A medical power of attorney authorizes healthcare decisions to be made on your behalf by a designated individual, while a financial power of attorney allows for an authorized individual to oversee your finances if needed. In general, a power of attorney is a document authorizing an individual to make decisions on behalf of another person.

How do I create a medical power of attorney?

Sep 27, 2021 · A medical power of attorney (medical POA or health POA) is a legal document you use to name an agent and give them the authority to make tough medical decisions for you. A medical POA is different from a normal POA (which is more general) or a financial POA (which is similar but for your money).

How do you obtain a medical power of attorney?

Apr 30, 2021 · A financial power of attorney authorizes an individual to make financial decisions, while a medical power of attorney allows for someone to make medical decisions.

How to establish a medical power of attorney?

Feb 10, 2021 · Unlike a regular power of attorney, which is nondurable, a medical power of attorney is always a durable power of attorney. A nondurable power of attorney expires and is no longer valid if you become incapacitated. Because of this, medical powers of attorney are written to be durable—they don't come into effect unless you become incapacitated.

Why do I need a medical power of attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What does power of attorney mean medical?

What is it called when you make medical decisions for someone?

Who makes medical decisions if you are incapacitated?

What is the best power of attorney to have?

Can a family member make medical decisions?

Can family override advance directive?

Who has the highest authority to make medical decisions when a patient does not have the capacity?

Who has the right to make health care decisions for patients?

Who makes decisions if no power of attorney?

What three decisions Cannot be made by a legal power of attorney?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What is the difference between power of attorney and lasting power of attorney?

What is a financial power of attorney?

A financial power of attorney permits someone you have designated (your agent, or attorney-in-fact) to oversee your finances. Typically, it is used so the person can step in and pay your bills or handle other financial or real estate matters. It can be a designation for a financial professional acting on your behalf, or you may use it to designate a trusted friend or family member to handle matters if or when you cannot physically or mentally do so yourself. In some cases it may also be used for isolated, one-off situations where it is not convenient for you to be present, such as a real estate closing in another city.

What is a power of attorney?

In general, a power of attorney is a document authorizing an individual to make decisions on behalf of another person. The person who gives the authority is called the principal, and the person who has the authority to act for the principal is called the agent, or the attorney-in-fact. You can designate both a financial power ...

Who is Hanna Rubin?

Hanna Rubin is the director of registrations for the NY State Attorney General’s charity bureau with 20+ years of experience as an executive editor. Anthony Battle is a financial planning expert, entrepreneur, dedicated life long learner and a recovering Wall Street professional.

Do you need a power of attorney for a living trust?

Likewise, if an individual has a living trust that appoints a person to act as a trustee, then a power of attorney may not be necessary. Identify an Agent: One adult will be named the agent in a power of attorney. An attorney, a faith leader, or a family counselor can all help facilitate this decision-making process.

Do you need to notarize a power of attorney?

Notarize the Power of Attorney: Once a power of attorney is written, it generally needs to be notarized. A verbal agreement is not recognized as a legal power of attorney, nor is a casually written letter or note. Once a power of attorney is written and notarized, keep a copy safely stored.

Who is Roberta from Chicago?

Roberta is a college professor who is planning a year-long sabbatical in Spain. Since she will remain in the country for a year, she will not be able to execute her financial dealings in Chicago. She appoints her mother to act as her financial power of attorney for her property and investments. Her mother will write checks and sign important documentation related to her investments and property.

What happens if you become incapacitated?

Evaluate if One Is Necessary: In general, if you become incapacitated, doctors will do every type of medical intervention to keep you alive. If you want to have more control over the type (and the extent of) the treatment you receive, then you will need to create a medical power of attorney that designates someone with the legal authority to decide the issue for you.

What is a medical power of attorney?

A power of attorney is a legal document that appoints someone as your representative and gives that person the power to act on your behalf. Different types of powers of attorney address different situations. With a medical power of attorney, you appoint someone—often referred to as your attorney-in-fact ...

Can a power of attorney make healthcare decisions?

With a medical power of attorney, you can appoint someone to make healthcare decisions for you if you become incapable of making those decisions yourself. While much of estate planning focuses on finances, a comprehensive estate plan should also help you prepare for any potential medical or healthcare decisions you may need to make in the future.

What happens if you don't have a power of attorney?

If You Do Not Have a Medical Power of Attorney 1 Living will. If you have a living will, it will only be enacted if you are in a permanent state of incapacity. This is because a living will addresses with end-of-life situations, and a key requirement is that you are permanently incapacitated. But if you are temporarily incapacitated—for example, if you fall into a temporary coma after an accident but your doctors expect you to eventually come out of the coma—your living will won't be able to help with the healthcare decisions that may need to be made during this time. 2 Your loved ones know what you want. It's easy to see the potential for conflict that could arise in this scenario. Your loved ones may not correctly remember your instructions, may interpret your directions to them differently or may decide on religious or moral grounds that a different decision would be better for you. Having a medical power of attorney avoids these situations. Additionally, your state's laws may give one of your loved ones priority in terms of medical decision-making power over another loved one who may be more likely to make medical decisions following your wishes.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

What is a power of attorney?

A power of attorney is a legal document wherein one person, known as the principal or grantor, grants certain powers to another person known as the agent or attorney-in-fact. The principal must have the requisite mental capacity at the time of signing in order for the document to be valid.

When does a power of attorney become effective?

A power of attorney is considered effective once the agent's power to act kicks in. Depending on the language used in the document, that power may become effective immediately upon signing or it may be "springing," which means it doesn't become effective until the principal becomes incapacitated and can no longer make decisions.

What is the fiduciary duty of a power of attorney?

A fiduciary duty is a legal obligation to exercise a high standard of care and to act only in the best interest of the principal. In many states, the agent will sign the power of attorney. In many states, one to two witnesses must be present when ...

Is a springing power of attorney durable?

Because a springing power of attorney only becomes effective upon the incapacity of the principal, all springing powers of attorney are durable. However, powers of attorney that are effective immediately upon signing may be durable or may be extinguished upon the incapacity of the principal. Durable powers of attorney are only extinguished upon ...

What is a financial power of attorney?

A financial power of attorney is just a document you need when you want to grant someone else the power to make money decisions for you. And it’s usually created alongside your will. This kind of POA is written specifically to let someone else act as your legal rep for financial matters. Much like other powers of attorney, ...

What is a financial POA?

Just as a medical POA only applies to medical choices someone makes for you, the financial POA extends no further than the right for someone else to make money decisions if and when you’re unavailable to do so yourself. (In case you’re wondering, you need both kinds of POA to have full protection.)

How to make a POA?

A number of things can make a financial POA kaput: 1 The death of the principal 2 The principal choosing to revoke the power at any time 3 A court ruling it invalid 4 The principal’s agent becoming unable to fulfill their duties as financial POA (this can be avoided by naming a successor agent in the document) 5 In some states, when the principal has both 1) named their spouse as the agent, and 2) later divorced their spouse 6 And generally speaking, if the principal becomes incapacitated unless the POA is worded to say that the agent’s authority should continue anyway

What is a POA in financial planning?

With a financial POA, your agent can keep everything moving smoothly with your money. Like most legal docs, the main purpose for creating a financial POA is to protect you and your family from a preventable legal battle.

Is Joe a good agent?

Yeah, Joe could be an awesome agent. For many people, the obvious choice is their spouse. If either of you travel a lot for work, appointing the other as an agent in your financial POA makes a lot of sense. Or maybe you know someone outside your family who just has good character and financial smarts.

What is financial power of attorney?

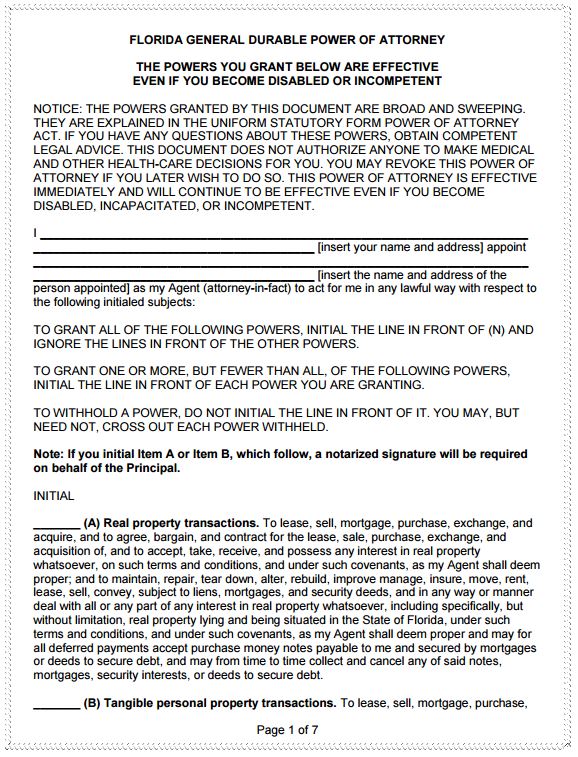

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

Do banks have power of attorney?

Many states have an official durable power of attorney form, which is usually a durable financial power of attorney form. Some banks and brokerage firms have their own power of attorney forms. Also, for buying or selling real property, a title insurance company, lender or closing agent may require the use of their form.

Can a third party accept a power of attorney?

Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form.

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

What is a power of attorney?

As stated above, the medical power of attorney is a legal document, more of a health care directive, which outlines your preferred methods of healthcare if you cannot speak for yourself. In the document, you will appoint a loved one or trusted person to oversee and follow your wishes for medical care on your behalf. Common names for this individual may be “agent”, “health care proxy” or similar.

What is an ordinary power of attorney?

“Ordinary” or “nondurable” powers of attorney are also legal documents that give another person the ability to act on your behalf but automatically ends if the person becomes mentally incapacitated ( loses mental capacity).

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

What happens if you don't have a durable power of attorney?

If you haven't made durable powers of attorney and something happens to you, your loved ones may have to go to court to get the authority to handle your affairs. To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

The Parties Involved

Types of Powers of Attorney

Effectiveness and Durability

Financial Power of Attorney

Medical Power of Attorney

- Also referred to as a power of attorney for health care or health care proxy, a medical power of attorney gives the agent the authority to make decisions about the medical care the principal receives if the principal is unable to make his own decisions either due to incapacity or some other condition that prevents communication. By definition then,...

Choosing An Agent

How to Revoke A Power of Attorney

Popular Posts:

- 1. william doupe, attorney, where is his office located in georgia

- 2. how to amend a durable health care power of attorney in tennessee

- 3. how can i find out if someone is durable power of attorney

- 4. why would my attorney reject my review of him

- 5. what happens to power of attorney when th epersion dies uk

- 6. who has to sign a medical power of attorney

- 7. what does your accident attorney do with your bills

- 8. what kind of attorney handles unmarried evictions

- 9. office of the attorney general texas how to save and open html file

- 10. what type of attorney handles power of attorney