A Durable Power of Attorney for Property (DPA) is a document that allows you (the principal) to give authority to another person (your agentor attorney-in-fact) to make financial/legal decisions and financial transactions on your behalf.

What is the purpose of a durable power of attorney?

Jan 27, 2022 · A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can still act on your behalf.

What can a power of attorney really do?

Jun 21, 2021 · A durable power of attorney (durable POA) is specifically meant to continue even if the person granting the power of attorney, the principal, becomes incapacitated. The durable power of attorney may be revoked at any time by the principal as long as they still have the mental capacity to make their own decisions, or possibly by a third party, if they can show that the …

What is the General Durable Power of attorney?

When you create and sign a durable power of attorney, you give another person legal authority to act on your behalf. This person is called your agent or, in some states, your attorney-in-fact. Commonly, people give their agent broad power to handle all of their finances. But you can give your agent as much or as little power as you wish.

What does a power of attorney allow you to do?

The Durable Power of Attorney: Your Most Important Estate Planning Document. For most people, the durable power of attorney is the most important estate planning instrument available -- even more useful than a will. A power of attorney allows a person you appoint -- your "attorney-in-fact" or “agent” -- to act in place of you – the “principal” -- for financial purposes when and if you …

What is the difference between a POA and a durable POA?

A general power of attorney ends the moment you become incapacitated. ... A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.Sep 11, 2018

What can you do with a power of attorney?

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the advantage to executing a durable power of attorney?

Creating a durable power of attorney protects you and your family if you can no longer handle your health or financial problems. An experienced power of attorney lawyer can explain your options and the ramifications of each type of POA, and advise you of the right powers to fit your needs.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Can social services take over power of attorney?

Without an LPA social services can make decisions on behalf a vulnerable person, if they think they lack mental capacity and believe it is in their best interests. ... They do not have to follow what the family want and cannot be liable for their decisions.

Can I sell my mother's house with power of attorney?

Answer: Those appointed under a Lasting Power of Attorney (LPA) can sell property on behalf the person who appointed them, provided there are no restrictions set out in the LPA. You can sell your mother's house as you and your sister were both appointed to act jointly and severally.Apr 2, 2014

Does next of kin override power of attorney?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Who has power of attorney after death if there is no will?

Is power of attorney valid after death? Unfortunately, if the principal dies, a power of attorney ceases to exist. The purpose of a POA is for the agent to act on behalf of the principal when the principal is unable to carry out their own legal matters.Jun 25, 2021

Do spouses automatically have power of attorney?

If two spouses or partners are making a power of attorney, they each need to do their own. ... A spouse often needs legal authority to act for the other – through a power of attorney. You can ask a solicitor to help you with all this, and you can also do it yourself online. It depends on your preference.Mar 26, 2015

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

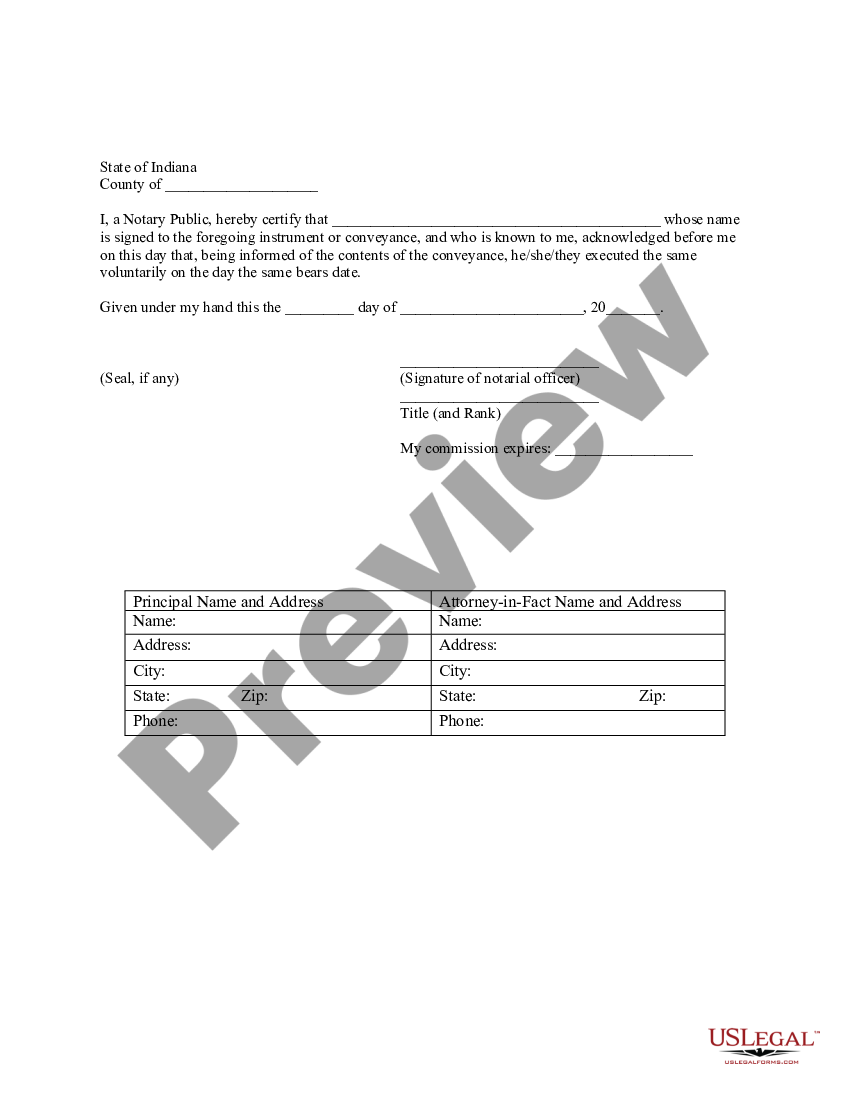

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

Why should a power of attorney be written?

Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorized to do a particular act, you should consult the attorney who prepared the document.

What is a power of attorney?

A Power of Attorney empowers an Attorney-in-Fact to do certain specified things for the Principal during the Principal's lifetime. A Living Trust also allows a person, called a "trustee," to do certain things for the maker of the trust during that person's lifetime but these powers also extend beyond death.

What happens if a third party refuses to honor a power of attorney?

Under some circumstances, if the third party's refusal to honor the Power of Attorney causes damage, the third party may be liable for those damages and even attorney's fees and court costs. Even mere delay may cause damage and this too may subject the third party to a lawsuit for damages.

What is an attorney in fact?

An Attorney-in-Fact is looked upon as a "fiduciary" under the law. A fiduciary relationship is one of trust. If the Attorney-in-Fact violates this trust, the law may punish the Attorney-in-Fact both civilly (by ordering the payments of restitution and punishment money) and criminally (probation or jail).

What is the purpose of an affidavit in Tennessee?

The purpose of the affidavit is to relieve the third party of liability for accepting an invalid Power of Attorney. In Tennessee, an affidavit that is similar to the one at the end of this Web page is acceptable to most third parties. Other states may have a different form. You may wish to consult your attorney.

What is an affidavit for power of attorney?

An affidavit is a sworn written statement. A third party may require you, as the Attorney-in-Fact, to sign an affidavit stating that you are validly exercising your duties under the Power of Attorney. If you want to use the Power of Attorney, you do need to sign the affidavit if so requested by the third party.

Is the principal incapacitated?

The Principal is not deceased, has not been adjudicated incapacitated or disabled; and has not revoked, partially or completely terminated, or suspended the Durable Power of Attorney; and. A petition to determine the incapacity of or to appoint a conservator for the Principal is not pending.

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

What happens if you don't have a power of attorney?

If you don't, in most states, it will automatically end if you later become incapacitated. Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless ...

When does a power of attorney end?

When a Financial Power of Attorney Ends. Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it.

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

How to transfer property to a trust?

transfer property to a trust you've already created. hire someone to represent you in court, and. manage your retirement accounts. The agent is required to act in your best interests, maintain accurate records, keep your property separate from his or hers, and avoid conflicts of interest.

When does a financial power of attorney take effect?

When a Financial Power of Attorney Takes Effect. A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of attorney for each other in case something happens to one of them -- or for when one spouse is out of town.) You should specify that you want your power ...

Where do you put a copy of a power of attorney?

If your agent will have authority to deal with your real estate, you must put a copy of the document on file at the local land records office. (In two states, North and South Carolina, you must record your power of attorney at the land records office for it to be durable.)

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a doctor override a power of attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision of a power of attorney. Additionally, doctors may also refuse to honor a power of attorney’s decision if they believe that the agent is not acting in the best interest of the patient.

Do power of attorney have fiduciary duty?

Yes — but the agent always has a fiduciary duty to act in good faith. If your power of attorney is making such a change, it must be in your best interests. If they do not act in your interests, they are violating their duties.

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can a power of attorney withdraw money from a bank account without authorization?

No — not without express authorization to do so. A person with power of attorney does not need to add their own name to the bank account. They already have the legal authority to withdraw money from your account to take care of your needs.

Can a person change their power of attorney?

Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of attorney.

What is durable power of attorney?

A durable power of attorney is the most common document of its kind, and the coverage afforded by the form is sweeping. It allows the agent to make financial, business and legal decisions on behalf of a principal, and the durability aspect extends the agent’s powers to during an event of incapacitation.

What does it mean if you don't have a POA?

The absence of a durable and/or medical POA can mean that family members will not be able to access accounts to pay for healthcare, taxes, insurance, utilities, and other important matters, and they won’t have clear instructions as to how to care for you if you should be faced with incapacitation.

How long do powers stay in effect?

Once powers have been granted, they will remain in effect until their powers are revoked, the contract expires (if an expiration date exists), or until the principal expires. Here’s a list of common matters for which an agent may be responsible to maintain on behalf of the principal: Banking – Deposits and withdrawals.

What is the difference between an agent and a principal?

Principal – the person handing over decision-making powers. Agent – the chosen individual to manage affairs, usually someone the principal deeply trusts , such as a close family member (also called an “attorney in fact”) Incapacitation – when the principal is no longer able to make decisions for themselves .

What do I need for an estate plan?

What Else Do I Need for My Estate Plan? 1 Living Will – usually paired with a medical power of attorney. If this form isn’t included, you’ll want to create one as it puts your medical wishes into writing. 2 Last Will and Testament – designates who gets what upon your passing

Why does the principal have no say in who is appointed?

First, the principal has no say in who is appointed, because appointment will happen after an event of incapacitation. Often, the court will choose a single conservator to handle both financial and medical matters. Second, the process is costly, lengthy, and very draining and stressful for all involved.

What is a living will?

Living Will – usually paired with a medical power of attorney. If this form isn’t included, you’ll want to create one as it puts your medical wishes into writing. Last Will and Testament – designates who gets what upon your passing.

What is POA in elder law?

A reputable elder law attorney can discuss your desires and concerns and devise POA documents that clearly explain the extent of powers you want your agent (s) to have and any limitations they must abide by. ...

What is POA document?

POA documents allow a person (the principal) to decide in advance whom they trust and want to act on their behalf should they become incapable of making decisions for themselves. The person who acts on behalf of the principal is called the agent. From there, it is important to distinguish between the two main types of POA: medical and financial. ...

What is a POA in medical terms?

A medical POA (also known as health care POA) gives a trustworthy friend or family member (the agent) the ability to make decisions about the care the principal receives if they are incapacitated. A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an agent ...

Why is POA important?

According to geriatric care manager and certified elder law attorney, Buckley Anne Kuhn-Fricker, JD, this provision is important because it gives a principal the flexibility to decide how involved they want their agent to be while they are still in possession of their faculties. For example, a financial agent could handle the day-to-day tasks of paying bills and buying food, while the principal continues to make their own investment and major purchasing decisions.

What is a generic POA?

A generic POA document that does not contain any limitations typically gives an agent broad power over medical or financial decisions. However, there are still a few things that an agent cannot do. One of the fundamental rules governing an agent’s power is that they are expected to act in their principal’s best interest.

What is the POA Act?

The Uniform POA Act. Each state has statutes that govern how power of attorney documents are written and interpreted. This can complicate matters when a principal decides what powers to give to their agent and when an agent tries to determine what actions are legally within their power.

How to change a principal's will?

Change a principal’s will. Break their fiduciary duty to act in the principal’s best interest. Make decisions on behalf of the principal after their death. POA ends with the death of the principal (The POA may also be named the executor of the principal's will or if the principal dies without a will, the agent may then petition to become ...

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

About The Power of Attorney

- A Durable Power of Attorney may be the most important of all legal documents. This legal document gives another person the right to do certain things for the maker of the Durable Power of Attorney. What those things are depends upon what the Durable Power of Attorney says. A person giving a Durable Power of Attorney can make it very broad or can limit the Durable Powe…

Powers and Duties of An Attorney-In-Fact

- What can I do as an Attorney-in-Fact? Powers of Attorney can be used for most everything but an Attorney-in-Fact can only do those acts that the Powers of Attorney specifies. Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorize…

Using The Power of Attorney

- When is a Power of Attorney effective? The Power of Attorney is effective as soon as the Principal signs it, unless the Principal states that it is only to be effective upon the happening of some future event. These are called "springing" powers, because they spring into action upon a certain occurrence. The most common occurrence states that the Power of Attorney will become effect…

Financial Management and The Liability of An Attorney-In-Fact

- What is "fiduciary responsibility"? As an Attorney-in-Fact, you are fiduciary to your Principal. A "fiduciary" is a person who has the responsibility for managing the affairs of another, even if only a part of that person's affairs are being managed. A fiduciary has the responsibility to deal fairly with the Principal and to be prudent in managing the Principal’s affairs. You, as an Attorney-in-Fa…

Relationship of Power of Attorney to Other Legal Devices

- What is the difference between an Attorney-in-Fact and an executor? An Executor, sometimes referred to as a "personal representative," is the person who takes care of another's estate after that person dies. An Attorney-in-Fact can only take care of a person's affairs while they are alive. An executor is named in a person's will and can only be appointed after a court proceeding calle…

Conservators and Powers of Attorney

- What is a Conservator? Conservators (called "Guardians" in some states) are appointed by the courts for people who are no longer able to act in their own best interests. A person who has a conservator appointed by the courts may not be able to lawfully execute a Power of Attorney. If you find out that a conservator had been appointed prior to the date the Principal signed the Po…

Affidavit by Attorney-In-Fact

- State of ____________ County of ___________ Before me, the undersigned authority, personally appeared ____________ (Attorney-in-Fact) ("Affiant") who swore or affirmed: Affiant is the Attorney-in-Fact named in the Durable Power of Attorney executed by _________________ ("Principal") on ______________, 200__. To the best of Affiant’s knowledge after diligent search and inquiry: The Pr…

Popular Posts:

- 1. how much schooling would go into becoming an attorney

- 2. where to file power of attorney, new york

- 3. what attorney use investigators

- 4. what to ask estate planning attorney

- 5. how cna attorney client privlege be compromised by raid on trumps attorney

- 6. last president who fire attorney general

- 7. who has the power of attorney for elaine m morris of the villages fl

- 8. what is a probate attorney in a criminal case

- 9. what can attorney do if not licensed in a state

- 10. what is does by states attorney at municipal district