As previously noted, a real estate attorney is required in all Connecticut property transactions. Regardless of the legal requirement, real estate attorneys are crucial for ensuring that the selling and buying processes go smoothly and that both parties are treated fairly.

Who is the lawyer for the seller in a real estate sale?

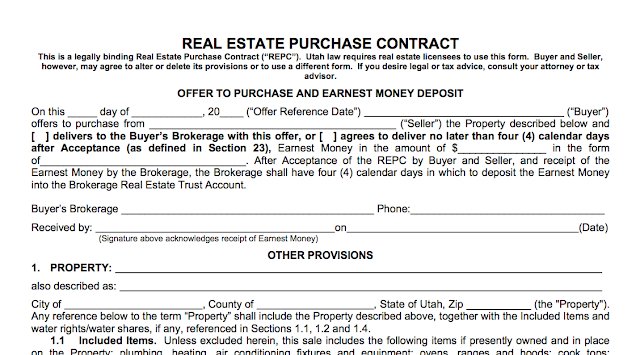

What does a real estate attorney do? Your guide to the role of an attorney in a Connecticut Real Estate closing. Throughout this process, your attorney will work closely you and your real estate agent to keep you informed and work with you. Four Things A Real Estate Attorney Does For You When Buying A Home: Contract. It starts with the contract.

Are attorneys always involved in real estate transactions in Connecticut?

Aug 23, 2019 · Real estate agents will establish the selling price and the terms in a contract between the buying and selling parties. The real estate attorney will review this contract and negotiate any repairs and adjustments that should be made to the contract.

What does a seller’s lawyer do at closing?

While Connecticut statutes do not require individuals buying or selling real estate to engage the services of an attorney, (1) statutes require an attorney to be involved in real estate transactions requiring title insurance and (2) certain services or activities in a real estate transaction may constitute the practice of law and thus can only be legally performed by an attorney.

Who can conduct real estate closings in Connecticut?

Does CT require real estate attorney? In some states, hiring a legal professional is optional for home buyers or sellers, but Connecticut is not one of those. In Connecticut, state law requires all home buyers and sellers to involve a real estate attorney in the process.

Do you need a lawyer to sell a house in Connecticut?

Every state has its own laws regarding real estate sales. In some states, hiring a legal professional is optional for home buyers or sellers, but Connecticut is not one of those. In Connecticut, state law requires all home buyers and sellers to involve a real estate attorney in the process.Aug 23, 2019

Does CT require an attorney at closing?

While Connecticut statutes do not require individuals buying or selling real estate to engage the services of an attorney, (1) statutes require an attorney to be involved in real estate transactions requiring title insurance and (2) certain services or activities in a real estate transaction may constitute the practice ...

Is Connecticut an attorney closing state?

Connecticut Officially Becomes an Attorney Closing State.Jul 14, 2019

What does a real estate attorney do for a buyer?

What Does A Real Estate Attorney Do? Real estate attorneys know how to, and are legally authorized to, prepare and review documents and contracts related to the sale and purchase of a home. In some cases, a real estate attorney is also the person who'll be in charge of your closing.4 days ago

Is CT a title or attorney state?

Connecticut Officially Becomes an Attorney Closing State.Jul 15, 2019

Is title insurance required in CT?

Owner's Policy Owner's title insurance is optional and usually issued in the amount of the real estate purchase. Coverage lasts as long as the purchaser or the purchaser's heirs have an interest in the property.Mar 15, 2010

Who pays closing costs in CT?

Seller closing costs are fees you pay when you finalize the sale of your home in Connecticut. These include the costs of verifying and transferring ownership to the buyer and many are unavoidable. In Connecticut, you'll pay about 2.7% of your home's final sale price in closing costs, not including realtor fees.Jan 1, 2022

Who pays transfer tax in CT?

sellerConnecticut's Real Estate Conveyance Tax The seller pays the tax when he or she conveys the property. Municipal town clerks collect the tax and remit the state share to the state Department of Revenue Services (DRS) (CGS §§ 12-494 et seq., as amended by PA 19-117, § 337).Jul 9, 2020

How much does a title search cost in CT?

The person or company requesting a Title Search must complete a Title Copy Records Request (form J-23T). The fee is $20. Certification is an additional $20. The Title Copy Records Request (form J-23T) must have the make, year, and identification number of the vehicle.

How to sell a house with a lien?

Sellers should also have an attorney on their side for legal guidance. Similar to issues that buyers may face, a real estate attorney is especially important for the following situations: 1 You inherited the property after the owner passed away. 2 There is a lien or judgment on the property you are trying to sell. 3 The property is fairly distressed. 4 The person you are buying the house from is being uncooperative.

Do sellers need an attorney?

Sellers should also have an attorney on their side for legal guidance. Similar to issues that buyers may face, a real estate attorney is especially important for the following situations:

What is a closing agent?

In a mortgage transaction, the “closing agent” is the person responsible for coordinating the activities of various parties involved in the transaction.

What is a mortgage loan in Connecticut?

a mortgage loan transaction, other than a home equity line of credit transaction or any other loan transaction that does not involve the issuance of a lender’s or mortgagee’s policy of title insurance in connection with such transaction, to be secured by real property in Connecticut, or.

What is closing in Connecticut?

The measure defines “real estate closing” as a closing for: 1 a mortgage loan transaction, other than a home equity line of credit transaction or any other loan transaction that does not involve the issuance of a lender’s or mortgagee’s policy of title insurance in connection with such transaction, to be secured by real property in Connecticut, or 2 any transaction wherein consideration is paid by a party to such transaction to effectuate a change in the ownership of real property in Connecticut.

Does a Connecticut mortgage lender need title insurance?

Lenders should ensure that only a Connecticut licensed attorney conducts the closing on any first- or second lien mortgage loan, other than a home equity line of credit, that require the issuance of title insurance.

What is the process of closing a loan?

The process of closing a loan generally involves four core functions: transferring title to the buyer; transmitting payment to the seller (usually through an escrow agent); discharging any outstanding liens on the property; and. creating a lien on the property in favor of the buyer’s lender.

Can an attorney close a loan in Connecticut?

Historically, no explicit authority has held that only an attorney may act as a closing agent in Connecticut. However, as a general matter, almost all loans in Connecticut are closed by an attorney. Connecticut Senate Bill 320 (Public Act No. 19-88) has codified that long-standing practice. As a result, as of October 1, 2019, only ...

What does a real estate lawyer do?

What does a real-estate lawyer do for a seller? In most real-estate sales, the lawyer representing the seller has an easier job than the individual representing the buyer. The tasks of the seller’s lawyer can be divided into two stages—before the contract is signed and after. Before a contract is in place, many sellers rely on their lawyer ...

What is a mechanic's lien waiver?

Where the seller’s property has improvements (residence, structures), the seller’s lawyer will typically get the seller to sign a mechanic’s lien waiver, which states that either no one who has done work on the property for a certain period of time prior to closing remains unpaid or that the seller promises to pay any such bill prior to closing.

What are closing costs in Connecticut?

Closing costs are, quite simply, the costs associated with the transfer of a home from one party to another. These costs, such as taxes, agent commission, and title transfer fees, are paid at closing when the seller officially transfers ownership to the buyer. There are a wide variety of closing costs when selling or buying a home in Connecticut ...

What is the FHA up front premium?

FHA Up-Front Mortgage Insurance Premium: For buyers who have an FHA loan, they are required to pay 1.75 percent of the base loan amount in UPMIP. This payment can be rolled into the total loan amount rather than an up-front payment. Yes.

Do you pay property taxes after closing?

Yes. No. Property tax: Most lenders want any taxes due within 60 days of closing to be paid up front. No. Yes. Real estate agent’s commission: This is the amount the real estate agent receives for selling the home, often 6 to 7 percent of the total sales price.

Does title insurance cover a lien?

This insurance also protects the lender in case there’s a problem with the title. Yes.

What is a closing attorney?

The closing attorney is available to explain documents such as a deed, a note, a deed of trust, a settlement statement, disbursement at the end of the transaction and loan documentation required by the lender. Record and disburse: The closing attorney is literally responsible for closing on the transaction and distributing all monies.

What is title examination?

The title examination is for the purchaser and the lender to evaluate title to the real estate. The purchaser will need to know whether there are certain restrictions of use, easements, encroachments or whether the title is marketable and clear for the seller to transfer the property to the purchaser. The closing attorney will identify any existing ...

What happens if you don't have a clear title?

Without clear title, the sale may become much more complicated . Upon receipt of a real estate purchase agreement or a request from a bank or mortgage broker, the closing attorney will begin to check the title to the property being sold.

Popular Posts:

- 1. council vs counsel vs consul which is attorney

- 2. california attorney who represents government contractors

- 3. why would a parent want power of attorney over child's bank

- 4. who is dr. rook's defense attorney conway ar

- 5. what state attorney generalshave actions against siirius

- 6. who is the county attorney for livingston county

- 7. how is attorney general chosen

- 8. how much does a real estate attorney cost in ct

- 9. how much does a city of lansing attorney make

- 10. when did cohen stop being trumps attorney