What Is a Durable Power of Attorney?

- Power of Attorney vs. Durable Power of Attorney. ...

- General Durable Power of Attorney Definition. A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect ...

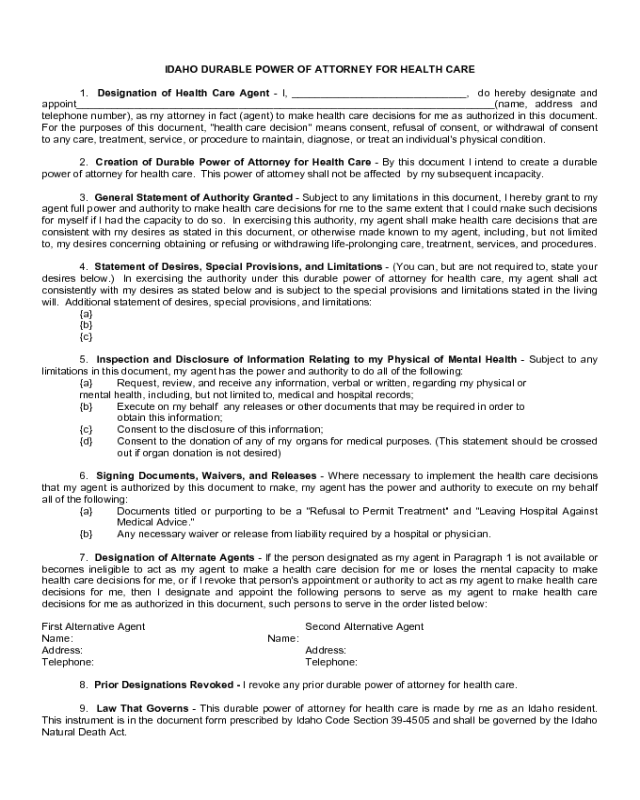

- Durable Power of Attorney for Healthcare. ...

- Obtaining and Removing a Power of Attorney. ...

What is the difference between durable and power of attorney?

A special type of power of attorney that is used frequently is the "durable" power of attorney. A durable power of attorney differs from a traditional power of attorney in that it continues the agency relationship beyond the incapacity of the principal. The two types of durable power of attorney are immediate and "springing."

What are the benefits of a durable power of attorney?

Sep 27, 2016 · A durable power of attorney means that you have designated someone as your agent, and your grant of authority to that agent will continue to stay in effect even when you are incapacitated. Understanding how a power of attorney works and what it means is very important for making advanced plans to secure your future.

What is the purpose of a durable power of attorney?

Jan 27, 2022 · A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can still act on your behalf. Since most older adults need a POA only in case they become incapacitated, this is the preferred type. Medical Power of …

What is the value of a durable power of attorney?

What is the difference between a durable power of attorney and power of attorney?

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated. ... A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.Sep 11, 2018

What is the difference between durable and non durable power of attorney?

In the case of a non-durable power of attorney, the agent is generally authorized to act once you sign the document, but the agent's authority ceases when and if you become incapacitated. ... The term "durable" refers to the document surviving the your incapacity.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How do I get a durable power of attorney?

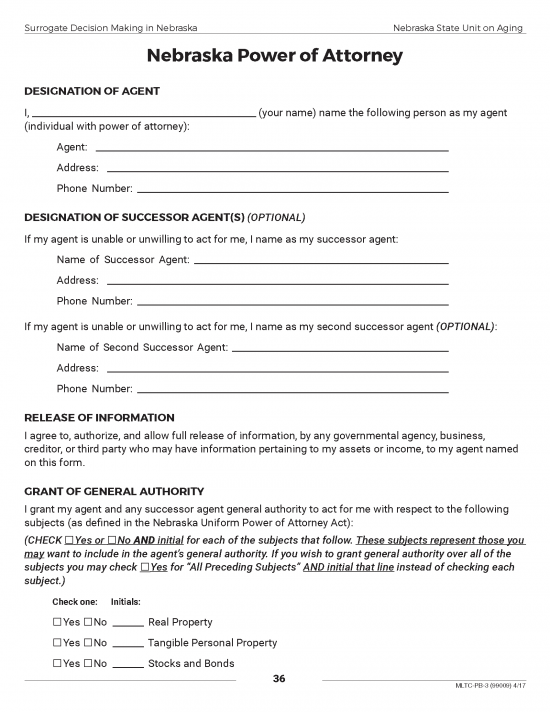

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

What is a POA?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What Does Durable Mean in a Durable Power of Attorney?

When you create a power of attorney, you give an agent or attorney in fact the legal power to act on your behalf. This means that the agent can enter into legally binding contracts on your behalf, manage and even sell your property for you, and otherwise take actions on your behalf.

Why You Need a Durable Power of Attorney

Incapacity planning, including creating a durable power of attorney, is one of the most important things which everyone should do.

Getting Help with a Durable Power of Attorney

You need to make sure you understand how a durable power of attorney works, why you need one, and how to create one. It is a common misconception that incapacity planning is only for seniors. Unfortunately, the reality is incapacity can happen any time.

Popular Posts:

- 1. why would someone choose to be a defense attorney a prosecutor

- 2. what month was michael w. jackson district attorney of the year

- 3. what is difference between attorney at law and counselor at law

- 4. if settle on a lawsuit how long can one person hold off on getting paid from the attorney

- 5. when can a health care power of attorney take effect

- 6. what kind of attorney do i need to handle a no contest plea for domestic abuse

- 7. what percentage can non attorney own of a d.c. based law firm

- 8. who are president trupms picks for un ambassador and attorney general

- 9. who was bill clintons attorney general

- 10. how much are attorney fees for fiscal sponsor agreement