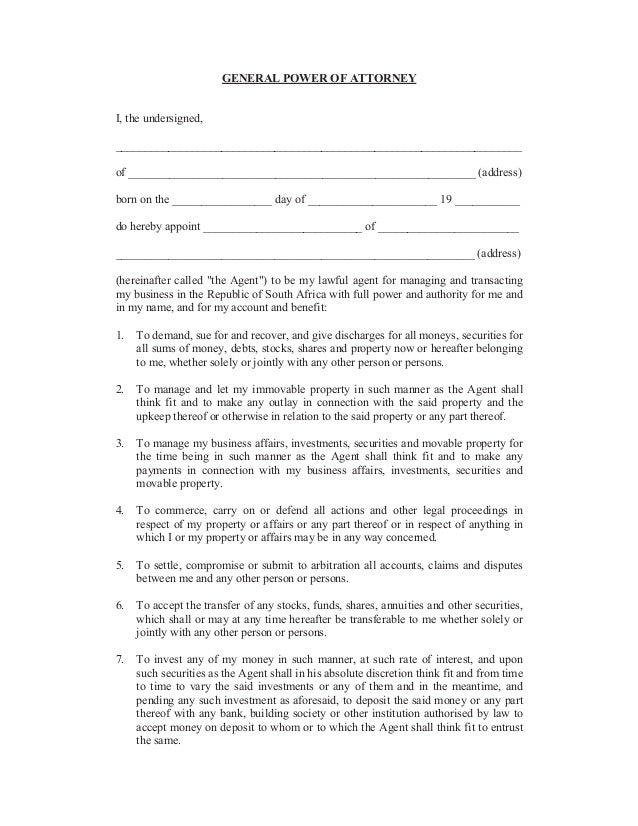

- General Power of Attorney. A general power of attorney gives an agent the power to act on your behalf and make business, real estate, financial, and legal decisions, such as ...

- Durable Power of Attorney. ...

- Medical Power of Attorney. ...

- Limited (Special) Power of Attorney. ...

- Springing Power of Attorney. ...

What does a power of attorney allow you to do?

A Power of Attorney is a legal document you use to allow another person to act for you. You create a legal relationship in which you are the principal and (9) … With a valid power of attorney, your agent can take any action permitted in the While some states permit attorneys-in-fact to make gifts as a matter of (10) …

What does a power of attorney allow me to do?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

What kind of power does a power of attorney actually have?

What Can a Financial Power of Attorney Do? An agent with a valid power of attorney for finances may be able to: Access the principal’s financial accounts to pay for health care, housing needs and other bills. File taxes on behalf of the principal. Make investment decisions on behalf of the principal. Collect the principal’s debts.

What is power of attorney and how does it work?

Jun 26, 2019 · Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and the medical power of …

What are the disadvantages of power of attorney?

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.Oct 7, 2019

What happens when someone takes power of attorney?

A power of attorney gives the attorney the legal authority to deal with third parties such as banks or the local council. Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can PoA spend money on themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What happens if you can't review updates?

If you are unable to review updates yourself, direct your agent to give an account to a third party. As for legal liability, an agent is held responsible only for intentional misconduct, not for unknowingly doing something wrong. This protection is included in power of attorney documents to encourage people to accept agent responsibilities.

Why do you need multiple agents?

Multiple agents can ensure more sound decisions, acting as checks and balances against one another. The downside is that multiple agents can disagree and one person's schedule can potentially delay important transactions or signings of legal documents. If you appoint only one agent, have a backup.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

1. Power of Attorney (POA) Definition – Investopedia

Power of attorney (POA) is a legal status granted to somebody that allows them to act on your behalf. The person given POA may have either broad or narrow legal (1) …

4. Power of Attorney – American Bar Association

An important part of lifetime planning is the power of attorney. For example, you may wish to permit your attorney-in-fact to make “annual exclusion” (9) …

5. 5 Misconceptions About a Power of Attorney – A Place for Mom

Jul 11, 2018 — Power of Attorney broadly refers to one’s authority to act and make decisions on behalf of another person in all or specified financial or legal (14) …

6. The 4 Types of Powers of Attorney in California

A power of attorney, which you may see or hear referenced as a “POA,” is a legal document. It allows you as the principal to appoint another person to act (17) …

8. Get more answers to your questions about Power of Attorney

A power of attorney allows you to appoint whoever you want to be your agent. A power of attorney can also allow someone you trust to help you with financial (24) …

What is the difference between a health POA and a financial POA?

The difference between a Health and a Financial POA is exactly what you think. Health POAs allow you to appoint an agent to act on your behalf regarding health-related matters. A Financial POA does this for all other financial-related issues in your life.

What is a POA?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

How to make a power of attorney legally binding?

4. Make Your Power Of Attorney Legally Binding. In order to be legally binding, your POA must be signed and notarized. You should certify multiple copies so your POA can readily act if the time comes. Almost any decision or transaction a POA will make on your behalf will require a certified copy of the legal POA.

What is a financial power of attorney?

A Financial Power of Attorney designates an agent the authority to make financial decisions and act on your behalf should you not be able to. This type of POA can be broad or very specific. It’s another title for General POA, and could typically grant all the same actions listed above.

When does a POA end?

A General POA: General POAs end as soon as you are incapacitated. While this tool is great for many things in life, it is not a solid option for end-of-life decisions. A Durable POA: A durable POA stays in effect until you pass away or revoke its power.

What is a fiduciary POA?

The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a wide range of authority. At the most basic level, your POA will act on your behalf if you become unable to do so ...

When was the Uniform Power of Attorney Act created?

The Uniform Power of Attorney Act (UPOAA) was created by the Uniform Law Commission in 2006 to establish universal rules for POAs across the states. The law states what powers are included by default, versus which need to be stated outright.

What is a POA in medical terms?

A medical POA (also known as health care POA) gives a trustworthy friend or family member (the agent) the ability to make decisions about the care the principal receives if they are incapacitated. A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an agent ...

Why is POA important?

According to geriatric care manager and certified elder law attorney, Buckley Anne Kuhn-Fricker, JD, this provision is important because it gives a principal the flexibility to decide how involved they want their agent to be while they are still in possession of their faculties. For example, a financial agent could handle the day-to-day tasks of paying bills and buying food, while the principal continues to make their own investment and major purchasing decisions.

What is a generic POA?

A generic POA document that does not contain any limitations typically gives an agent broad power over medical or financial decisions. However, there are still a few things that an agent cannot do. One of the fundamental rules governing an agent’s power is that they are expected to act in their principal’s best interest.

What is the POA Act?

The Uniform POA Act. Each state has statutes that govern how power of attorney documents are written and interpreted. This can complicate matters when a principal decides what powers to give to their agent and when an agent tries to determine what actions are legally within their power.

What is POA document?

POA documents allow a person (the principal) to decide in advance whom they trust and want to act on their behalf should they become incapable of making decisions for themselves. The person who acts on behalf of the principal is called the agent. From there, it is important to distinguish between the two main types of POA: medical and financial. ...

What is POA in elder law?

A reputable elder law attorney can discuss your desires and concerns and devise POA documents that clearly explain the extent of powers you want your agent (s) to have and any limitations they must abide by. ...

How to change a principal's will?

Change a principal’s will. Break their fiduciary duty to act in the principal’s best interest. Make decisions on behalf of the principal after their death. POA ends with the death of the principal (The POA may also be named the executor of the principal's will or if the principal dies without a will, the agent may then petition to become ...

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

Can a doctor override a power of attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision of a power of attorney. Additionally, doctors may also refuse to honor a power of attorney’s decision if they believe that the agent is not acting in the best interest of the patient.

Do power of attorney have fiduciary duty?

Yes — but the agent always has a fiduciary duty to act in good faith. If your power of attorney is making such a change, it must be in your best interests. If they do not act in your interests, they are violating their duties.

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can a power of attorney withdraw money from a bank account without authorization?

No — not without express authorization to do so. A person with power of attorney does not need to add their own name to the bank account. They already have the legal authority to withdraw money from your account to take care of your needs.

Can a person change their power of attorney?

Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of attorney.

Why is it important to appoint someone?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority.

What to do if you do not believe a will is in keeping with your wishes?

If you do not believe that the document is in keeping with your wishes, then you should certainly consult with an attorney about how to get the document changed to reflect those wishes. They do not “trump” a will.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why do parents want to appoint their children?

They do this because they want to be fair to all of them and don’t want anyone to feel slighted. While these are valid reasons, it can create issues down the road.

Can a power of attorney be used without oversight?

They are typically able to engage in such actions, without your direct oversight, because the document allows for that. There are many different types. People often think that one power of attorney document is like all others. This is simply not the case. There are powers of attorney that are limited to healthcare.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Can you put toothpaste back in the tube?

You can’t put the toothpaste back in the tube. If it is discovered that your power of attorney abused that position and has taken money from you, it can be difficult to recover all of the property. It is like putting toothpaste back into the tube at times.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

How many types of power of attorney should I include in my estate plan?

Therefore, you may want to include two or three types of power of attorney in your estate plan.

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

When does a power of attorney expire?

For example, during an extended period of travel outside of the country. A general power of attorney expires upon your incapacitation (unless it’s durable) or death. The powers granted under a general power of attorney may be restricted by state statutes.

Can you rescind a durable power of attorney?

A durable power of attorney ends automatically when you die. You can rescind a durable POA using a revocation of power of attorney form as long as you’re competent .

When does a medical power of attorney become effective?

A medical power of attorney becomes effective immediately after you’ve signed it, but can only be used if you’ve been declared mentally incompetent by physician (s). Once you’ve selected an agent, make sure they know how to sign as power of attorney on your behalf. 3. General Power of Attorney.

Can a limited power of attorney cash checks?

For example, a limited power of attorney can allow someone to cash checks for you. However, this person won’t be able to access or manage your finances fully. This type of power of attorney expires once the specific task has been completed or at the time stated in the form.

What is Durable Power of Attorney?

What Does a Durable Power of Attorney Mean?#N#In regard to a durable POA, the word “durable” specifically means that the effectiveness of the assigned power of attorney remains in effect even if the principal becomes mentally incompetent. Typically, there are four situations that would render powers of attorney null and void: 1 If you revoke it 2 If you become mentally incompetent 3 If there is an expiration date 4 If you die

What does "durable" mean in POA?

In regard to a durable POA, the word “durable” specifically means that the effectiveness of the assigned power of attorney remains in effect even if the principal becomes mentally incompetent. Typically, there are four situations that would render powers of attorney null and void: If you revoke it.

What is the fiduciary obligation of a power of attorney?

By law, the agent under a power of attorney has an overriding obligation, commonly known as a fiduciary obligation, to make financial decisions that are in the best interests of the principal (the person who named the agent under the power of attorney).

Why do people hesitate to get a power of attorney?

People hesitate towards getting a power of attorney because they are worried that the agent will mismanage their affairs and assets. Legally, your agent shouldn’t do something that is not in your best interests — that is their fiduciary obligation to you as your agent.

What does it mean to get a power of attorney from the internet?

Getting a power of attorney document from the internet means that you could be paying for a document that:: “If a power of attorney is ambiguous it is ripe for challenges and interjections,” Furman says. “The issue is that when problems with a power of attorney are discovered it is usually too late to do anything about it.”.

Why do we need a power of attorney?

A power of attorney should be created to appropriately represent the specifics of the unique circumstances and the decisions and care that need to be made on behalf of the person. “People should stay away from the internet and have a power of attorney custom drafted to your circumstances,” Furman advises.

Can a durable POA be used for death?

A durable power of attorney can withstand the mental incapacity of the individual, but not death. A durable POA allows the agent to continue to act on the principal’s behalf, even if the principal is mentally incompetent.

What is POA in law?

Power of attorney (POA) rules vary depending on the state. There are several types. A POA can be limited or general. It can also be durable or non-durable.

What is a general power of attorney?

A general power of attorney allows you to do anything the principal can do. That includes handling all finances and transactions, including a home sale. Depending on the situation, some banks may be uncomfortable with a large transaction like a home sale done with a general POA and may ask you to have a specific POA for real estate created.

What happens if you have a non-durable POA?

A non-durable POA will specifically terminate if the other person becomes incapacitated. If you intend to have a short-term limited power of attorney, it may be non-durable as well.

What can a realtor do for you?

A professional realtor can help you understand what repairs need to be made and what changes won't really matter to buyers. Don't assume you have to pay an arm and a leg to get full-service real estate help, either.

What does it mean when you work with a real estate agent?

When you work with a real estate agent to find the right buyer at the right price, you'll be fulfilling your financial responsibilities to the principal and you'll have peace of mind that everything is being handled well.

What happens if you are close to someone who wants to sell your home?

If you are close to someone who wants to sell a home but they are ill, plan to travel, or will otherwise be unavailable to handle the transaction, they may designate you to be their agent with a limited real estate power of attorney.

Can you sell a house with a POA?

With the POA, you will be able to sell the home for them. As the agent in a power of attorney document, you have a fiduciary responsibility to do what's in the best interest of the principal. For instance, you cannot use a POA to sell a home to yourself for far less than market value if that's not in the best interest of the seller.

Popular Posts:

- 1. what kind of attorney do i need for being falsely accused

- 2. who can witness a lasting power of attorney form

- 3. how to reach the attorney general

- 4. how does attorney get paid contingency case

- 5. what happens when an attorney violates the rules of proffesional conduct

- 6. attorney for when a family member is jailed

- 7. who do i need a tax attorney or tax accountant

- 8. should your attorney tell you what you will sue for in mediation

- 9. what are th cosequences if an attorney represents both sides without a waver

- 10. why you want your attorney in mediation room